Kering Shares Plunge 6% Following Disappointing Q1 Earnings

Table of Contents

Kering, a global leader in the luxury sector, houses iconic brands like Gucci, Yves Saint Laurent, Balenciaga, Bottega Veneta, and others. Its performance is closely watched as a key indicator of the health and trajectory of the entire luxury goods market. The Q1 earnings announcement revealed unexpectedly negative results, triggering the substantial decline in Kering's share price. Let's examine the factors behind this significant event.

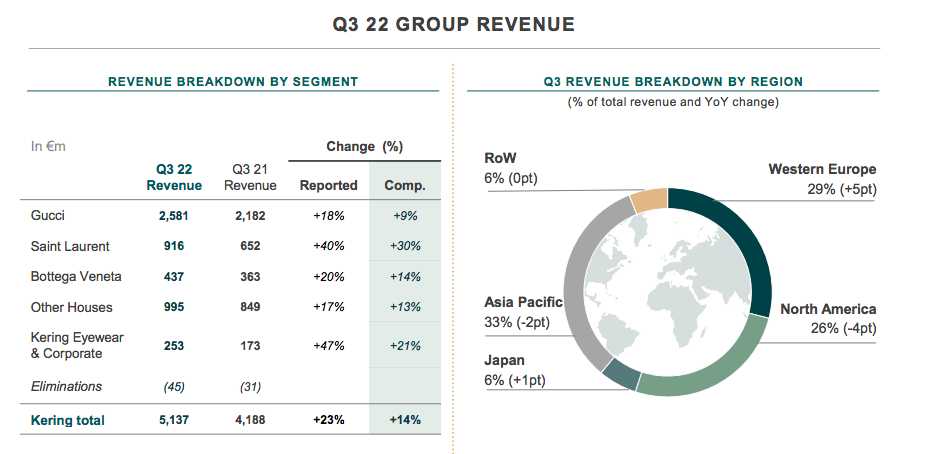

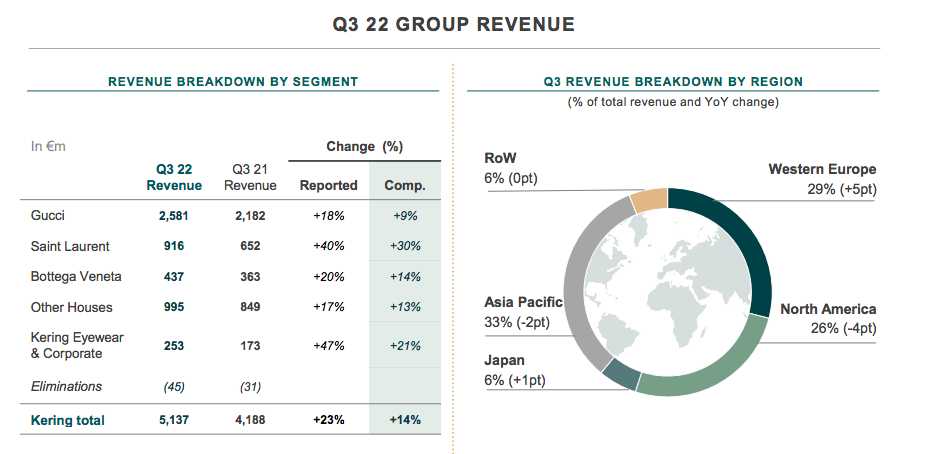

Disappointing Q1 Sales Figures Fuel Kering Share Drop

The Q1 earnings report revealed disappointing sales figures, falling short of market expectations and compared to previous quarters. While precise numbers will vary depending on the final report, initial reports indicated a significant slowdown in growth across several key brands. This underperformance fueled the dramatic "Kering shares plunge." For example, Gucci, typically a significant revenue driver, experienced a notable decrease in sales, impacting the overall company performance. Similarly, other brands within the Kering portfolio also registered lower-than-anticipated sales.

Several factors contributed to these lower-than-expected sales figures:

- Supply chain disruptions: Ongoing global supply chain issues hampered production and delivery, leading to stock shortages and impacting sales.

- Geopolitical instability: The ongoing war in Ukraine and related geopolitical uncertainties negatively affected consumer confidence and spending patterns, particularly in key markets.

- Changes in consumer spending habits: Shifting consumer preferences and a potential slowdown in discretionary spending impacted demand for luxury goods.

- Increased competition: Intensifying competition within the luxury market from other established brands and emerging players put pressure on Kering's market share.

- Specific brand challenges: Certain brands within the Kering portfolio faced unique challenges, such as changes in creative direction or marketing strategies that impacted sales performance.

Impact on Investor Confidence and Market Reaction

The immediate market reaction to Kering's Q1 earnings report was swift and severe. The 6% "Kering shares plunge" led to a substantial decrease in Kering's market capitalization. Trading volume spiked as investors reacted to the disappointing news, highlighting the significant impact of the report on investor sentiment. Several financial analysts expressed concerns about the company's future growth prospects, citing the weakening sales trends as a major cause for concern. Some analysts even issued rating downgrades, further contributing to the negative market reaction. [Link to reputable financial news source].

Investor concerns included:

- Concerns about future growth prospects, given the weak Q1 performance.

- Uncertainty about the luxury goods market's recovery from various global challenges.

- Impact on Kering's long-term strategic goals and ability to meet its financial targets.

Kering's Response and Future Outlook

In response to the disappointing Q1 results, Kering released an official statement acknowledging the challenges and outlining its strategies to address them. The company highlighted plans to implement cost-cutting measures, refine its marketing strategies, and focus on launching new products to stimulate demand. Kering also expressed confidence in its long-term growth potential and its ability to navigate the current market headwinds. However, the projections for the remainder of the year remained cautious, reflecting the uncertainties in the global economic and geopolitical landscape.

Kering's potential solutions and future strategies include:

- Launching innovative new products to capture market share and reignite consumer interest.

- Implementing targeted marketing campaigns to enhance brand awareness and drive sales.

- Implementing cost-cutting measures to improve profitability and enhance operational efficiency.

- Exploring expansion opportunities in new and emerging markets to diversify its revenue streams.

Analyzing the Kering Shares Plunge and What's Next

The significant 6% "Kering shares plunge" following the disappointing Q1 earnings report was driven by a confluence of factors, including weaker-than-expected sales across key brands, supply chain disruptions, geopolitical instability, and increased competition. This resulted in a significant negative impact on investor confidence and a substantial market reaction. Kering's response involves a multi-pronged approach aimed at addressing the challenges and restoring growth. However, the overall outlook remains uncertain, influenced by the evolving global economic landscape and consumer spending patterns.

Stay informed about the future trajectory of Kering shares and the ongoing impact of Q1 results by regularly checking our financial news section. Keep an eye on the "Kering share price," "Kering stock," and "Kering's financial performance" for further updates. [Link to relevant news source/website]

Featured Posts

-

Reopening The Dreyfus Case A Parliamentary Push For Recognition

May 24, 2025

Reopening The Dreyfus Case A Parliamentary Push For Recognition

May 24, 2025 -

8 Stock Market Jump On Euronext Amsterdam Following Tariff Announcement

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam Following Tariff Announcement

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Purchase Information

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Purchase Information

May 24, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 24, 2025 -

Kyle Walkers Recent Activities Details And Annie Kilners Response

May 24, 2025

Kyle Walkers Recent Activities Details And Annie Kilners Response

May 24, 2025

Latest Posts

-

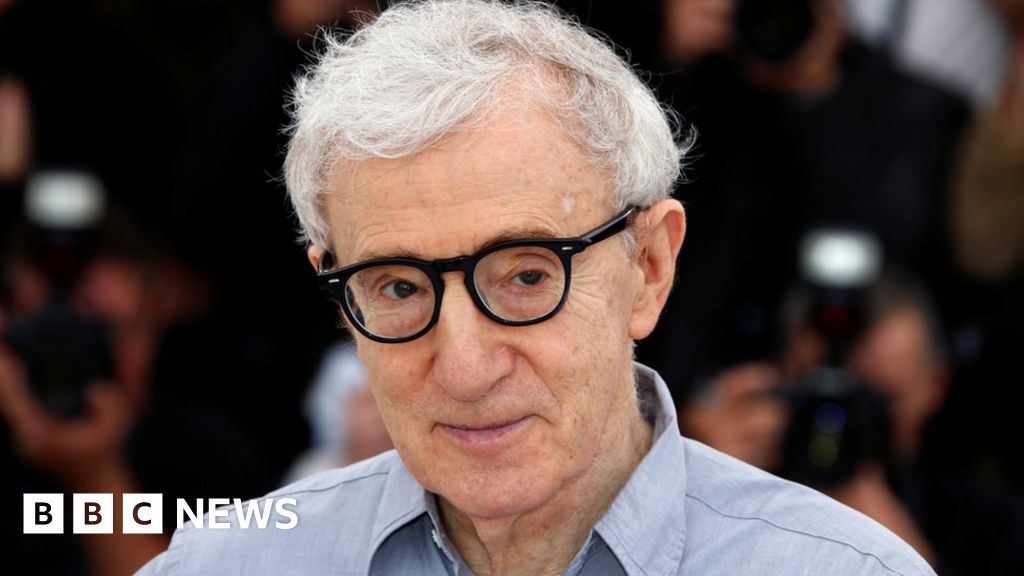

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025 -

Did Woody Allen Abuse Dylan Farrow Sean Penn Weighs In

May 24, 2025

Did Woody Allen Abuse Dylan Farrow Sean Penn Weighs In

May 24, 2025 -

How 17 Celebrities Lost Everything Instantly

May 24, 2025

How 17 Celebrities Lost Everything Instantly

May 24, 2025 -

The 17 Biggest Celebrity Reputation Ruins

May 24, 2025

The 17 Biggest Celebrity Reputation Ruins

May 24, 2025 -

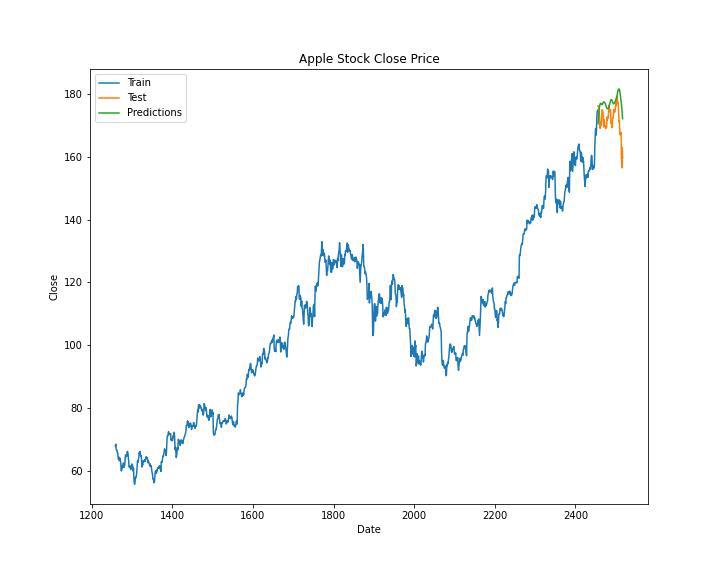

200 Apple Stock Is It A Buy Based On A 254 Price Prediction

May 24, 2025

200 Apple Stock Is It A Buy Based On A 254 Price Prediction

May 24, 2025