Japan Trading House Shares Surge: Berkshire Hathaway's Long-Term Investment

Table of Contents

Berkshire Hathaway's Investment Strategy and its Impact

Berkshire Hathaway's investment philosophy centers on identifying undervalued companies with strong fundamentals and long-term growth potential. This "value investing" approach, famously championed by Warren Buffett, prioritizes long-term value creation over short-term gains. Berkshire's investment in five major Japanese trading houses – Itochu, Mitsubishi, Mitsui, Sumitomo, and Marubeni – represents a significant commitment, demonstrating confidence in their future prospects.

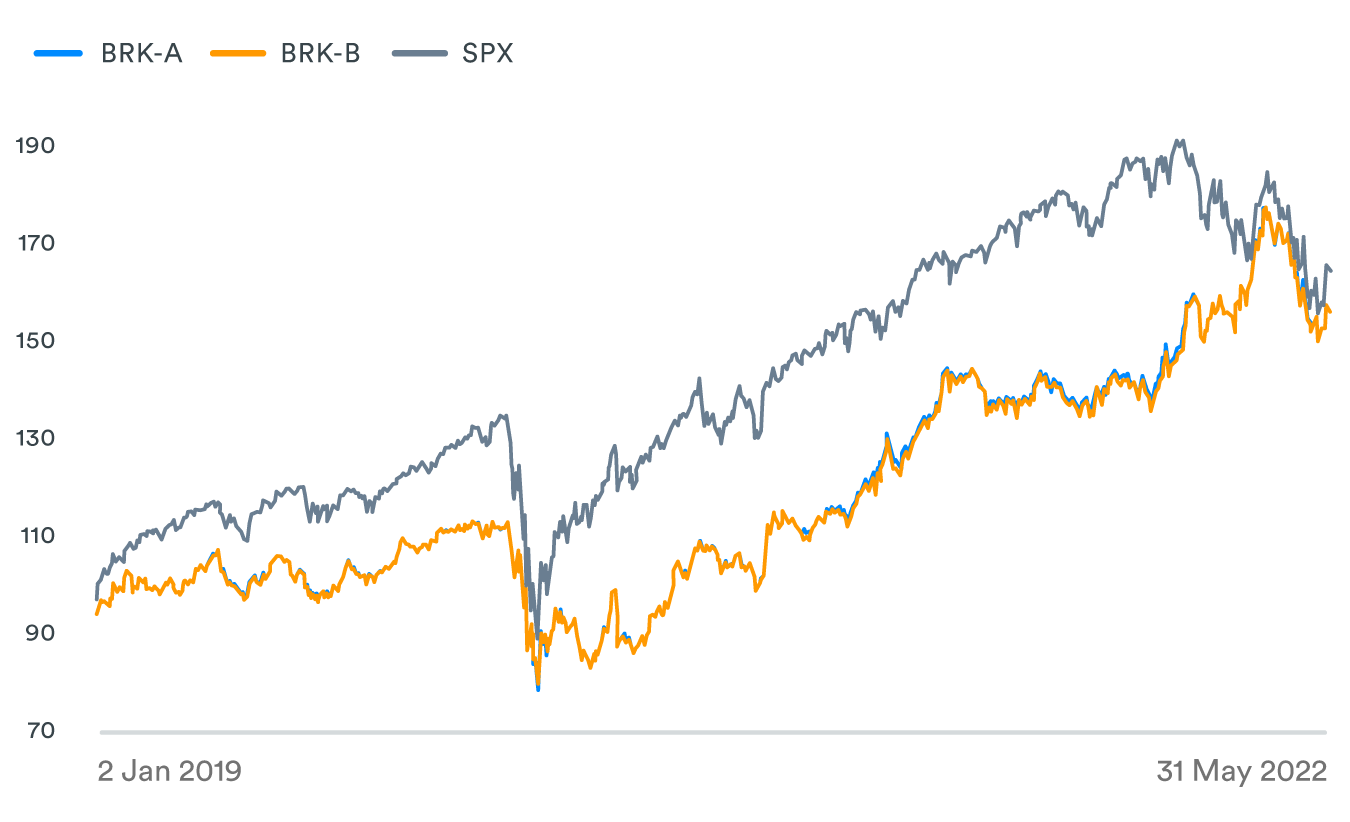

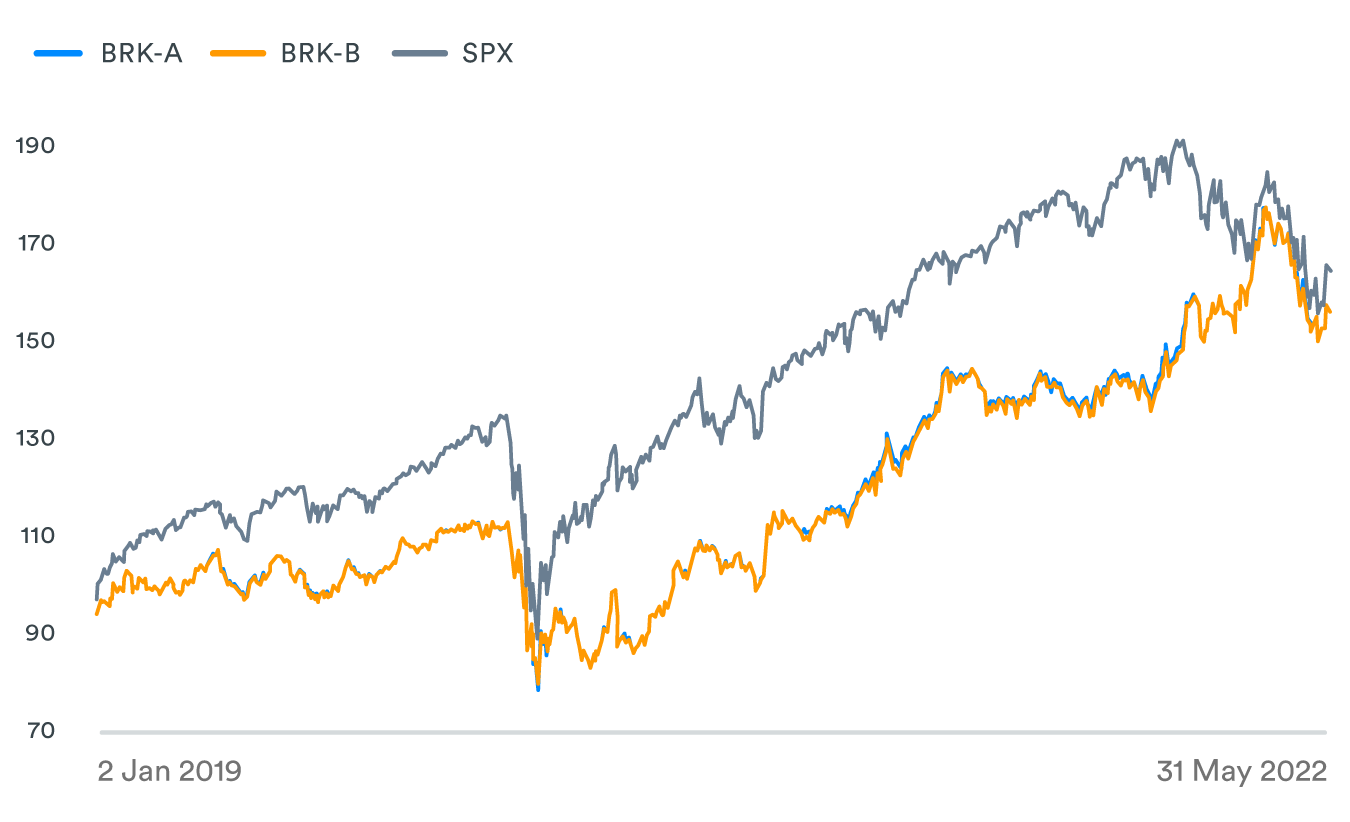

The announcement of Berkshire's investment triggered an immediate and substantial market reaction:

- Sharp increase in share prices: The share prices of all five trading houses saw significant increases immediately following the news.

- Increased trading volume: Trading activity in these stocks surged as investors reacted to the news and sought to capitalize on the perceived undervaluation.

- Positive media coverage and analyst commentary: The investment received overwhelmingly positive media attention and was lauded by many financial analysts as a shrewd move.

Buffett's endorsement carries immense weight, boosting investor confidence and signaling to the market that these companies are fundamentally sound and poised for growth. This injection of confidence has attracted further investment, leading to the sustained increase in share prices. The possibility of further investments by Berkshire Hathaway in the Japanese market further fuels investor optimism.

Understanding the Japanese Trading Houses (Sogo Shosha)

Japanese trading companies, also known as Sogo Shosha, are global conglomerates with incredibly diversified business portfolios. These are not simply importers and exporters; they are involved in a vast array of sectors, including: energy, metals, machinery, chemicals, food, textiles, and infrastructure development. Their operations span the globe, making them significant players in the international marketplace.

Their key strengths lie in:

- Diverse business portfolios: This diversification provides resilience against economic downturns affecting specific sectors.

- Strong financial positions: Years of consistent profitability have resulted in robust balance sheets, enabling them to weather economic storms.

- Long-term growth potential: Their global reach and involvement in essential industries provide ample opportunities for continued expansion.

- Competitive advantages: Decades of experience, extensive global networks, and strong relationships with governments and businesses provide a significant competitive edge.

Examples of successful ventures highlight their prowess: Itochu's involvement in renewable energy projects, Mitsubishi's contributions to automotive manufacturing, and Mitsui's success in the resources sector all showcase their diverse capabilities.

Factors Contributing to the Surge in Japan Trading House Shares

Prior to Berkshire Hathaway's investment, many analysts considered these companies to be undervalued, reflecting a lack of international recognition of their true potential. Several factors contributed to the subsequent surge in Japan Trading House shares:

- Undervaluation: The market previously underestimated the long-term value and growth potential of these companies.

- Increased profitability and expansion: The companies' strong financial positions and diversified portfolios offer significant potential for future expansion into new markets and increased profitability.

- Macroeconomic factors: Global commodity price increases and signs of economic recovery globally have positively impacted their business activities.

- Increased investor interest and foreign capital inflow: Berkshire Hathaway's investment has attracted significant attention from international investors, resulting in a substantial inflow of foreign capital.

In summary:

- Berkshire Hathaway's investment acted as a catalyst.

- Undervaluation was corrected.

- Macroeconomic factors were supportive.

- International investor interest increased dramatically.

Risks and Potential Challenges

While the outlook is positive, investing in Japanese trading house shares involves inherent risks:

- Geopolitical instability: Global political events can impact their businesses and operations.

- Currency fluctuations: Changes in exchange rates can affect profitability.

- Regulatory changes: New regulations in various markets could pose challenges.

- Long-term sustainability: The current growth trajectory may not be sustainable indefinitely. Careful consideration of these factors is crucial for any investor.

Conclusion

The surge in Japan Trading House shares is a compelling example of how a significant investment can reshape market perceptions and unlock previously unrealized value. Berkshire Hathaway's strategic move has not only boosted the share prices of these companies but has also highlighted their importance in the global economy. The potential for continued growth and expansion in the sector remains significant, presenting attractive investment opportunities for those willing to take a long-term perspective. Learn more about the exciting opportunities in the Japan Trading House shares market and consider exploring investment options in these dynamic companies. Stay informed about future developments related to Berkshire Hathaway's investments and the evolving landscape of Japanese trading companies.

Featured Posts

-

The Future Of Family Planning Otc Birth Control In A Post Roe World

May 08, 2025

The Future Of Family Planning Otc Birth Control In A Post Roe World

May 08, 2025 -

Record Historico Los Dodgers Y Su Asombroso Inicio De Temporada 2024

May 08, 2025

Record Historico Los Dodgers Y Su Asombroso Inicio De Temporada 2024

May 08, 2025 -

Posthaste Addressing The Overvalued Canadian Dollar

May 08, 2025

Posthaste Addressing The Overvalued Canadian Dollar

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025

Latest Posts

-

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025

Aktuelle Lotto 6aus49 Ergebnisse Ziehung Vom 12 April 2025

May 08, 2025 -

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025

Lotto 6aus49 Alle Zahlen Vom 19 April 2025

May 08, 2025 -

Xrp Price Prediction After A 400 Increase Where To Next

May 08, 2025

Xrp Price Prediction After A 400 Increase Where To Next

May 08, 2025 -

Lotto 6aus49 Ziehung Vom 12 April 2025 Alle Ergebnisse

May 08, 2025

Lotto 6aus49 Ziehung Vom 12 April 2025 Alle Ergebnisse

May 08, 2025 -

400 And Climbing Analyzing Xrps Future Price Trajectory

May 08, 2025

400 And Climbing Analyzing Xrps Future Price Trajectory

May 08, 2025