Navigate The Private Credit Job Market: 5 Do's & 5 Don'ts

Table of Contents

- 5 Do's to Navigate the Private Credit Job Market

- Do 1: Network Strategically within the Private Credit Industry

- Do 2: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

- Do 3: Master the Fundamentals of Private Credit

- Do 4: Showcase Your Analytical and Financial Modeling Skills

- Do 5: Prepare for Behavioral and Technical Interviews

- 5 Don'ts to Avoid in the Private Credit Job Market

- Don't 1: Neglect Networking Opportunities

- Don't 2: Submit Generic Applications

- Don't 3: Underestimate the Importance of Financial Modeling

- Don't 4: Lack Knowledge of Private Credit Strategies

- Don't 5: Underprepare for Interviews

- Conclusion

5 Do's to Navigate the Private Credit Job Market

Do 1: Network Strategically within the Private Credit Industry

Building a strong network is paramount in the private credit job market. Don't underestimate the power of personal connections.

- Attend Industry Events: SuperReturn, industry conferences, and smaller, specialized events are invaluable for meeting professionals.

- Leverage LinkedIn: Actively engage on LinkedIn, join relevant groups, and connect with people working in private credit. Follow key players and firms.

- Informational Interviews: Reach out to professionals for informational interviews. Learn about their career paths and gain insights into the industry.

- Join Professional Organizations: Membership in organizations like the Alternative Investment Management Association (AIMA) demonstrates your commitment to the field.

Do 2: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

Generic applications rarely succeed in this competitive market. Each application should be meticulously tailored.

- Highlight Relevant Skills: Showcase your financial analysis, accounting, legal, or other relevant experience, even if seemingly tangential. Emphasize transferable skills.

- Quantify Achievements: Use metrics and data to demonstrate the impact of your work. Instead of saying "improved efficiency," say "improved efficiency by 15%."

- Incorporate Keywords: Use keywords specific to private credit, such as direct lending, mezzanine financing, distressed debt, senior secured debt, subordinated debt, unitranche, and private equity.

- Research the Firm: Understand the firm's investment strategy, target sectors, and recent transactions before applying. Demonstrate your knowledge in your cover letter.

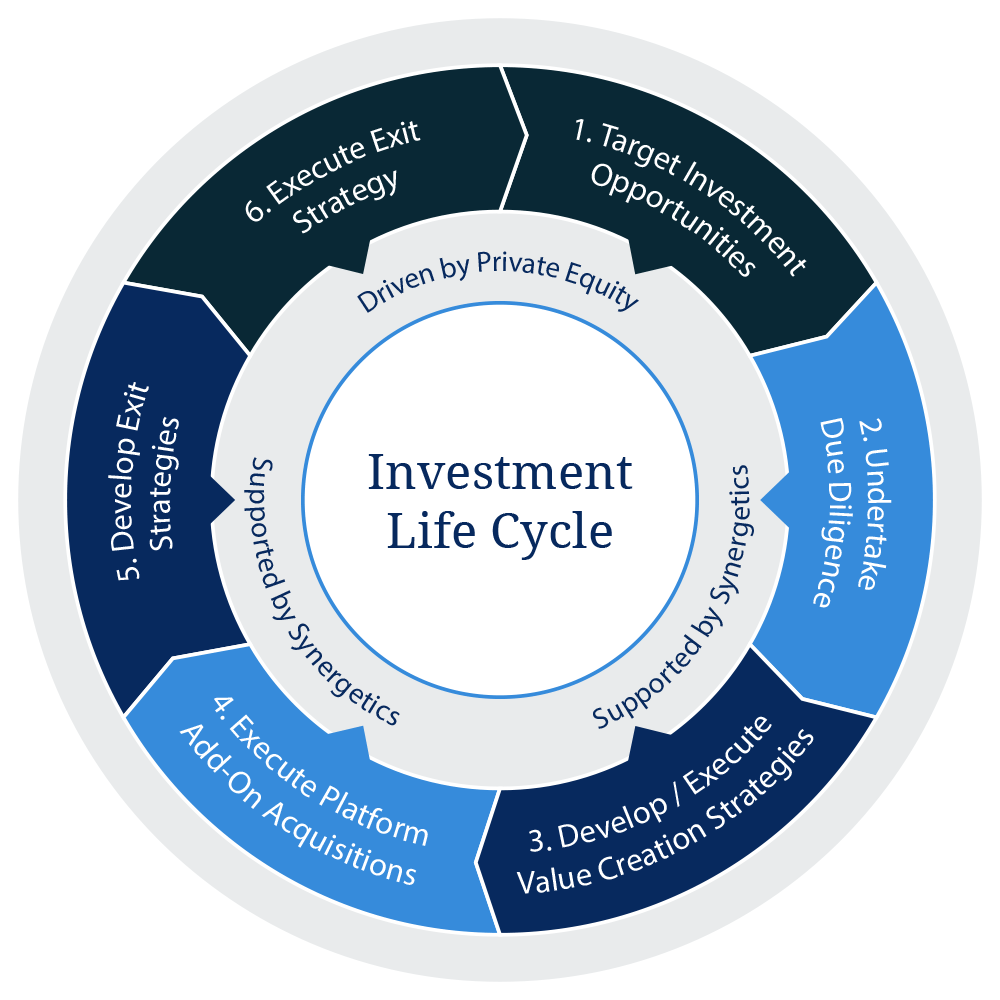

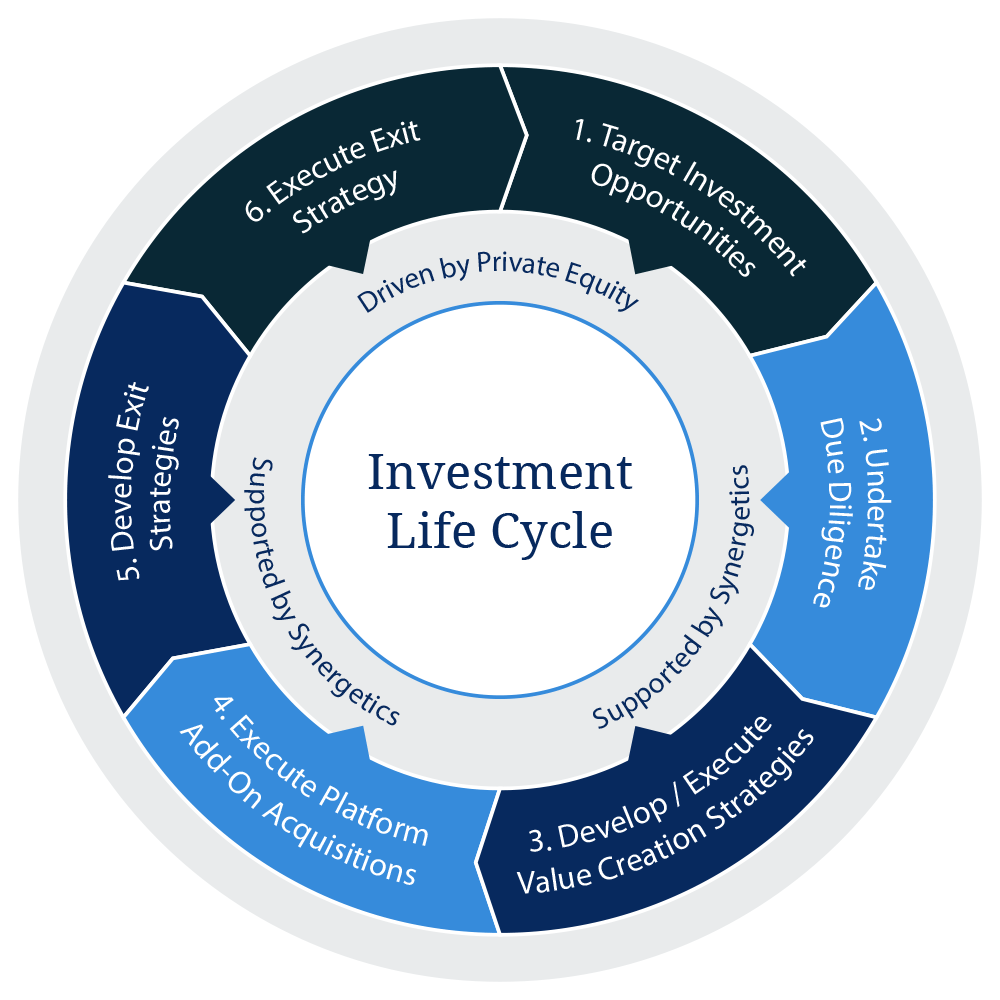

Do 3: Master the Fundamentals of Private Credit

A thorough understanding of private credit principles is non-negotiable.

- Understand Private Credit Strategies: Learn the differences between senior secured debt, subordinated debt, mezzanine financing, and other strategies.

- Develop Financial Modeling Skills: Proficiency in financial modeling, including LBO modeling and discounted cash flow (DCF) analysis, is critical.

- Stay Updated: Follow industry news, publications (like Private Debt Investor), and regulatory changes to remain current.

- Consider Relevant Certifications: The CFA charter or CAIA designation can significantly enhance your credentials.

Do 4: Showcase Your Analytical and Financial Modeling Skills

Private credit roles demand strong analytical abilities and financial modeling expertise.

- Build a Portfolio: Develop a portfolio of your best financial models to showcase your skills during interviews.

- Master Excel and Other Software: Demonstrate proficiency in Excel, Argus, and other relevant software.

- Highlight Analytical Achievements: Provide examples where you used analytical skills to solve complex problems and add value.

- Practice Explaining Your Approach: Be ready to explain your modeling methodology and assumptions clearly and confidently.

Do 5: Prepare for Behavioral and Technical Interviews

Thorough preparation is crucial for success in private credit interviews.

- Practice Common Interview Questions: Prepare answers for questions about your experience, your understanding of private credit, and your career goals. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Prepare Examples: Have concrete examples ready to showcase your problem-solving, teamwork, and communication skills.

- Research Interviewers and the Firm: Show your interest by asking insightful questions about the firm, its culture, and the role.

- Demonstrate Enthusiasm: Convey your passion for private credit and your long-term career aspirations.

5 Don'ts to Avoid in the Private Credit Job Market

Don't 1: Neglect Networking Opportunities

Networking is not optional; it's essential in the private credit job market.

- Avoid Passivity: Actively seek out networking events and engage with professionals.

- Don't Underestimate Relationships: Building strong relationships can open doors to opportunities you might not find otherwise.

Don't 2: Submit Generic Applications

A generic application shows a lack of interest and effort.

- Avoid the "One-Size-Fits-All" Approach: Tailor each resume and cover letter to the specific firm and role.

- Demonstrate Genuine Interest: Research the firm thoroughly and show that you understand their investment strategy.

Don't 3: Underestimate the Importance of Financial Modeling

Financial modeling skills are paramount in private credit.

- Practice Consistently: Develop your skills through practice and seek feedback on your models.

- Don't Be Afraid to Ask for Help: If you're struggling with a specific concept, seek help from mentors or peers.

Don't 4: Lack Knowledge of Private Credit Strategies

A solid understanding of private credit strategies is critical.

- Continuous Learning: Stay informed about market trends and emerging strategies.

- Thorough Research: Research different private credit strategies and their implications.

Don't 5: Underprepare for Interviews

Unpreparedness demonstrates a lack of professionalism.

- Practice, Practice, Practice: Rehearse your answers to common interview questions.

- Research the Firm: Thoroughly research the firm's history, investment strategy, and recent activities.

Conclusion

Successfully navigating the private credit job market requires a proactive and well-informed approach. By following these five "dos" and avoiding the five "don'ts," you significantly increase your chances of securing a fulfilling and lucrative career in private credit. Remember to network effectively, tailor your applications, master the fundamentals, showcase your skills, and prepare thoroughly for interviews. Start building your career in the exciting world of the private credit job market today!

Experience A Dutch Street Party At Millcreek Commons King Day Event

Experience A Dutch Street Party At Millcreek Commons King Day Event

Mission Impossible Dead Reckoning Part Two What The Big Game Trailer Revealed

Mission Impossible Dead Reckoning Part Two What The Big Game Trailer Revealed

Kendrick Lamar And Szas 2024 European Tour Uk Dates And Ticket Information

Kendrick Lamar And Szas 2024 European Tour Uk Dates And Ticket Information

87 Month Prison Term Sought For George Santos In Sweeping Fraud Case Doj Filing

87 Month Prison Term Sought For George Santos In Sweeping Fraud Case Doj Filing

Rural School 2700 Miles From Dc Feeling The Impact Of Trumps Presidency

Rural School 2700 Miles From Dc Feeling The Impact Of Trumps Presidency

Core Weave Inc Crwv Unpacking Wednesdays Stock Market Movement

Core Weave Inc Crwv Unpacking Wednesdays Stock Market Movement

Tuesdays Core Weave Crwv Stock Fall A Detailed Explanation

Tuesdays Core Weave Crwv Stock Fall A Detailed Explanation

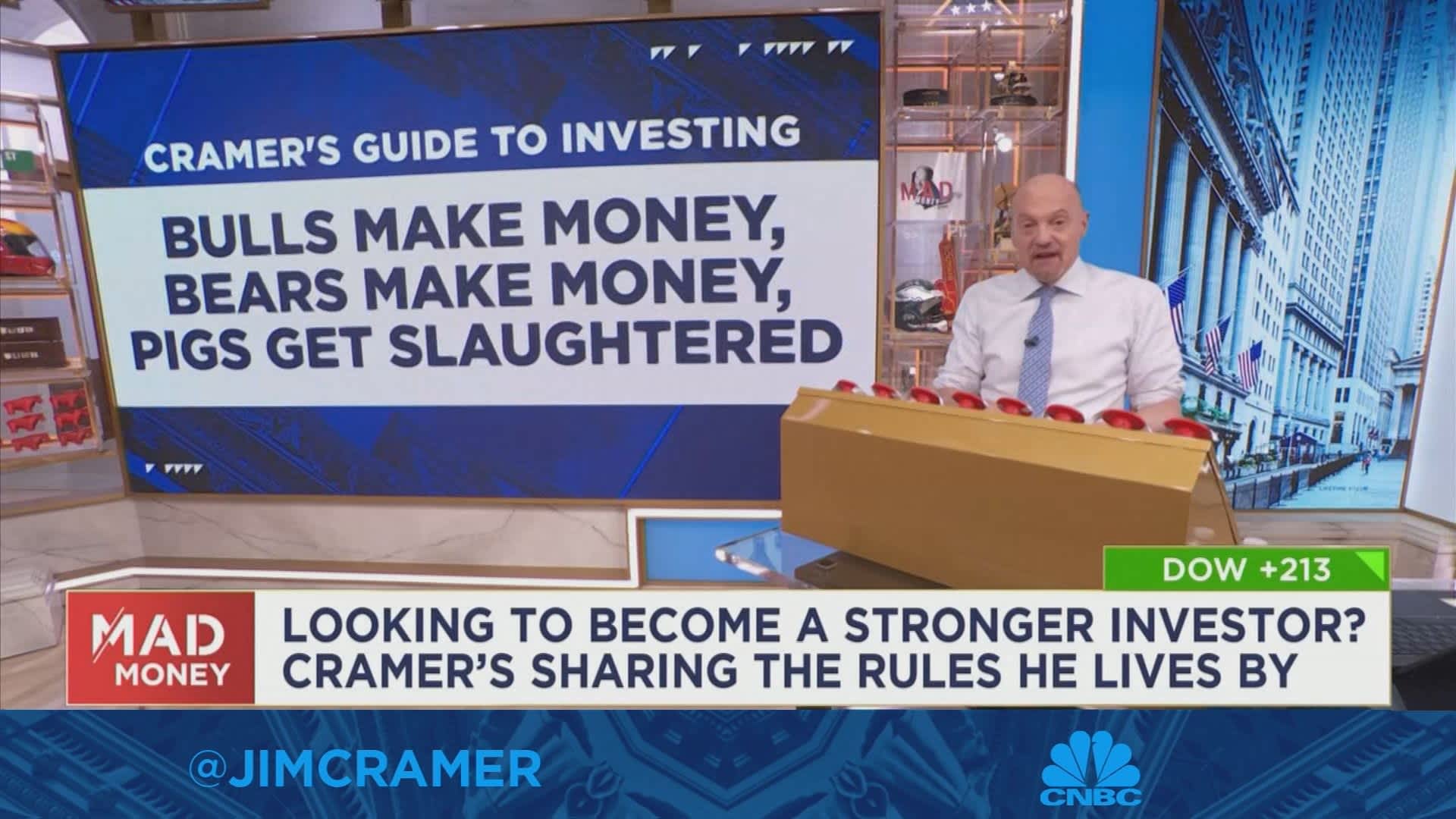

Is Core Weave Crwv A Strong Investment Jim Cramer Weighs In

Is Core Weave Crwv A Strong Investment Jim Cramer Weighs In

Factors Contributing To Core Weave Inc Crwv Stocks Wednesday Gain

Factors Contributing To Core Weave Inc Crwv Stocks Wednesday Gain

Core Weave Inc Crwv Stock Drop On Tuesday Reasons And Analysis

Core Weave Inc Crwv Stock Drop On Tuesday Reasons And Analysis