Fintech IPO Market Crash: Examining The Role Of Trump Tariffs And Affirm (AFRM)

Table of Contents

The Lingering Impact of Trump Tariffs on Fintech Growth

Trump's tariffs, implemented as part of a broader trade war, significantly disrupted global supply chains. This disruption had a profound and lasting impact on the Fintech sector, affecting both established companies and startups preparing for IPOs. The keywords associated with this section are Trump Tariffs, Trade War, Supply Chain Disruption, Inflation, and Fintech Investment.

-

Increased production costs: Tariffs increased the cost of hardware and software components, essential for many Fintech companies. This directly impacted profitability, squeezing margins and making it harder to compete.

-

Reduced consumer spending: Higher prices for goods and services, a direct consequence of tariffs and resulting inflation, led to reduced consumer spending. This decrease in demand negatively affected the revenue streams of many Fintech businesses, particularly those reliant on consumer transactions.

-

Difficulty securing international partnerships and investments: The trade war created uncertainty in the global market, making it challenging for Fintech companies to secure international partnerships and investments. This limited access to capital and hindered expansion efforts.

-

Negative impact on overall economic growth: The overall slowdown in economic growth caused by the trade war further dampened investor confidence in Fintech, making them less willing to invest in high-growth, potentially risky ventures.

Supporting this analysis, inflation rates surged during and after the tariff period, impacting business costs and reducing consumer purchasing power. Reports from organizations like the Congressional Research Service detailed the negative impact of tariffs on various sectors, including technology and finance, offering quantifiable evidence of the damage.

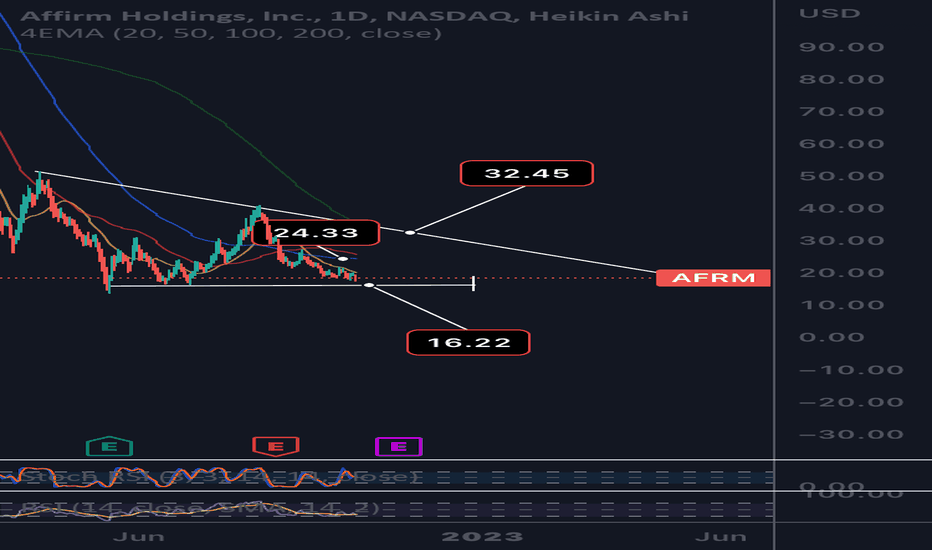

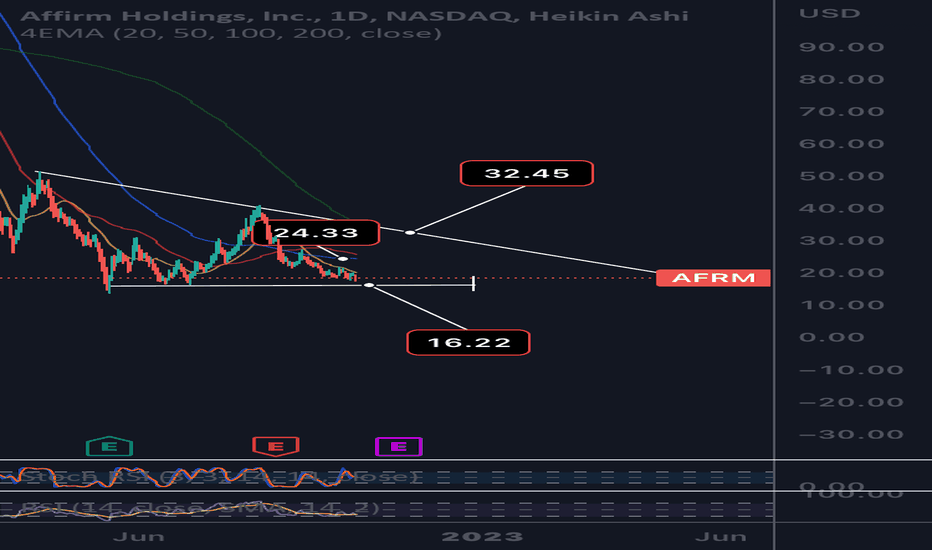

Affirm (AFRM) as a Case Study in Fintech IPO Volatility

Affirm (AFRM), a leading Buy Now Pay Later (BNPL) company, serves as a compelling case study illustrating the volatility of the Fintech IPO market. Its performance, or lack thereof, significantly influenced investor sentiment towards other Fintech IPOs. Keywords relevant to this section include Affirm (AFRM), IPO Performance, Fintech Stock, Stock Valuation, Growth Stock, and Buy Now Pay Later (BNPL).

-

Initial enthusiasm and subsequent correction: Affirm's IPO initially generated significant investor enthusiasm, but its stock price subsequently experienced considerable corrections. This volatility highlighted the risks associated with investing in high-growth Fintech companies.

-

Impact of rising interest rates on the BNPL model: Rising interest rates, a major macroeconomic factor discussed further below, significantly impacted the BNPL model. Higher borrowing costs increased Affirm's operating expenses and reduced its profitability.

-

Competition in the BNPL market: The BNPL market is highly competitive, with numerous players vying for market share. Affirm's struggle to maintain a dominant position contributed to investor concerns.

-

AFRM's financial performance: Affirm's financial performance, particularly its profitability and revenue growth, directly impacted investor perceptions and its stock valuation. Charts displaying AFRM's stock price trajectory alongside its financial performance data clearly illustrate this correlation.

The Broader Macroeconomic Factors Contributing to the Fintech IPO Crash

Beyond specific events like the Trump tariffs and the performance of individual companies like Affirm, broader macroeconomic factors played a crucial role in the Fintech IPO market crash. These factors significantly reduced investor risk appetite and contributed to the overall market downturn. Keywords for this section include Interest Rate Hikes, Inflation, Recession Fears, Market Volatility, and Investor Sentiment.

-

Increased cost of borrowing: Interest rate hikes by central banks increased the cost of borrowing for Fintech startups and established companies. This made it more expensive to secure funding and hampered expansion plans.

-

Reduced investor appetite for growth stocks: In a high-inflation, rising interest rate environment, investors shifted their focus from high-growth, often unprofitable, companies to more stable, established businesses offering higher dividends or steady returns.

-

Increased focus on profitability: The changing investment landscape emphasized profitability over rapid growth. Many Fintech companies, previously valued primarily on their growth potential, faced scrutiny for their lack of profitability.

-

General market uncertainty: The combination of high inflation, rising interest rates, and geopolitical uncertainty created a climate of general market uncertainty, leading to a sell-off in tech stocks, including those in the Fintech sector. Data on interest rate changes, inflation rates, and relevant market indices (like the Nasdaq Composite) clearly demonstrates these macroeconomic trends.

Conclusion

The Fintech IPO market crash resulted from a confluence of factors. The lingering effects of Trump tariffs increased costs and hampered growth, while the performance of companies like Affirm (AFRM) highlighted the inherent volatility of the sector. Simultaneously, broader macroeconomic conditions—including rising interest rates, high inflation, and recessionary fears—further dampened investor sentiment and fueled the market downturn.

While the Fintech IPO market has experienced a downturn, opportunities may still exist for discerning investors. Thorough due diligence and a deep understanding of the factors driving market fluctuations are crucial for navigating this complex landscape. Continue researching the Fintech IPO market and its related dynamics to make informed investment decisions. Stay informed on the impact of Trump tariffs and the performance of key players like Affirm (AFRM) to effectively evaluate future opportunities within the Fintech IPO space.

Featured Posts

-

Nonna A Film Featuring Lorraine Bracco And Brenda Vaccaro

May 14, 2025

Nonna A Film Featuring Lorraine Bracco And Brenda Vaccaro

May 14, 2025 -

Alkaras Nadal I Federer Kao Inspiracija Za Buduce Generacije Tenisera

May 14, 2025

Alkaras Nadal I Federer Kao Inspiracija Za Buduce Generacije Tenisera

May 14, 2025 -

Is Vince Vaughn Italian Fact Checking His Background

May 14, 2025

Is Vince Vaughn Italian Fact Checking His Background

May 14, 2025 -

Figmas Quiet Ipo Pursuit A Look Back At The Adobe Deal

May 14, 2025

Figmas Quiet Ipo Pursuit A Look Back At The Adobe Deal

May 14, 2025 -

Captain America Brave New World A Significant Characters Absence And Its Mcu Consequences

May 14, 2025

Captain America Brave New World A Significant Characters Absence And Its Mcu Consequences

May 14, 2025

Latest Posts

-

Wynonna And Ashley Judds Docuseries Uncovering Family Truths

May 14, 2025

Wynonna And Ashley Judds Docuseries Uncovering Family Truths

May 14, 2025 -

Wynonna And Ashley Judd Open Up About Family Life In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up About Family Life In New Docuseries

May 14, 2025 -

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025 -

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025 -

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025