Activision Blizzard Acquisition: FTC's Appeal And Future Uncertainty

Table of Contents

The FTC's Case Against the Activision Blizzard Acquisition

The FTC's opposition to the Activision Blizzard acquisition centers on concerns about anti-competitive practices and the potential for market dominance by Microsoft.

Anti-competitive Concerns

The FTC argues that the merger would significantly reduce competition, particularly within the lucrative cloud gaming market.

- Microsoft's Market Power: Microsoft already holds a substantial share of the console market with its Xbox consoles. Acquiring Activision Blizzard, with its extensive portfolio of popular franchises like Call of Duty, World of Warcraft, and Candy Crush, would further consolidate Microsoft's power.

- Exclusionary Practices: The FTC fears that Microsoft could leverage its ownership of Activision Blizzard titles to exclude competitors, potentially making these games unavailable or less accessible on rival platforms like PlayStation or Nintendo Switch. This could severely limit consumer choice.

- Stifled Innovation and Higher Prices: Reduced competition often leads to less innovation and potentially higher prices for gamers. The FTC believes this merger could stifle the development of new gaming experiences and ultimately harm consumers.

Evidence Presented by the FTC

The FTC has presented a considerable amount of evidence to support its claim, including:

- Internal Microsoft Communications: Emails and documents obtained by the FTC allegedly reveal Microsoft's intentions to use the acquisition to limit competition.

- Market Analysis and Projections: The FTC's economic experts have provided analyses suggesting the merger would create a dominant player with significant market power.

- Testimony from Industry Experts: The FTC has called upon experts in the gaming industry to testify about the potential anti-competitive effects of the merger.

Microsoft's Counterarguments

Microsoft contends that the acquisition will actually benefit gamers and promote competition. Their arguments include:

- Wider Availability: Microsoft pledges to bring Activision Blizzard games to more platforms, including cloud gaming services, making them accessible to a wider audience.

- Increased Competition: Microsoft argues that the combined entity would still face significant competition from other major players in the gaming market, such as Sony and Tencent.

- Investment in Game Development: Microsoft insists the acquisition will lead to increased investment in game development and innovation, ultimately benefiting consumers.

The FTC's Appeal and the Legal Process

The initial court ruling in favor of Microsoft prompted the FTC to file an appeal, prolonging the legal battle and increasing uncertainty.

The Initial Ruling and Subsequent Appeal

A federal judge initially dismissed the FTC's lawsuit to block the merger, a decision that surprised many industry observers. The FTC's appeal focuses on several key points of contention:

- The Judge's Interpretation of Antitrust Laws: The FTC believes the judge misapplied or misinterpreted relevant antitrust laws in their initial ruling.

- Insufficient Consideration of Cloud Gaming: The FTC argues that the court did not adequately weigh the potential harm to competition within the rapidly growing cloud gaming market.

- Weight of Evidence: The FTC maintains that the court insufficiently considered the substantial evidence presented demonstrating potential anti-competitive outcomes.

Potential Outcomes and Implications

The outcome of the FTC's appeal will profoundly impact the future of the gaming landscape:

- Blocked Acquisition: A successful appeal could result in the acquisition being completely blocked, a significant win for the FTC and proponents of increased competition in the gaming industry.

- Acquisition Proceeds: If the appeal fails, the merger is likely to proceed, leading to significant consolidation within the gaming sector.

- Industry-Wide Implications: The decision will set a precedent for future mergers and acquisitions in the tech industry, influencing how regulators approach similar deals in the future.

The Broader Impact on the Gaming Industry

The Activision Blizzard acquisition has far-reaching consequences extending beyond the immediate players.

The Future of Cloud Gaming

The acquisition's impact on cloud gaming is a central point of contention:

- Microsoft's Cloud Dominance: Concerns exist that Microsoft could leverage the acquisition to create a dominant cloud gaming ecosystem, potentially squeezing out smaller competitors.

- Reduced Choice for Consumers: A monopolized cloud gaming market could limit consumer choice and potentially lead to higher subscription fees or reduced game availability.

- Innovation Stifled: Less competition in the cloud gaming space could stifle innovation and hinder the development of new technologies and services.

Implications for Game Developers and Consumers

The acquisition's ramifications will affect various stakeholders:

- Job Security: While Microsoft has promised job security for Activision Blizzard employees, concerns remain about potential restructuring and layoffs.

- Game Pricing and Availability: The merger could influence the pricing and availability of Activision Blizzard games, potentially leading to higher prices or exclusive deals on Microsoft platforms.

- Creative Control and Innovation: Some worry that the acquisition might stifle creative control and innovation within Activision Blizzard's studios, potentially leading to less diverse and experimental game development.

Conclusion

The FTC's appeal regarding the Activision Blizzard acquisition represents a crucial juncture for the gaming industry. The outcome will profoundly shape the competitive landscape, influencing cloud gaming access, game pricing, and developer practices. Understanding the nuances of this case—from the FTC's concerns about anti-competitive behavior to Microsoft's arguments about pro-competitive benefits—is essential for anyone following the gaming industry. Stay informed on all developments in this crucial Activision Blizzard Acquisition case to better understand the potential shifts in the gaming market. The future of gaming hinges, in part, on the resolution of this significant merger.

Featured Posts

-

Nfl Scouting Combine Ashton Jeanty And The Chicago Bears

Apr 25, 2025

Nfl Scouting Combine Ashton Jeanty And The Chicago Bears

Apr 25, 2025 -

How Rented I Pads Enhance Business Conference Networking

Apr 25, 2025

How Rented I Pads Enhance Business Conference Networking

Apr 25, 2025 -

Hudsons Bays Liquidation What The Court Documents Show

Apr 25, 2025

Hudsons Bays Liquidation What The Court Documents Show

Apr 25, 2025 -

Cardinal Conclave A Battle For The Future Of Catholicism

Apr 25, 2025

Cardinal Conclave A Battle For The Future Of Catholicism

Apr 25, 2025 -

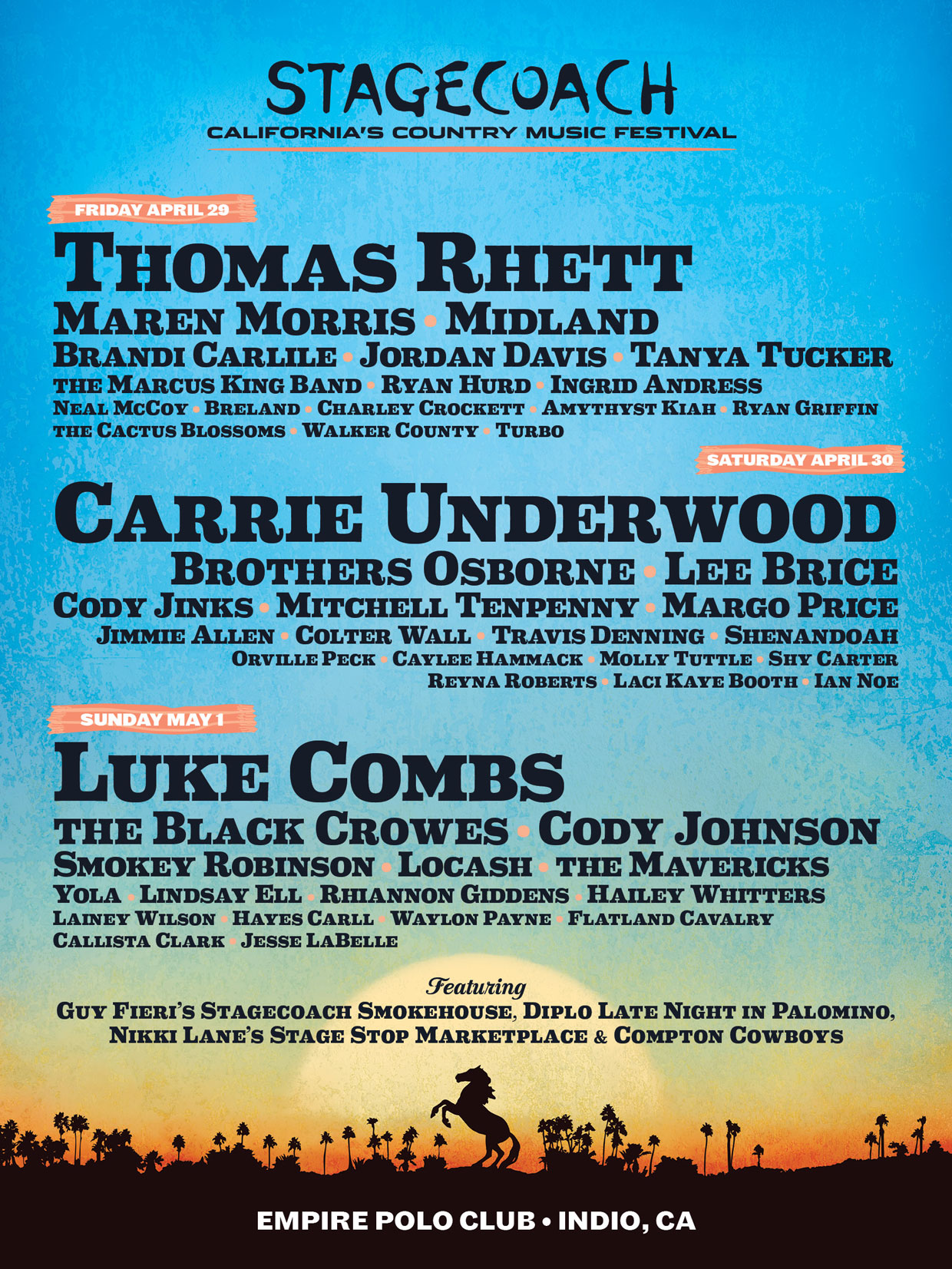

Stagecoach 2025 Country Pop And Desert Nights What To Expect

Apr 25, 2025

Stagecoach 2025 Country Pop And Desert Nights What To Expect

Apr 25, 2025

Latest Posts

-

Palantirs Nato Deal Predicting The Future Of Public Sector Ai

May 10, 2025

Palantirs Nato Deal Predicting The Future Of Public Sector Ai

May 10, 2025 -

Palantir Stock Analyzing Q1 2024 Earnings Government Vs Commercial Performance

May 10, 2025

Palantir Stock Analyzing Q1 2024 Earnings Government Vs Commercial Performance

May 10, 2025 -

Bundesliga 2 Matchday 27 Results And Colognes Rise To The Top

May 10, 2025

Bundesliga 2 Matchday 27 Results And Colognes Rise To The Top

May 10, 2025 -

Palantir And Nato A New Ai Revolution In The Public Sector

May 10, 2025

Palantir And Nato A New Ai Revolution In The Public Sector

May 10, 2025 -

Bundesliga 2 Matchday 27 Overview Cologne Dethrones Hamburg

May 10, 2025

Bundesliga 2 Matchday 27 Overview Cologne Dethrones Hamburg

May 10, 2025