Will Trump's Policies Affect Bitcoin's Price? A 2024 Prediction

Table of Contents

Trump's Past Stance on Cryptocurrencies

Trump's past public statements on Bitcoin and cryptocurrencies have been somewhat limited, lacking the detailed pronouncements seen on other policy areas. While he hasn't explicitly endorsed or condemned Bitcoin, his administration's actions offer some clues.

- Specific quotes or instances: A comprehensive search reveals few direct quotes from Trump himself specifically mentioning Bitcoin. However, his focus on financial regulation and his appointments to key positions provide indirect indications.

- Analysis of his past administration's actions: The Trump administration focused on combating illicit finance, which could potentially lead to increased scrutiny of cryptocurrency transactions and exchanges. This could manifest as stricter KYC/AML (Know Your Customer/Anti-Money Laundering) rules.

- Key figures' opinions: While Trump himself remained relatively quiet on the subject, certain figures within his administration held strong views on financial regulation that could indirectly affect cryptocurrency. Understanding these differing opinions within his potential cabinet is crucial for predicting future regulatory approaches.

Potential Regulatory Changes Under a Trump Presidency

A second Trump term could bring significant changes to the US regulatory landscape for cryptocurrencies. The direction of these changes remains uncertain, leading to considerable speculation regarding "Trump Bitcoin price 2024."

- Increased regulation: A focus on combating illicit activities and protecting investors could lead to stricter KYC/AML rules, potentially impacting the anonymity often associated with Bitcoin. This increased oversight might slow adoption, putting downward pressure on price.

- Deregulation or laissez-faire approach: Alternatively, a less interventionist approach could encourage innovation and wider adoption. A more hands-off regulatory environment could lead to increased price volatility but also potentially higher long-term growth.

- Impact on Bitcoin adoption and price: The balance between these opposing forces will significantly influence Bitcoin's price. A highly regulated environment could stifle innovation, while an overly lax approach could invite abuse and investor distrust.

- Comparison with opposing candidates: Understanding the stated crypto policies of potential opposing candidates provides a crucial benchmark for comparison. This comparative analysis enhances the prediction's accuracy by contextualizing Trump's potential impact.

The Impact of Trump's Economic Policies on Bitcoin

Trump's economic policies could significantly influence Bitcoin's value, either directly through tax changes or indirectly through their impact on broader economic conditions.

- Impact of potential tax changes: Changes to capital gains taxes on cryptocurrency investments could impact investor behavior and subsequently influence Bitcoin's price. Lower taxes could encourage investment, driving the price up, while higher taxes could have the opposite effect.

- Economic uncertainty and Bitcoin as a safe haven: Periods of economic uncertainty often see investors seeking safe haven assets. Bitcoin, with its decentralized nature and limited supply, could benefit from increased demand during such times, particularly if Trump's policies create economic volatility.

- Influence of potential trade wars: Trump's history of initiating trade wars could impact global economic stability and create uncertainty in traditional markets. This uncertainty could drive investors towards Bitcoin as a less correlated asset, pushing the price upwards.

- Correlation with traditional markets: Historically, Bitcoin's price has shown some correlation with traditional markets. Understanding this relationship under previous periods of similar economic conditions—under Trump's first term, for example—helps in forecasting future price movements.

Geopolitical Factors and Bitcoin's Price

A Trump presidency could significantly alter US foreign policy, impacting global cryptocurrency markets and influencing the "Trump Bitcoin price 2024" narrative.

- Impact of shifts in US foreign policy: Changes in international relations, sanctions, or trade agreements could have both positive and negative impacts on the global adoption of Bitcoin and its price.

- International sanctions and Bitcoin adoption: Bitcoin's decentralized nature could make it attractive in countries facing international sanctions, leading to increased demand and price appreciation.

- Bitcoin as a tool for circumventing sanctions: The potential use of Bitcoin to bypass financial sanctions could be a double-edged sword, potentially boosting its price but also attracting increased regulatory scrutiny.

Predicting Bitcoin's Price in 2024 under a Trump Presidency

Based on the analysis above, predicting Bitcoin's price under a Trump presidency in 2024 involves significant uncertainty. Several scenarios are possible:

- Bullish scenario: A less interventionist approach to crypto regulation combined with economic uncertainty could drive the price significantly higher, potentially reaching $100,000 or more.

- Bearish scenario: Increased regulation and a stable (or declining) economic outlook could stifle growth, leading to a lower price range, potentially even below current levels.

- Price range prediction: Considering the various factors, a reasonable prediction range for Bitcoin's price in 2024 under a Trump presidency could be between $30,000 and $80,000.

- Factors contributing to prediction: This range considers the potential for both increased regulation and economic uncertainty driving demand.

- Potential unexpected events: This prediction does not account for unforeseen global events that could significantly impact Bitcoin's price.

- Disclaimer: It is crucial to remember that cryptocurrency price predictions are inherently speculative. This analysis should not be considered financial advice.

Conclusion

The potential impact of a Trump presidency on Bitcoin's price in 2024 is complex and depends on a confluence of factors: regulatory changes, economic policies, and geopolitical events. While a definitive prediction is impossible, a reasonable price range, considering different scenarios, can be estimated. The analysis suggests that "Trump Bitcoin price 2024" is likely to experience significant volatility influenced by the interplay between regulatory oversight and economic conditions. Stay informed about the evolving political landscape and its potential impact on your cryptocurrency investments. Continue to monitor "Trump Bitcoin price 2024" news and analysis for the latest updates. This analysis offers a potential outlook, but remember to conduct your own research before making investment decisions.

Featured Posts

-

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025

Por Que Este Betis Es Ya Historico Un Repaso A Sus Logros

May 08, 2025 -

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025 -

Inter Milan Defeat Feyenoord Advance To Europa League Quarter Finals

May 08, 2025

Inter Milan Defeat Feyenoord Advance To Europa League Quarter Finals

May 08, 2025 -

Counting Crows Snl Performance A Pivotal Moment In Their Career

May 08, 2025

Counting Crows Snl Performance A Pivotal Moment In Their Career

May 08, 2025 -

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

May 08, 2025

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

May 08, 2025

Latest Posts

-

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Performance

May 08, 2025 -

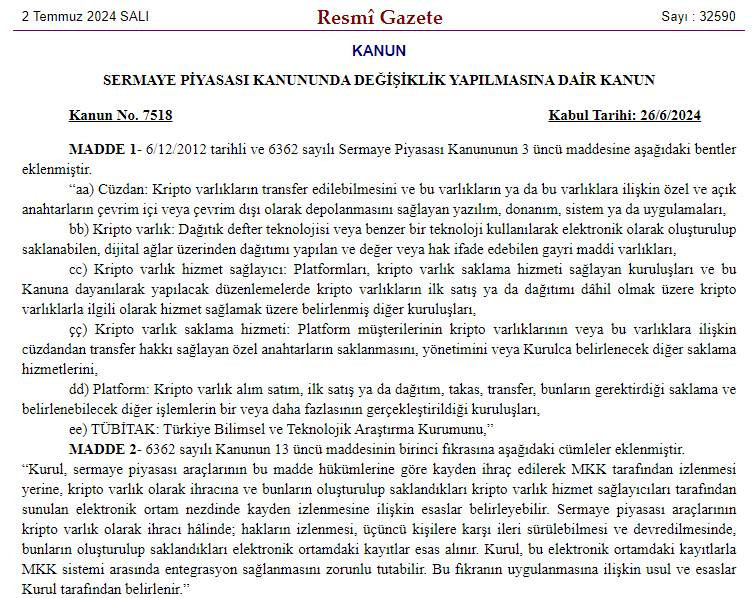

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025

Sifrenizi Unuttunuz Mu Kripto Varliklarinizi Nasil Koruyabilirsiniz

May 08, 2025 -

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025

Son Dakika Bakan Simsek In Kripto Para Sektoeruene Yoenelik Uyarisi

May 08, 2025 -

Kripto Varlik Mirasi Sifre Kaybi Ve Coezuem Yollari

May 08, 2025

Kripto Varlik Mirasi Sifre Kaybi Ve Coezuem Yollari

May 08, 2025 -

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025

Ekonomi Haberleri Bakan Simsek Kripto Piyasasini Uyardi

May 08, 2025