Oil Market News And Analysis: April 24 Update

Table of Contents

Global Crude Oil Price Movements

The global crude oil market experienced significant fluctuations on April 24th. Crude oil prices, specifically WTI (West Texas Intermediate) and Brent crude, saw notable shifts, reflecting the ongoing uncertainty in the energy market. This section will analyze these price movements and the factors driving them.

- WTI Crude: Opened at $X, reached a high of $Y, experienced a low of $Z, and closed at $A. This represents a [Percentage]% change compared to the previous day's closing price and a [Percentage]% change compared to the week's opening price. The volatility in WTI crude prices underlines the sensitivity of the market to global events.

- Brent Crude: Opened at $X, reached a high of $Y, experienced a low of $Z, and closed at $A. This represents a [Percentage]% change compared to the previous day's closing price and a [Percentage]% change compared to the week's opening price. The correlation between WTI and Brent crude movements continues to be strong, reflecting interconnected global supply and demand dynamics.

- Price Volatility: The observed oil price volatility is largely attributed to [mention specific reasons, e.g., concerns over global economic slowdown, unexpected production cuts, geopolitical instability]. These factors highlight the inherent unpredictability of the oil price fluctuations in the current environment. [Insert chart/graph visualizing price movements].

OPEC+ Production Decisions and Impact

OPEC+ (Organization of the Petroleum Exporting Countries and its allies) plays a crucial role in shaping the global oil supply. Recent meetings and decisions regarding oil production quotas significantly influence crude oil prices.

- Recent OPEC+ Meeting: The most recent OPEC+ meeting on [Date] resulted in a decision to [Summarize the decision, e.g., maintain current production levels, implement further production cuts, increase production]. This decision was influenced by [Mention factors influencing the decision, e.g., concerns about weakening global demand, geopolitical uncertainty].

- Impact on Oil Supply: The OPEC+ decision is expected to [Explain the predicted impact, e.g., tighten global oil supply, stabilize prices, lead to further price increases]. The effectiveness of these decisions in influencing oil price forecasts will depend on various factors, including the adherence of member countries to production quotas.

- Future Adjustments: The possibility of future production cuts or adjustments remains high, depending on the evolving global economic landscape and oil market trends. The ongoing tension within the OPEC+ alliance, especially between Saudi Arabia and Russia, adds another layer of uncertainty.

Geopolitical Factors Influencing Oil Prices

Geopolitical risk remains a primary driver of oil price analysis. Ongoing conflicts, political instability, and sanctions significantly impact global energy security and, consequently, oil prices.

- Ongoing Conflicts: The ongoing conflict in [mention specific geopolitical conflict] continues to create uncertainty in the oil market, as it disrupts supply chains and raises concerns about potential further escalation. This directly impacts oil price volatility.

- Sanctions and Embargoes: Sanctions imposed on [mention countries affected by sanctions] affect global oil supply and contribute to price increases. The effectiveness of these sanctions and the potential for circumvention add to the complexity of the oil market news.

- Political Instability: Political instability in major oil-producing regions creates risks to production and supply, leading to oil price fluctuations. These risks translate into higher prices as investors seek to protect themselves from potential disruptions.

Demand Outlook and Economic Indicators

The outlook for oil demand is intrinsically linked to global economic growth and energy consumption patterns. Several key economic indicators provide valuable insights into future oil demand.

- Global Economic Slowdown: Concerns regarding a potential global economic slowdown or even recession are impacting oil demand forecasts. A weaker global economy generally leads to reduced fuel demand and lower oil prices.

- Key Economic Indicators: Indicators such as GDP growth, industrial production, and manufacturing PMI (Purchasing Managers' Index) provide crucial data to assess the health of the global economy and its influence on oil demand.

- Future Demand Outlook: The outlook for future oil demand remains uncertain, with differing projections from various analysts. This uncertainty adds further volatility to the market. The risk of a recession could significantly curtail energy consumption, leading to lower oil prices.

- Disruptive Factors: Unexpected events, such as natural disasters or pandemics, can drastically disrupt oil demand and create unpredictable market swings.

Focus on Specific Regions/Countries: The United States

The US oil market is a critical component of the global landscape. US oil production has undergone significant changes in recent years, influenced by technological advancements (like shale oil production) and government policies.

- US Shale Oil Production: The rise of shale oil extraction has made the US a major oil producer, impacting global supply dynamics. However, the profitability of shale oil production is sensitive to oil prices, affecting production levels.

- Impact on Global Markets: Changes in US oil production significantly influence global oil price trends, affecting not only the American market but also international energy security.

Conclusion

The oil market on April 24th was characterized by significant price movements driven by a combination of factors. OPEC+ production decisions, geopolitical risks, and the outlook for global economic growth and demand all played a substantial role in shaping crude oil prices. WTI and Brent crude experienced volatility, reflecting the inherent uncertainties within the energy market. The interplay between supply and demand, influenced by geopolitical events and economic indicators, will continue to shape the trajectory of oil prices in the coming weeks and months.

Stay ahead of the curve with our ongoing oil market news and analysis. Check back regularly for updates and in-depth insights into this dynamic and crucial sector. You can also follow us on social media [social media links] for the latest updates and relevant news.

Featured Posts

-

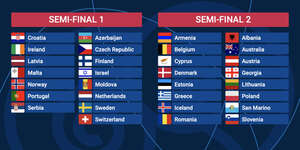

Eurovision 2025 Semi Final Running Orders Announced

Apr 25, 2025

Eurovision 2025 Semi Final Running Orders Announced

Apr 25, 2025 -

Tim The Yowie Man And The Unique Anzac Day Heater Tradition In Canberra

Apr 25, 2025

Tim The Yowie Man And The Unique Anzac Day Heater Tradition In Canberra

Apr 25, 2025 -

Unexpected Casting For Godzilla X Kongs Next Installment

Apr 25, 2025

Unexpected Casting For Godzilla X Kongs Next Installment

Apr 25, 2025 -

Gold Price Surge Follows Trumps Softer Tone Market Analysis

Apr 25, 2025

Gold Price Surge Follows Trumps Softer Tone Market Analysis

Apr 25, 2025 -

Eurovision 2025 When And Where To Watch Live In Australia

Apr 25, 2025

Eurovision 2025 When And Where To Watch Live In Australia

Apr 25, 2025

Latest Posts

-

Fox News Internal Debate Trump Tariffs And Economic Consequences

May 10, 2025

Fox News Internal Debate Trump Tariffs And Economic Consequences

May 10, 2025 -

Money Talks Fox News Hosts Spar Over Trump Tariffs And Economic Impact

May 10, 2025

Money Talks Fox News Hosts Spar Over Trump Tariffs And Economic Impact

May 10, 2025 -

Fox News Host Jesse Watters Faces Criticism Over Wifes Infidelity Joke

May 10, 2025

Fox News Host Jesse Watters Faces Criticism Over Wifes Infidelity Joke

May 10, 2025 -

Fox News Host Counters Colleague On Trumps Trade Policies

May 10, 2025

Fox News Host Counters Colleague On Trumps Trade Policies

May 10, 2025 -

Fox News Hosts Fiery Rebuttal To Colleagues Trump Tariff Take

May 10, 2025

Fox News Hosts Fiery Rebuttal To Colleagues Trump Tariff Take

May 10, 2025