Apple Price Target Lowered, But Wedbush Remains Confident: What Does It Mean For Investors?

Table of Contents

Wedbush's Lowered Apple Price Target: The Details

Wedbush, a prominent investment firm, recently reduced its Apple price target. While the previous target was [Insert Previous Price Target], the new target stands at [Insert New Price Target]. This represents a [Percentage] decrease. This adjustment wasn't made lightly; Wedbush cited several key factors contributing to their decision. The reduction reflects a more cautious outlook on the immediate future, primarily driven by:

- Macroeconomic Headwinds: The global economic slowdown is impacting consumer spending, potentially affecting iPhone sales and overall demand for Apple products.

- iPhone Sales Projections: While iPhone sales remain robust, Wedbush anticipates a slight slowdown in growth compared to previous projections.

- Increased Competition: The intensifying competition in the smartphone market, particularly in the premium segment, is another factor contributing to the lowered price target.

Why Wedbush Remains Confident in Apple's Long-Term Prospects

Despite the lowered price target, Wedbush maintains a positive long-term outlook for Apple. Their confidence stems from several key factors:

- Strong Brand Loyalty: Apple boasts unparalleled brand loyalty, a powerful asset that safeguards its market share and customer base.

- Services Revenue Growth: Apple's services segment continues to exhibit strong growth, demonstrating its capacity for recurring revenue streams beyond hardware sales. This includes Apple Music, iCloud, Apple TV+, and other subscription services.

- Future Product Launches: Wedbush anticipates the launch of innovative products and services in the coming years, potentially driving significant future growth. This includes exciting potential advancements in AR/VR, and continued development in the Apple ecosystem.

- Expansion into New Markets: Ongoing exploration and expansion into new markets will present substantial opportunities for future revenue growth.

Analyzing the Impact on Apple Investors

The lowered price target, coupled with Wedbush's continued confidence, presents a nuanced picture for Apple investors. Short-term investors might view the price reduction as a signal to reconsider their positions, potentially taking profits or reducing exposure. However, long-term investors with a higher risk tolerance may view this as a buying opportunity, considering the sustained belief in Apple's fundamental strength.

Potential risks include continued macroeconomic uncertainty, increased competition, and potential production issues. Opportunities include the potential for growth in the services sector, upcoming product launches, and Apple's strong brand position. Investors should carefully evaluate their risk tolerance and investment horizon before making any decisions regarding their Apple stock holdings. Consider diversifying your portfolio to mitigate risk.

Comparing Wedbush's Opinion with Other Analyst Predictions

While Wedbush's lowered price target is noteworthy, it's essential to consider the broader analyst consensus. Other firms may hold different perspectives on Apple's stock. For example, [Analyst Firm 1] currently has a price target of [Price Target], while [Analyst Firm 2] holds a target of [Price Target]. This variation highlights the diverse interpretations of market signals and future projections.

- [Analyst Firm 1]: Price Target [Price Target], Rationale [brief summary]

- [Analyst Firm 2]: Price Target [Price Target], Rationale [brief summary]

- [Analyst Firm 3]: Price Target [Price Target], Rationale [brief summary]

Conclusion: Navigating the Apple Price Target Shift – A Call to Action

The recent reduction in Apple's price target by Wedbush, while significant, doesn't negate the firm's underlying confidence in Apple's long-term prospects. Understanding both the short-term market fluctuations and the long-term potential is crucial for informed investment decisions. The information presented here provides a starting point for your analysis. Remember, thorough research, careful consideration of your own risk tolerance, and a well-defined investment strategy are paramount when investing in Apple stock or any other asset. Don't hesitate to consult with a qualified financial advisor before making any significant investment decisions. Before investing in Apple stock, conduct your own thorough due diligence.

Featured Posts

-

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025

Kak Khorosho Vy Znaete Roli Olega Basilashvili Test

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

The Ultimate Guide To Dr Beachs Top 10 Us Beaches 2025

May 24, 2025

The Ultimate Guide To Dr Beachs Top 10 Us Beaches 2025

May 24, 2025 -

Dazi E Mercati La Caduta Delle Borse E Le Reazioni Dell Unione Europea

May 24, 2025

Dazi E Mercati La Caduta Delle Borse E Le Reazioni Dell Unione Europea

May 24, 2025 -

I Dazi Statunitensi E Il Costo Della Moda Una Guida Completa

May 24, 2025

I Dazi Statunitensi E Il Costo Della Moda Una Guida Completa

May 24, 2025

Latest Posts

-

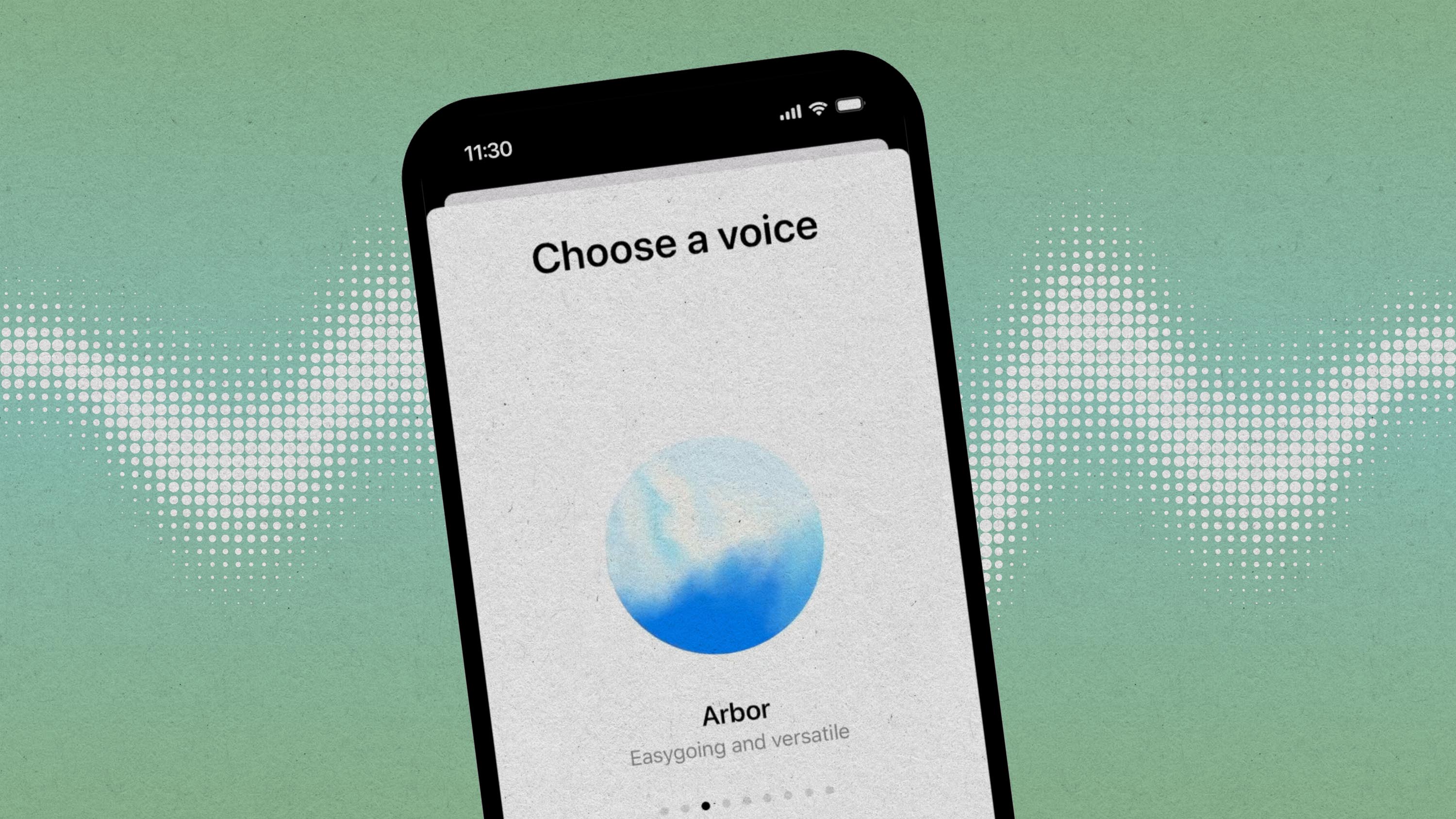

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025

Voice Assistant Development Revolutionized Open Ais Latest Tools

May 24, 2025 -

Three Years Of Data Breaches Cost T Mobile 16 Million

May 24, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million

May 24, 2025 -

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025

The Future Of Museum Programs Post Trump Budget Reductions

May 24, 2025 -

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025

Funding Crisis How Trumps Cuts Affected Us Museums And Their Programs

May 24, 2025 -

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025

The Impact Of Trump Era Funding Cuts On Us Museums

May 24, 2025