Factors Contributing To CoreWeave Inc. (CRWV) Stock's Wednesday Gain

Table of Contents

Strong Earnings Report and Positive Financial Guidance

CoreWeave's Wednesday gain was largely attributed to a surprisingly strong earnings report that exceeded market expectations. The key figures revealed significant positive momentum for the company:

- Revenue Growth: CoreWeave reported a [insert percentage or specific figure] increase in revenue compared to the same period last year, surpassing analysts' consensus estimates. This robust growth signals increasing demand for the company's GPU cloud computing services.

- Earnings Per Share (EPS): The company's EPS also exceeded predictions, indicating strong profitability and efficient operational management. [Insert specific EPS figure and comparison to expectations].

- Positive Outlook: The company provided positive financial guidance for the upcoming quarter and the full year, further bolstering investor confidence. This upward revision of revenue projections suggests a continued trajectory of growth.

- Customer Acquisition and Retention: The earnings report highlighted strong customer acquisition and impressive customer retention rates. This suggests a robust and loyal customer base, indicative of the quality and value of CoreWeave's services in the competitive GPU cloud computing market.

These impressive financial results paint a picture of a healthy and rapidly growing company, directly impacting the positive CRWV stock performance on Wednesday. The strong CRWV financials clearly exceeded expectations and played a major role in the day's price surge.

Increased Investor Confidence and Positive Analyst Sentiment

The positive reaction to CoreWeave's earnings report translated into a surge in investor confidence and significantly improved analyst sentiment. This positive feedback loop further contributed to the CRWV stock's Wednesday gain. Key elements include:

- Analyst Upgrades: Several prominent investment firms upgraded their ratings for CRWV stock following the release of the earnings report, citing the strong financial performance and positive future outlook.

- Institutional Investor Activity: There was noticeable increased buying activity from institutional investors, indicating a strong belief in CoreWeave's long-term potential and the value proposition of their GPU cloud computing offerings.

- Buying Pressure: The combination of positive analyst sentiment and institutional buying created significant buying pressure, driving up the demand for CRWV shares and pushing the price higher.

This improved investor sentiment and the associated increase in buying pressure were crucial in amplifying the impact of the strong earnings report on the CRWV stock price. Positive analyst sentiment and buying pressure have a demonstrably strong effect on market valuation and were major factors in Wednesday's gain.

Industry-Wide Tailwinds and Growth in GPU Computing

The positive momentum in CRWV stock is not solely attributable to the company's performance; broader industry tailwinds also played a significant role. The rapidly expanding GPU cloud computing market is experiencing explosive growth, driven by several factors:

- Increased Demand for High-Performance Computing: The rising adoption of AI and machine learning, demanding high-performance computing resources, is a primary driver of growth in the GPU cloud computing sector. CoreWeave is well-positioned to benefit from this trend.

- Technological Advancements: Continuous advancements in GPU technology and cloud computing infrastructure are pushing the boundaries of what's possible, creating new opportunities for companies like CoreWeave to innovate and expand their service offerings.

- Strategic Partnerships: Strategic partnerships and collaborations with key players in the tech industry can further accelerate growth and expand market reach for CoreWeave.

These industry-wide tailwinds are creating a favorable environment for CoreWeave to thrive, further contributing to the positive investor sentiment and ultimately, the CRWV stock price increase on Wednesday. The growth in GPU computing, AI and machine learning are major tailwinds impacting the success of CRWV.

Speculative Trading and Short Covering

While the previously mentioned factors are likely the most significant drivers, it's important to acknowledge the potential role of speculative trading and short covering in contributing to Wednesday's CRWV stock price surge. Short covering, where investors who bet against the stock buy shares to limit their losses, can create a sudden and rapid price increase.

- Short Interest: While the exact figures aren't always publicly available, it's possible that a significant level of short interest in CRWV existed prior to the earnings report.

- Short Squeeze Potential: The positive earnings report might have triggered a short squeeze, where short sellers rushed to cover their positions, leading to additional upward pressure on the stock price.

However, it's crucial to remember that this factor might be less sustainable than the fundamental improvements within the company and the broader industry trends. The impact of short-term speculative trading and short covering should be considered within the larger context of the company's strong fundamentals.

Understanding CoreWeave Inc. (CRWV) Stock's Positive Momentum and Future Outlook

In summary, CoreWeave Inc.'s (CRWV) impressive Wednesday stock price increase was a result of a confluence of factors, primarily its strong earnings report exceeding expectations, a surge in positive analyst sentiment and institutional investor confidence, and favorable industry tailwinds in the burgeoning GPU cloud computing market. While short-term speculative trading might have played a role, the underlying strength of the company and the industry is the key takeaway.

It's important to maintain a cautious outlook, acknowledging the inherent volatility of the stock market. While Wednesday's performance is positive, future performance is never guaranteed.

Before making any investment decisions related to CoreWeave Inc. (CRWV) stock, conduct your own thorough research. Understand the company's fundamentals, analyze the market conditions, and consider the risks involved. Further analysis of CoreWeave Inc. (CRWV) and its performance is warranted before making any investment choices. Remember that thorough due diligence is crucial for any investment decision concerning CoreWeave Inc. (CRWV) stock.

Featured Posts

-

Wyoming Wildlife Needs You Volunteer For The Guided Fishing Advisory Board

May 22, 2025

Wyoming Wildlife Needs You Volunteer For The Guided Fishing Advisory Board

May 22, 2025 -

Kartels Impact On Rum Culture A Stabroek News Perspective

May 22, 2025

Kartels Impact On Rum Culture A Stabroek News Perspective

May 22, 2025 -

Blake Lively And Taylor Swift Alleged Blackmail And Leaked Texts Amid Baldoni Feud

May 22, 2025

Blake Lively And Taylor Swift Alleged Blackmail And Leaked Texts Amid Baldoni Feud

May 22, 2025 -

Virginias Gas Prices A 50 Cent Per Gallon Decrease

May 22, 2025

Virginias Gas Prices A 50 Cent Per Gallon Decrease

May 22, 2025 -

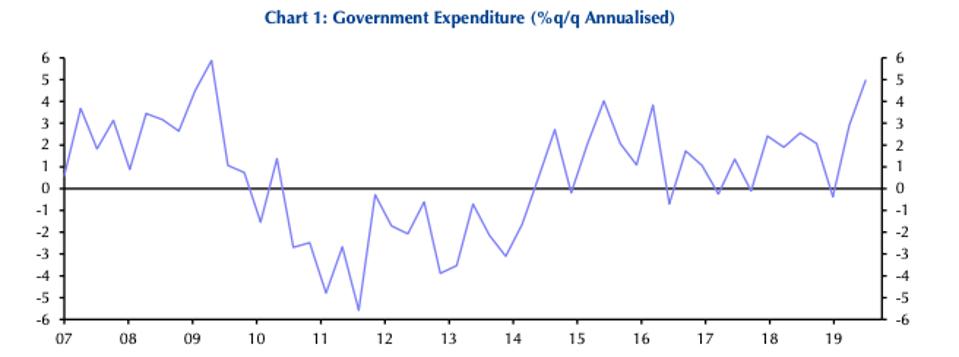

Sses 3 Billion Spending Cut Impact Of Slowing Growth

May 22, 2025

Sses 3 Billion Spending Cut Impact Of Slowing Growth

May 22, 2025

Latest Posts

-

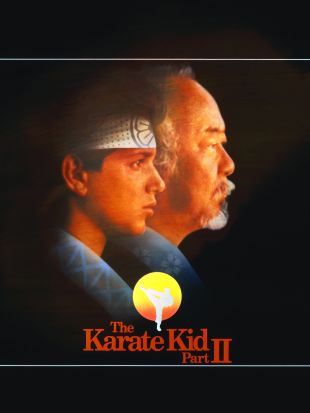

The Karate Kid Part Ii Characters Locations And Key Moments

May 23, 2025

The Karate Kid Part Ii Characters Locations And Key Moments

May 23, 2025 -

The Karate Kid Part Ii Analyzing The Films Themes And Story

May 23, 2025

The Karate Kid Part Ii Analyzing The Films Themes And Story

May 23, 2025 -

The Karate Kid Part Ii A Look At Daniels Continued Martial Arts Journey

May 23, 2025

The Karate Kid Part Ii A Look At Daniels Continued Martial Arts Journey

May 23, 2025 -

The Karate Kid Part Ii Exploring Mr Miyagis Return To Okinawa

May 23, 2025

The Karate Kid Part Ii Exploring Mr Miyagis Return To Okinawa

May 23, 2025 -

Karate Kid Legend First Reactions A Triumphant Return For Macchio And Chan

May 23, 2025

Karate Kid Legend First Reactions A Triumphant Return For Macchio And Chan

May 23, 2025