Lion Electric Acquisition: Updated Offer From Investor Group

Table of Contents

Details of the Updated Offer

While specifics remain limited pending official announcements, reports suggest a previous offer from an unnamed investor group has been superseded. The original offer, rumored to be significantly lower, reportedly valued Lion Electric at a price point that was deemed insufficient by the company's board.

The key changes in the updated offer, based on current market speculation, include:

-

Valuation: The updated offer reportedly reflects a substantially higher valuation, potentially exceeding previous estimates. While the exact figures remain unconfirmed, market analysts anticipate a price per share significantly above the previous proposal. This increased valuation reflects the growing recognition of Lion Electric's market position and future potential in the rapidly expanding zero-emission vehicle market.

-

Financing: Details regarding the financing mechanism are scarce, but indications suggest a blend of cash and possibly equity financing. The precise proportions and structure of the financing remain undisclosed, leaving room for various interpretations. Securing sufficient funding will be critical for the successful completion of the acquisition.

-

Conditions: The success of the acquisition hinges on various conditions precedent, such as regulatory approvals and due diligence completion. These standard conditions often involve antitrust reviews, as well as financial audits of Lion Electric's books. Negotiations surrounding these conditions are expected to shape the final terms of the acquisition agreement.

-

Timeline: The proposed timeframe for completion is currently unknown. However, given the complexities involved in such a transaction, it's anticipated the process will span several months, possibly involving additional negotiations and regulatory hurdles.

The reasons behind the updated offer likely stem from several factors: increasing investor confidence in the EV sector, improved market conditions for EV manufacturers, and a reassessment by the investor group of Lion Electric's long-term growth prospects. The identity of the investor group remains largely unconfirmed, although market rumors point toward several potential candidates, including major players in the automotive and financial industries. However, without official confirmation, these remain mere speculations.

Potential Impacts on Lion Electric

The updated acquisition offer holds significant implications for Lion Electric, impacting both its financial position and operational strategy.

Financial Implications

-

Short-Term Benefits: A successful acquisition could result in a substantial injection of capital, allowing Lion Electric to accelerate its growth plans, reduce debt levels, and improve its overall financial flexibility. The increased valuation could also lead to immediate benefits for existing shareholders.

-

Long-Term Benefits: Increased capital could significantly bolster research and development efforts, enabling faster innovation and the introduction of new zero-emission vehicle models. This could solidify Lion Electric's position within the competitive EV market.

-

Risks: While the acquisition promises financial benefits, risks remain. Potential risks include the dilution of existing shareholder value through the issuance of new shares and the potential for integration challenges post-acquisition. Careful analysis is needed to fully assess these factors.

-

Stock Price Impact: The announcement of the updated offer has already generated significant market interest, impacting Lion Electric's stock price. Further fluctuations are expected as the deal progresses and further information is released.

Operational Impacts

-

Production and R&D: The acquisition could potentially lead to increased production capacity and accelerated research and development initiatives, fostering innovation and technological advancements within Lion Electric's product portfolio. Access to additional resources and expertise could significantly enhance operational efficiency.

-

Leadership and Management: A change in ownership might result in changes to Lion Electric's leadership structure and management team. The integration of the acquiring company’s expertise and strategies could have a profound influence on operational decision-making.

-

Supplier and Customer Relationships: The acquisition's effect on Lion Electric’s relationship with its existing suppliers and customers requires careful consideration. Successful integration will necessitate maintaining established supply chains and fostering strong relationships with key clients.

Implications for the Electric Vehicle Industry

The Lion Electric acquisition carries broader implications for the electric vehicle sector. It underscores the growing interest and investment in the EV industry, signaling a period of significant consolidation and potential shifts in the competitive landscape.

-

Competitive Landscape: The acquisition could reshape the competitive dynamics within the EV market, affecting the strategies and market shares of other electric vehicle manufacturers. The combined entity could emerge as a formidable force, leading to increased competition and innovation.

-

Innovation and Investment: Increased investment following the acquisition may stimulate innovation in the EV industry, accelerating the development of new technologies and more sustainable transportation solutions. It might also prompt competitors to accelerate their own research and development efforts.

-

EV Adoption: The overall impact on the adoption of electric vehicles is difficult to predict with absolute certainty. However, the increased scale and resources of the merged entity could potentially accelerate the transition to electric vehicles globally.

Conclusion

The updated acquisition offer for Lion Electric represents a significant development in the electric vehicle industry. The proposed deal promises substantial financial and operational benefits for Lion Electric, potentially accelerating its growth and reinforcing its position within a rapidly evolving sector. However, careful consideration of potential risks and integration challenges is crucial. The deal also carries broader implications for the EV market, influencing competition, innovation, and overall industry dynamics.

Call to Action: Stay informed about the latest developments in the Lion Electric Acquisition by following our website for updates and in-depth analysis. Keep an eye out for future articles exploring the final outcome of this significant transaction and its lasting effects on the electric vehicle market. Understanding this Lion Electric Acquisition is crucial for investors and anyone interested in the future of sustainable transportation.

Featured Posts

-

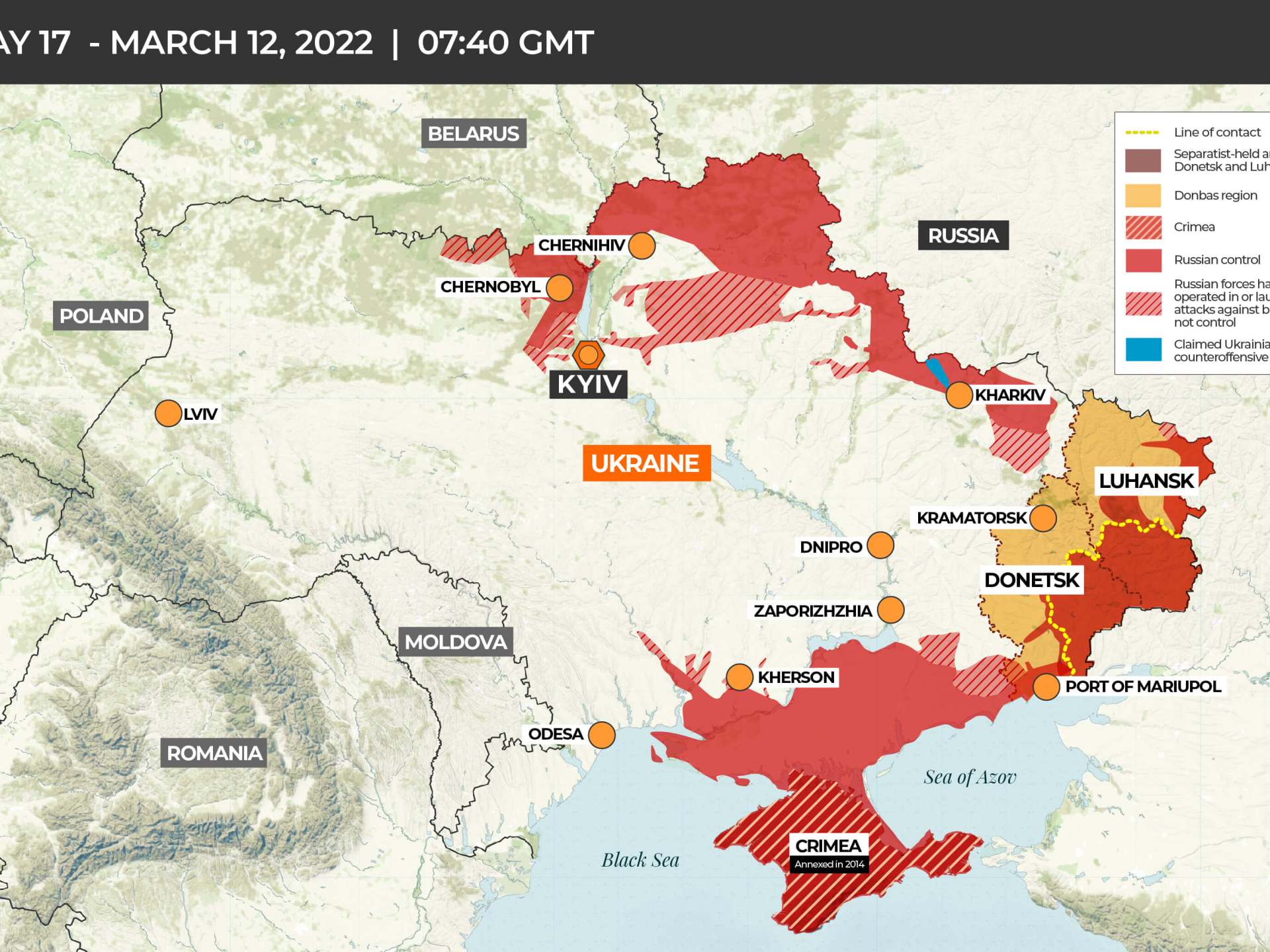

Ukraine Conflict How Trumps Policies Affected Us And European Pressure On Russia

May 14, 2025

Ukraine Conflict How Trumps Policies Affected Us And European Pressure On Russia

May 14, 2025 -

Chimes Path To Ipo Analyzing The Digital Banks Financial Success

May 14, 2025

Chimes Path To Ipo Analyzing The Digital Banks Financial Success

May 14, 2025 -

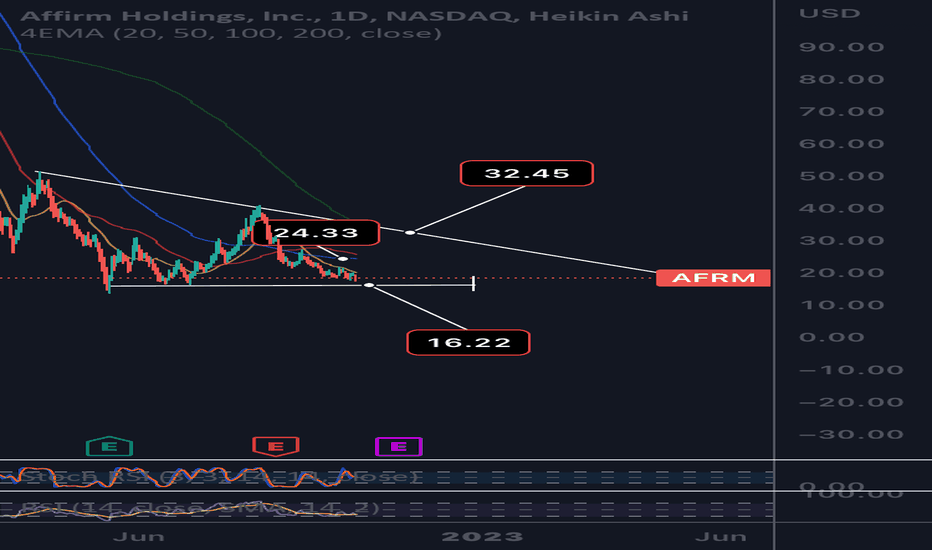

Fintech Ipo Market Crash Examining The Role Of Trump Tariffs And Affirm Afrm

May 14, 2025

Fintech Ipo Market Crash Examining The Role Of Trump Tariffs And Affirm Afrm

May 14, 2025 -

Snow White Box Office Bomb A Case Study In Alienating Audiences

May 14, 2025

Snow White Box Office Bomb A Case Study In Alienating Audiences

May 14, 2025 -

169 Million Box Office Fail Has Disneys Live Action Remake Strategy Reached Its Peak

May 14, 2025

169 Million Box Office Fail Has Disneys Live Action Remake Strategy Reached Its Peak

May 14, 2025

Latest Posts

-

Damiano David Perspektivi Uchasti U Nastupnomu Yevrobachenni

May 14, 2025

Damiano David Perspektivi Uchasti U Nastupnomu Yevrobachenni

May 14, 2025 -

Obgovorennya Povernennya Damiano Davida Na Stsenu Yevrobachennya

May 14, 2025

Obgovorennya Povernennya Damiano Davida Na Stsenu Yevrobachennya

May 14, 2025 -

Prognoz Chi Pobachimo Damiano Davida Na Yevrobachenni Znovu

May 14, 2025

Prognoz Chi Pobachimo Damiano Davida Na Yevrobachenni Znovu

May 14, 2025 -

Povernennya Damiano Davida Na Yevrobachennya Analiz Situatsiyi

May 14, 2025

Povernennya Damiano Davida Na Yevrobachennya Analiz Situatsiyi

May 14, 2025 -

Damiano David Ta Yevrobachennya Scho Chekaye Nas U Maybutnomu

May 14, 2025

Damiano David Ta Yevrobachennya Scho Chekaye Nas U Maybutnomu

May 14, 2025