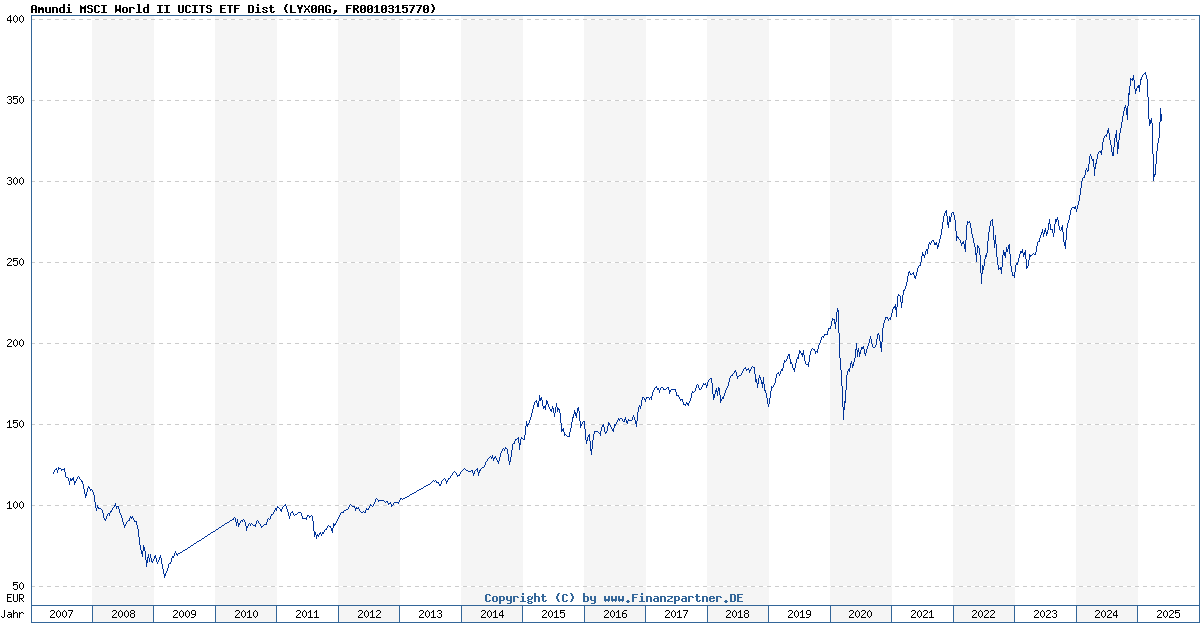

Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist: Key Considerations

Table of Contents

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF Dist

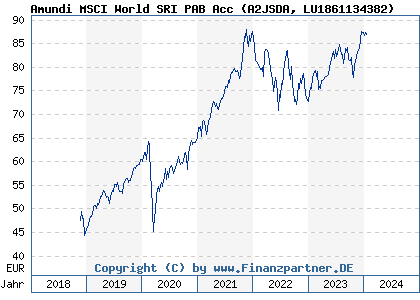

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist, like any ETF, fluctuates daily based on several key factors. Understanding these factors is essential for managing your investment expectations.

-

Market Fluctuations: The primary driver of NAV changes is the performance of the underlying assets within the ETF. Market volatility, whether driven by economic news, geopolitical events, or company-specific factors, directly impacts the value of the holdings. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV. This is often reflected in the daily changes in the ETF's market price.

-

Currency Exchange Rates: Because the Amundi MSCI World II UCITS ETF Dist invests globally, currency exchange rates play a significant role. Fluctuations in the value of different currencies against the Euro (assuming the ETF is denominated in EUR) can impact the NAV. For instance, a strengthening Euro relative to the US dollar will increase the NAV if a substantial portion of the holdings are in US dollar-denominated assets. Conversely, a weakening Euro will lower the NAV. This is a crucial aspect of currency risk associated with international investments.

-

Dividend Distributions: The Amundi MSCI World II UCITS ETF Dist distributes dividends earned from its underlying holdings. On the ex-dividend date, the NAV will typically decrease to reflect the dividend payout. While this might seem like a negative, it actually represents a return on your investment. The dividend yield is a key factor to consider when evaluating the overall performance of the ETF.

-

Management Fees and Expenses: The ETF charges management fees and expenses, which are deducted from the fund's assets. These costs, often expressed as an expense ratio, have a small but cumulative effect on the NAV over time. A higher expense ratio implies a slightly lower NAV growth compared to an ETF with a lower expense ratio. Therefore, understanding the expense ratio is essential for comparing similar ETFs.

Interpreting the NAV and its Implications for Your Investment

Understanding the NAV and its implications is vital for effective portfolio management.

-

Finding the Daily NAV: The daily NAV of the Amundi MSCI World II UCITS ETF Dist is readily available on the ETF provider's website (Amundi), major financial news websites, and through your brokerage account. Look for the official closing NAV, which usually reflects the closing price of the underlying assets on the relevant exchange.

-

NAV vs. Market Price: While the NAV represents the net asset value of the ETF, the market price is the actual price at which the ETF is trading on the exchange. These two figures may differ slightly due to supply and demand fluctuations. However, in a liquid market, they usually track relatively closely. Significant discrepancies can indicate market inefficiencies or other factors influencing the trading price.

-

NAV Changes and Investment Returns: Changes in the NAV directly reflect the overall performance of your investment. A positive change in NAV indicates growth, while a negative change represents a loss. However, remember that this only reflects the value of your investment at a specific point in time; to determine your actual return, account for any dividends received and the initial investment cost.

-

Tracking Error: The Amundi MSCI World II UCITS ETF Dist aims to track a specific benchmark index (MSCI World). Tracking error measures the difference between the ETF's performance and the benchmark's performance. A higher tracking error suggests the ETF is not perfectly mirroring the index's movements, potentially indicating a less efficient portfolio management or other factors affecting the ETF's investment performance.

Comparing the NAV of Amundi MSCI World II UCITS ETF Dist to Competitors

Comparing the NAV performance of the Amundi MSCI World II UCITS ETF Dist to similar ETFs is a crucial step in making informed investment decisions. This allows investors to assess the relative performance of the ETF and identify potential alternatives with better returns or lower expense ratios.

-

Key Competitors: Several other ETFs track the MSCI World index or similar global equity benchmarks. Examples include the iShares Core MSCI World UCITS ETF and Vanguard FTSE All-World UCITS ETF. Comparing their NAVs over time allows you to assess relative performance.

-

Benchmark Comparison: By comparing the NAV of the Amundi MSCI World II UCITS ETF Dist to its benchmark index (MSCI World), you can gauge its tracking efficiency and identify any potential deviations in performance. This helps in evaluating the effectiveness of the ETF's investment strategy.

-

Informed Investment Decisions: NAV comparisons are a valuable tool for building a well-diversified investment portfolio. By assessing the relative performance and expense ratios of competing ETFs, investors can choose the most suitable investment to align with their risk tolerance and investment objectives.

Using NAV to Monitor Your Investment in Amundi MSCI World II UCITS ETF Dist

Regularly monitoring the NAV of your Amundi MSCI World II UCITS ETF Dist investments is crucial for effective portfolio management.

-

Regular Monitoring: Review the NAV on a regular basis (e.g., weekly or monthly) to track the performance of your investment. Pay attention to significant movements or trends in the NAV that might signal broader market changes.

-

Identifying Trends: By tracking the NAV over time, you can identify potential trends and patterns. For example, consistently positive NAV growth indicates strong performance, while consistent negative growth may warrant a review of your investment strategy.

-

Long-Term vs. Short-Term: Remember that ETF investing is generally a long-term strategy. While short-term fluctuations in the NAV are inevitable, they shouldn't dictate your investment decisions. Focus on the long-term growth potential of the ETF and your overall portfolio.

Conclusion: Making Informed Decisions Based on the NAV of Amundi MSCI World II UCITS ETF Dist

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is paramount for successful ETF investing. Factors such as market fluctuations, currency exchange rates, dividend distributions, and management fees all contribute to the daily NAV changes. By regularly monitoring the NAV, comparing it to competitors, and understanding its implications, you can make informed investment decisions and optimize your portfolio performance. Stay informed about the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist investments to optimize your portfolio performance. For more detailed information, visit the Amundi website. [Link to Amundi website]

Featured Posts

-

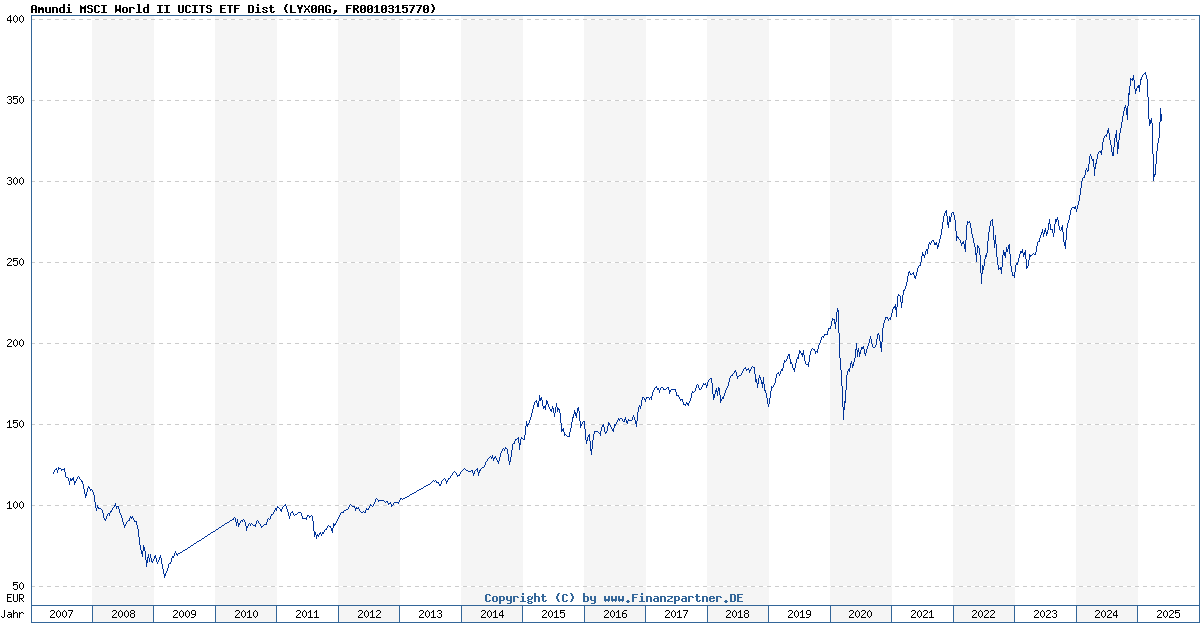

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

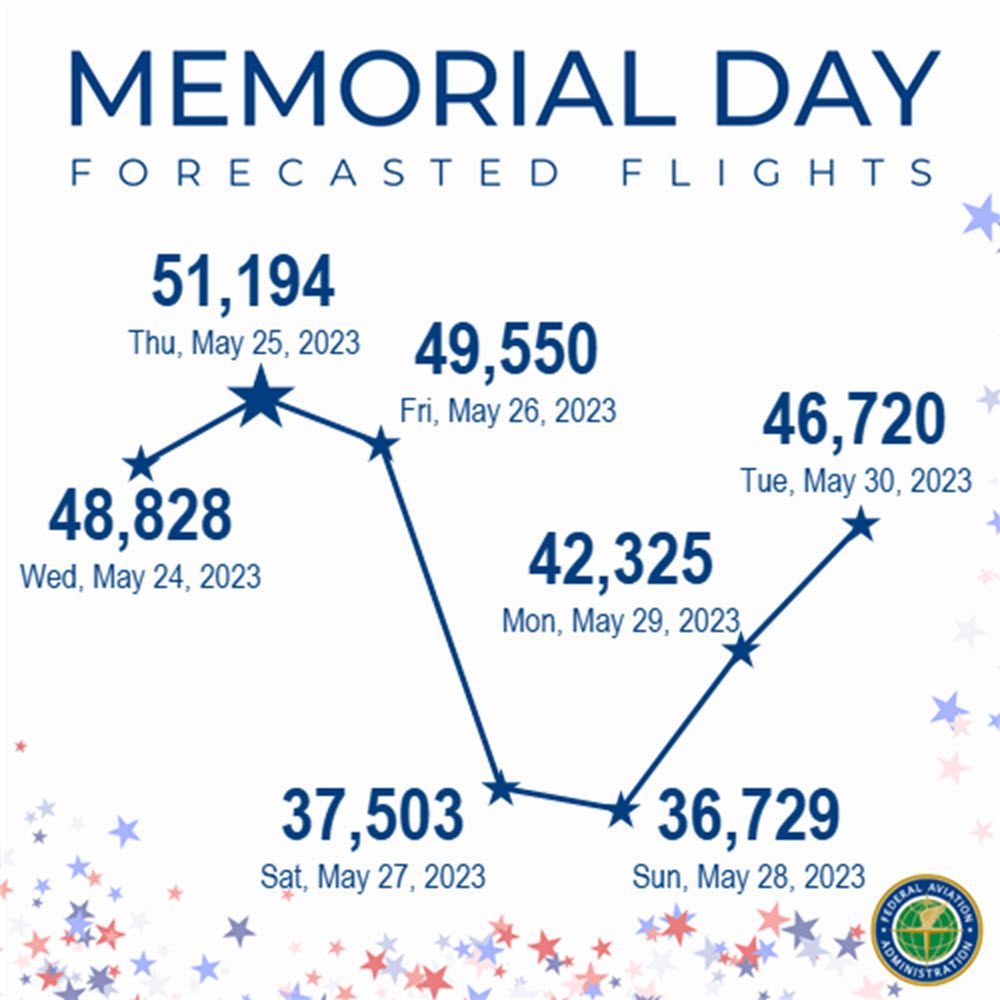

Ferrari 296 Speciale Detalhes Do Novo Motor Hibrido De 880 Cv

May 24, 2025

Ferrari 296 Speciale Detalhes Do Novo Motor Hibrido De 880 Cv

May 24, 2025 -

March 26 2025 Nyt Mini Crossword All The Answers You Need

May 24, 2025

March 26 2025 Nyt Mini Crossword All The Answers You Need

May 24, 2025 -

80 Millio Forintert Extrak Luxus Porsche 911 Bemutatasa

May 24, 2025

80 Millio Forintert Extrak Luxus Porsche 911 Bemutatasa

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Latest Posts

-

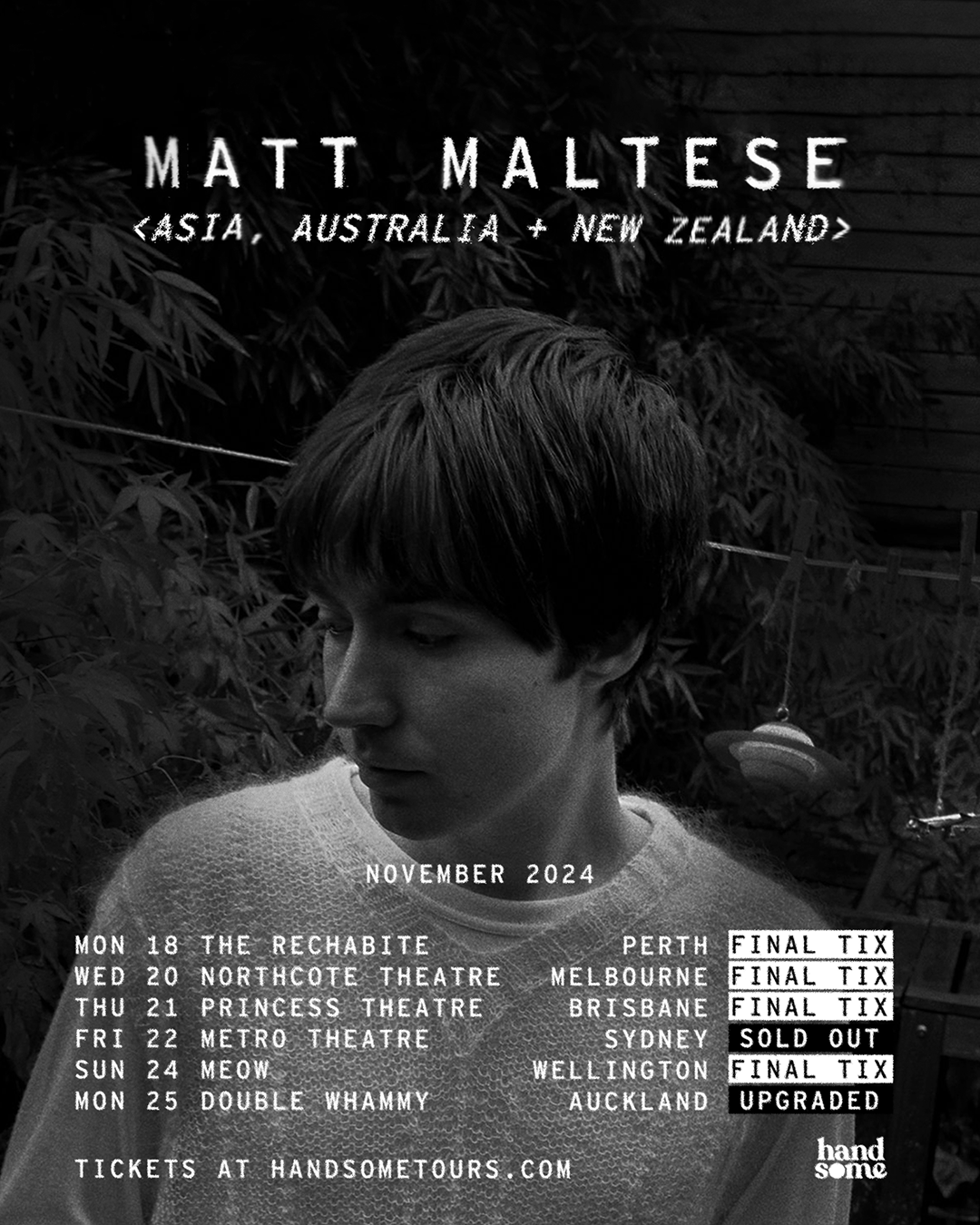

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025