Japanese Bond Market: Swap Data Hints At Foreigner's Long-Term Yield Rebound Outlook

Table of Contents

H2: Analyzing the Swap Data: Unveiling Foreign Investor Sentiment

Swap data, which reflects agreements to exchange interest rate payments, provides a valuable window into market expectations. Specifically, the JGB swap market offers insights into the anticipated future movement of Japanese government bond yields. By analyzing the activity in these swaps, particularly those with longer maturities, we can gauge the sentiment of major players, including foreign investors.

Key observations from recent swap data reveal:

- Increased activity in longer-term JGB swaps by foreign entities: A notable surge in trading volume has been observed in swaps with maturities exceeding 10 years, suggesting increased foreign interest in longer-term JGB yield predictions.

- Specific examples of swap positions and their implications: For instance, a significant increase in the number of foreign investors entering into receiver swap positions (betting on higher future yields) indicates a growing expectation of a yield rebound. Conversely, a decline in payer swap positions (betting on lower future yields) reinforces this perspective. Detailed analysis of these positions, available through specialized financial data providers, provides further granularity.

- Comparison with previous periods of similar activity and outcomes: Comparing current swap data with past periods exhibiting similar patterns can shed light on the potential trajectory of JGB yields. Historical correlations between swap activity and subsequent yield movements offer valuable context, though it's important to remember that past performance is not indicative of future results.

Several reasons explain this heightened foreign investor activity:

- Changing global economic conditions and their influence on JGB attractiveness: Rising global interest rates, coupled with a stronger US dollar, may be reducing the relative attractiveness of low-yielding Japanese government bonds. This is further complicated by the recent increase in global uncertainty.

- Impact of monetary policy shifts by the Bank of Japan (BOJ): The BOJ's gradual shift away from its ultra-loose monetary policy, although still cautious, could contribute to expectations of higher yields. This is a critical factor, as the BOJ's actions have historically had a profound impact on JGB yields.

- Diversification strategies and the role of the JGB market in global portfolios: Foreign investors might be adjusting their portfolio allocations, seeking higher yields to offset the impact of rising global interest rates. The JGB market, traditionally viewed as a safe haven, may be experiencing a reevaluation given the current global financial environment.

H2: The Potential for a Long-Term Yield Rebound in the JGB Market

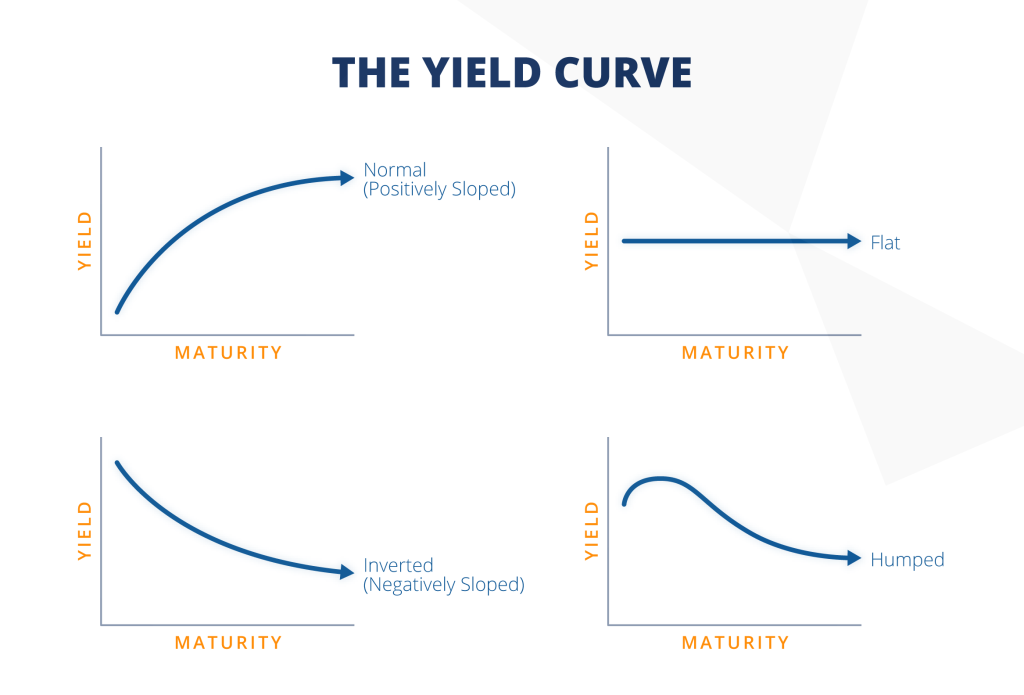

Currently, JGB yields remain historically low, reflecting the BOJ's long-standing yield curve control policy. However, the swap data suggests a potential shift. A long-term yield rebound could be driven by:

- Potential unwinding of BOJ's monetary easing policies: Any further adjustments to the BOJ's monetary policy, even incremental ones, could lead to a significant increase in JGB yields. Market participants are carefully scrutinizing any policy shifts to gauge their impact on long-term JGB yields.

- Increased inflation expectations in Japan: While inflation in Japan remains relatively subdued compared to other developed nations, any sustained increase in inflationary pressures could force the BOJ to reconsider its accommodative stance, eventually leading to higher yields.

- Shifting global interest rate environments: The upward trend in global interest rates could exert upward pressure on JGB yields as investors seek higher returns elsewhere. This global context is crucial in understanding the dynamics of the Japanese bond market.

A yield rebound carries significant consequences:

- Impact on Japanese government borrowing costs: Higher yields will increase the cost of borrowing for the Japanese government, potentially impacting its fiscal policy.

- Effects on the profitability of JGB holdings for foreign investors: A yield rebound could enhance the returns for foreign investors who hold JGBs, potentially attracting further investments. Conversely, investors with short positions could face losses.

- Influence on the Japanese yen exchange rate: Changes in JGB yields can affect the Japanese yen's exchange rate, impacting international trade and investment flows.

H2: Risks and Uncertainties Surrounding the Outlook

Despite the indications from swap data, several factors could impede a JGB yield rebound:

- Unexpected economic slowdown in Japan or globally: A global recession or a significant slowdown in the Japanese economy could lead to decreased demand for JGBs and suppress yields.

- Continued intervention by the BOJ to maintain yield curve control: The BOJ's commitment to its yield curve control policy remains a key uncertainty. If the BOJ continues to actively intervene in the market to keep yields low, it could counteract any upward pressure.

- Geopolitical risks impacting investor confidence: Geopolitical events, such as escalating international tensions, can significantly influence investor sentiment and impact JGB yields.

It's crucial to acknowledge the limitations of relying solely on swap data:

- The need for multiple data points and alternative analyses: Analyzing swap data in conjunction with other market indicators, such as inflation expectations and economic growth forecasts, provides a more comprehensive picture.

- The inherent uncertainty and volatility of financial markets: Financial markets are inherently unpredictable. Unexpected events can significantly impact market dynamics, rendering even the most sophisticated analyses subject to uncertainty.

Key uncertainties and risks include:

- Inflationary pressures and their impact on BOJ policy: The extent to which inflation rises in Japan will significantly impact the BOJ's policy decisions.

- Global economic growth and its influence on investor appetite: The health of the global economy will affect investor demand for Japanese government bonds.

- Potential for unforeseen policy changes: Unanticipated shifts in BOJ policy or government regulations could dramatically impact JGB yields.

3. Conclusion:

Swap data offers valuable insights into the potential for a long-term yield rebound in the Japanese bond market, driven in part by foreign investor sentiment. While various factors, including BOJ policy and global economic conditions, will influence this trend, the observed increase in activity in longer-term JGB swaps suggests growing expectations of higher yields. However, significant risks and uncertainties remain. Understanding this complex interplay is crucial for effective investment strategies.

Call to Action: Stay informed on developments in the Japanese bond market and continue analyzing swap data and other relevant indicators to make well-informed decisions regarding your investments in the Japanese bond market and its long-term yield outlook. Closely monitoring shifts in foreign investment, BOJ policy, and global economic conditions is key to navigating the nuances of long-term yield movements in this dynamic market.

Featured Posts

-

Caonabo De Oro 2025 Emilia Pereyra Y Carlos Manuel Estrella Grandes Ganadores

Apr 25, 2025

Caonabo De Oro 2025 Emilia Pereyra Y Carlos Manuel Estrella Grandes Ganadores

Apr 25, 2025 -

Wrongful Death Lawsuit Against Lauderdale County Detention Center

Apr 25, 2025

Wrongful Death Lawsuit Against Lauderdale County Detention Center

Apr 25, 2025 -

Update Felony Sexual Extortion Charges Against Ex Charlottesville Meteorologist

Apr 25, 2025

Update Felony Sexual Extortion Charges Against Ex Charlottesville Meteorologist

Apr 25, 2025 -

Oil Market News And Analysis April 24 Update

Apr 25, 2025

Oil Market News And Analysis April 24 Update

Apr 25, 2025 -

Canadian Dollar A Detailed Analysis Of Current Market Trends

Apr 25, 2025

Canadian Dollar A Detailed Analysis Of Current Market Trends

Apr 25, 2025

Latest Posts

-

Nyt Strands Crossword Hints Unlocking The April 9 2025 Puzzle

May 10, 2025

Nyt Strands Crossword Hints Unlocking The April 9 2025 Puzzle

May 10, 2025 -

Nyt Strands Thursday April 10 Game 403 Find The Solutions Here

May 10, 2025

Nyt Strands Thursday April 10 Game 403 Find The Solutions Here

May 10, 2025 -

Nyt Strands April 9 2025 Complete Guide To Solving Todays Crossword

May 10, 2025

Nyt Strands April 9 2025 Complete Guide To Solving Todays Crossword

May 10, 2025 -

Solve Nyt Strands Game 403 Hints And Answers For Thursday April 10

May 10, 2025

Solve Nyt Strands Game 403 Hints And Answers For Thursday April 10

May 10, 2025 -

Strands Nyt April 10 2024 Complete Hints And Answers Game 403

May 10, 2025

Strands Nyt April 10 2024 Complete Hints And Answers Game 403

May 10, 2025