Posthaste: How High Down Payments Price Canadians Out Of Homes

Table of Contents

The Soaring Cost of Housing and its Impact on Down Payments

Escalating House Prices in Major Canadian Cities

House prices in major Canadian cities like Toronto, Vancouver, and Montreal have skyrocketed in recent years. This dramatic increase significantly impacts the amount needed for a down payment.

- Toronto: Average house prices have increased by X% year-over-year (Source: Canadian Real Estate Association - insert specific data and year). This translates to a minimum down payment of Y dollars for a typical home (assuming a 5% down payment).

- Vancouver: Similar upward trends are observed in Vancouver, with an average price increase of Z% year-over-year (Source: Canadian Real Estate Association - insert specific data and year), requiring a down payment of W dollars for an average property.

- Montreal: While Montreal's market is relatively more affordable, it's still experiencing substantial growth, impacting down payment needs. (Source: Canadian Real Estate Association - insert specific data and year).

These escalating prices make saving for a sufficient down payment increasingly challenging, especially for first-time homebuyers.

The Role of Interest Rates in Increasing Down Payment Burden

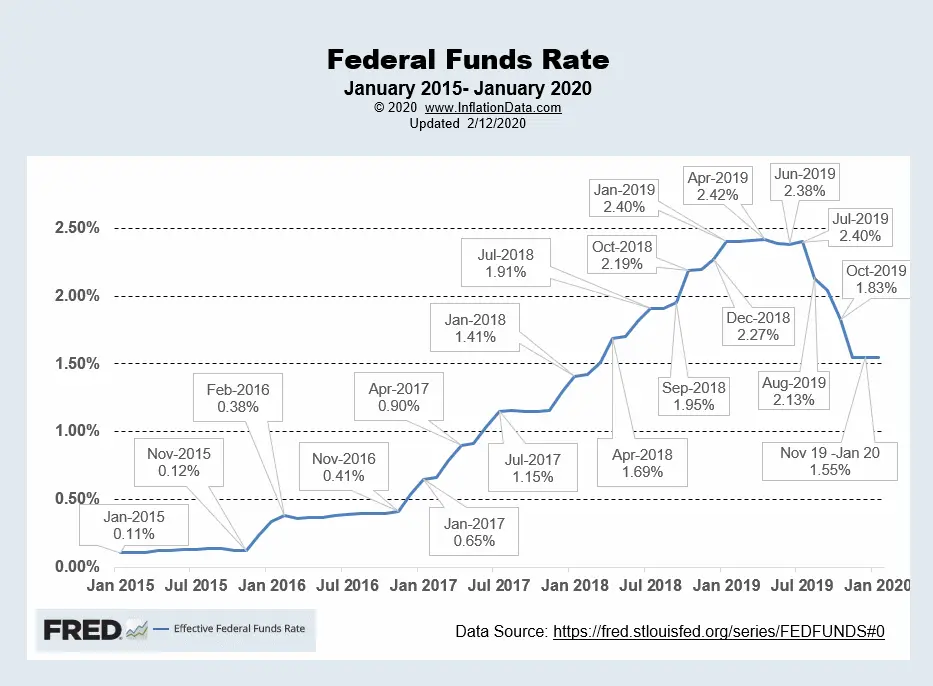

Rising interest rates further exacerbate the affordability crisis. A higher interest rate means a larger mortgage payment, increasing the overall cost of the home and making it even more difficult to save for a substantial down payment.

- Example: A 1% increase in interest rates can add thousands of dollars to the total cost of a mortgage over its lifetime.

- Variable vs. Fixed Rates: Variable-rate mortgages offer lower initial payments but are vulnerable to rate hikes. Fixed-rate mortgages provide stability but often come with higher initial payments. Both impact the affordability of saving for a down payment.

The interplay between rising house prices and interest rates creates a perfect storm, making homeownership a distant dream for many Canadians.

Stricter Lending Policies and Their Effect on Down Payment Requirements

The Impact of the Stress Test

The Bank of Canada's mortgage stress test requires lenders to qualify borrowers at a higher interest rate than the actual rate they're offered. This measure aims to ensure borrowers can handle unexpected interest rate increases, but it effectively increases the required down payment for many potential homebuyers.

- Example: A borrower who qualifies for a mortgage at a 5% interest rate might need to demonstrate affordability at a 6% rate under the stress test, increasing their needed down payment.

- Effectiveness: While intended to prevent defaults, the stress test adds to the already significant hurdle of saving for a down payment.

Changes in Mortgage Insurance Premiums

For those putting down less than 20%, CMHC mortgage loan insurance is mandatory. Changes in these premiums directly affect the overall cost, impacting down payment amounts.

- Premium Variations: Premiums vary based on the down payment percentage. A smaller down payment means higher insurance premiums, increasing the financial burden.

- Impact on First-Time Homebuyers: This disproportionately affects first-time homebuyers who typically have less savings and rely heavily on CMHC insurance.

The Disproportionate Impact on Specific Demographics

Challenges Faced by First-Time Homebuyers

First-time homebuyers face significant hurdles in saving for a down payment.

- Lack of Savings Opportunities: Competition for rental units and rising rent prices leave little room for substantial savings.

- Competition with Investors: Increased competition from investors driving up prices makes it harder for first-time buyers to enter the market.

- High Down Payment Threshold: The sheer size of down payments required, even for modest homes, creates a substantial barrier to entry.

Impact on Lower-Income Households and Marginalized Communities

High down payments disproportionately affect lower-income households and marginalized communities.

- Statistical Disparity: Homeownership rates are significantly lower among lower-income groups and specific marginalized communities (Source: insert relevant statistical data and source).

- Societal Implications: This disparity perpetuates inequality and limits access to the wealth-building opportunities associated with homeownership.

Potential Solutions and Government Interventions

Government Initiatives to Increase Homeownership Affordability

Several government initiatives aim to increase homeownership affordability.

- First-Time Home Buyer Incentive: This program offers a shared-equity mortgage loan, reducing the down payment required. (Explain details and limitations)

- Other Programs: Mention other relevant provincial or federal programs and their effectiveness in addressing the down payment challenge.

Alternative Financing Options and Strategies

Exploring alternative financing strategies could ease the burden of high down payments.

- Shared Equity Programs: These programs allow individuals or organizations to invest a portion of the home's equity in exchange for reduced down payments.

- Innovative Financing Solutions: Explore and discuss newer financing models that might emerge to better assist buyers. (Examples from other countries can be included)

Conclusion: Navigating the High Cost of Down Payments in Canada

High down payments represent a major barrier to homeownership for many Canadians. Rising house prices, stricter lending policies, and the disproportionate impact on specific demographics contribute to this challenge. While government initiatives exist, they often fall short of fully addressing the problem. Exploring alternative financing models and continued policy adjustments are crucial to making homeownership more accessible and equitable for all Canadians. Understanding the challenges of high down payments is the first step towards achieving your dream of homeownership. Learn more about available resources and government programs today – don't let high down payments price you out of the market!

Featured Posts

-

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Adoptee

May 10, 2025

Conseil Metropolitain De Dijon La 3e Ligne De Tram Concertation Adoptee

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

Analysis Of Us Government Grants For Transgender Animal Research

May 10, 2025

Analysis Of Us Government Grants For Transgender Animal Research

May 10, 2025 -

Imf Review Of Pakistans 1 3 Billion Loan India Tensions And Economic Outlook

May 10, 2025

Imf Review Of Pakistans 1 3 Billion Loan India Tensions And Economic Outlook

May 10, 2025 -

Interest Rate Decisions Understanding The Feds Cautious Approach

May 10, 2025

Interest Rate Decisions Understanding The Feds Cautious Approach

May 10, 2025