$200 Apple Stock: Is It A Buy Based On A $254 Price Prediction?

Table of Contents

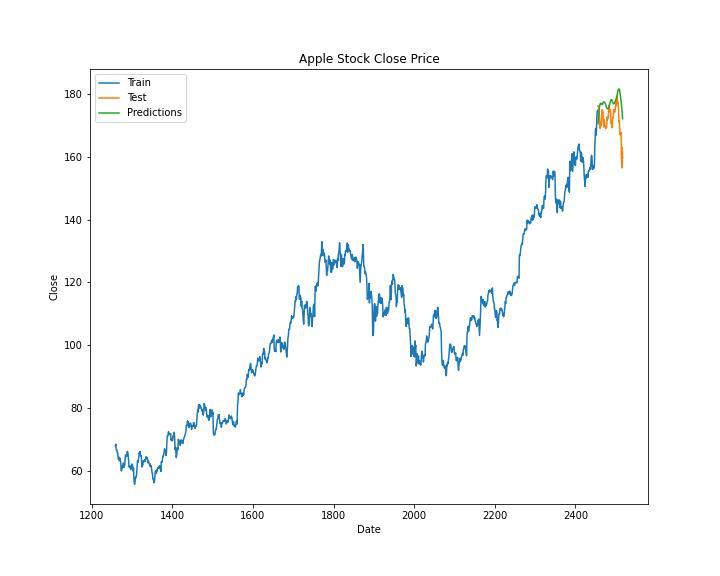

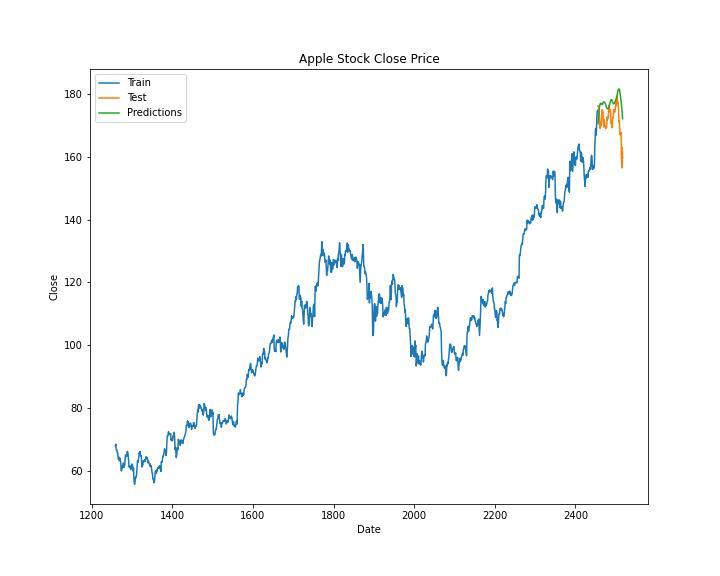

Analyzing the $254 Apple Stock Price Prediction

Several factors contribute to the optimistic $254 Apple stock price prediction, but understanding the source and potential pitfalls is crucial.

Source and Reliability of the Prediction

The $254 prediction isn't a single, monolithic forecast. Various analysts and investment firms have offered projections in this range, often citing a confluence of positive indicators. For example, [link to reputable source 1] suggests a $250 price target based on anticipated growth in services revenue. [Link to reputable source 2] offers a more conservative projection of $245, citing potential macroeconomic headwinds. It's essential to evaluate the track record and potential biases of each source. Some analysts may be overly bullish due to affiliations with Apple or other vested interests. Always approach such predictions with a healthy dose of skepticism and independent verification.

Factors Supporting the Prediction

Several factors underpin the positive outlook for Apple stock:

- New Product Launches: The upcoming iPhone 15 series and the innovative Apple Vision Pro headset are expected to drive significant sales and revenue growth. These products represent substantial technological advancements and cater to expanding market segments.

- Strong Financial Performance: Apple consistently demonstrates robust financial performance, with high profit margins and steady revenue growth year over year. This stability contributes to investor confidence.

- Market Expansion: Apple continues to expand its market reach into emerging economies and new product categories, further fueling growth potential. The Services sector, in particular, shows tremendous promise.

- Technological Advancements: Apple's ongoing investments in research and development ensure a consistent stream of innovative products and services, maintaining its competitive edge.

Potential Risks and Downside

While the outlook is generally positive, several risks could impact Apple's stock price:

- Economic Downturn: A global recession or significant economic slowdown could negatively affect consumer spending and reduce demand for Apple products.

- Competition: Intense competition from other tech giants, particularly in the smartphone and wearable markets, poses a continuous threat.

- Supply Chain Issues: Disruptions to Apple's global supply chain, potentially caused by geopolitical instability or natural disasters, could impact production and sales.

- Regulatory Changes: Increased regulatory scrutiny in various markets could lead to higher compliance costs or limit Apple's business operations. The prediction of $254 doesn't account for unforeseen regulatory hurdles.

Evaluating Apple's Current Financial Health

Understanding Apple's current financial position is critical to assessing the $200 entry point.

Recent Financial Performance

Apple's recent earnings reports paint a picture of continued success. Revenue growth has remained strong, profit margins are healthy, and debt levels are manageable. [Link to Apple's latest financial report]. Comparing these figures to previous years and industry benchmarks reveals consistent outperformance, indicating a strong foundation for future growth. Key performance indicators (KPIs) such as revenue growth, earnings per share (EPS), and return on equity (ROE) should be closely monitored.

Future Growth Potential

Apple's future growth prospects are promising, driven by:

- Services Revenue Growth: The Services segment, encompassing Apple Music, iCloud, and the App Store, has become a significant revenue driver and is expected to continue its upward trajectory.

- Wearables Market Expansion: The Apple Watch and AirPods continue to gain popularity, opening up new avenues for revenue generation and market dominance.

- Innovation Pipeline: Apple's ongoing investments in research and development suggest a steady flow of innovative products and services that can drive future growth.

Considering Your Investment Strategy and Risk Tolerance

The $254 prediction's impact depends heavily on your investment horizon and risk appetite.

Long-Term vs. Short-Term Investment

A long-term investor might view a $200 price point as an attractive entry opportunity, anticipating the potential upside to $254 or beyond. However, a short-term investor may be more sensitive to market fluctuations and might prefer a more conservative approach. Align your investment timeline with your personal financial goals and risk tolerance.

Diversification and Risk Management

Never put all your eggs in one basket. Diversifying your portfolio across different asset classes is crucial to mitigating risk. Consider including other stocks, bonds, or alternative investments to reduce your overall portfolio volatility. Remember that even a strong company like Apple is subject to market forces.

Conclusion: Should You Buy Apple Stock at $200?

The decision to buy Apple stock at $200, based on a $254 price prediction, requires careful consideration. While the prediction is supported by positive factors like new product launches and strong financial performance, potential downsides such as economic downturns and competition must be factored in. Thorough research, an understanding of your risk tolerance, and a well-diversified portfolio are essential for informed investment decisions. Is a $200 Apple stock price a good entry point for you? Research further to decide!

Disclaimer: This article provides general information and should not be considered as financial advice. Investing in the stock market involves inherent risks, and you could lose money. Consult a qualified financial advisor before making any investment decisions.

Featured Posts

-

Tik Tok Fame Years Later A Viral Video Reunites Tik Toker With Pope Leo

May 24, 2025

Tik Tok Fame Years Later A Viral Video Reunites Tik Toker With Pope Leo

May 24, 2025 -

Sergey Yurskiy Nasledie Geniya Na 90 Letie So Dnya Rozhdeniya

May 24, 2025

Sergey Yurskiy Nasledie Geniya Na 90 Letie So Dnya Rozhdeniya

May 24, 2025 -

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025 -

Exclusive Trumps Private Conversations Reveal Putins War Plans

May 24, 2025

Exclusive Trumps Private Conversations Reveal Putins War Plans

May 24, 2025 -

Indonesia Classic Art Week 2025 Pameran Porsche Dan Karya Seni

May 24, 2025

Indonesia Classic Art Week 2025 Pameran Porsche Dan Karya Seni

May 24, 2025

Latest Posts

-

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025

Turning Trash To Treasure An Ai Powered Poop Podcast From Repetitive Documents

May 24, 2025 -

Best And Final Job Offer Dont Give Up Negotiation Tactics

May 24, 2025

Best And Final Job Offer Dont Give Up Negotiation Tactics

May 24, 2025 -

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Hardware Speculation On Open Ai And Jony Ives Collaboration

May 24, 2025 -

Beyond Best And Final Effective Job Offer Negotiation Techniques

May 24, 2025

Beyond Best And Final Effective Job Offer Negotiation Techniques

May 24, 2025 -

Open Ai And Jony Ive The Potential For A Strategic Partnership In Ai Hardware

May 24, 2025

Open Ai And Jony Ive The Potential For A Strategic Partnership In Ai Hardware

May 24, 2025