Tuesday's CoreWeave (CRWV) Stock Fall: A Detailed Explanation

Table of Contents

The Impact of Overall Market Sentiment on CRWV Stock Price

Tuesday's market presented a challenging environment for many stocks, including CRWV. The overall market sentiment played a significant role in the CoreWeave stock decline. The broader tech sector, of which CoreWeave is a part, experienced a downturn, impacting investor confidence in growth stocks like CRWV. This correlation between the broader market and CRWV's performance highlights the vulnerability of growth stocks to overall market volatility.

- Market Indices Movements: Major indices like the Nasdaq and S&P 500 experienced notable declines on Tuesday, contributing to the negative market sentiment. This general downward trend influenced investor behavior across various sectors, including cloud computing.

- Investor Sentiment in Cloud Computing: Investor confidence in the cloud computing sector, while generally positive in the long term, can be susceptible to short-term fluctuations. News and events outside of CoreWeave's direct control can impact overall sentiment towards the entire sector, impacting CRWV stock price.

- Economic Uncertainty: Lingering economic uncertainty and concerns about inflation and interest rates often lead to investors seeking safer investments, causing a sell-off in higher-risk growth stocks like CRWV.

Analyzing Specific News and Financial Reports Affecting CoreWeave (CRWV)

While the general market sentiment contributed to the CRWV stock decline, specific news and financial reports may have exacerbated the situation. It's important to analyze any press releases, earnings reports, or analyst ratings released around Tuesday that could have influenced investor actions.

- Earnings Reports and Press Releases: The absence of any negative news does not preclude a downward trend. Conversely, any negative news or even a slightly disappointing earnings report could trigger a sell-off. Any such reports should be analyzed thoroughly for their impact on investor confidence.

- Analyst Ratings: Changes in analyst ratings can significantly impact investor perception and trading activity. A downgrade from a prominent analyst firm could trigger a wave of selling pressure.

- News Sources: Scrutinizing reliable financial news sources for any relevant articles or reports published on or around Tuesday is crucial for a comprehensive understanding of the situation.

Competitive Landscape and its Influence on CoreWeave (CRWV) Stock

The cloud computing market is fiercely competitive. Actions by CoreWeave's competitors could indirectly influence CRWV's stock price, even without direct announcements regarding CoreWeave itself.

- Key Competitors and Recent Activities: Monitoring the activities of major players in the cloud computing market is essential. New product launches, strategic partnerships, or aggressive pricing strategies from competitors can impact investor perception of CoreWeave's competitive position.

- Market Share Changes: Any shift in market share amongst competitors can influence investor sentiment regarding CoreWeave's future prospects.

- Competitive Pressures: Increased competitive pressure, whether due to pricing wars or technological advancements by competitors, can negatively affect investor confidence in a company's ability to maintain profitability and growth.

Short-Selling and its Potential Role in the CRWV Stock Decline

Increased short-selling activity could have played a role in the CRWV stock price decline. Short-selling involves borrowing shares, selling them, and then buying them back at a lower price to profit from the price difference. A high level of short-selling can create downward pressure on a stock's price.

- Understanding Short-Selling: Short-selling is a common trading strategy, but high levels can amplify price declines and create a self-fulfilling prophecy.

- Short Interest Data: Analyzing short interest data (if available) can shed light on the extent to which short-selling contributed to the drop.

- Implications for Long-Term Investors: While short-selling is a legitimate trading strategy, significant short interest can create volatility and negatively impact long-term investors.

Conclusion: Understanding and Navigating the CoreWeave (CRWV) Stock Situation

Tuesday's CRWV stock fall was likely a complex event influenced by a confluence of factors, including broader market sentiment, potentially negative news or reports, competitive pressures within the cloud computing market, and potentially elevated short-selling activity. Thorough research and a nuanced understanding of these factors are crucial for making informed investment decisions. Staying informed about CoreWeave (CRWV) stock and broader cloud computing market trends is essential for navigating the volatility of the stock market. Conduct further research and closely monitor CRWV stock performance and related news before making any investment decisions regarding CRWV investment. Remember to conduct your own thorough CoreWeave stock analysis before investing in CRWV stock or other cloud computing investments.

Featured Posts

-

Core Inflation Surge Presents A Dilemma For The Bank Of Canada

May 22, 2025

Core Inflation Surge Presents A Dilemma For The Bank Of Canada

May 22, 2025 -

Alles Over Tikkie Een Complete Gids Voor Gebruikers In Nederland

May 22, 2025

Alles Over Tikkie Een Complete Gids Voor Gebruikers In Nederland

May 22, 2025 -

Us Chip Exports Nvidia Ceos Frank Assessment And Political Commentary

May 22, 2025

Us Chip Exports Nvidia Ceos Frank Assessment And Political Commentary

May 22, 2025 -

Solve Todays Wordle April 12 1393 Hints And Solution

May 22, 2025

Solve Todays Wordle April 12 1393 Hints And Solution

May 22, 2025 -

Bp Executive Compensation A Significant 31 Decrease

May 22, 2025

Bp Executive Compensation A Significant 31 Decrease

May 22, 2025

Latest Posts

-

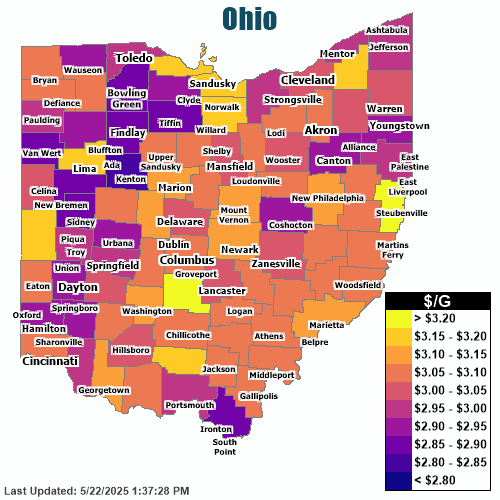

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025