Chime's Path To IPO: Analyzing The Digital Bank's Financial Success

Table of Contents

Chime's Disruptive Business Model: A Key to Success

Chime's ascendancy is largely attributed to its innovative and disruptive business model. This model cleverly addresses the needs of a significant segment of the population often overlooked by traditional banking institutions.

Targeting the Underserved Market:

Chime has strategically focused on attracting consumers underserved by traditional banks. This includes:

- Millennials and Gen Z: These demographics are digitally native and appreciate the convenience and ease of use offered by Chime's mobile-first banking platform.

- Low-income individuals: Chime's fee-free model and accessible features make banking more manageable for those with limited financial resources. This represents a substantial underserved banking market.

- Individuals with poor credit history: Traditional banks often deny services to those with less-than-perfect credit scores; Chime offers a more inclusive approach to financial services.

This targeted approach has provided Chime with a significant competitive advantage in the fintech disruption sweeping the industry.

Fee-Free Banking and Innovative Features:

Chime's fee-free banking model is a major differentiator. This, coupled with innovative features, has been instrumental in attracting and retaining a loyal customer base. Key features include:

- Early direct deposit: Chime offers early access to funds, a highly attractive feature for many customers, providing financial flexibility.

- Spending insights: The app provides tools and features that help users track spending, promoting financial literacy tools and better budgeting habits.

- Round-ups: Automatic savings features like round-ups make saving more accessible and convenient.

These features are crucial for attracting customers and fostering loyalty in the competitive mobile-first banking market.

Strategic Partnerships and Growth Strategies

Chime's strategic partnerships and targeted growth strategies have played a vital role in its expansion and overall financial success.

Collaborations and Acquisitions:

Chime has strategically forged partnerships and explored acquisitions to expand its reach and capabilities:

- Partnerships with credit bureaus: These collaborations enhance credit reporting for Chime users, bridging the gap between the traditional banking system and the fintech world.

- Investments in other fintech companies: Strategic investments in complementary businesses solidify Chime's position within the wider fintech ecosystem. This allows for expansion into new services and markets.

These strategic alliances are critical for business expansion and long-term growth in the increasingly complex financial technology landscape.

Effective Marketing and Customer Acquisition:

Chime's marketing strategies have been incredibly effective:

- Digital marketing prowess: Chime leverages digital marketing channels adeptly, including social media and targeted online advertising, to reach its key demographic effectively and economically.

- Focus on word-of-mouth referrals: Satisfied customers are encouraged to recommend Chime to their friends and family. This generates organic growth and boosts brand awareness significantly.

- Strong brand awareness: Chime has successfully cultivated a recognizable and trustworthy brand, essential for attracting new customers and reinforcing loyalty in a competitive market.

Analyzing Chime's customer acquisition cost relative to its revenue growth paints a clear picture of the effectiveness of its marketing strategy.

Financial Performance and IPO Readiness

Assessing Chime's financial performance is crucial to evaluate its IPO readiness. A strong track record is essential for investor confidence.

Revenue Growth and Profitability:

Chime has demonstrated impressive growth across several key metrics:

- Rapid user base growth: The number of Chime users has expanded dramatically since its inception, showcasing strong market demand and adoption.

- High customer lifetime value: Chime's ability to retain customers for extended periods contributes significantly to its long-term profitability and sustainability.

- Increasing revenue streams: Expansion into additional financial services, such as credit building and investing, diversified its income streams and enhanced its financial strength. Analyzing Chime's financial statements reveals a promising growth trajectory.

Examining Chime's revenue growth, profit margin, and other financial metrics highlights its promising future.

Regulatory Compliance and Risk Management:

For a successful IPO, regulatory compliance and effective risk management are non-negotiable:

- Stringent regulatory compliance: Chime has demonstrated its commitment to complying with all relevant financial regulations, a crucial aspect for securing investor trust and a successful IPO.

- Proactive risk mitigation: Chime’s proactive risk management strategies safeguard its operations and financial stability, inspiring confidence in its long-term sustainability.

Strong regulatory compliance and effective risk mitigation are essential for securing a strong IPO valuation.

Conclusion

Chime's journey towards its IPO is a testament to the power of a disruptive business model, strategic partnerships, and a focus on customer needs. Its targeted approach to the underserved banking market, innovative features, and effective marketing have propelled its remarkable growth. Chime’s strong financial performance and demonstrable commitment to regulatory compliance and risk management further solidify its readiness for a successful IPO. The key takeaways highlight the importance of understanding market needs, embracing technological innovation, and strategically partnering to achieve rapid growth in the competitive digital banking space. Continue following Chime's progress and the developments leading up to its Chime IPO, and explore further research on the transformative impact of digital banking and the exciting future of neobanks.

Featured Posts

-

Revised Offer For Lion Electric Investor Group Submits New Bid

May 14, 2025

Revised Offer For Lion Electric Investor Group Submits New Bid

May 14, 2025 -

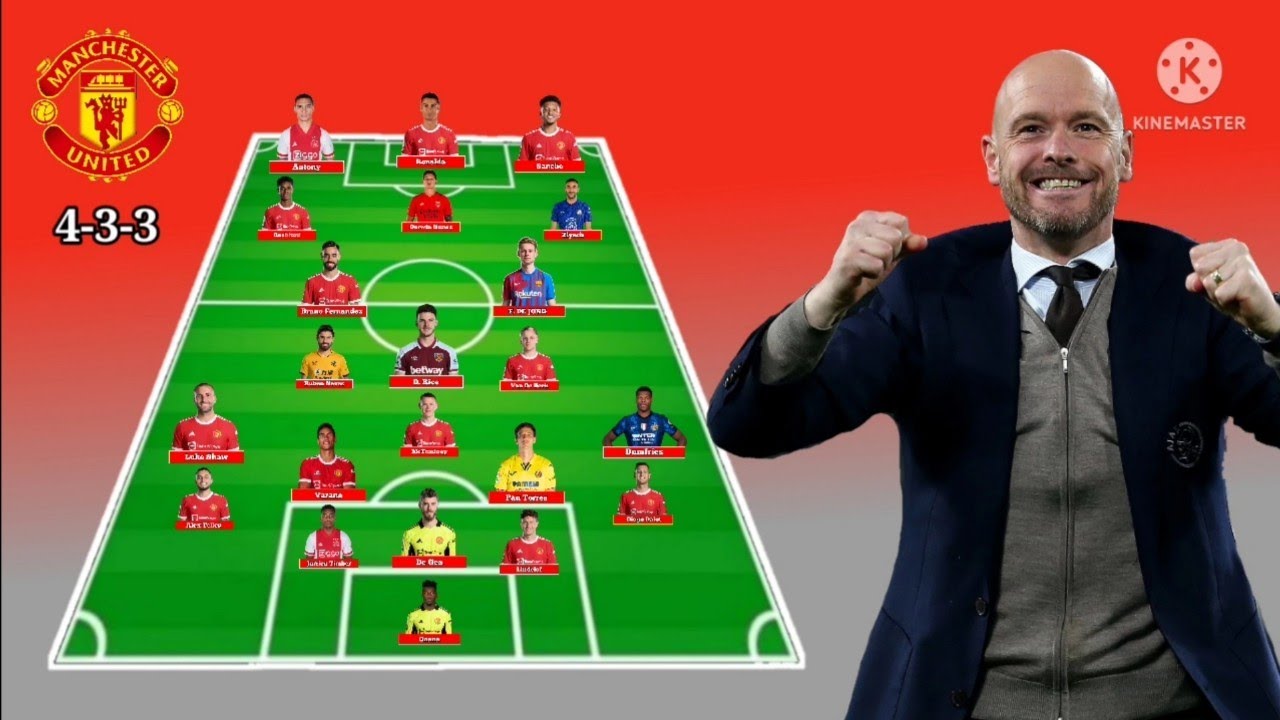

Man United Transfer Targets Amorims Seven Player List

May 14, 2025

Man United Transfer Targets Amorims Seven Player List

May 14, 2025 -

Rachel Zegler Represents Snow White In Spain Gal Gadot Missing

May 14, 2025

Rachel Zegler Represents Snow White In Spain Gal Gadot Missing

May 14, 2025 -

Vince Vaughn Ethnicity A Look At His Family History

May 14, 2025

Vince Vaughn Ethnicity A Look At His Family History

May 14, 2025 -

Selin Dion Detalna Biografiya Osobiste Zhittya Ta Ostanni Novini

May 14, 2025

Selin Dion Detalna Biografiya Osobiste Zhittya Ta Ostanni Novini

May 14, 2025

Latest Posts

-

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025

Exploring Vince Vaughns Family Roots And Ethnicity

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025 -

Is Vince Vaughn Of Italian Origin A Detailed Look

May 14, 2025

Is Vince Vaughn Of Italian Origin A Detailed Look

May 14, 2025 -

Wynonna And Ashley Judd A Family Docuseries Reveals Untold Stories

May 14, 2025

Wynonna And Ashley Judd A Family Docuseries Reveals Untold Stories

May 14, 2025 -

Vince Vaughn Ethnicity A Look At His Family History

May 14, 2025

Vince Vaughn Ethnicity A Look At His Family History

May 14, 2025