Understanding Apple Stock's (AAPL) Future Price Levels

Table of Contents

Analyzing Apple's Current Financial Performance and Growth Prospects

Understanding Apple's current financial health is paramount to any AAPL stock price prediction. Analyzing key performance indicators (KPIs) provides insights into the company's growth trajectory and potential for future returns. Key areas to examine include:

-

AAPL Earnings and Revenue Growth: Examine Apple's recent quarterly earnings reports (available on the Apple investor relations website and through financial news sources) focusing on revenue growth, profit margins, and earnings per share (EPS). Consistent growth in these metrics signifies a healthy financial foundation, boosting investor confidence and potentially driving up the AAPL stock price. Look for trends – is revenue growth accelerating or decelerating? Are profit margins stable or shrinking?

-

Apple Product Sales and Market Share: Analyze the sales performance of Apple's core product lines: iPhones, iPads, Macs, wearables (Apple Watch, AirPods), and services (Apple Music, iCloud, App Store). Strong sales figures across these categories indicate robust demand and market leadership. Monitoring Apple's market share against competitors like Samsung, Google, and Microsoft helps gauge its competitive strength and potential for future growth. New product launches and their initial reception are also vital indicators.

-

Competitive Landscape and Emerging Technologies: Evaluate Apple's competitive landscape and the potential impact of emerging technologies like augmented reality (AR), virtual reality (VR), and electric vehicles. Apple's ability to innovate and adapt to these changes is crucial for its long-term success and AAPL stock price performance. Analyzing the impact of competitors' innovations and strategies is equally important.

-

Innovative Capabilities and Long-Term Growth: Apple's consistent ability to innovate and introduce groundbreaking products is a major driver of its stock price. Analyzing its research and development (R&D) spending, patent filings, and future product roadmap gives insights into its long-term growth potential. Consider the pipeline of future innovations and their potential market impact.

Evaluating Key Market Factors Affecting AAPL Stock Price

Beyond Apple's internal performance, external market forces significantly impact the AAPL stock price. Understanding these factors is crucial for informed investment decisions.

-

Stock Market Trends and Economic Indicators: The overall health of the stock market (bull or bear market) directly influences Apple stock performance. Macroeconomic factors like interest rates, inflation, and economic growth also play a significant role. Rising interest rates, for example, can increase borrowing costs for companies and reduce investor appetite for riskier assets, impacting AAPL stock.

-

Geopolitical Risks and Global Economy: Geopolitical events and global economic uncertainties can significantly affect investor sentiment and the AAPL stock price. International trade disputes, political instability in key markets, and global pandemics can all create volatility.

-

US Dollar and Supply Chain Disruptions: The strength of the US dollar relative to other currencies can impact Apple's revenue from international sales. A stronger dollar reduces the value of foreign earnings when converted to US dollars. Supply chain disruptions, as witnessed in recent years, can severely impact production, leading to lower sales and potentially impacting the AAPL stock price.

Assessing Investor Sentiment and Analyst Predictions for AAPL

Investor sentiment and analyst predictions are valuable, though not definitive, indicators of future AAPL stock price movements.

-

Apple Stock Analyst Ratings and Price Targets: Review analyst ratings and price targets from reputable financial institutions like Goldman Sachs, Morgan Stanley, and JP Morgan. These ratings reflect analysts' assessments of the company's prospects and provide a range of potential price targets. However, it's essential to consider that analyst opinions can vary significantly.

-

Investor Confidence and Sentiment Analysis: Analyze investor sentiment through social media, financial news articles, and other sources. High investor confidence often leads to increased demand for AAPL stock, driving the price upward. Conversely, negative sentiment can lead to price declines.

-

Market Capitalization and Institutional Investor Activity: Apple's market capitalization (the total value of all outstanding shares) reflects investor perception of its worth. Large movements in market capitalization often indicate significant shifts in investor sentiment. Monitoring institutional investor activity (buying and selling of large blocks of shares) can provide insights into market trends. Short-selling activity (betting against the stock) can also influence the price.

Understanding Technical Analysis of AAPL Stock Charts

Technical analysis uses charts and indicators to predict future price movements. While not a standalone predictor, it can offer insights when combined with fundamental analysis.

-

Technical Indicators: Common technical indicators, such as moving averages (simple moving average (SMA), exponential moving average (EMA)), relative strength index (RSI), and moving average convergence divergence (MACD), help identify potential trends and momentum shifts in AAPL stock.

-

Support and Resistance Levels: Identifying support (price levels where buying pressure is strong) and resistance (price levels where selling pressure is strong) levels on AAPL stock charts can help forecast potential price movements.

-

Limitations of Technical Analysis: It's important to remember that technical analysis is not foolproof. It should be used in conjunction with fundamental analysis (evaluating the company's financials) for a more comprehensive view.

Conclusion

Predicting the future price of Apple stock (AAPL) requires a multi-faceted approach that considers its financial performance, market factors, investor sentiment, and technical indicators. While precise predictions are impossible, understanding these elements offers valuable insights for informed investment strategies. Analyzing AAPL earnings, monitoring Apple revenue growth, and staying aware of market trends are all crucial.

Call to Action: Continue your research on understanding Apple stock's (AAPL) future price levels. Stay informed about the latest financial news, analyst reports, and market trends to refine your investment decisions. Remember to always diversify your portfolio and consult with a financial advisor before making any significant investment decisions related to AAPL or any other stock.

Featured Posts

-

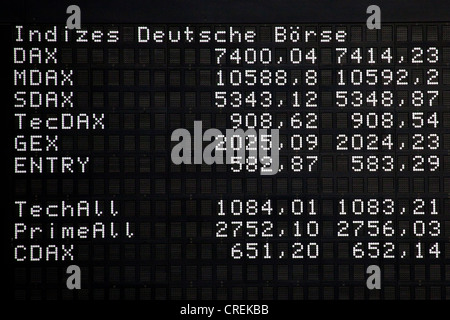

Steady Start For Dax Frankfurt Stock Market Opens After Record Growth

May 24, 2025

Steady Start For Dax Frankfurt Stock Market Opens After Record Growth

May 24, 2025 -

Crystal Palace Eye Kyle Walker Peters On A Free Transfer

May 24, 2025

Crystal Palace Eye Kyle Walker Peters On A Free Transfer

May 24, 2025 -

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025

Darwin Teen Arrested Shop Owner Stabbed During Nightcliff Robbery

May 24, 2025 -

The Lingering Hope Waiting For A Call That May Never Come

May 24, 2025

The Lingering Hope Waiting For A Call That May Never Come

May 24, 2025 -

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Latest Posts

-

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025 -

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025 -

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025 -

Italy Amends Citizenship Law Eligibility Via Great Grandparents Explained

May 24, 2025

Italy Amends Citizenship Law Eligibility Via Great Grandparents Explained

May 24, 2025 -

Generating A Poop Podcast How Ai Processes Repetitive Scatological Documents

May 24, 2025

Generating A Poop Podcast How Ai Processes Repetitive Scatological Documents

May 24, 2025