Understanding The Bitcoin Rebound: Potential Risks And Rewards

Table of Contents

Factors Contributing to a Bitcoin Rebound

Several factors can contribute to a Bitcoin rebound, making it a complex phenomenon to predict but potentially lucrative to understand.

Market Sentiment and Investor Confidence

A shift in market sentiment is often the primary catalyst for a Bitcoin price resurgence. Positive news, such as regulatory approvals, increased institutional adoption, or significant technological advancements, can dramatically boost investor confidence.

- Increased media coverage showcasing positive developments: Positive news coverage from reputable sources can sway public opinion and attract new investors.

- Growing institutional investment and adoption: Large-scale institutional investment signals a growing acceptance of Bitcoin as a legitimate asset class.

- Successful network upgrades and improvements: Improvements to Bitcoin's underlying technology enhance its scalability, security, and efficiency, increasing its attractiveness to investors.

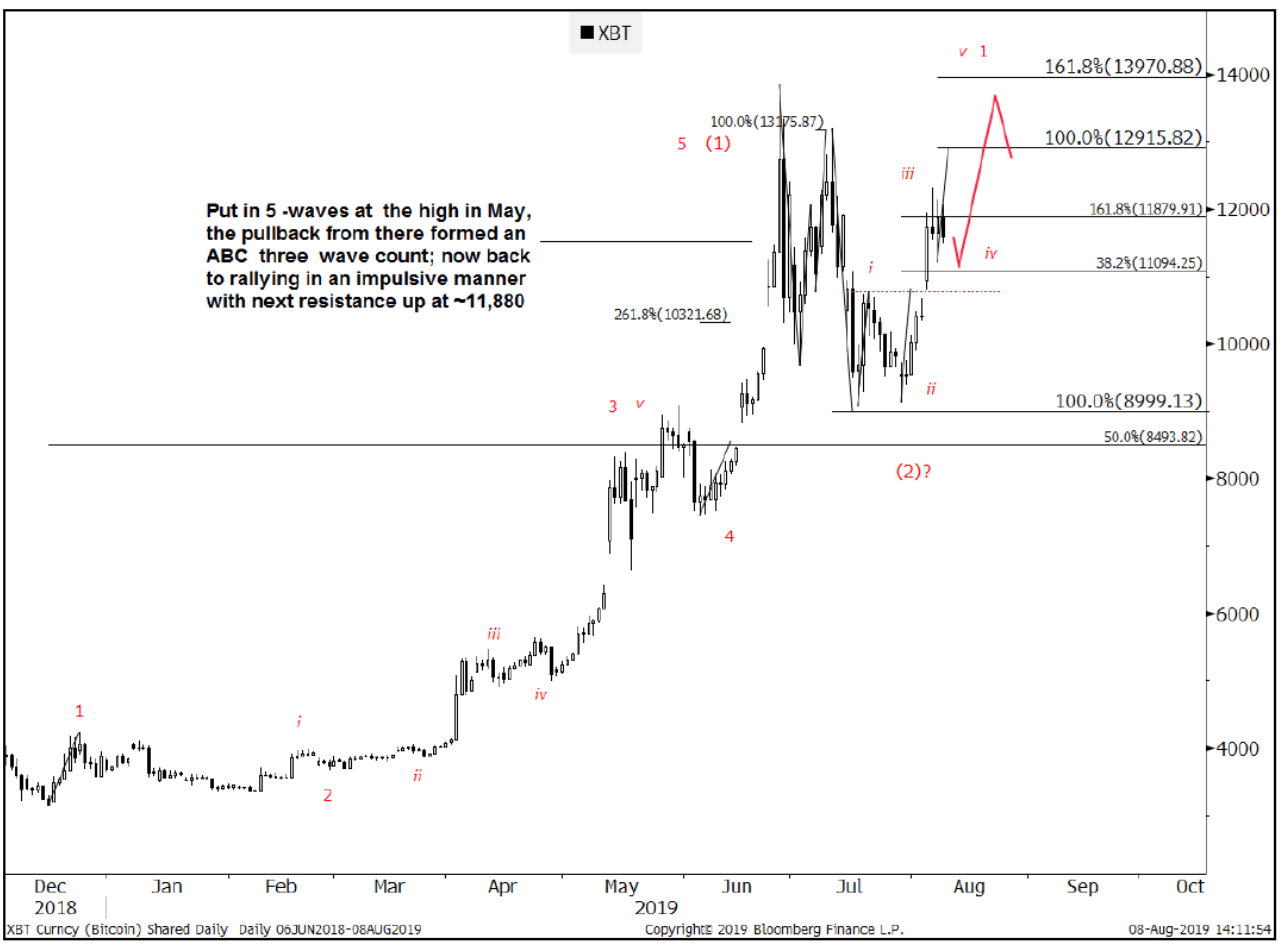

Technical Analysis and Chart Patterns

Technical analysis plays a vital role in predicting potential Bitcoin rebounds. Experienced traders use various indicators and chart patterns to identify potential reversal points.

- Identifying key support and resistance levels: Support levels represent price points where buying pressure is expected to outweigh selling pressure, while resistance levels mark the opposite. Breaks above resistance levels often signal a bullish trend.

- Analyzing moving averages and relative strength index (RSI): Moving averages smooth out price fluctuations, helping to identify trends, while the RSI measures the momentum of price changes, signaling overbought or oversold conditions.

- Recognizing classic chart patterns like head and shoulders reversals: These patterns, identified on price charts, can indicate potential turning points in a downtrend, suggesting an upcoming Bitcoin rebound.

Macroeconomic Factors

Global macroeconomic conditions significantly influence Bitcoin's price. Events such as inflation, interest rate changes, and geopolitical instability can all contribute to or hinder a Bitcoin rebound.

- Impact of inflation on Bitcoin as a hedge against inflation: Some investors view Bitcoin as a hedge against inflation, driving demand during periods of high inflation.

- Influence of monetary policy decisions on cryptocurrency markets: Central bank actions, such as interest rate hikes or quantitative easing, can affect the overall market sentiment and Bitcoin's price.

- Correlation between Bitcoin price and traditional market performance: Bitcoin's price can be correlated with the performance of traditional markets, meaning positive movements in stock markets might lead to a Bitcoin rebound.

Potential Rewards of a Bitcoin Rebound

A successful Bitcoin rebound can offer significant rewards for investors.

Capital Appreciation

The primary reward of a Bitcoin rebound is capital appreciation. Investors who bought Bitcoin during a dip can see substantial gains as the price rises.

- Potential for significant returns on investment: Bitcoin's volatility means that successful rebounds can deliver exceptionally high returns.

- Importance of risk management and diversification: While potential returns are high, it's crucial to manage risk through diversification and stop-loss orders.

Market Dominance and Network Effects

A strong rebound can reinforce Bitcoin's position as the dominant cryptocurrency, further strengthening its network effects.

- Increased adoption and usage of Bitcoin: A rising price attracts new users and investors, increasing transaction volume and network activity.

- Strengthening of the Bitcoin ecosystem and infrastructure: A successful rebound supports the development of new Bitcoin-related products and services.

Potential Risks Associated with a Bitcoin Rebound

Despite the potential rewards, several risks are associated with a Bitcoin rebound.

Volatility and Price Corrections

Even during a rebound, Bitcoin's price can experience sharp corrections.

- Importance of setting stop-loss orders to limit potential losses: Stop-loss orders automatically sell your Bitcoin if the price falls below a predetermined level, limiting potential losses.

- Understanding the risk of "pump and dump" schemes: Be aware of manipulative trading schemes that artificially inflate the price before a sudden crash.

Regulatory Uncertainty

Regulatory changes can significantly impact Bitcoin's price, potentially dampening even a strong rebound.

- Impact of government regulations on Bitcoin trading and adoption: New regulations can either boost or hinder the growth of the Bitcoin market.

- Geopolitical events and their influence on cryptocurrency markets: Geopolitical instability can create uncertainty and volatility in the Bitcoin market.

Security Risks

Security breaches and hacks remain a significant concern for Bitcoin investors.

- Importance of using secure wallets and exchanges: Choose reputable and secure platforms to store and trade your Bitcoin.

- Awareness of potential phishing scams and other online threats: Be vigilant against phishing attempts and other online scams designed to steal your Bitcoin.

Conclusion

Understanding the intricacies of a Bitcoin rebound requires a comprehensive analysis of market sentiment, technical indicators, and macroeconomic factors. While the potential rewards are substantial, significant risks also exist. By carefully considering these factors and implementing effective risk management strategies, investors can navigate the volatile world of Bitcoin and potentially capitalize on rebound opportunities. Continue learning about Bitcoin rebound trends and strategies to make informed decisions in this dynamic market. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions regarding the Bitcoin rebound or any other cryptocurrency.

Featured Posts

-

Andor First Look Delivers On 31 Years Of Star Wars Teases

May 08, 2025

Andor First Look Delivers On 31 Years Of Star Wars Teases

May 08, 2025 -

Miras Birakanlar Icin Kripto Varlik Guevenligi Rehberi

May 08, 2025

Miras Birakanlar Icin Kripto Varlik Guevenligi Rehberi

May 08, 2025 -

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025

Where To Buy A Ps 5 Before A Potential Price Increase

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sarti

May 08, 2025 -

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Akuzat Dhe Pasojat E Mundshme

May 08, 2025

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Akuzat Dhe Pasojat E Mundshme

May 08, 2025

Latest Posts

-

New Uber Shuttle 5 Rides From United Center For Fans

May 08, 2025

New Uber Shuttle 5 Rides From United Center For Fans

May 08, 2025 -

Announcing Uber Pet Service In Delhi And Mumbai

May 08, 2025

Announcing Uber Pet Service In Delhi And Mumbai

May 08, 2025 -

Delhi And Mumbai Get Uber Pet Services Easier Pet Travel

May 08, 2025

Delhi And Mumbai Get Uber Pet Services Easier Pet Travel

May 08, 2025 -

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 08, 2025

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 08, 2025 -

Zhurnalist Raskryl Detali Predlozheniya Zenita Zhersonu E500 000

May 08, 2025

Zhurnalist Raskryl Detali Predlozheniya Zenita Zhersonu E500 000

May 08, 2025