Post-Election Australian Asset Market Outlook: A Positive Forecast?

Table of Contents

Government Policy and its Impact on Investment

The newly elected government's policy platform will undoubtedly shape the Post-Election Australian Asset Market Outlook. Analyzing these proposals is key to anticipating potential market movements. Specific policy changes will directly affect investment strategies across different asset classes.

- Specific policy changes impacting the property market: Proposed changes to negative gearing or capital gains tax could significantly influence residential property investment. Similarly, new regulations concerning foreign investment in real estate will affect market dynamics. Increased stamp duty or land tax could also dampen investor enthusiasm.

- Infrastructure spending plans and their effect on related sectors: Increased government spending on infrastructure projects, such as roads, railways, and utilities, will likely boost related sectors like construction, engineering, and materials supply. This increased activity could translate into positive growth and investment opportunities in these sectors.

- Potential changes to taxation affecting investment strategies: Alterations to tax rates for capital gains, dividends, or franking credits will impact investment decisions. Investors will need to adapt their strategies based on these changes to optimize returns.

- Analysis of the government's approach to regulation and its influence on market confidence: A business-friendly regulatory environment fosters confidence and attracts investment, while excessive regulation can stifle economic growth. The government's stance on regulation will greatly influence investor sentiment and market stability.

Economic Growth Projections and Asset Performance

The Post-Election Australian Asset Market Outlook is intrinsically linked to broader economic forecasts. Projected GDP growth and inflation rates will influence the performance of various asset classes. Global economic conditions also play a crucial role.

- GDP growth forecasts and their correlation with asset prices: Stronger GDP growth typically correlates with higher asset prices, as increased economic activity stimulates demand. Conversely, slower growth can lead to price corrections.

- Inflation predictions and their impact on interest rates and investment returns: High inflation generally leads to interest rate hikes by the Reserve Bank of Australia (RBA), affecting borrowing costs and returns on fixed-income investments. This impacts investment decisions across asset classes.

- Analysis of key economic indicators (e.g., unemployment, consumer confidence): Low unemployment rates usually suggest a strong economy, while high consumer confidence points to increased spending and potential market buoyancy. These indicators provide insights into the overall economic health.

- Discussion of potential risks to economic growth (e.g., global recession, supply chain disruptions): External factors such as global recessions or supply chain issues can significantly impact the Australian economy and the performance of domestic assets.

Analysis of Key Asset Classes: Property, Equities, and Bonds

Understanding the interplay between government policies, economic forecasts and asset classes is critical for a comprehensive Post-Election Australian Asset Market Outlook. Let's break down the forecast for each major sector.

Property Market Outlook

- Forecast for residential and commercial property values: Depending on the government's policies and broader economic conditions, property values could either increase or decrease. Factors such as interest rates and housing supply will play a significant role.

- Analysis of rental yields and vacancy rates: These metrics indicate the attractiveness of property investments. High rental yields and low vacancy rates suggest strong market demand.

- Impact of interest rate changes on mortgage affordability: Interest rate adjustments by the RBA directly affect mortgage repayments and, consequently, the affordability of property purchases.

- Potential investment opportunities within the property sector: Depending on the market conditions and government policies, specific property segments might offer better investment potential than others.

Equities Market Outlook

- Expected performance of the Australian share market (ASX): The ASX's performance will be shaped by global market conditions, economic growth, and investor sentiment.

- Sector-specific analysis (e.g., resources, technology, financials): Different sectors within the ASX are expected to perform differently based on their sensitivity to economic shifts and government policies.

- Impact of global market trends on Australian equities: Global events and economic performance greatly influence the Australian equities market, highlighting the interconnectedness of the global economy.

- Potential risks and opportunities in the equities market: Identifying potential risks and opportunities requires thorough analysis of specific companies and market trends.

Bond Market Outlook

- Analysis of government bond yields and their sensitivity to interest rate changes: Government bond yields are influenced by interest rate expectations and are typically inversely related to bond prices.

- Discussion of corporate bond market performance: Corporate bond yields reflect the creditworthiness of individual companies and their sensitivity to economic conditions.

- Assessment of the risk and return profile of different bond investments: Investors should consider the risk-return trade-off when making bond investment decisions.

Risks and Uncertainties

While the Post-Election Australian Asset Market Outlook appears positive based on the initial analysis, several uncertainties remain.

- Geopolitical risks and their potential influence on the Australian economy: Global geopolitical events can cause market volatility and significantly impact asset prices.

- Uncertainty surrounding interest rate hikes and their potential impact on asset prices: The RBA's approach to interest rate adjustments will continue to affect market performance.

- Potential for unforeseen economic shocks (e.g., natural disasters): Unforeseen economic shocks can introduce significant uncertainty into the market.

Conclusion

The Post-Election Australian Asset Market Outlook presents a complex picture. While projected economic growth and government policies suggest potential opportunities, significant risks and uncertainties remain. The property market may see moderate growth depending on interest rate changes and government interventions. The equities market is expected to follow global trends, presenting both risks and rewards. The bond market's performance will hinge on interest rate movements. Understanding the Post-Election Australian Asset Market Outlook is crucial for informed investment decisions. While this analysis offers a perspective, it's recommended to consult with a financial advisor to tailor a strategy to your specific circumstances and risk tolerance. Stay informed on the evolving Post-Election Australian Asset Market Outlook for the best investment opportunities.

Featured Posts

-

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025

Will Australian Assets Rise After The Election Expert Analysis

May 06, 2025 -

Carneys Plan A Generation Defining Economic Transformation

May 06, 2025

Carneys Plan A Generation Defining Economic Transformation

May 06, 2025 -

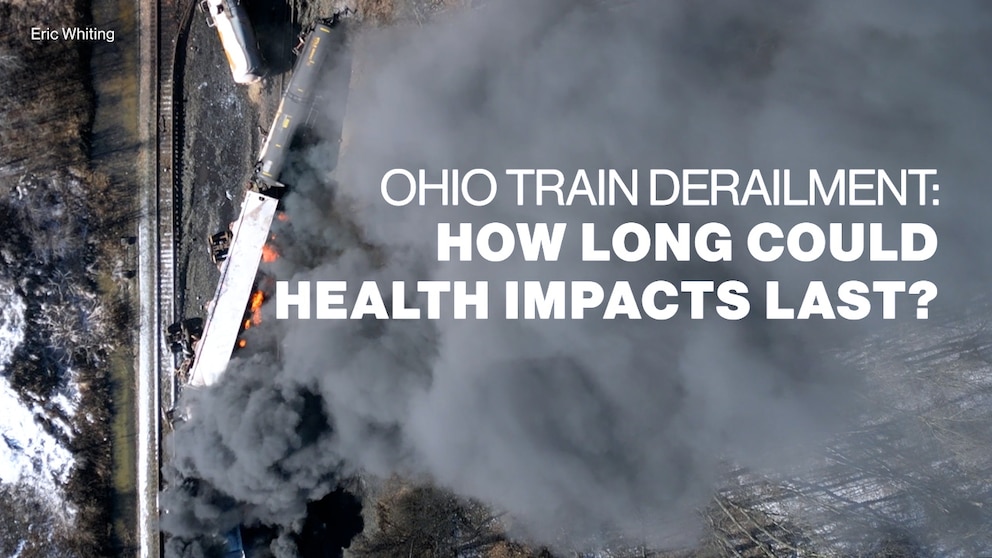

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

May 06, 2025

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

May 06, 2025 -

Rising Waters Threaten Venice Exploring A Bold New Solution

May 06, 2025

Rising Waters Threaten Venice Exploring A Bold New Solution

May 06, 2025 -

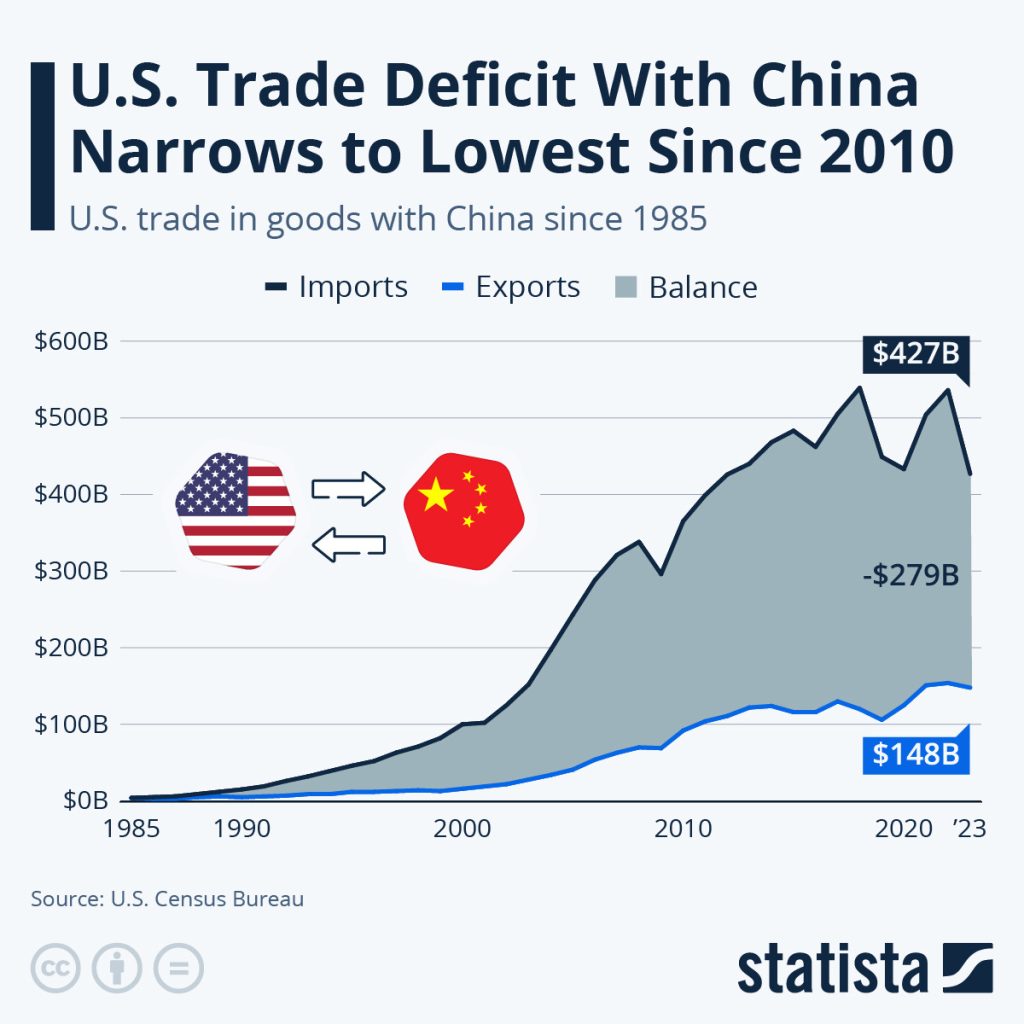

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025

Latest Posts

-

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Winning Prediction And Best Bets

May 06, 2025 -

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025

Celtics Vs Knicks Playoff Game 1 Predictions And Betting Analysis

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For The Nba Playoffs

May 06, 2025 -

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025

Celtics Vs Heat Tipoff Time Tv Channel And Live Stream February 10

May 06, 2025 -

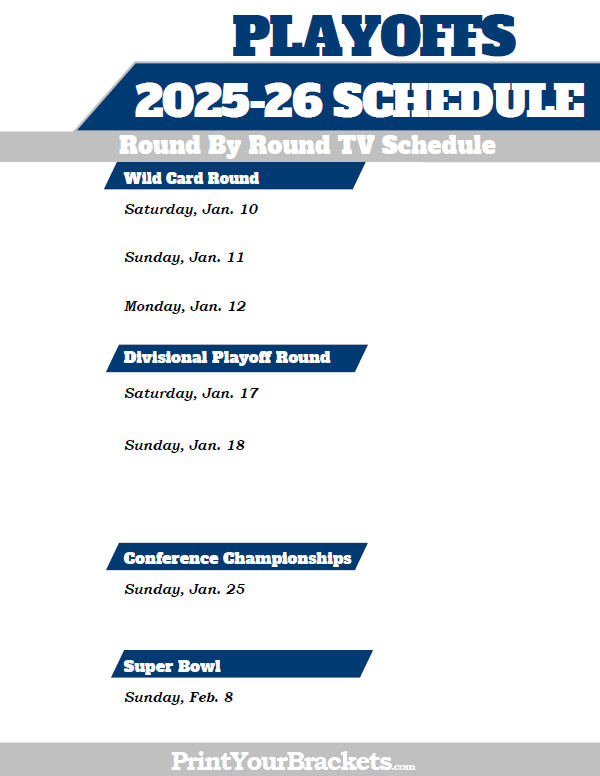

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025