Private Credit Jobs: 5 Crucial Do's And Don'ts For Success

Table of Contents

Do's for Success in Private Credit Jobs

Develop Specialized Skills & Expertise

The private credit landscape demands a specialized skillset. To stand out, you need to master several key areas:

- Networking: Building relationships within the industry is paramount.

- Financial Modeling: Proficiency in Excel, discounted cash flow (DCF) analysis, and leveraged buyout (LBO) modeling is essential for evaluating potential investments.

- Credit Analysis: A deep understanding of credit risk assessment, including financial statement analysis and credit scoring models, is crucial.

- Due Diligence: Meticulous due diligence is vital to identify potential risks and opportunities in private debt investments.

- Legal & Regulatory Knowledge: Familiarity with relevant laws and regulations governing private lending is non-negotiable.

- Understanding of different private credit strategies: Grasping the nuances of direct lending, mezzanine financing, distressed debt, and other strategies is vital for making informed investment decisions.

Mastering these skills demonstrates your competence and greatly enhances your desirability as a candidate. Consider pursuing relevant certifications, such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst), to further bolster your credentials. Continuous learning and staying abreast of market trends are equally important for long-term success in private credit jobs.

Network Strategically and Build Relationships

Networking is not just about collecting business cards; it's about building genuine relationships.

- Attend industry conferences: These events provide excellent opportunities to connect with professionals and learn about the latest trends.

- Join relevant professional organizations: Membership in organizations focused on private credit, finance, or alternative investments provides access to networking events and valuable resources.

- Leverage LinkedIn: Optimize your profile to showcase your expertise and connect with professionals in the private credit industry.

- Conduct informational interviews: Reach out to professionals in private credit roles to learn about their experiences and gain insights into the industry.

- Build relationships with professionals in private equity, hedge funds, and other relevant fields: These connections can lead to valuable opportunities and mentorship.

Actively cultivating your network within the private credit community opens doors to job opportunities, mentorship, and invaluable industry insights, increasing your chances of securing a desirable private credit job.

Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They must be compelling and tailored to each specific private credit job application.

- Highlight relevant experience: Showcase your skills and accomplishments that are directly applicable to the specific role.

- Quantify achievements: Use metrics and numbers to demonstrate the impact of your work, such as "increased efficiency by 15%."

- Use keywords relevant to private credit jobs: Research job postings to identify common keywords and incorporate them naturally into your resume and cover letter.

- Customize applications for each role: Generic applications rarely succeed. Each application should be meticulously tailored to the specific requirements of the job description.

- Showcase strong communication skills: Your resume and cover letter should be clear, concise, and error-free.

Remember to use Applicant Tracking System (ATS) friendly formatting to ensure your application gets noticed. A well-crafted resume and cover letter significantly increase your chances of landing an interview for private credit jobs.

Don'ts for Success in Private Credit Jobs

Neglecting Fundamental Financial Knowledge

A solid foundation in finance is non-negotiable.

- Underestimating the importance of core accounting principles: A strong understanding of accounting is vital for analyzing financial statements.

- Overlooking financial statement analysis: The ability to interpret balance sheets, income statements, and cash flow statements is essential.

- Lacking understanding of valuation methodologies: Knowledge of different valuation techniques is crucial for assessing the value of potential investments.

Lacking these fundamental skills will significantly hinder your progress in private credit. Ensure you possess a strong understanding of core financial principles before pursuing roles in this field.

Underestimating the Importance of Soft Skills

Technical skills are important, but soft skills are equally crucial for success in private credit jobs.

- Ignoring communication skills: Effective communication is vital for collaborating with team members and clients.

- Neglecting teamwork abilities: Private credit often involves working in teams, requiring strong collaboration and interpersonal skills.

- Lacking the ability to handle pressure: The industry can be demanding, so resilience and the ability to manage pressure are essential.

- Neglecting attention to detail: Accuracy and attention to detail are crucial in analyzing financial information and conducting due diligence.

Strong soft skills enable you to effectively collaborate, communicate, and navigate the challenges inherent in private credit roles.

Ignoring Industry Trends and Regulations

The private credit industry is dynamic and constantly evolving.

- Failing to keep up with market changes: Staying informed about market trends, new investment strategies, and economic conditions is essential.

- Overlooking regulatory updates (e.g., Dodd-Frank): Understanding and complying with relevant regulations is crucial for mitigating risk.

- Not understanding evolving investment strategies: The private credit landscape is constantly changing, requiring continuous learning and adaptation.

Ignoring these crucial aspects will make you less competitive and potentially expose you and your employer to significant risks. Staying informed is key to success in private credit jobs.

Conclusion: Securing Your Dream Private Credit Job

Securing a successful career in private credit requires a strategic approach. By diligently following the "do's" and avoiding the "don'ts" outlined above, you significantly increase your chances of landing your dream job. Start building your network today, master essential skills in private credit, and begin tailoring your resume for private credit roles now. Focus on developing a comprehensive skillset, understanding industry trends, and building strong relationships – these are the keys to unlocking success in the competitive world of private credit jobs.

Featured Posts

-

Activision Blizzard Acquisition Ftcs Appeal And Future Uncertainty

Apr 25, 2025

Activision Blizzard Acquisition Ftcs Appeal And Future Uncertainty

Apr 25, 2025 -

From Behind To Top Bayern Munichs Bundesliga Winning Streak Continues

Apr 25, 2025

From Behind To Top Bayern Munichs Bundesliga Winning Streak Continues

Apr 25, 2025 -

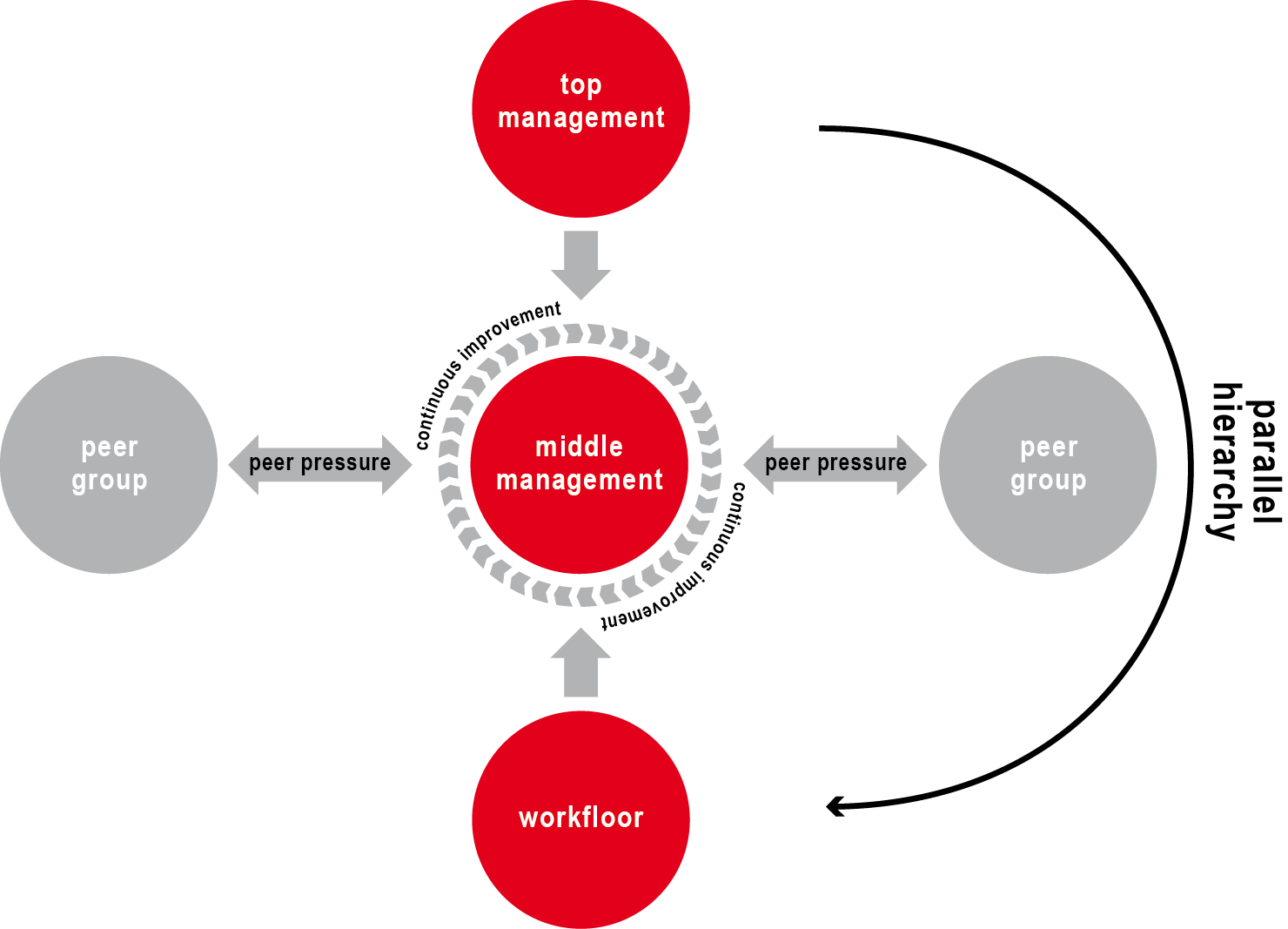

The Benefits Of Strong Middle Management For Companies And Employees

Apr 25, 2025

The Benefits Of Strong Middle Management For Companies And Employees

Apr 25, 2025 -

Desain Meja Rias Minimalis Modern Di Rumah Tren 2025

Apr 25, 2025

Desain Meja Rias Minimalis Modern Di Rumah Tren 2025

Apr 25, 2025 -

Pumas Impact On Hyrox A Look At Their Footwear

Apr 25, 2025

Pumas Impact On Hyrox A Look At Their Footwear

Apr 25, 2025

Latest Posts

-

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vliyanie S Sh A

May 10, 2025

Riski Novogo Naplyva Ukrainskikh Bezhentsev V Germaniyu Vliyanie S Sh A

May 10, 2025 -

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 10, 2025

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 10, 2025 -

Imf Review Of Pakistans 1 3 Billion Loan India Tensions And Economic Outlook

May 10, 2025

Imf Review Of Pakistans 1 3 Billion Loan India Tensions And Economic Outlook

May 10, 2025 -

S Sh A I Noviy Krizis Bezhentsev Vzglyad Iz Germanii

May 10, 2025

S Sh A I Noviy Krizis Bezhentsev Vzglyad Iz Germanii

May 10, 2025 -

Unian Makron I Tusk Podpishut Masshtabnoe Soglashenie Mezhdu Frantsiey I Polshey

May 10, 2025

Unian Makron I Tusk Podpishut Masshtabnoe Soglashenie Mezhdu Frantsiey I Polshey

May 10, 2025