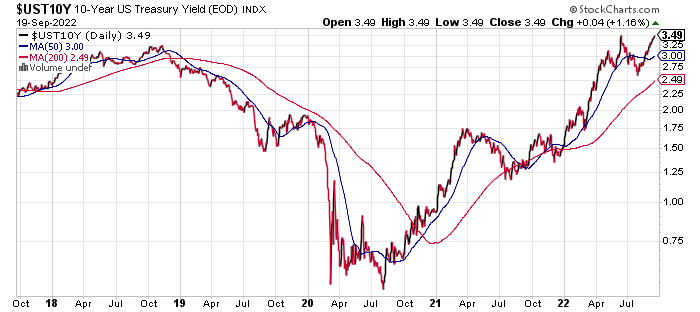

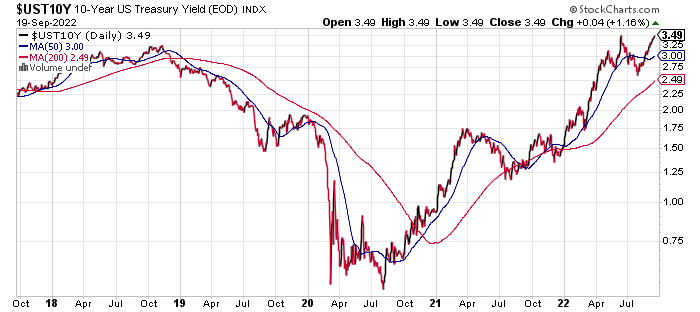

Moody's 30-Year Yield At 5%: Is 'Sell America' Back?

Table of Contents

The Significance of the 5% 30-Year Treasury Yield

The 30-year Treasury yield serves as a crucial benchmark for long-term interest rates in the US and globally. Its movement significantly impacts various sectors of the economy. The recent climb to 5% is largely attributable to a confluence of factors: stubborn inflation, the Federal Reserve's ongoing monetary policy tightening, and persistent global economic uncertainty. This increase has far-reaching consequences:

- Impact on Mortgage Rates and Housing Market: Higher yields translate directly into increased mortgage rates, potentially cooling down the already slowing housing market. Affordability becomes a significant concern for prospective homebuyers.

- Influence on Corporate Borrowing Costs: Businesses face higher borrowing costs when issuing long-term debt, impacting investment decisions and potentially hindering economic growth. This increased cost of capital can stifle expansion plans and job creation.

- Attractiveness of US Treasuries Compared to International Bonds: While a 5% yield might seem attractive, it needs to be considered in comparison to yields offered by other developed nations. If international bonds offer competitive or even superior yields, capital might flow outwards.

Analyzing the "Sell America" Narrative

The "Sell America" narrative refers to periods where investors lose confidence in the US economy and actively divest from US assets, leading to capital flight. Historically, this has been triggered by factors such as significant economic downturns, political instability, or the perception of better investment opportunities abroad. To determine if we are experiencing a resurgence of this trend, several key economic indicators must be examined:

- Current State of the US Dollar: The strength or weakness of the dollar is a crucial indicator. A weakening dollar can make US assets less attractive to foreign investors, potentially contributing to capital outflow.

- Foreign Investment Flows into the US: Tracking foreign direct investment (FDI) and portfolio investment flows provides vital insights into investor sentiment towards the US economy. A decline in these flows could support the "Sell America" narrative.

- Comparison of US Yields with Those of Other Developed Nations: A comprehensive comparison of US Treasury yields with those of similar sovereign bonds in other countries is essential. If yields elsewhere are significantly higher, it could incentivize investors to shift their investments abroad.

Alternative Explanations for the Yield Increase

While the "Sell America" narrative offers a plausible explanation, it's crucial to consider alternative factors driving the 5% 30-year yield. These include:

- Increased Government Borrowing: Rising government debt levels can increase the supply of Treasury bonds, potentially pushing yields higher. The US government's fiscal policy plays a major role in influencing bond yields.

- Inflation Expectations: Persistent inflation, or even the expectation of future inflation, can drive up yields as investors demand higher returns to compensate for the erosion of purchasing power. Market sentiment on inflation is crucial.

- Global Market Dynamics: Geopolitical events, global economic slowdowns, or unexpected shifts in international monetary policies can all impact the demand for US Treasuries and subsequently influence yields.

The Role of Moody's Rating

Moody's Investors Service plays a significant role in assessing the creditworthiness of US government debt. Their ratings directly impact investor confidence and, consequently, Treasury yields.

- Current Moody's Rating for US Treasury Bonds: Moody's current rating for US Treasuries is a key factor. Any downgrade could trigger a sell-off and push yields even higher.

- Potential Impact of a Downgrade on the 30-Year Yield: A downgrade would likely increase the perceived risk associated with holding US Treasuries, leading investors to demand higher yields as compensation for that increased risk.

- Historical Precedent for Moody's Ratings Impacting Market Sentiment: Historical data shows a clear correlation between Moody's ratings and market reactions. Past instances of rating changes, both upgrades and downgrades, provide valuable insights into the potential impact of future rating actions.

Conclusion: Is "Sell America" Really Back? A Look at the 30-Year Yield at 5%

The 5% 30-year Treasury yield is a significant development with broad implications for the US and global economies. While the "Sell America" narrative is a plausible interpretation, the evidence suggests a more nuanced picture. Several factors, including increased government borrowing, inflation expectations, and global market dynamics, also contribute to the yield increase. A simple conclusion that "Sell America" is definitively back is premature. A thorough assessment requires continuous monitoring of various economic indicators and careful consideration of the interplay between domestic and international factors.

Stay informed about the evolving situation by monitoring the Moody's 30-year yield and other key economic indicators. Understanding the dynamics of the 5% yield is crucial in navigating this complex economic environment.

Featured Posts

-

Americans Escaping Trump The Rise Of European Citizenship Applications

May 21, 2025

Americans Escaping Trump The Rise Of European Citizenship Applications

May 21, 2025 -

Peppa Pigs Real Name Revealed Fans React To Shocking Discovery

May 21, 2025

Peppa Pigs Real Name Revealed Fans React To Shocking Discovery

May 21, 2025 -

Abn Amro Analyse Van De Stijgende Occasionmarkt En De Rol Van Autobezit

May 21, 2025

Abn Amro Analyse Van De Stijgende Occasionmarkt En De Rol Van Autobezit

May 21, 2025 -

Nyt Crossword April 25 2025 Clues And Answers

May 21, 2025

Nyt Crossword April 25 2025 Clues And Answers

May 21, 2025 -

Le Hellfest A Mulhouse Concert Exceptionnel Au Noumatrouff

May 21, 2025

Le Hellfest A Mulhouse Concert Exceptionnel Au Noumatrouff

May 21, 2025

Latest Posts

-

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025

49 Dogs Seized From Washington County Breeder Details Emerge

May 21, 2025 -

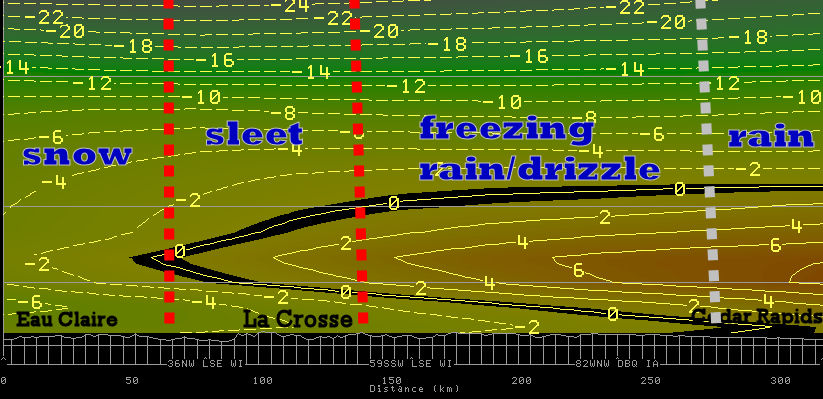

Driving In A Wintry Mix Rain And Snow Safety Tips

May 21, 2025

Driving In A Wintry Mix Rain And Snow Safety Tips

May 21, 2025 -

Investing In Big Bear Ai A Practical Guide For Investors

May 21, 2025

Investing In Big Bear Ai A Practical Guide For Investors

May 21, 2025 -

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025

Big Bear Ai Stock Current Market Conditions And Investment Implications

May 21, 2025 -

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

May 21, 2025

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

May 21, 2025