Ryanair's Growth Outlook: Tariff Wars And The Planned Share Buyback

Table of Contents

Ryanair's Current Market Position and Challenges

Ryanair maintains a significant market share in the European low-cost carrier market, but several challenges threaten its continued growth. Increased competition from other budget airlines and even legacy carriers attempting to compete on price puts pressure on fares and profitability. Furthermore, soaring fuel prices and persistent inflation significantly impact operational costs, squeezing profit margins. While air travel demand shows signs of recovery post-pandemic, fluctuating economic conditions create uncertainty regarding future passenger numbers.

- Market Share: Ryanair's dominant position is undeniable, but maintaining that position requires constant adaptation and innovation in the face of intensifying competition.

- Fuel Prices and Inflation: The volatile nature of fuel costs represents a major risk factor, demanding effective hedging strategies to mitigate the impact on profitability. Inflationary pressures add to these challenges, affecting everything from staffing costs to airport charges.

- Competition: The emergence of new low-cost competitors and the aggressive pricing strategies of established airlines necessitate a constant evaluation of Ryanair's route network and pricing models.

- Air Travel Demand: The recovery in air travel demand is encouraging, yet the airline industry remains vulnerable to economic downturns which directly affect consumer spending on discretionary items like air travel.

The Impact of Tariff Wars on Ryanair's Operations

Tariff wars and trade disputes significantly impact Ryanair's operations, particularly on international routes. Brexit, for example, has introduced new complexities and increased bureaucratic hurdles for flights between the UK and the EU. Changes in air passenger duty or other EU regulations can also influence profitability. The overall effect of these geopolitical factors is an increase in operational costs and a potential reduction in the efficiency of cross-border operations.

- Trade Disputes: Escalating trade tensions between countries can disrupt flight routes and increase operational costs, potentially necessitating route adjustments or cancellations.

- Brexit Impact: Post-Brexit regulations have created additional administrative burdens and potential delays, impacting the smooth operation of UK-based flights and impacting operational efficiency.

- Regulatory Changes: Changes in air passenger duty or other regulatory frameworks in different jurisdictions can significantly affect pricing strategies and profitability.

- Operational Costs: The cumulative impact of trade disputes and regulatory uncertainty contributes to increased operational complexity and costs for Ryanair.

The Planned Share Buyback: Implications for Investors

Ryanair's announced share buyback program signals confidence in its future financial performance. This capital allocation strategy aims to return value to shareholders by reducing the number of outstanding shares, potentially driving up the stock price. This move can increase investor confidence and may indicate a belief that the company is undervalued in the current market. However, the strategy should be viewed in relation to other possible uses of capital.

- Share Buyback Details: A detailed breakdown of the buyback program's size, timeline, and specific conditions is crucial for investors to assess its potential impact.

- Impact on Stock Price: The share buyback's effect on the stock price will depend on several factors, including market sentiment, overall economic conditions, and the airline's future financial performance.

- Investor Confidence: The buyback program demonstrates management’s belief in the company's long-term prospects and can boost investor confidence.

- Implications for Shareholders: Existing shareholders benefit directly from a potential increase in share price, while potential investors need to carefully consider the risk-reward profile before making an investment decision.

- Competitor Comparison: Analyzing how Ryanair's share buyback strategy compares to that of its competitors provides valuable context and insights into industry best practices.

Alternative Uses of Capital and Their Potential Impact

Instead of a share buyback, Ryanair could have used its capital for fleet expansion, opening new routes, investing in technology upgrades, or supporting the adoption of more sustainable aviation fuel. Each option presents different levels of risk and potential returns.

- Fleet Expansion: Investing in new aircraft could improve operational efficiency and increase capacity, but carries significant capital expenditure.

- Route Expansion: Developing new routes presents growth opportunities but entails market research, risk assessment, and competitive analysis.

- Investment in Technology: Technological advancements are crucial for cost optimization and enhancing the customer experience; however, such investments may have a longer payback period.

- Sustainable Aviation Fuel: Investing in sustainable aviation fuel aligns with environmental concerns but involves higher upfront costs and a dependence on future technological developments.

Conclusion

Ryanair's growth outlook is a complex equation factoring in market competition, fluctuating fuel costs, the impact of geopolitical events like tariff wars, and its own financial strategies, like the recent share buyback. While the share buyback signals confidence, investors must also consider the alternative capital allocation options and the ongoing challenges the airline faces. Monitoring Ryanair's financial performance, market position, and strategic responses to these challenges is paramount. Stay informed about Ryanair’s progress and future announcements to make informed decisions regarding your investment in this key player in the low-cost airline market. Understand the implications of Ryanair’s growth outlook, including the effects of tariff wars and the share buyback, to make sound investment choices.

Featured Posts

-

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025 -

Analyzing Liverpools Psg Victory Arne Slots Take On Luck And Alissons World Class Performance

May 21, 2025

Analyzing Liverpools Psg Victory Arne Slots Take On Luck And Alissons World Class Performance

May 21, 2025 -

Funkos Dexter Pop Vinyl Figures A Collectors Guide

May 21, 2025

Funkos Dexter Pop Vinyl Figures A Collectors Guide

May 21, 2025 -

Rentedaling En Stijgende Huizenprijzen Abn Amro Analyse

May 21, 2025

Rentedaling En Stijgende Huizenprijzen Abn Amro Analyse

May 21, 2025 -

The Goldbergs Behind The Scenes Look At A Popular Sitcom

May 21, 2025

The Goldbergs Behind The Scenes Look At A Popular Sitcom

May 21, 2025

Latest Posts

-

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025 -

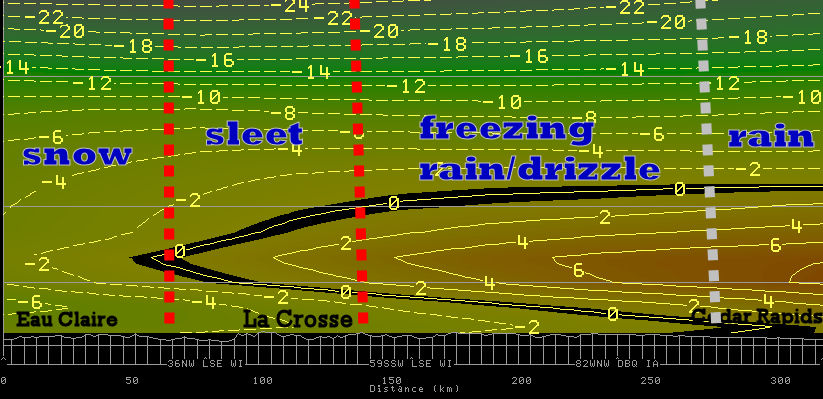

Driving In A Wintry Mix Rain And Snow Safety Tips

May 21, 2025

Driving In A Wintry Mix Rain And Snow Safety Tips

May 21, 2025 -

Investing In Big Bear Ai A Practical Guide For Investors

May 21, 2025

Investing In Big Bear Ai A Practical Guide For Investors

May 21, 2025 -

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025 -

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

May 21, 2025

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

May 21, 2025