Posthaste: Addressing The Overvalued Canadian Dollar

Table of Contents

Factors Contributing to an Overvalued Canadian Dollar

Several intertwined factors contribute to the current situation of an overvalued Canadian dollar. Understanding these factors is crucial to developing effective strategies for managing the currency's value.

Strong Commodity Prices

High prices for key Canadian exports like oil, natural gas, and lumber significantly boost demand for the Canadian dollar (CAD). This is because international buyers need CAD to purchase these commodities.

- Oil: Fluctuations in global oil prices directly impact the CAD. A rise in oil prices typically strengthens the CAD. For example, the price increase in 2022 significantly strengthened the Canadian dollar.

- Natural Gas: Similar to oil, high natural gas prices increase demand for the CAD, particularly from energy-hungry nations.

- Lumber: The Canadian lumber industry's performance significantly influences the CAD, especially during periods of high global construction activity.

This increased demand pushes up the CAD's value against other currencies. Global demand for these commodities plays a critical role; high global demand strengthens this effect.

High Interest Rates

The Bank of Canada's recent interest rate hikes have attracted significant foreign investment, further strengthening the CAD. Higher interest rates make Canadian assets more attractive to international investors seeking higher returns.

- Capital Inflow: Higher interest rates encourage capital inflows, increasing demand for the CAD to purchase Canadian bonds and other investments.

- Rate Differential: Comparing Canadian interest rates to those in other major economies (like the US or Eurozone) highlights this attraction. A higher rate differential attracts more investment.

While attracting foreign investment is positive, the downsides include potentially slowing economic growth and impacting businesses that rely on borrowing.

Safe Haven Status

The Canadian dollar is often perceived as a safe haven currency during times of global economic uncertainty. Investors seek refuge in stable currencies like the CAD, driving up demand and value.

- Global Uncertainty: Events like the 2008 financial crisis or the COVID-19 pandemic have historically seen investors flock to the CAD, boosting its value.

- Political Stability: Canada's reputation for political and economic stability further enhances its safe-haven appeal.

This safe-haven status, while providing some security, can also lead to an overvalued CAD, especially when the underlying economic fundamentals don't fully justify such strength.

Economic Consequences of an Overvalued Canadian Dollar

An overvalued Canadian dollar has several negative consequences for the Canadian economy.

Impact on Exports

A strong CAD makes Canadian goods and services more expensive for international buyers, reducing demand and hindering exports.

- Manufacturing: Industries like manufacturing often suffer, as their products become less competitive in global markets.

- Agriculture: Canadian agricultural exports also face challenges, as their price advantage erodes with a strong CAD.

This reduced competitiveness leads to lower export volumes and negatively impacts economic growth.

Impact on Inflation

While a strong CAD usually helps to control inflation by making imports cheaper, it can also have paradoxical effects. If the CAD strengthens too much, it might lead to a reduction in domestic investment and production, potentially leading to inflationary pressure in specific sectors.

- Import Costs: Cheaper imports typically help to lower inflation. However, a very strong CAD can also reduce the competitiveness of domestically produced goods, potentially harming industries and ultimately increasing prices.

- Imported Inflation: A weakening CAD, on the other hand, can lead to imported inflation as the cost of imported goods rises.

The impact of the CAD on inflation is complex and depends on various factors.

Impact on Businesses

Canadian businesses face significant challenges due to the overvalued dollar.

- Reduced Profitability: Export-oriented businesses see reduced profitability due to lower demand for their goods.

- Increased Competition: Domestic businesses face increased competition from cheaper imports.

- Mitigation Strategies: Businesses often adapt with strategies such as diversification into other markets, cost-cutting measures, and increased focus on domestic sales.

Potential Solutions to Address the Overvalued Canadian Dollar

Addressing the issue requires a multi-pronged approach.

Government Intervention

While controversial, government intervention in the foreign exchange market is a potential tool, though it carries risks and limitations.

- Foreign Exchange Interventions: The government could buy or sell CAD to influence its value, but this is a short-term solution and can be costly.

- Trade Agreements: Promoting free trade agreements can increase export competitiveness and lessen reliance on a favorable exchange rate.

Monetary Policy Adjustments

The Bank of Canada's monetary policy plays a vital role. Carefully managing interest rates is crucial.

- Interest Rate Adjustments: Lowering interest rates could make Canadian assets less attractive to foreign investors, potentially weakening the CAD. However, this carries risks of increasing inflation.

- Balancing Act: The Bank of Canada faces a delicate balancing act between controlling inflation and managing the exchange rate.

Any adjustments require careful consideration of their wider economic impacts.

Diversification of the Canadian Economy

Reducing reliance on commodity exports is crucial for long-term stability.

- Investment in Technology: Investing in innovative technologies and sectors less sensitive to commodity price fluctuations is vital.

- Developing High-Value-Added Industries: Focusing on developing industries that produce high-value-added goods and services makes the economy less vulnerable to exchange rate fluctuations.

Conclusion: Managing the Overvalued Canadian Dollar

The overvalued Canadian dollar is a complex issue stemming from high commodity prices, high interest rates, and its safe-haven status. This strong dollar negatively impacts exports, potentially influences inflation, and presents challenges for businesses. Addressing this requires a multifaceted approach involving potential government intervention, careful monetary policy adjustments by the Bank of Canada, and a concerted effort to diversify the Canadian economy. Understanding the complexities of an overvalued Canadian dollar is crucial for navigating the current economic landscape. Stay informed and engage in the conversation about managing the overvalued Canadian dollar effectively.

Featured Posts

-

First Trailer For The Long Walk Simple But Effective Horror

May 08, 2025

First Trailer For The Long Walk Simple But Effective Horror

May 08, 2025 -

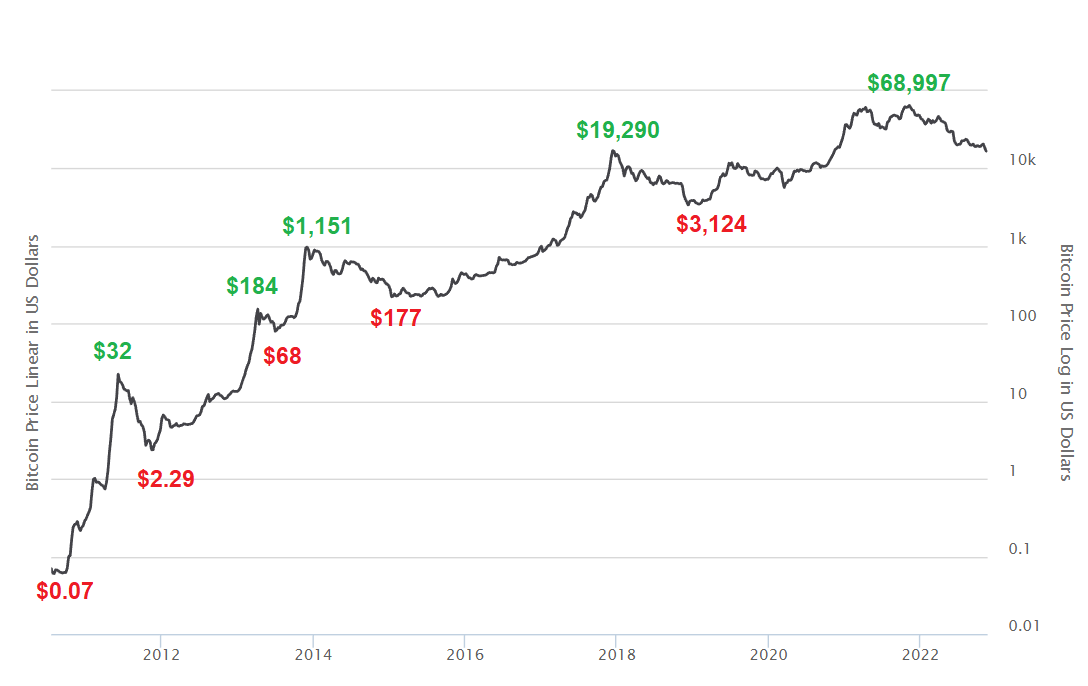

Us China Trade Deal Spurs Bitcoin Price Increase

May 08, 2025

Us China Trade Deal Spurs Bitcoin Price Increase

May 08, 2025 -

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025 -

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025 -

2 1 0 1

May 08, 2025

2 1 0 1

May 08, 2025

Latest Posts

-

Stephen Kings The Long Walk Trailer Previews A Grim And Gripping Film

May 08, 2025

Stephen Kings The Long Walk Trailer Previews A Grim And Gripping Film

May 08, 2025 -

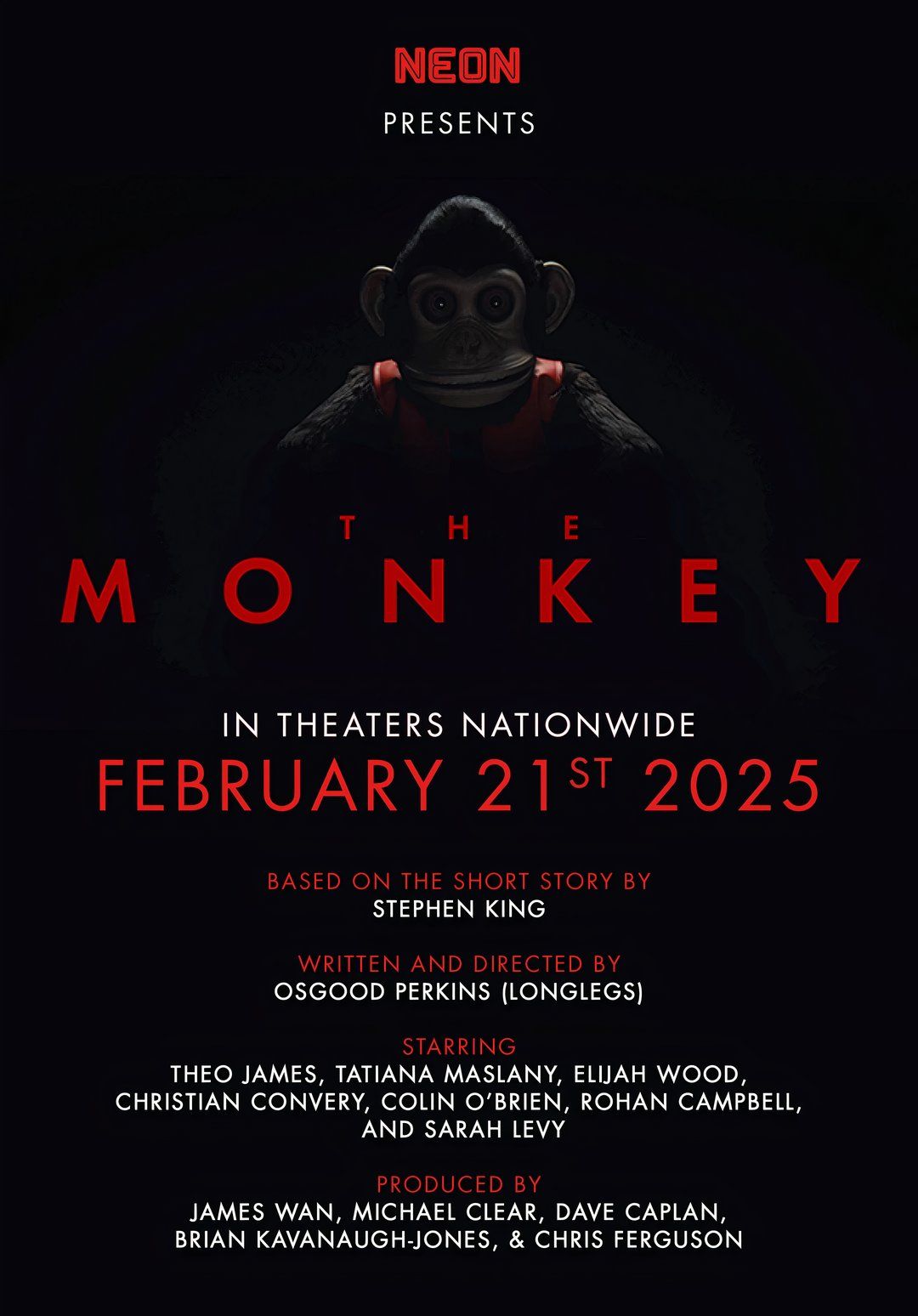

The Monkey 2025 A Potential Low Point In A Strong Year For Stephen King Adaptations

May 08, 2025

The Monkey 2025 A Potential Low Point In A Strong Year For Stephen King Adaptations

May 08, 2025 -

First Trailer For The Long Walk Simple But Effective Horror

May 08, 2025

First Trailer For The Long Walk Simple But Effective Horror

May 08, 2025 -

The Long Walk A First Trailer Thats Simply Scary

May 08, 2025

The Long Walk A First Trailer Thats Simply Scary

May 08, 2025 -

Stephen King In 2025 The Monkey And The Larger Picture Of His Film Adaptations

May 08, 2025

Stephen King In 2025 The Monkey And The Larger Picture Of His Film Adaptations

May 08, 2025