8% Stock Market Jump On Euronext Amsterdam Following Tariff Announcement

Table of Contents

The Tariff Announcement: Details and Context

Specifics of the Tariff Announcement: What, Who, and How?

The unexpected 8% surge on Euronext Amsterdam was directly linked to a significant tariff announcement originating from [Source of Announcement – e.g., the European Union, a specific country]. The announcement detailed [Specific details - e.g., the reduction or elimination of tariffs on specific imported goods].

- Specific Tariff Reductions/Eliminations: [List specific examples, e.g., a 10% reduction on imported steel, complete removal of tariffs on certain agricultural products].

- Affected Industries: The changes primarily impacted the [List affected industries, e.g., technology, renewable energy, agricultural sectors] within the Euronext Amsterdam market.

- Involved Trading Partners: The announcement involved revised trade agreements between [Mention countries involved, e.g., the EU and a major trading partner like the US or China].

Prior to the announcement, market sentiment was [Describe pre-announcement sentiment – e.g., cautious, uncertain, or anticipating negative news]. The surprise nature of the positive announcement significantly contributed to the market's enthusiastic response.

Immediate Market Reaction: The 8% Surge on Euronext Amsterdam

Analyzing the Speed and Magnitude of the Increase

The 8% increase was remarkably swift, occurring within [Timeframe – e.g., a single trading day]. This sharp and sudden rise contrasted with previous market movements, which had been characterized by [Describe previous market trends – e.g., gradual declines or stagnation].

- Opening and Closing Prices: [Provide specific data, e.g., The index opened at X and closed at Y, representing an 8% increase].

- Trading Volume: [Provide data on trading volume, e.g., Trading volume surged by Z%, indicating high investor activity].

- Specific Stock Performance: [Give examples of specific companies or sectors that showed significant gains, e.g., Shares of Company A saw a 12% increase].

The sheer magnitude of the jump created a powerful psychological impact, bolstering investor confidence and fueling further buying.

Reasons Behind the Stock Market Jump

Positive Economic Expectations

The market interpreted the tariff announcement as a positive signal for economic growth and improved trade relations. The reduced tariffs were seen as:

- Increased Trade: Lower import costs were expected to stimulate trade between involved nations.

- Reduced Costs for Businesses: Businesses operating within the affected sectors anticipated lower input costs, leading to increased profitability.

- Positive Investor Sentiment: The announcement significantly improved overall investor confidence, encouraging greater investment activity.

Investor Speculation and Market Sentiment

Beyond the direct impact of the tariff announcement, other factors contributed to the market's enthusiasm:

- Speculation: Market participants likely speculated on further positive economic news related to the tariff agreement.

- News Cycles: Positive media coverage and expert commentary further amplified the positive sentiment.

- General Market Trends: The broader global economic climate might have also played a role in the market's responsiveness to the good news.

Potential Long-Term Implications and Risks

Sustainability of the Market Rise

The question remains whether the 8% jump is a temporary phenomenon or indicative of sustained growth. Several factors could influence the long-term trajectory:

- Global Economic Uncertainty: Ongoing geopolitical tensions and global economic instability could impact market performance.

- Geopolitical Risks: Future policy changes or unforeseen events could reverse the positive market momentum.

- Potential for Future Tariff Changes: The possibility of further tariff adjustments could introduce volatility into the market.

Impact on Specific Sectors

The tariff changes didn't impact all sectors equally.

- Beneficiaries: [List sectors that benefited most, e.g., Technology companies reliant on imported components saw a significant boost].

- Vulnerable Sectors: [List sectors that might face challenges, e.g., Domestic producers competing with cheaper imports].

Comparison with Other Market Reactions to Tariff Announcements

This 8% jump on Euronext Amsterdam can be compared to other market reactions to similar tariff announcements globally. While [mention similar examples and their outcomes], the Euronext Amsterdam response was notably sharp, possibly amplified by [mention unique factors specific to the Amsterdam market – e.g., its concentration in certain sectors, investor confidence levels].

Conclusion: Understanding the 8% Stock Market Jump on Euronext Amsterdam

The 8% jump on Euronext Amsterdam following the tariff announcement represents a significant market event, driven by a confluence of factors including the direct impact of tariff reductions, positive investor sentiment, and speculation about future economic growth. While the initial reaction was overwhelmingly positive, the sustainability of this increase depends on several factors, including global economic stability and the potential for future policy changes. Understanding this event is crucial for anyone involved in the Euronext Amsterdam stock market or global markets more broadly. To stay informed about such impactful market movements and the implications of tariff announcements, continue to monitor market analyses and news from reputable financial sources. Keep up-to-date on Euronext Amsterdam stock market trends and tariff announcements to make informed investment decisions.

Featured Posts

-

Mia Farrow Demands Trumps Imprisonment For Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Venezuelan Deportation Policy

May 24, 2025 -

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025 -

Beurzen Herstellen Na Trumps Uitstel Aex Fondsen Boeken Winsten

May 24, 2025

Beurzen Herstellen Na Trumps Uitstel Aex Fondsen Boeken Winsten

May 24, 2025 -

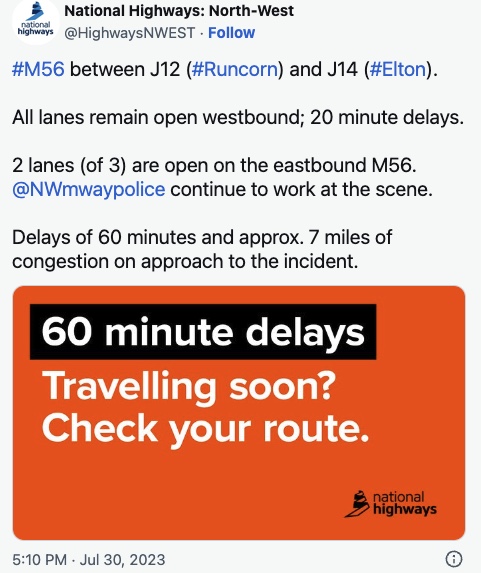

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 24, 2025

Latest Posts

-

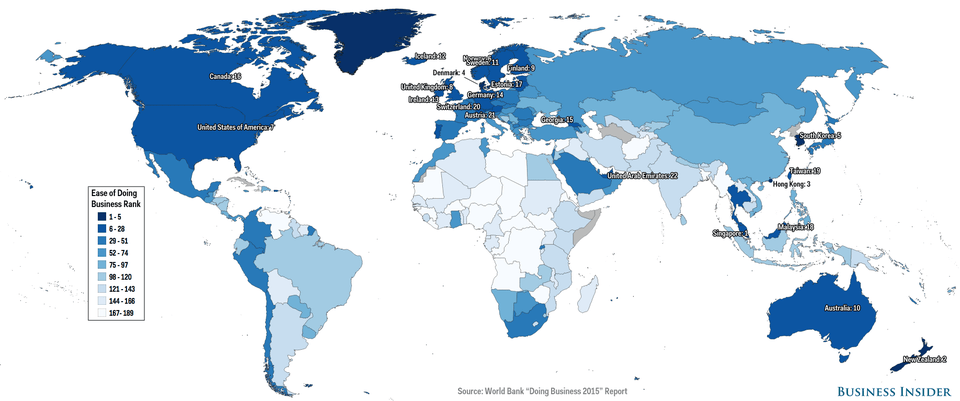

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Areas

May 24, 2025 -

Mapping The Countrys Newest Business Hotspots

May 24, 2025

Mapping The Countrys Newest Business Hotspots

May 24, 2025 -

Global Deforestation Surges Wildfires Drive Unprecedented Losses

May 24, 2025

Global Deforestation Surges Wildfires Drive Unprecedented Losses

May 24, 2025 -

The Countrys Top Emerging Business Hubs A Geographic Analysis

May 24, 2025

The Countrys Top Emerging Business Hubs A Geographic Analysis

May 24, 2025 -

Navigating The China Market Case Studies Of Bmw Porsche And Others

May 24, 2025

Navigating The China Market Case Studies Of Bmw Porsche And Others

May 24, 2025