Rising Copper Prices: Analysis Of China's Influence And US Trade Relations

Table of Contents

China's Growing Demand and its Impact on Rising Copper Prices

China's economic growth and ambitious infrastructure plans are major drivers of rising copper prices. The country's massive consumption of copper significantly impacts global supply and demand dynamics.

China's Infrastructure Investments

Massive infrastructure projects are a key factor fueling the demand for copper. China's ongoing investments in high-speed rail, renewable energy (solar, wind), and extensive urban development require enormous quantities of copper.

- Increased demand for copper wiring, cabling, and construction materials: These projects necessitate vast amounts of copper for electrical wiring, cabling systems, and building construction. The sheer scale of these undertakings translates into a significant portion of global copper demand.

- Government policies promoting green energy further boost copper consumption: China's commitment to renewable energy sources like solar and wind power necessitates extensive use of copper in the manufacturing and installation of these systems. This green initiative further drives up copper demand.

- Analysis of historical data correlating Chinese infrastructure spending with copper price increases: Statistical analysis clearly demonstrates a strong correlation between increases in Chinese infrastructure spending and subsequent rises in global copper prices. This relationship highlights the significant influence of China's economic policies on the copper market.

China's Role in Global Copper Production and Refining

China's position as a major copper producer and refiner significantly impacts global supply chains and price fluctuations. Its influence extends beyond mere consumption.

- Examination of China's copper mining output and its impact on global supply: China's substantial copper mining output contributes a significant portion to the global supply. Fluctuations in Chinese production directly affect the overall availability of copper.

- Analysis of Chinese copper refining capacity and its influence on global market prices: China's extensive copper refining capacity plays a crucial role in processing raw copper into usable forms. Any disruptions or changes in this capacity can heavily influence global copper prices.

- Discussion of potential bottlenecks and supply chain disruptions originating from China: Geopolitical factors, environmental regulations, or unexpected economic slowdowns in China can create bottlenecks and disruptions in the global copper supply chain, leading to price volatility.

The Impact of Chinese Economic Slowdowns

Economic slowdowns in China can significantly impact global copper demand and subsequently, copper prices. This creates considerable market volatility for investors.

- Analysis of past economic slowdowns in China and their correlation with copper price drops: Historical data reveals a clear correlation between economic slowdowns in China and subsequent decreases in global copper prices. This underlines the sensitivity of the copper market to changes in Chinese economic activity.

- Discussion of potential future economic slowdowns and their predicted impact on the copper market: Analysts constantly assess the potential for future economic slowdowns in China and their likely impact on global copper demand and pricing. Understanding these predictions is vital for risk management.

- Strategies for mitigating risk in the face of fluctuating Chinese demand: Diversification of sourcing, hedging strategies, and careful monitoring of Chinese economic indicators are crucial strategies for mitigating risk associated with fluctuating Chinese copper demand.

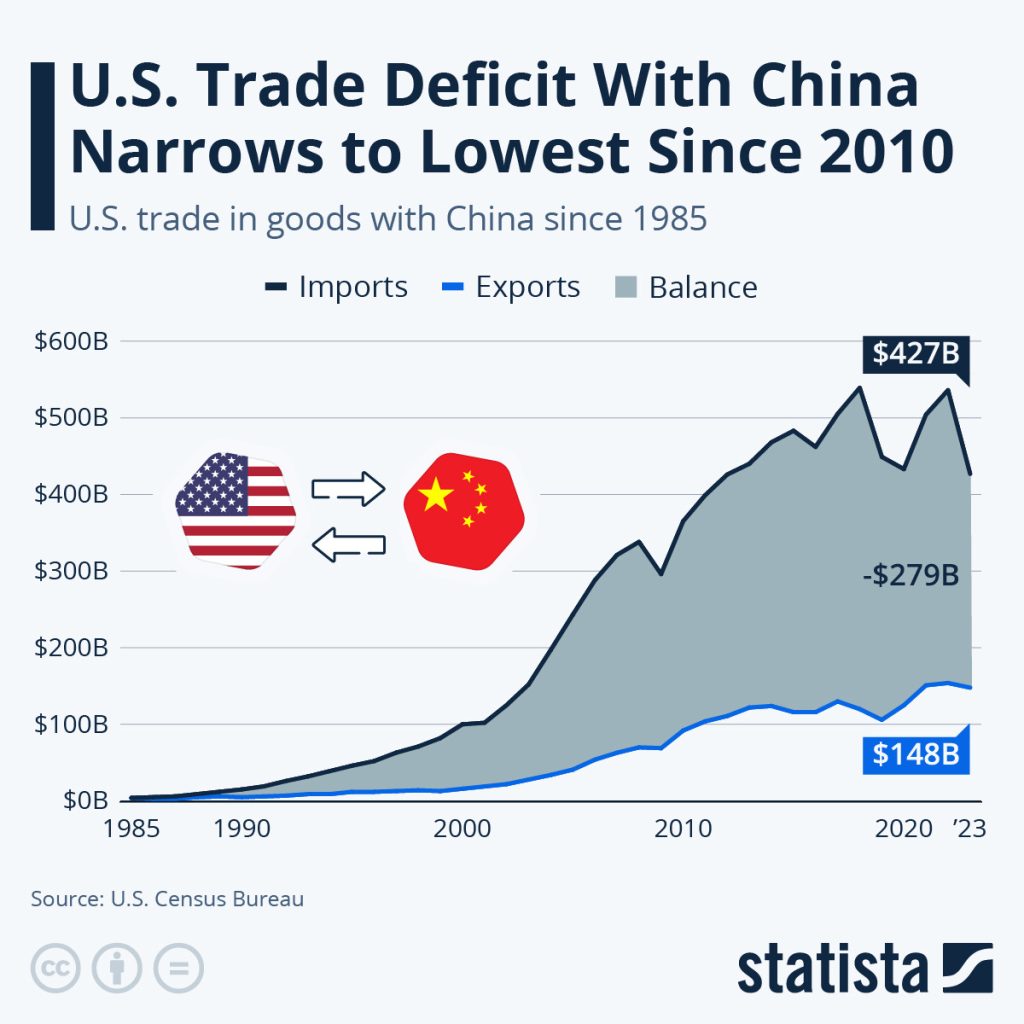

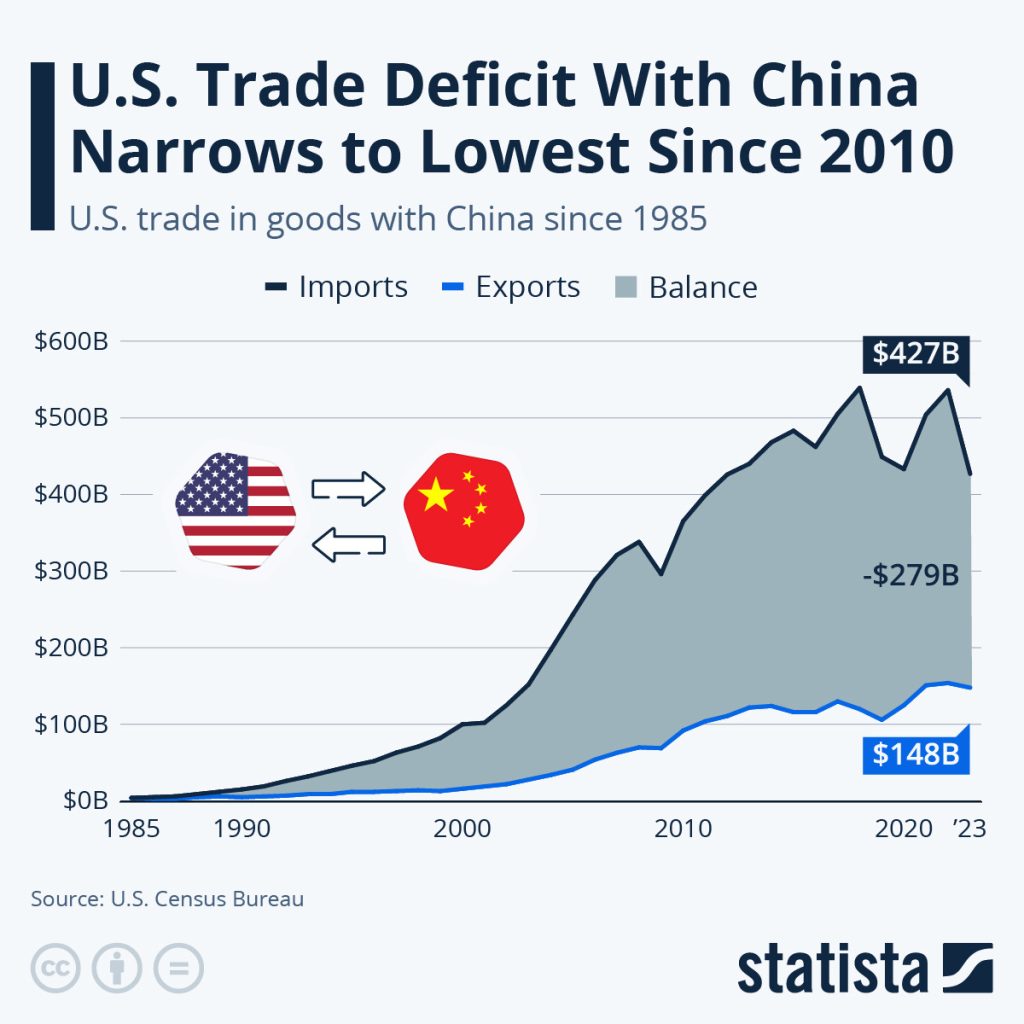

US Trade Relations and their Influence on Rising Copper Prices

US-China trade relations significantly influence global copper markets, impacting supply chains and prices. Trade disputes and tariffs can dramatically affect copper prices.

Tariffs and Trade Wars

Trade disputes between the US and China, including the imposition of tariffs, can disrupt copper supply chains and increase prices.

- Analysis of past tariff impacts on copper imports and exports between the US and China: Past tariff implementations have demonstrably impacted copper trade volumes between the US and China, illustrating the sensitivity of the market to trade tensions.

- Discussion of potential future trade conflicts and their predicted impact on copper prices: The potential for future trade conflicts between the two countries and their potential effect on copper prices remains a crucial concern for market participants.

- Exploration of alternative sourcing strategies to mitigate tariff-related price increases: Businesses are exploring alternative sourcing strategies to reduce their reliance on copper from specific regions, mitigating risks associated with trade disputes and tariffs.

US Domestic Copper Production and Consumption

The level of US domestic copper production and consumption also plays a crucial role in price sensitivity to global market fluctuations.

- Analysis of US copper production levels and their impact on domestic prices: The level of domestic copper production in the US directly influences its dependence on imports and, therefore, its vulnerability to global price fluctuations.

- Discussion of factors affecting US copper consumption, including construction activity and manufacturing output: Construction activity and manufacturing output within the US significantly affect domestic copper consumption and contribute to overall price dynamics.

- Comparison of US copper market dynamics with other major consuming nations: Comparing the US copper market dynamics with those of other major consumers provides a broader perspective on global copper pricing trends.

Conclusion

The price of copper is intricately linked to the economic activity of China and the complex trade relationship between China and the US. Understanding China's massive infrastructure investments, its role in global production and refining, and the influence of US trade policies is crucial for navigating the volatile copper market. Fluctuations in rising copper prices necessitate careful monitoring of these key factors. Stay informed on the latest developments in Chinese economic policy and US-China trade relations to make informed decisions about investments and supply chain strategies related to rising copper prices. Continuously track copper price trends and adapt your strategies accordingly to effectively manage risk in this dynamic market.

Featured Posts

-

The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025

The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025 -

The Importance Of Middle Management Bridging The Gap Between Leadership And Employees

May 06, 2025

The Importance Of Middle Management Bridging The Gap Between Leadership And Employees

May 06, 2025 -

Hos Kokmamanin Marka Degerine Etkisi Oernek Calismalar

May 06, 2025

Hos Kokmamanin Marka Degerine Etkisi Oernek Calismalar

May 06, 2025 -

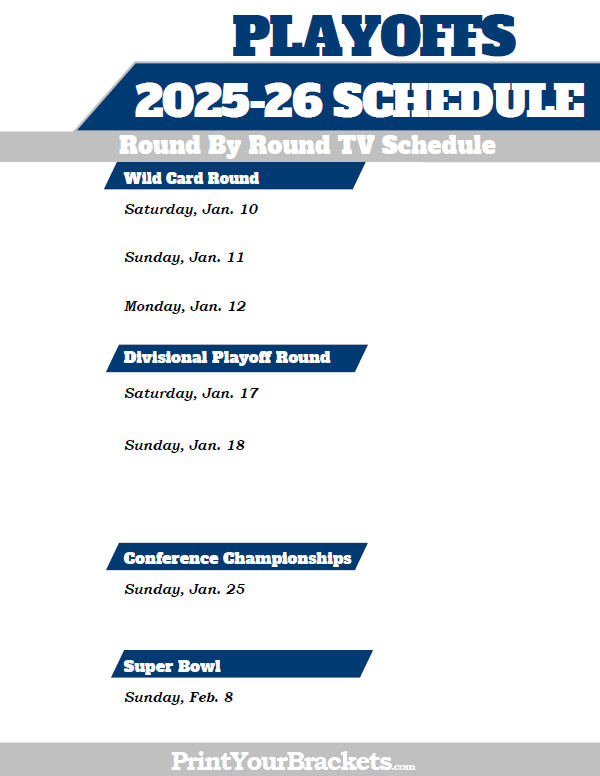

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025 -

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Latest Posts

-

Duze Zamowienie Trotylu Polska Na Swiatowym Rynku Materialow Wybuchowych

May 06, 2025

Duze Zamowienie Trotylu Polska Na Swiatowym Rynku Materialow Wybuchowych

May 06, 2025 -

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025

Polska I Eksport Trotylu Rzut Oka Na Duze Zamowienie

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025

Zamowienie Na Trotyl Z Polski Implikacje Dla Bezpieczenstwa

May 06, 2025 -

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025

Analyzing The Popularity Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025 -

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025

Kontrowersyjny Eksport Trotylu Z Polski Analiza Zamowienia

May 06, 2025