Forecasting Apple Stock (AAPL) Price Levels

Table of Contents

Analyzing Apple's Financial Performance and Fundamentals

Forecasting AAPL's stock price begins with a deep dive into its financial health and underlying fundamentals. This involves scrutinizing various aspects to understand its past performance and potential future trajectory.

Revenue and Earnings Growth

Analyzing Apple's revenue streams is paramount for accurate Apple stock price analysis. The company generates revenue from diverse sources, including: iPhones, Services (App Store, Apple Music, iCloud), Macs, iPads, Wearables, and Accessories. Consistent earnings growth is a strong indicator of future stock price appreciation. Key financial ratios such as Earnings Per Share (EPS) and the revenue growth rate offer vital insights into the company's profitability and expansion.

- Recent Performance: Apple has consistently demonstrated strong revenue and earnings growth over the past decade.

- Future Projections: Analysts predict continued growth, driven by factors like the expanding Services segment and international market expansion. However, economic downturns can impact future projections.

- Key Ratios: Monitoring EPS growth and year-over-year revenue increase provides a clear picture of the company's financial health.

Product Innovation and Market Share

Apple's success hinges on its ability to innovate and maintain a strong market share. New product launches, such as the iPhone, Apple Watch, and iPad, significantly impact the AAPL stock forecast. Analyzing the competitive landscape – considering rivals like Samsung and Google – is essential.

- Upcoming Products: Rumors and official announcements surrounding future product releases (e.g., new iPhones, updated Macs) heavily influence investor sentiment and, consequently, stock prices.

- Market Share: Maintaining or increasing market share in key segments (smartphones, wearables, tablets) indicates a healthy competitive position, boosting investor confidence.

- Technological Innovation: Apple's commitment to research and development fuels its ongoing innovation, making its future stock price difficult to predict but potentially lucrative.

Debt and Cash Position

A strong balance sheet is crucial for any company's long-term viability. Apple's substantial cash reserves and relatively low debt levels contribute to its financial stability and enhance its ability to weather economic downturns.

- Current Financial Position: Apple maintains a strong cash position, providing financial flexibility for acquisitions, research and development, and share buybacks.

- Implications: A healthy balance sheet contributes to stock price stability and increases investor confidence, potentially leading to higher valuations in the Apple stock future.

Assessing External Factors Influencing Apple Stock

While internal factors are crucial, external forces also play a significant role in shaping AAPL's stock price.

Macroeconomic Conditions

Global economic trends, including inflation, interest rates, and recessionary fears, exert a powerful influence on consumer spending and, subsequently, Apple's sales.

- Economic Impact: Periods of economic uncertainty can negatively impact consumer spending on discretionary items like iPhones and other Apple products, affecting Apple stock prediction.

- Interest Rates: Rising interest rates can increase borrowing costs for businesses and consumers, potentially dampening demand for Apple products.

Geopolitical Risks and Supply Chain Dynamics

Geopolitical instability and trade wars pose significant risks to Apple's supply chain, potentially disrupting production and distribution.

- Supply Chain Vulnerabilities: Apple's reliance on global manufacturing networks makes it vulnerable to disruptions caused by geopolitical events.

- Trade Wars: Trade disputes can increase production costs and affect the availability of Apple products, impacting AAPL stock price analysis.

Competitive Landscape and Technological Disruptions

The competitive landscape is constantly evolving. Competitors like Samsung and Google consistently introduce innovative products and services. Emerging technologies could also disrupt Apple's market position.

- Competitive Threats: New entrants and established competitors constantly challenge Apple's market leadership, affecting investor sentiment and Apple stock prediction.

- Disruptive Technologies: The emergence of new technologies could render some of Apple's products obsolete, posing a long-term risk.

Utilizing Technical Analysis and Forecasting Tools

Technical analysis offers another perspective on AAPL stock forecast.

Chart Patterns and Indicators

Technical analysts utilize chart patterns (head and shoulders, double tops/bottoms) and indicators (moving averages, RSI, MACD) to identify potential price trends.

- Moving Averages: These provide insights into price momentum and potential support and resistance levels.

- RSI (Relative Strength Index): This indicator helps assess whether the stock is overbought or oversold.

- MACD (Moving Average Convergence Divergence): This indicator identifies changes in momentum.

Algorithmic Trading and Predictive Modeling

Algorithmic trading and machine learning are increasingly used to predict stock prices. However, these methods are not foolproof.

- Limitations: Algorithmic predictions are susceptible to biases in the data used to train the models.

- Cautions: It's crucial to avoid relying solely on algorithmic predictions.

Mastering the Art of Forecasting Apple Stock (AAPL) Price Levels

Predicting Apple stock prices requires a holistic approach, integrating fundamental analysis (financial performance, external factors) with technical analysis (chart patterns, indicators). Remember that stock market forecasting is inherently uncertain, and risk management is crucial. While tools and techniques can offer valuable insights, they do not guarantee success. Start your Apple stock price forecasting journey today! Become a savvy Apple stock (AAPL) investor with informed forecasting strategies and thorough research before making any investment decisions.

Featured Posts

-

Dissidents Chinois En France Face A La Repression De Pekin

May 24, 2025

Dissidents Chinois En France Face A La Repression De Pekin

May 24, 2025 -

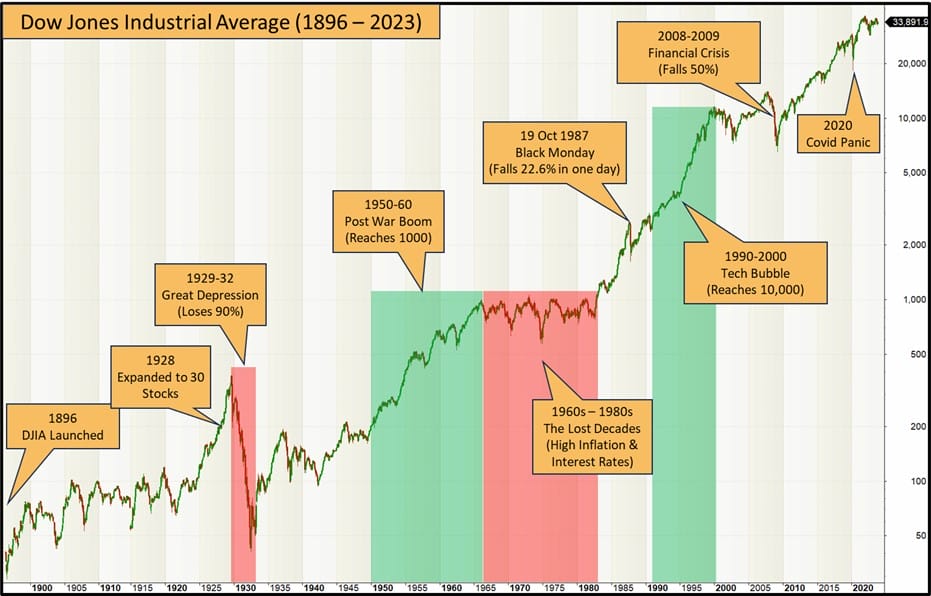

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Dist Nav Analysis

May 24, 2025 -

G 7 Weighs Lower Tariffs On Chinese Imports De Minimis Debate Heats Up

May 24, 2025

G 7 Weighs Lower Tariffs On Chinese Imports De Minimis Debate Heats Up

May 24, 2025 -

Ae Xplore England Airpark And Alexandria International Airports New Global Travel Initiative

May 24, 2025

Ae Xplore England Airpark And Alexandria International Airports New Global Travel Initiative

May 24, 2025 -

Frances National Rally Sundays Turnout Raises Questions About Le Pens Support

May 24, 2025

Frances National Rally Sundays Turnout Raises Questions About Le Pens Support

May 24, 2025

Latest Posts

-

Changes To Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025

Changes To Italian Citizenship Law Eligibility Through Great Grandparents

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent Pathway

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent Pathway

May 24, 2025 -

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025 -

Best And Final Job Offer Dont Give Up Negotiation Tactics

May 24, 2025

Best And Final Job Offer Dont Give Up Negotiation Tactics

May 24, 2025 -

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025