IMF Review Of Pakistan's $1.3 Billion Loan: India Tensions And Economic Outlook

Table of Contents

IMF's Conditions and Pakistan's Economic Reforms

The IMF's disbursement of the $1.3 billion loan is contingent upon Pakistan meeting a series of stringent conditions designed to stabilize its economy. These conditions, often referred to as structural adjustment programs, demand significant economic reforms. Keywords: IMF conditions Pakistan, structural adjustment, fiscal reforms Pakistan, monetary policy Pakistan.

The core of these reforms centers around fiscal consolidation, aiming to reduce the country's massive budget deficit. This involves:

- Tax Reforms: Implementing broader tax collection measures to increase government revenue. This includes tackling tax evasion and broadening the tax base.

- Privatization: Selling off state-owned enterprises to reduce government debt and improve efficiency. This often faces significant political resistance.

- Monetary Policy Adjustments: Controlling inflation through measures like raising interest rates, which can negatively impact economic growth in the short-term.

- Energy Sector Reforms: Addressing the chronic energy crisis through improved efficiency and diversification of energy sources.

Meeting these conditions presents formidable challenges for Pakistan. The political landscape is often volatile, hindering the implementation of unpopular reforms. Powerful vested interests may resist privatization efforts, and the public may struggle with the consequences of fiscal austerity measures.

- Potential Positive Impacts: Reduced inflation, improved fiscal health, increased foreign investment.

- Potential Negative Impacts: Short-term economic slowdown, social unrest due to austerity measures, potential political instability.

The Impact of India-Pakistan Tensions on the Economy

The volatile relationship between India and Pakistan significantly impacts Pakistan's economic stability. Keywords: India Pakistan tensions, military spending Pakistan, regional instability, trade relations India Pakistan, geopolitical risks Pakistan. Heightened tensions divert resources towards defense, increasing military spending at the expense of crucial social programs and development initiatives.

- Investor Confidence: Geopolitical instability scares away foreign investors, hindering economic growth and reducing access to much-needed capital.

- Trade Disruptions: Strained relations often lead to disruptions in trade and commerce, impacting various sectors, particularly agriculture and textiles.

- Tourism: Tensions dramatically affect the tourism sector, a crucial source of revenue for Pakistan.

The constant threat of conflict creates a climate of uncertainty, making it difficult to attract foreign investment and impacting long-term economic planning. The cost of maintaining a large military also places a significant burden on the already strained national budget.

- Specific Examples: The frequent border skirmishes lead to decreased cross-border trade. Negative media coverage of tensions discourages tourist visits.

Pakistan's Short-Term and Long-Term Economic Outlook

Pakistan's short-term economic outlook is inextricably linked to the success or failure of the IMF loan program and the resolution of its geopolitical issues. Keywords: Pakistan economic growth, debt sustainability Pakistan, inflation Pakistan, poverty reduction Pakistan, sustainable development Pakistan. If the conditions are met, a degree of macroeconomic stability might be achieved, curbing inflation and possibly leading to modest growth. However, the challenges are substantial.

- Short-Term Prospects: Continued economic hardship, potential for further devaluation of the Pakistani Rupee, high inflation impacting the poorest segments of the population.

- Long-Term Challenges: High levels of public debt, dependence on foreign aid, lack of diversification in the economy.

- Long-Term Opportunities: Potential for growth in certain sectors (e.g., technology), development of renewable energy sources, improved trade relations with regional partners.

The sustainability of Pakistan's debt is a critical concern. Without significant reforms and sustained economic growth, the country risks a debt crisis. The IMF loan offers a lifeline, but its success hinges on political will and effective implementation of necessary reforms.

Potential Solutions and International Assistance

Addressing Pakistan's economic woes requires a multi-pronged approach involving domestic reforms and significant international assistance. Keywords: Foreign aid Pakistan, debt relief Pakistan, international cooperation Pakistan, economic diversification Pakistan.

- Debt Relief: International creditors could offer debt relief to alleviate the burden of servicing Pakistan's massive debt.

- Foreign Aid: Increased financial assistance from international organizations and friendly nations could provide much-needed support for crucial social programs and development initiatives.

- Economic Diversification: Moving away from reliance on a few key sectors towards a more diversified economy is essential for long-term sustainability. This includes promoting industries like technology, renewable energy, and tourism.

- Regional Cooperation: Improved relations with neighboring countries, especially India, are vital for boosting trade and investment.

International cooperation is crucial. A stable and prosperous Pakistan is in the interest of the entire region. The potential for regional cooperation, focusing on trade and development, offers significant long-term benefits.

Conclusion: Navigating the Future with the IMF Pakistan Loan

The IMF loan review represents a critical juncture for Pakistan's economy. The success of the program is contingent on implementing necessary reforms, managing geopolitical tensions with India, and securing substantial international assistance. The challenges are immense, but opportunities for sustainable development and economic growth exist. The path forward demands a concerted effort from the Pakistani government, international organizations, and neighboring countries. To stay updated on the evolving situation, we encourage readers to further research the IMF loan to Pakistan and its implications for the region. Search for "Pakistan IMF loan update," "analyzing Pakistan's economic future," and "impact of geopolitical tensions on Pakistan's economy" for more in-depth analysis.

Featured Posts

-

Transgender Equality In Thailand Recent Developments Reported By The Bangkok Post

May 10, 2025

Transgender Equality In Thailand Recent Developments Reported By The Bangkok Post

May 10, 2025 -

Nottingham Attacks Experienced Judge To Oversee Investigation

May 10, 2025

Nottingham Attacks Experienced Judge To Oversee Investigation

May 10, 2025 -

Woman Kills Man In Unprovoked Racist Stabbing Attack

May 10, 2025

Woman Kills Man In Unprovoked Racist Stabbing Attack

May 10, 2025 -

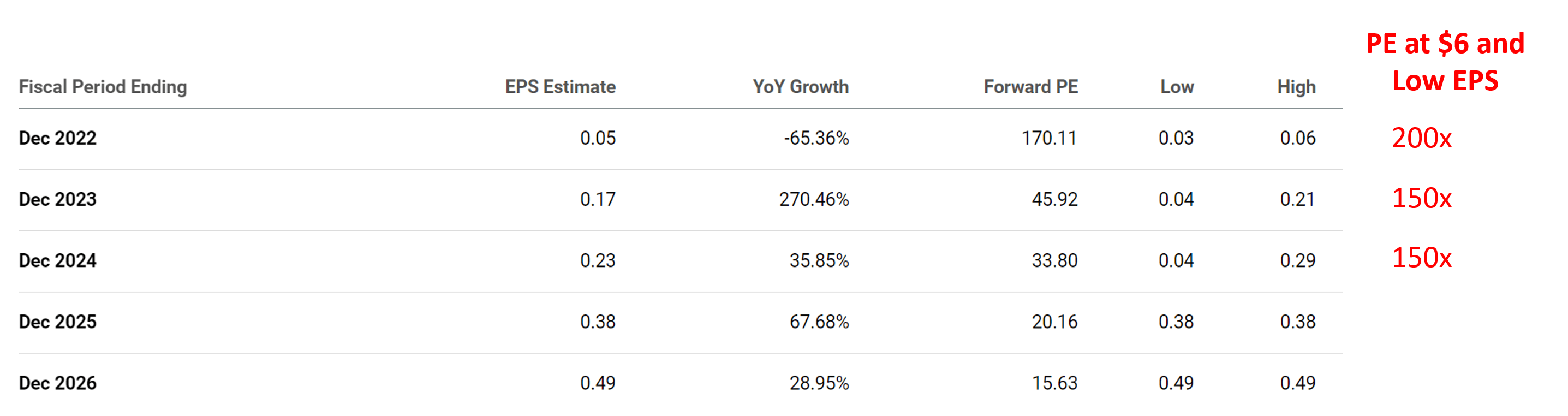

Evaluating Palantir Following A 30 Market Correction

May 10, 2025

Evaluating Palantir Following A 30 Market Correction

May 10, 2025 -

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 10, 2025

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 10, 2025