March 7th, 2025: CAC 40 Weekly Market Summary - Stable Despite Friday Drop

Table of Contents

Overall Weekly Performance of the CAC 40

Opening and Closing Values:

The CAC 40 opened the week at 7,250 points on Monday, March 2nd, 2025. Despite the Friday downturn, it closed at 7,235 points on Friday, March 7th, 2025, representing a minor weekly decrease of approximately 0.2%. This relatively small change is noteworthy given the significant drop observed on Friday.

Weekly Volatility and Trading Volume:

The week witnessed moderate volatility. While Monday and Tuesday saw relatively quiet trading, Wednesday and Thursday experienced increased fluctuations before the sharper decline on Friday. Compared to the previous week's relatively stable performance, this week showed slightly increased volatility.

- High: 7,280 points (Wednesday)

- Low: 7,195 points (Friday)

- Average Daily Trading Volume: 5.5 billion euros (slightly above the average for the past month)

- The increased trading volume, particularly on Wednesday and Friday, indicates heightened market activity and investor engagement in response to the unfolding events.

Key Contributing Factors to Overall Stability:

Several factors contributed to the CAC 40's unexpected resilience:

- Positive Inflation Data: France released encouraging inflation data mid-week, suggesting a potential slowdown in price increases, which boosted investor confidence.

- Strong Euro Performance: A stronger Euro against the US dollar positively impacted the performance of several CAC 40 companies with significant international operations.

- Positive Earnings Reports: A number of prominent CAC 40 companies released positive Q4 2024 earnings reports, counterbalancing negative news in other sectors.

Impact of Friday's Market Dip on the CAC 40

Magnitude of the Friday Decline:

Friday's market dip saw the CAC 40 fall by 1.5%, erasing much of the week's gains. This sharp decline warrants careful consideration.

Reasons Behind the Friday Dip:

The Friday downturn can be attributed to a confluence of factors:

- Geopolitical Uncertainty: Renewed tensions in Eastern Europe sparked concerns among investors, leading to risk aversion.

- Tech Sector Sell-Off: A global sell-off in the technology sector, driven by concerns about future interest rate hikes, negatively impacted several CAC 40 tech companies.

- Profit-Taking: Some analysts suggest that the Friday dip resulted from profit-taking by investors after a period of relatively strong market performance.

Short-Term and Long-Term Implications:

- Short-term: The Friday dip could signal increased volatility in the short term. The market may consolidate before resuming its upward trend, or experience further declines depending on incoming data.

- Long-term: The overall stability of the CAC 40, even with the Friday drop, suggests a relatively robust economic outlook for France and Europe. The long-term outlook remains cautiously optimistic.

Sectoral Performance within the CAC 40

Top and Bottom Performing Sectors:

- Top Performers: The Energy sector outperformed others, driven by rising oil prices. The Luxury Goods sector also saw strong gains thanks to robust consumer spending in Asia.

- Bottom Performers: The Technology and Financial sectors experienced significant declines, largely mirroring the global trends.

Analysis of Sectoral Trends:

- The strong performance in energy reflects global concerns regarding energy security and rising prices.

- The decline in the technology sector indicates investor concerns about future growth and the impact of rising interest rates.

Technical Analysis of the CAC 40

Key Chart Patterns and Indicators:

While the week showed some volatility, no significant chart patterns emerged that suggest a dramatic shift in trend.

Support and Resistance Levels:

- Support: The 7,150 point level acted as a key support level throughout the week. A breach of this level could signal further declines.

- Resistance: The 7,300 point level proved to be a strong resistance level, hindering upward movement.

Conclusion: Key Takeaways and Future Outlook for the CAC 40

This CAC 40 Weekly Market Summary reveals a week of moderate volatility culminating in a Friday dip, yet ultimately ending with surprising overall stability. The resilience of the index suggests a degree of underlying strength in the French and European economies, despite geopolitical uncertainties. The coming week will likely see continued volatility, particularly if geopolitical tensions escalate or negative economic data is released. However, the market's resilience may prove significant in the long term. To stay informed on the CAC 40's performance and receive future CAC 40 Weekly Market Summaries, subscribe to our newsletter or follow us on social media for regular updates.

Featured Posts

-

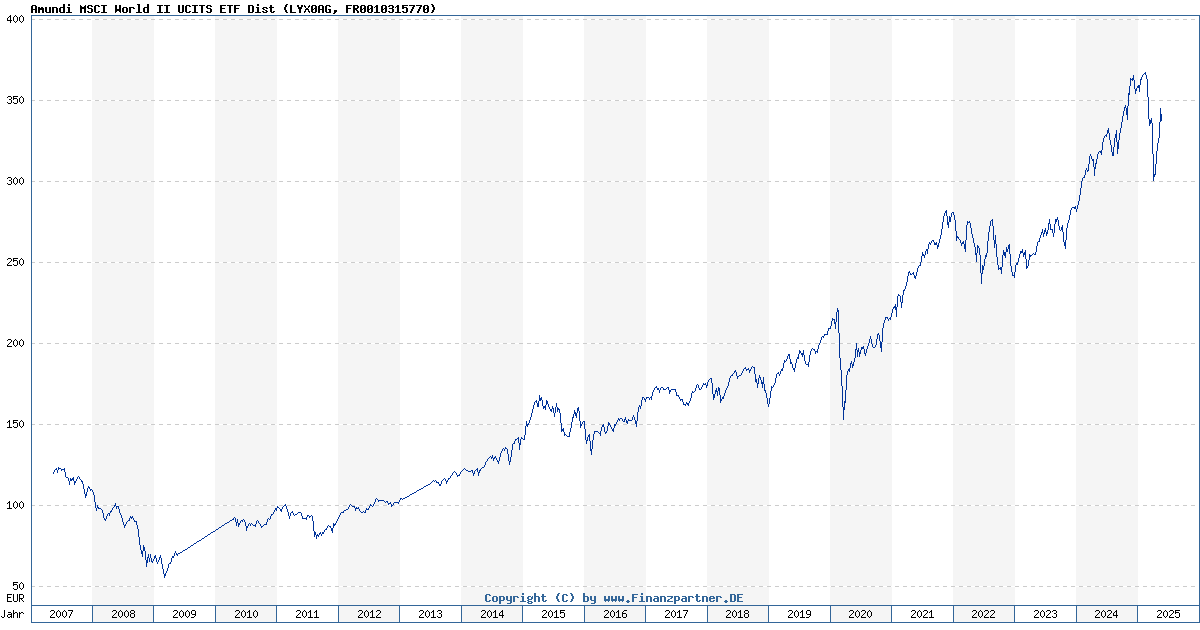

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 24, 2025 -

New Hot Wheels Ferrari Sets A Mamma Mia Moment For Collectors

May 24, 2025

New Hot Wheels Ferrari Sets A Mamma Mia Moment For Collectors

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street

May 24, 2025 -

Guccis New Creative Director An Analysis Of Demna Gvasalias Impact

May 24, 2025

Guccis New Creative Director An Analysis Of Demna Gvasalias Impact

May 24, 2025 -

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Latest Posts

-

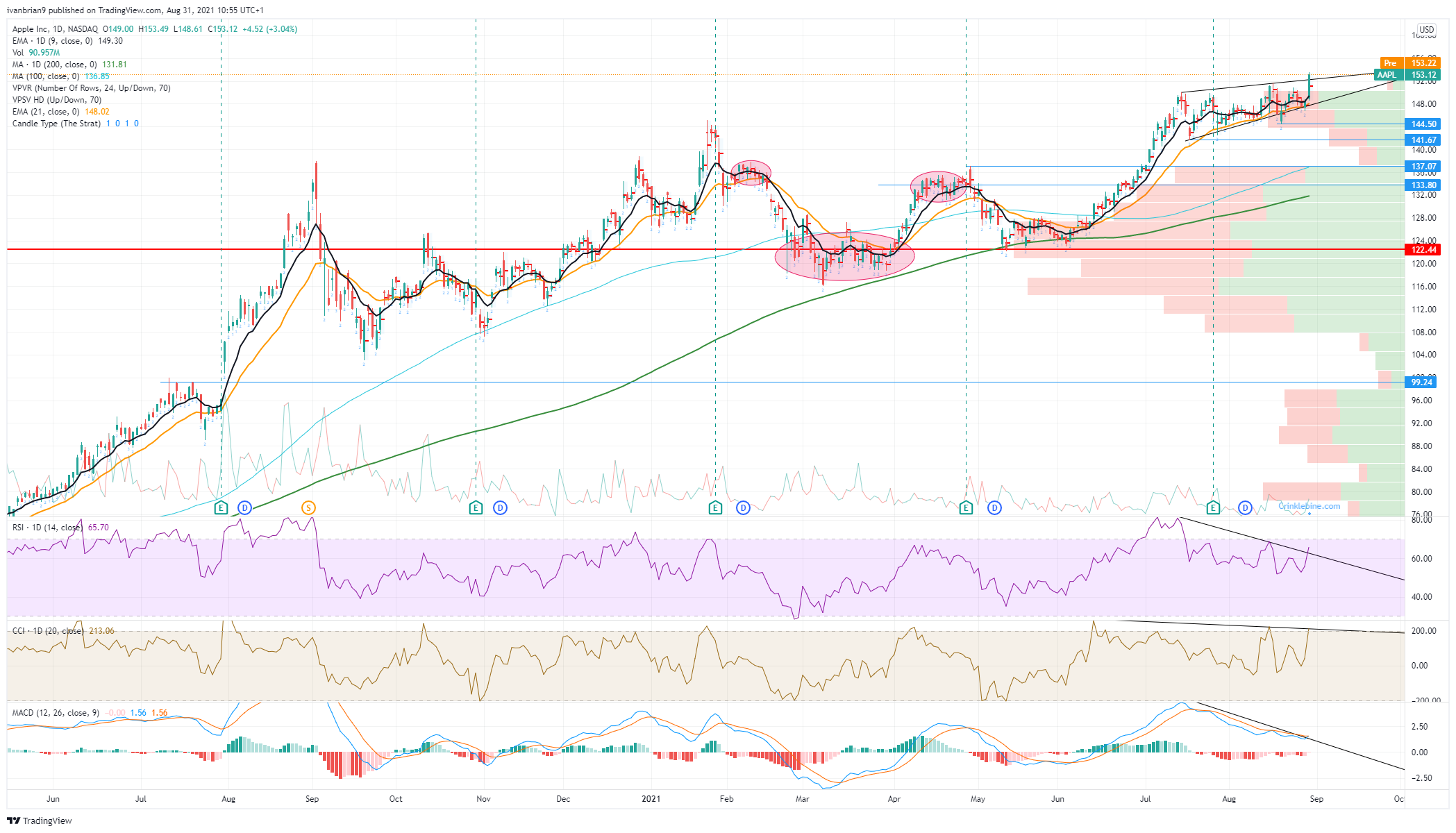

Analyzing Apple Stock Before Its Fiscal Q2 Report

May 24, 2025

Analyzing Apple Stock Before Its Fiscal Q2 Report

May 24, 2025 -

Understanding Apple Stocks Aapl Future Price Levels

May 24, 2025

Understanding Apple Stocks Aapl Future Price Levels

May 24, 2025 -

Apple Price Target Lowered But Wedbush Remains Confident What Does It Mean For Investors

May 24, 2025

Apple Price Target Lowered But Wedbush Remains Confident What Does It Mean For Investors

May 24, 2025 -

Where Will Apple Stock Aapl Go Next Key Price Level Predictions

May 24, 2025

Where Will Apple Stock Aapl Go Next Key Price Level Predictions

May 24, 2025 -

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025