Canadian Dollar: A Detailed Analysis Of Current Market Trends

Table of Contents

Influence of Commodity Prices on the Canadian Dollar

Canada's economy is significantly tied to its robust commodity exports, primarily oil, natural gas, and lumber. Fluctuations in global commodity prices directly impact the CAD's exchange rate. The relationship is generally positive: higher commodity prices typically strengthen the Canadian dollar, while lower prices weaken it. This correlation makes the CAD a commodity currency, meaning its value is strongly influenced by the performance of the global commodities market.

- The price of oil, in particular, has a significant correlation with the CAD's performance. A surge in oil prices often boosts the CAD, as increased demand translates to higher export revenues and a stronger currency. Conversely, a slump in oil prices typically weakens the loonie.

- Changes in global demand for Canadian resources also affect the currency's value. Factors such as global economic growth, industrial activity, and energy consumption levels play a crucial role. Increased global demand strengthens the CAD, while decreased demand weakens it.

- Diversification of the Canadian economy is lessening, but not eliminating, the CAD's reliance on commodity prices. While efforts to diversify away from resource dependence are underway, commodity prices remain a dominant factor influencing the Canadian dollar's exchange rate. This dependence makes the CAD susceptible to global market shocks related to commodity supply and demand.

Impact of Interest Rate Decisions by the Bank of Canada

The Bank of Canada's monetary policy decisions profoundly influence the Canadian dollar. Raising interest rates generally attracts foreign investment, strengthening the currency, as higher rates offer more attractive returns. Conversely, lowering interest rates can weaken the CAD, as investors may seek higher returns elsewhere. These crucial decisions are based on various economic factors, including inflation, employment levels, and economic growth forecasts.

- Higher interest rates make the CAD more attractive to investors seeking higher returns. This increased demand for the CAD strengthens its value relative to other currencies.

- Inflationary pressures often lead the Bank of Canada to raise interest rates. By increasing interest rates, the Bank aims to cool down the economy and curb inflation. This often results in a stronger CAD, although it can also slow economic growth.

- Predicting future interest rate changes is crucial for understanding future CAD movements. Market participants closely monitor the Bank of Canada's statements and economic forecasts to anticipate future interest rate adjustments and their impact on the Canadian dollar. Understanding these announcements can be critical for effective currency trading strategies.

Geopolitical Events and Their Effect on the Canadian Dollar

Global events, such as trade wars, political instability, and broader global economic uncertainty, can significantly impact the Canadian dollar. These events often increase volatility in the forex market, affecting the CAD's value against other major currencies, especially the US dollar, given the close economic ties between the two nations.

- Trade tensions between Canada and its major trading partners can weaken the CAD. Uncertainty regarding trade agreements and potential tariffs can negatively affect Canadian exports and investor confidence, leading to a weaker Canadian dollar.

- Global economic slowdowns can negatively impact demand for Canadian goods and services, thus weakening the CAD. A global recession can reduce demand for Canadian exports, putting downward pressure on the loonie.

- Political stability within Canada itself plays a role in investor confidence and the CAD's value. Political uncertainty or instability can negatively impact investor confidence, leading to a weaker Canadian dollar.

Analyzing the Current State and Future Outlook of the Canadian Dollar

Based on current economic indicators and market sentiment, forecasting future CAD movements requires careful consideration of the factors discussed above. This involves analyzing economic forecasts, monitoring inflation levels and projections, and assessing the Bank of Canada's recent statements and planned actions. Remember that currency trading is inherently risky, and predictions are not guarantees.

- Consider current inflation levels and future projections. High inflation can lead to interest rate hikes, strengthening the CAD, while low inflation may lead to lower interest rates, weakening it.

- Analyze the Bank of Canada’s recent statements and future plans. The Bank's communication regarding monetary policy provides insights into potential future interest rate changes and their likely impact on the CAD.

- Monitor global economic growth and geopolitical events for potential impacts. Global economic conditions and geopolitical risks significantly influence the Canadian dollar's value.

Conclusion

The Canadian dollar's value is a complex interplay of commodity prices, Bank of Canada policies, and global events. Understanding these factors is crucial for navigating the complexities of the CAD market. By closely monitoring these indicators and economic forecasts, individuals and businesses can make more informed decisions regarding investments and international trade involving the Canadian dollar. Stay informed about the latest developments to make strategic choices in your interactions with the Canadian dollar. Continue to monitor Canadian dollar exchange rates and market trends for a comprehensive understanding of this dynamic currency. Understanding the nuances of the Canadian dollar and its fluctuating value is key to successful financial planning and investment strategies.

Featured Posts

-

Is Elon Musks Robotaxi Vision Crumbling

Apr 25, 2025

Is Elon Musks Robotaxi Vision Crumbling

Apr 25, 2025 -

Anafartalar Caddesi Nin Tarihi Yeniden Canlandirilmasi Abb Projesi

Apr 25, 2025

Anafartalar Caddesi Nin Tarihi Yeniden Canlandirilmasi Abb Projesi

Apr 25, 2025 -

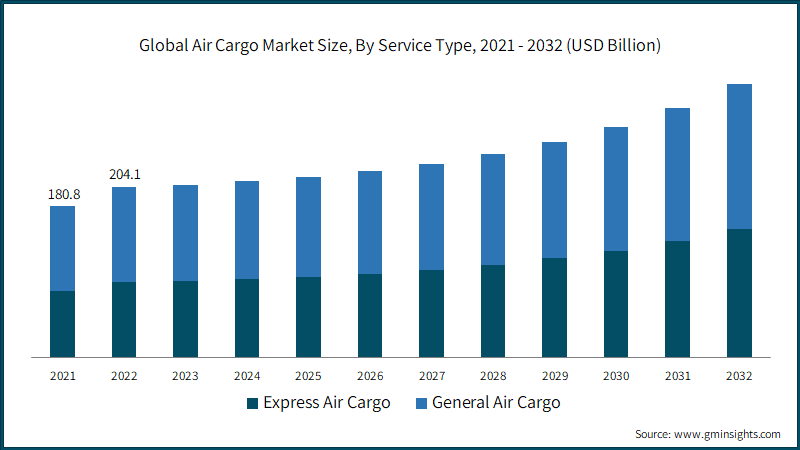

Tougher Emissions Targets Xis Pledge At International Climate Talks

Apr 25, 2025

Tougher Emissions Targets Xis Pledge At International Climate Talks

Apr 25, 2025 -

Goles Y Mas Goles Repaso De La Liga Santafesina

Apr 25, 2025

Goles Y Mas Goles Repaso De La Liga Santafesina

Apr 25, 2025 -

Sky Sports Reporter Confirms Arsenal Talks For Premier League Champion

Apr 25, 2025

Sky Sports Reporter Confirms Arsenal Talks For Premier League Champion

Apr 25, 2025

Latest Posts

-

Conservative Pundit Jeanine Pirros North Idaho Visit What To Expect

May 10, 2025

Conservative Pundit Jeanine Pirros North Idaho Visit What To Expect

May 10, 2025 -

Unveiling Jeanine Pirro A Closer Look At Her Fox News Career

May 10, 2025

Unveiling Jeanine Pirro A Closer Look At Her Fox News Career

May 10, 2025 -

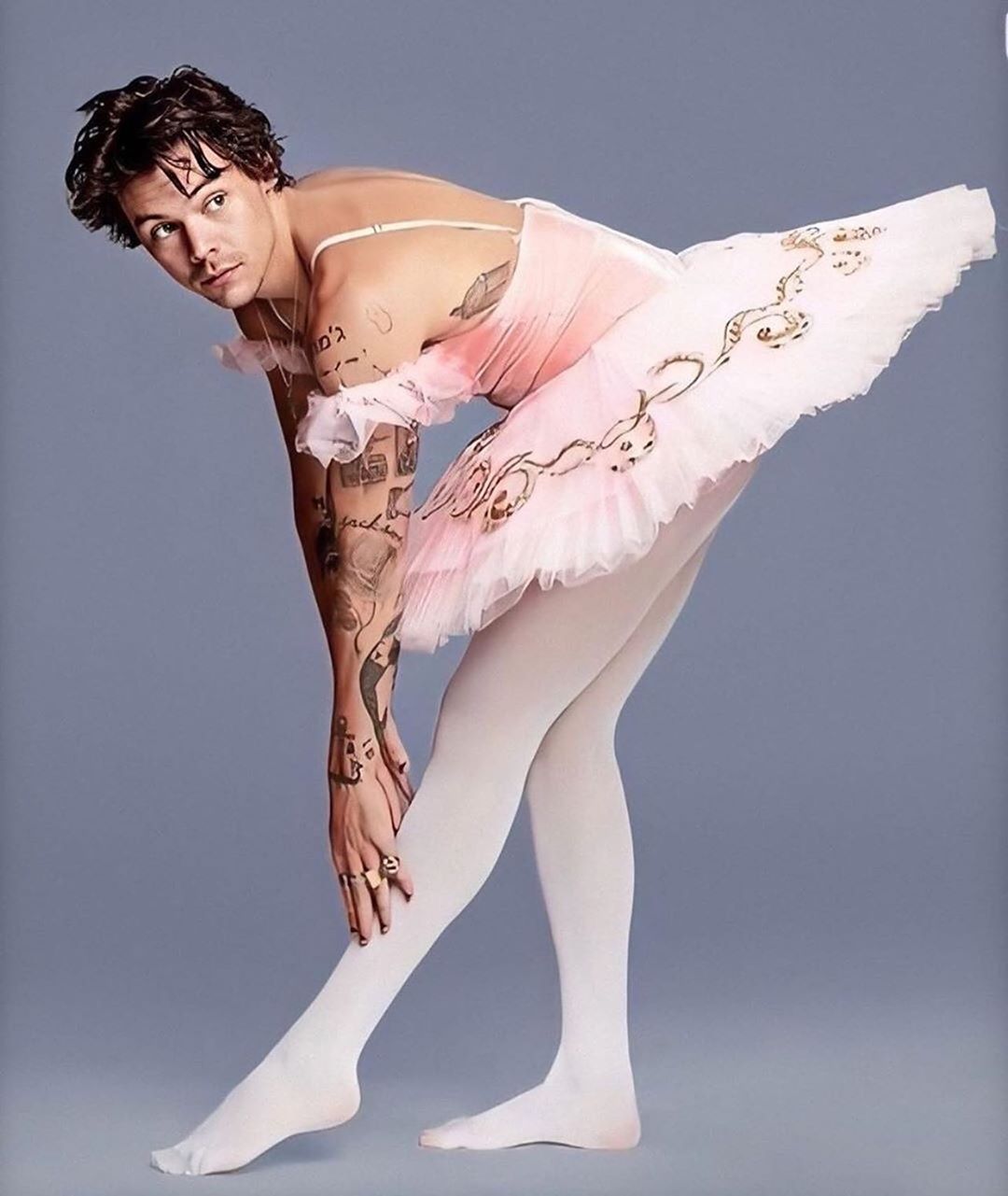

The Snl Impression That Left Harry Styles Heartbroken

May 10, 2025

The Snl Impression That Left Harry Styles Heartbroken

May 10, 2025 -

Benson Boones Response To Harry Styles Similarity Claims

May 10, 2025

Benson Boones Response To Harry Styles Similarity Claims

May 10, 2025 -

Harry Styles Snl Impression Backlash A Devastated Star

May 10, 2025

Harry Styles Snl Impression Backlash A Devastated Star

May 10, 2025