Latest Tariff Hike By Trump Causes 2% Drop In Amsterdam Stock Exchange

Table of Contents

Immediate Impact of the Tariff Hike on Amsterdam's AEX Index

The immediate reaction to the Trump tariff announcement was swift and dramatic. The AEX index, a key indicator of the Amsterdam Stock Exchange's performance, plummeted by 2.1% within the first hour of trading. This translates to a significant loss in market capitalization, with billions of euros wiped off the value of listed companies. Trading volume also surged, indicating heightened investor activity and, importantly, panicked selling. This sharp decline contrasts with some previous reactions to Trump's trade policies, suggesting a growing sensitivity to further economic uncertainty.

- Specific details: The AEX index fell from 600 points to 588 points within the first hour of trading.

- Trading volume: Trading volume increased by 35% compared to the average daily volume for the previous week, indicating significant market activity driven by the tariff news.

- Investor sentiment: Analyst reports suggest a strong negative shift in investor sentiment, with many adopting a risk-averse approach following the announcement.

- Comparison to previous reactions: While previous tariff announcements caused market fluctuations, the speed and intensity of this reaction suggest a growing concern among investors regarding the long-term consequences of the trade war.

Sectors Most Affected by the Trump Tariffs in Amsterdam

The impact of the Trump tariffs wasn't evenly distributed across all sectors of the Amsterdam Stock Exchange. Export-oriented companies and import-dependent businesses suffered the most significant losses. Specific sectors disproportionately impacted include:

- Technology: Companies relying on imported components for manufacturing electronics experienced supply chain disruptions and increased production costs.

- Manufacturing: Industries reliant on imported raw materials faced higher input costs, squeezing profit margins and hindering competitiveness.

- Agriculture: Dutch agricultural exports, particularly to the US, were directly affected by retaliatory tariffs, leading to reduced sales and revenue.

These sectors are particularly vulnerable because they are heavily integrated into global supply chains and are directly exposed to the fluctuating cost of imported goods and export demand. The consequences include decreased profitability, potential job losses, and a dampening effect on future investment in these vulnerable industries. The ripple effect extends to related businesses and service providers, impacting the broader Dutch economy.

Longer-Term Economic Implications for the Netherlands

The longer-term economic implications of the Trump tariffs for the Netherlands are concerning. The immediate market drop is only the initial sign of potential wider economic consequences.

- GDP Growth: Economists predict a potential 0.5% reduction in the Netherlands' GDP growth rate for the next year due to reduced export demand and decreased investor confidence.

- Foreign Investment: The increased economic uncertainty could discourage foreign direct investment, hindering future economic expansion and job creation.

- Economic Uncertainty: The rising uncertainty is impacting both consumer and business confidence, leading to reduced spending and investment. This creates a negative feedback loop that could further slow economic growth.

- Government Responses: The Dutch government may need to implement fiscal stimulus measures to mitigate the negative impact of the tariffs, potentially increasing government debt.

The extent of these longer-term consequences will depend on the duration and intensity of the trade war and the effectiveness of any government interventions.

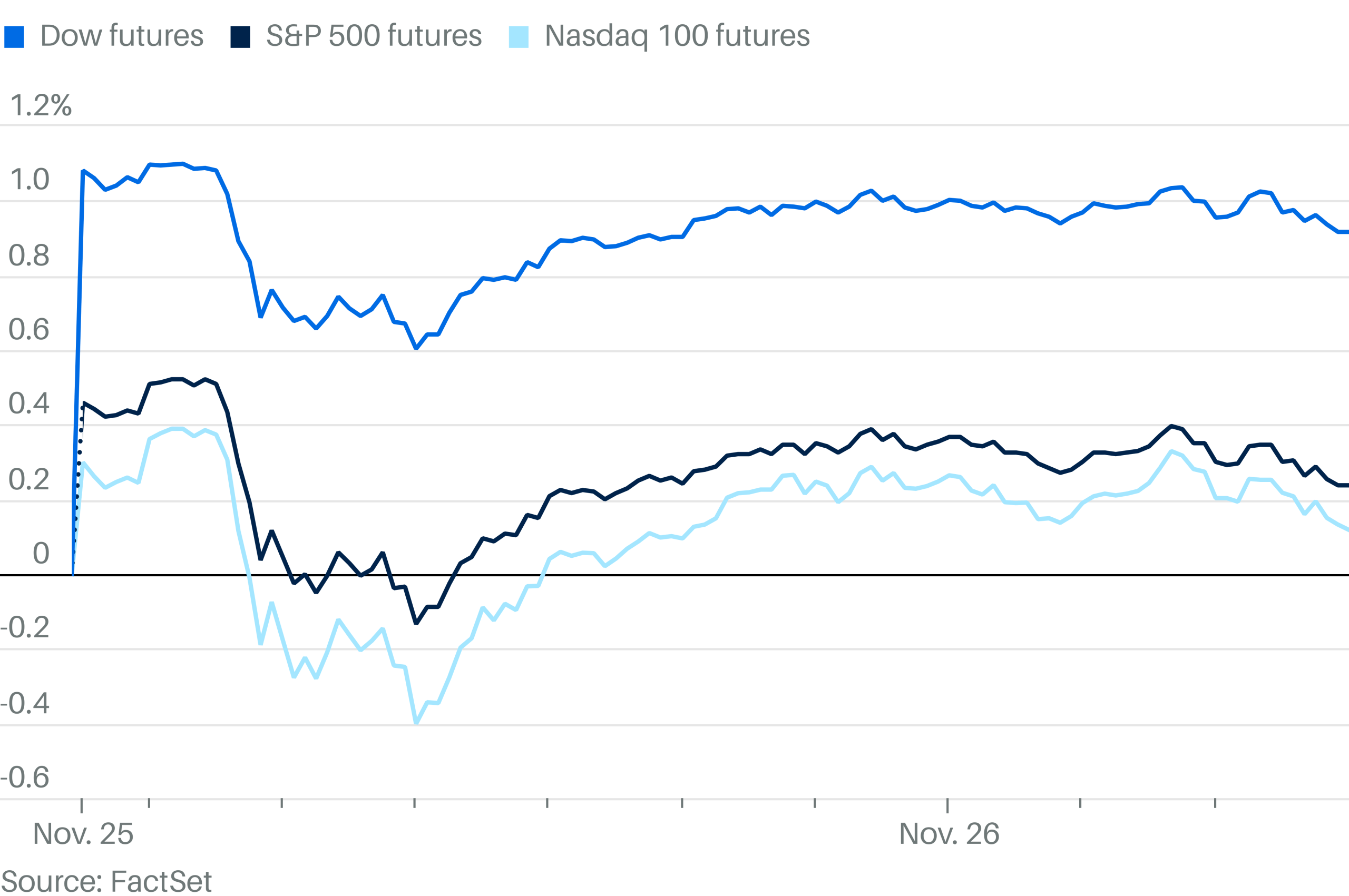

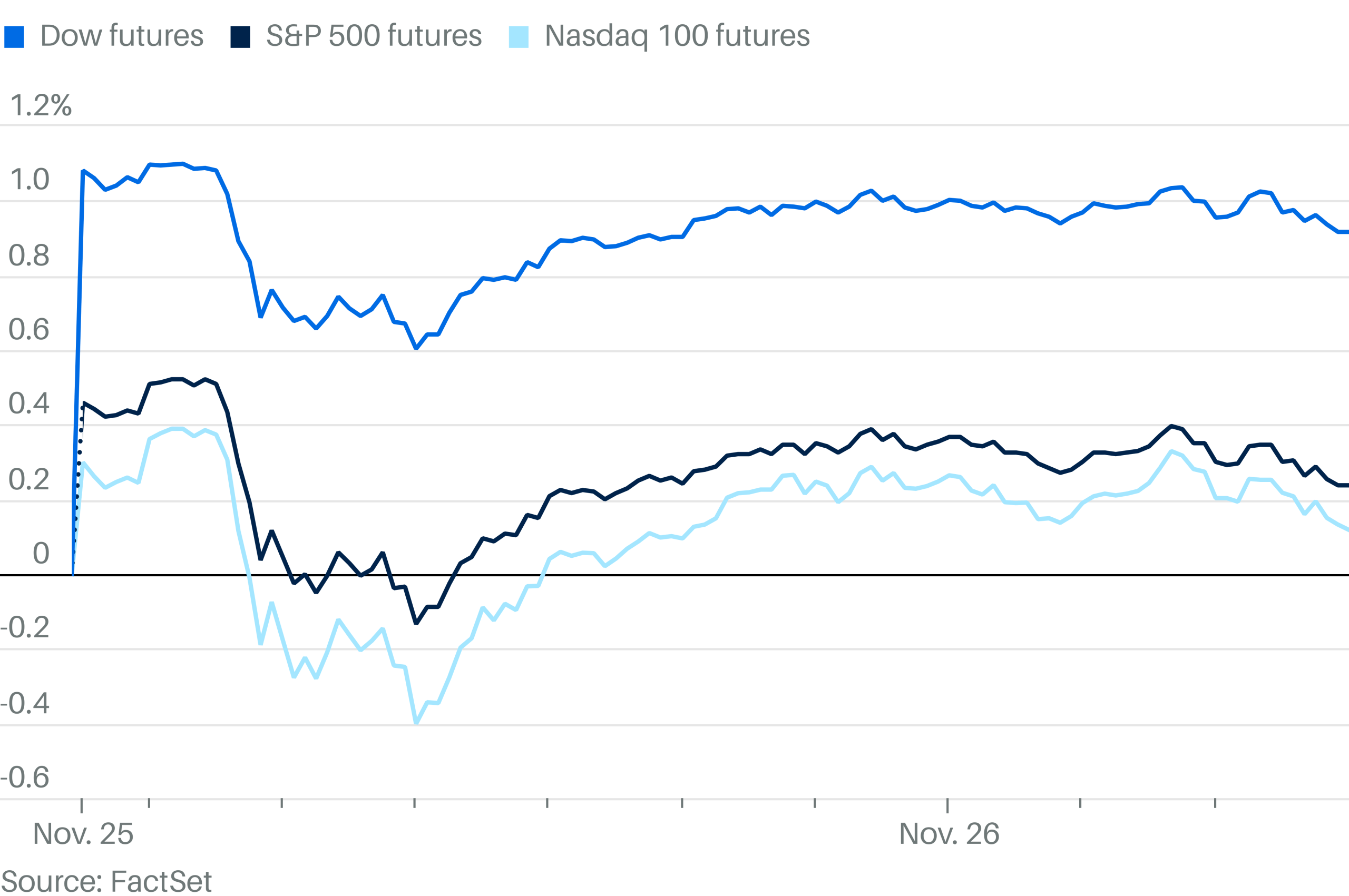

International Market Reactions and Global Uncertainty

The Amsterdam Stock Exchange's reaction wasn't isolated. Other major stock exchanges, including those in New York, London, and Frankfurt, also experienced declines, albeit to varying degrees, reflecting the interconnectedness of global markets. The escalating trade war increases global economic uncertainty, heightening the risk of a wider economic slowdown. Expert opinions vary, but many predict increased market volatility in the coming months. The interconnectedness of global markets means that a downturn in one region can quickly spread, amplifying the negative impacts of the Trump tariffs.

Conclusion

The Trump administration's latest tariff hike has triggered a significant 2% drop in the Amsterdam Stock Exchange's AEX index, impacting various sectors and creating significant economic uncertainty. The immediate impact has been felt across export-oriented and import-dependent businesses, while longer-term consequences include potential GDP reduction, decreased foreign investment, and reduced consumer confidence. The interconnected nature of global markets means that this situation demands careful monitoring. Stay informed about the ongoing impact of Trump's tariffs on the Amsterdam Stock Exchange and global markets. Monitor economic news and adjust your investment strategies accordingly to mitigate risks associated with the ongoing trade war and future tariff hikes. Regularly check for updates on the effects of Trump tariffs and their influence on the Amsterdam Stock Exchange to make informed investment decisions.

Featured Posts

-

Eurovision Village 2025 Conchita Wurst And Jj Live Performance

May 24, 2025

Eurovision Village 2025 Conchita Wurst And Jj Live Performance

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025 -

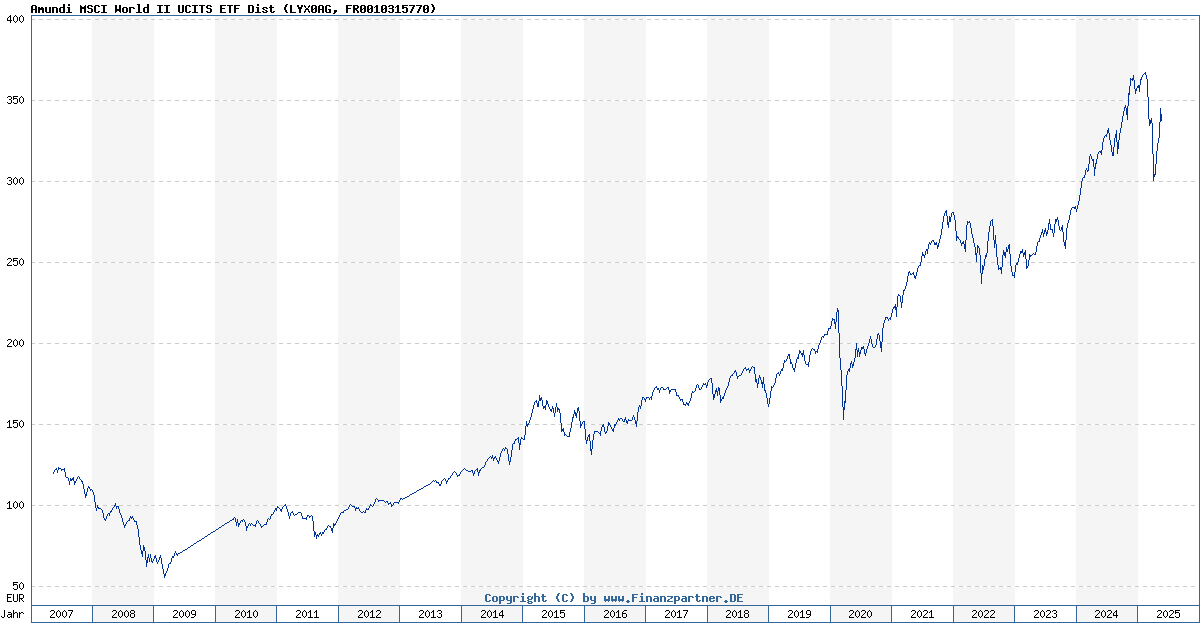

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Key Considerations

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Key Considerations

May 24, 2025 -

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Latest Posts

-

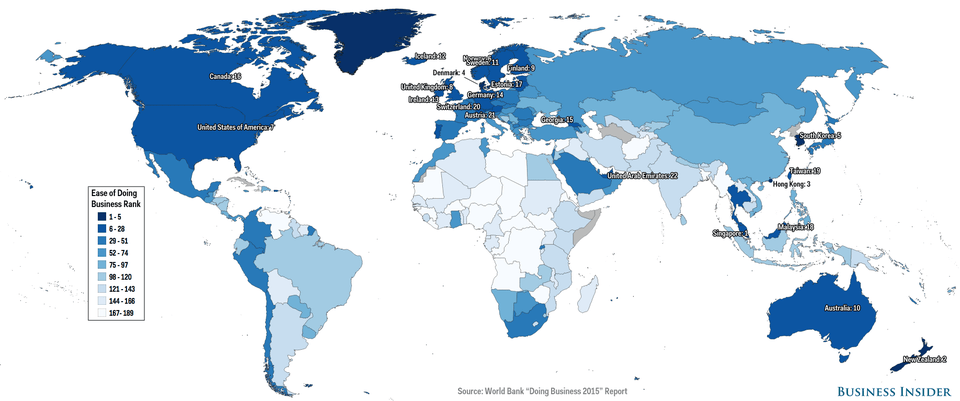

Investment Guide The Countrys Promising New Business Centers

May 24, 2025

Investment Guide The Countrys Promising New Business Centers

May 24, 2025 -

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025

Understanding The Growth Of The Countrys Leading Business Centers

May 24, 2025 -

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025

A Data Driven Map Of The Countrys Top Business Hotspots

May 24, 2025 -

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025

The Countrys Business Landscape Unveiling The Hottest New Markets

May 24, 2025 -

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025