Posthaste Warning: The World's Largest Bond Market Faces Trouble

Table of Contents

Soaring Interest Rates and Their Impact on Bond Prices

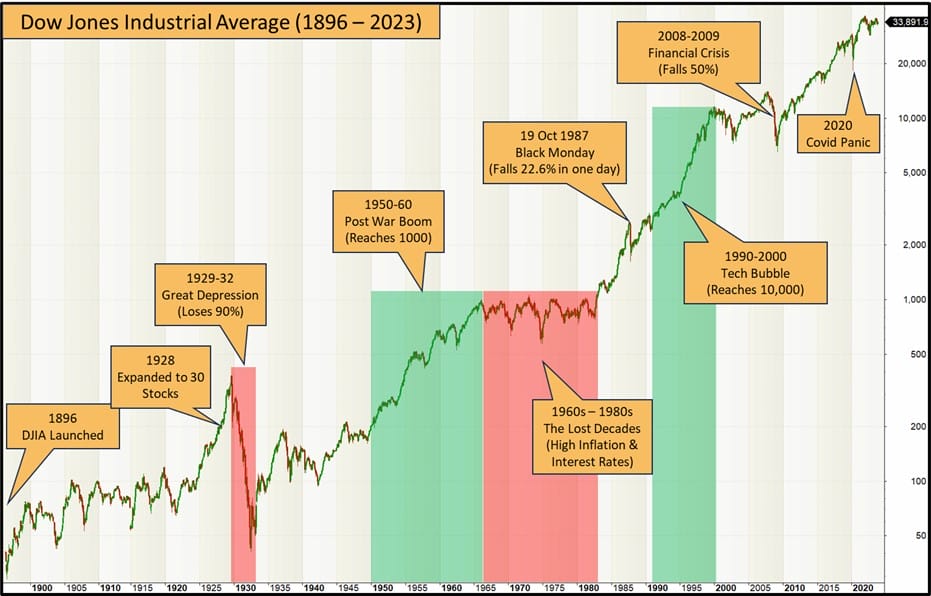

The relationship between interest rates and bond prices is inversely proportional. This means that as interest rates rise, bond prices fall, and vice versa. The Federal Reserve's aggressive campaign of interest rate hikes to combat inflation has significantly impacted bond yields. This aggressive monetary policy, while aiming to curb inflation, has created a challenging environment for bond investors.

- Rising interest rates make existing bonds less attractive. Investors are less inclined to hold bonds with lower fixed interest payments when new bonds offer higher yields.

- Increased yields on newly issued bonds put downward pressure on older bond prices. This phenomenon forces investors to accept lower prices for existing bonds to maintain competitiveness.

- The impact on different types of bonds (short-term vs. long-term) varies. Longer-term bonds are generally more sensitive to interest rate changes than short-term bonds due to their longer duration.

[Insert chart showing correlation between interest rate increases and bond price movements] The chart clearly illustrates the inverse relationship; as the Federal Funds Rate climbed, bond prices experienced a corresponding decline. This trend highlights the significant risk associated with holding fixed-income assets in a rising interest rate environment.

The Inflationary Spiral and its Threat to Fixed Income

Persistent inflation significantly erodes the purchasing power of bond returns. High inflation reduces the real return on investment, meaning that while the nominal yield might seem attractive, the actual purchasing power of the returns diminishes. Central banks face the difficult task of controlling inflation without triggering a recession, a delicate balancing act with potentially severe consequences.

- Inflation's impact on real bond yields (inflation-adjusted returns) is substantial. Real yields represent the actual return after accounting for inflation, offering a more realistic picture of investment performance.

- The risk of higher-than-expected inflation further depressing bond prices is a significant concern. Unforeseen inflationary pressures can exacerbate the negative impact on bond valuations.

- Strategies investors may use to mitigate inflation risk within their bond portfolios include: Investing in inflation-protected securities (TIPS), diversifying into other asset classes, and considering shorter-term bonds.

[Insert statistics on current inflation rates and their projected trajectory] The current inflation rate of X% and projected rate of Y% underscore the urgency for investors to consider the impact on their fixed-income investments.

Increased Risk of Recession and its Implications for the Bond Market

Economic recessions significantly impact bond market performance. During recessions, investor behavior often shifts. While a "flight to safety" might increase demand for government bonds, the overall economic downturn often leads to decreased demand and potentially increased defaults.

- How recessionary fears influence investor demand for bonds is complex. Fear of recession can drive investors to seek safety in government bonds, increasing demand. However, a severe recession can also decrease overall demand.

- The potential for increased bond defaults during economic downturns is a significant risk. Companies struggling financially may default on their debt obligations, leading to losses for bondholders.

- Safe haven assets and alternative investment strategies during a recession include: Gold, other precious metals, and high-quality corporate bonds with strong credit ratings.

Alternative Investment Strategies in a Troubled Bond Market

Given the current challenges facing the US Treasury bond market, investors need to explore alternative investment strategies. While traditional bonds remain a core component of many portfolios, diversification is crucial in the current climate.

- High-yield bonds (and their increased risks): High-yield bonds offer higher returns but carry significantly higher default risk, especially during economic downturns.

- Diversification into other asset classes (stocks, real estate, commodities): Allocating funds to different asset classes helps reduce overall portfolio volatility.

- Strategies for actively managing bond portfolios in a volatile market: This could involve adjusting portfolio duration, utilizing bond ETFs, or employing tactical asset allocation strategies.

Conclusion

The world's largest bond market, the US Treasury market, faces significant challenges: rising interest rates, persistent inflation, and the looming threat of recession. These factors create a complex and volatile environment for investors, requiring careful consideration and proactive portfolio management. The implications for investors and the global economy are substantial. To navigate this turbulent landscape effectively, investors should carefully consider their risk tolerance and investment objectives. Seek professional financial advice to develop a robust investment strategy tailored to your specific needs. Further research on topics such as "US Treasury bond outlook," "fixed income investment strategies," or "managing bond portfolio risk" is strongly recommended. Don't underestimate the potential impact on your investments in the world's largest bond market – take action today.

Featured Posts

-

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025

Chat Gpt Maker Open Ai Under Ftc Investigation A Deep Dive

May 24, 2025 -

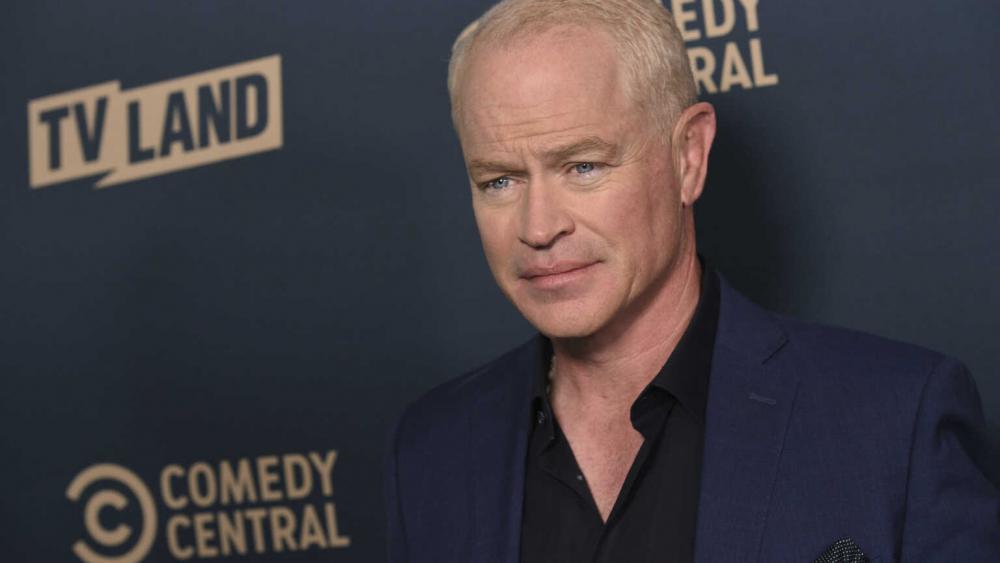

The Last Rodeo An Interview With Neal Mc Donough On Bull Riding And Portraying The Pope

May 24, 2025

The Last Rodeo An Interview With Neal Mc Donough On Bull Riding And Portraying The Pope

May 24, 2025 -

Forecasting Apple Stock Aapl Price Levels

May 24, 2025

Forecasting Apple Stock Aapl Price Levels

May 24, 2025 -

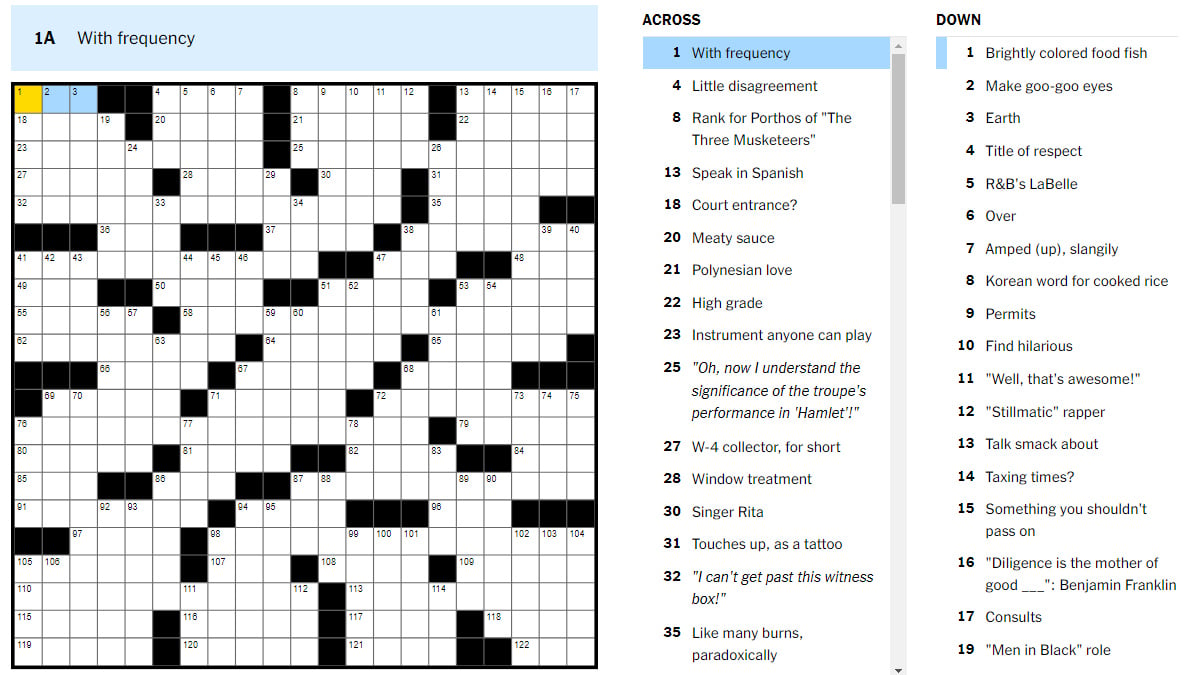

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025

Latest Posts

-

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025 -

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025 -

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025 -

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025