Is XRP A Commodity? SEC Decision And Ongoing Debate

Table of Contents

The SEC's Case Against Ripple and its Implications for XRP Classification

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleged that Ripple engaged in an unregistered securities offering by selling XRP. The core of the SEC's argument rested on the application of the Howey Test, a framework used to determine whether an investment contract constitutes a security. The Howey Test considers four factors: (1) an investment of money; (2) in a common enterprise; (3) with a reasonable expectation of profits; and (4) derived from the efforts of others.

The SEC argued that XRP purchasers invested money with a reasonable expectation of profit, driven primarily by Ripple's efforts in developing and promoting the cryptocurrency. They highlighted Ripple's direct sales of XRP and its marketing strategies as evidence of a common enterprise reliant on the company's efforts.

Ripple's defense countered that XRP is a decentralized, functional cryptocurrency with utility beyond mere investment. They argued that XRP is not an investment contract because its value isn't primarily derived from Ripple's efforts, emphasizing the decentralized nature of the XRP Ledger and its use in cross-border payments.

Key Arguments Summarized:

-

SEC's Arguments:

- XRP sales constituted an investment contract.

- Purchasers expected profits based on Ripple's efforts.

- A common enterprise existed between Ripple and XRP holders.

- Ripple's actions significantly impacted XRP's value.

-

Ripple's Arguments:

- XRP is a decentralized digital asset with utility.

- XRP's value is not solely dependent on Ripple's actions.

- Many XRP transactions occurred outside of Ripple's direct control.

- The XRP Ledger operates independently of Ripple.

The judge's partial ruling, while not definitively classifying XRP as a security or commodity across all sales contexts, significantly impacted the market. The ruling highlighted the complexities of applying traditional securities laws to novel crypto assets, suggesting that certain XRP sales may be considered securities transactions, while others might not. This added to the ongoing debate surrounding the application of the Howey Test in the cryptocurrency space.

The Ongoing Debate: Commodity vs. Security

While the SEC focused on XRP as a security, arguments for classifying XRP as a commodity exist. Proponents point to XRP's fungibility—its interchangeability with other units of XRP—and its trading on numerous cryptocurrency exchanges. Unlike securities, which often represent ownership in a company or asset, commodities are typically tangible or intangible goods traded in the market.

Contrasting Commodity and Security Characteristics:

-

Commodity:

- Fungible and interchangeable units.

- Primarily traded on exchanges for utilitarian purposes.

- Little to no expectation of profit derived from the issuer's efforts.

-

Security:

- Represents ownership or an investment contract.

- Often involves an expectation of profit derived from the efforts of others.

- Subject to registration and regulatory oversight.

The debate extends beyond a simple binary choice. Some argue for alternative classifications, recognizing the limitations of applying traditional financial definitions to the evolving landscape of cryptocurrencies. The complexities of digital asset classification necessitate nuanced legal and regulatory frameworks. The ongoing regulatory uncertainty surrounding XRP highlights the urgent need for clearer definitions and guidelines.

Market Reactions and Future Outlook for XRP

The SEC's decision and Ripple's response have caused significant market volatility for XRP. Regulatory uncertainty often leads to price fluctuations as investors react to changing legal landscapes. The ruling's ambiguity has created uncertainty for exchanges and investors concerning XRP's future trading status and compliance requirements.

The long-term impact on XRP adoption and use cases remains unclear. While XRP continues to be used in cross-border payments and other applications, regulatory clarity is crucial for widespread acceptance and mainstream adoption.

Further legal challenges are likely, potentially involving appeals or new lawsuits. The eventual outcome will significantly shape the future of XRP and influence how other cryptocurrencies are regulated.

Conclusion: Understanding the XRP Classification Debate and its Future

The debate surrounding XRP's classification as a commodity or security remains complex, highlighting the challenges in applying traditional financial frameworks to decentralized digital assets. The SEC's decision, while providing some clarity, underscores the ongoing regulatory uncertainty within the cryptocurrency market. The need for clear and comprehensive regulatory frameworks is crucial for fostering innovation and protecting investors in this rapidly evolving space. Stay informed about the ongoing developments in the XRP classification debate, conduct thorough research, and consult with financial advisors before making any investment decisions related to XRP or other cryptocurrencies. Remember, this information is for educational purposes and does not constitute financial advice.

Featured Posts

-

A Definitive List The Best Krypto Stories

May 08, 2025

A Definitive List The Best Krypto Stories

May 08, 2025 -

New The Long Walk Trailer Hints At A Terrifying Adaptation Of Stephen Kings Novel

May 08, 2025

New The Long Walk Trailer Hints At A Terrifying Adaptation Of Stephen Kings Novel

May 08, 2025 -

Thunder Pacers Injury News Game On March 29th

May 08, 2025

Thunder Pacers Injury News Game On March 29th

May 08, 2025 -

Taiwanese Investors Us Bond Etf Pullback Reasons And Implications

May 08, 2025

Taiwanese Investors Us Bond Etf Pullback Reasons And Implications

May 08, 2025 -

Japan Trading Houses See Share Price Increase Following Berkshire Investment

May 08, 2025

Japan Trading Houses See Share Price Increase Following Berkshire Investment

May 08, 2025

Latest Posts

-

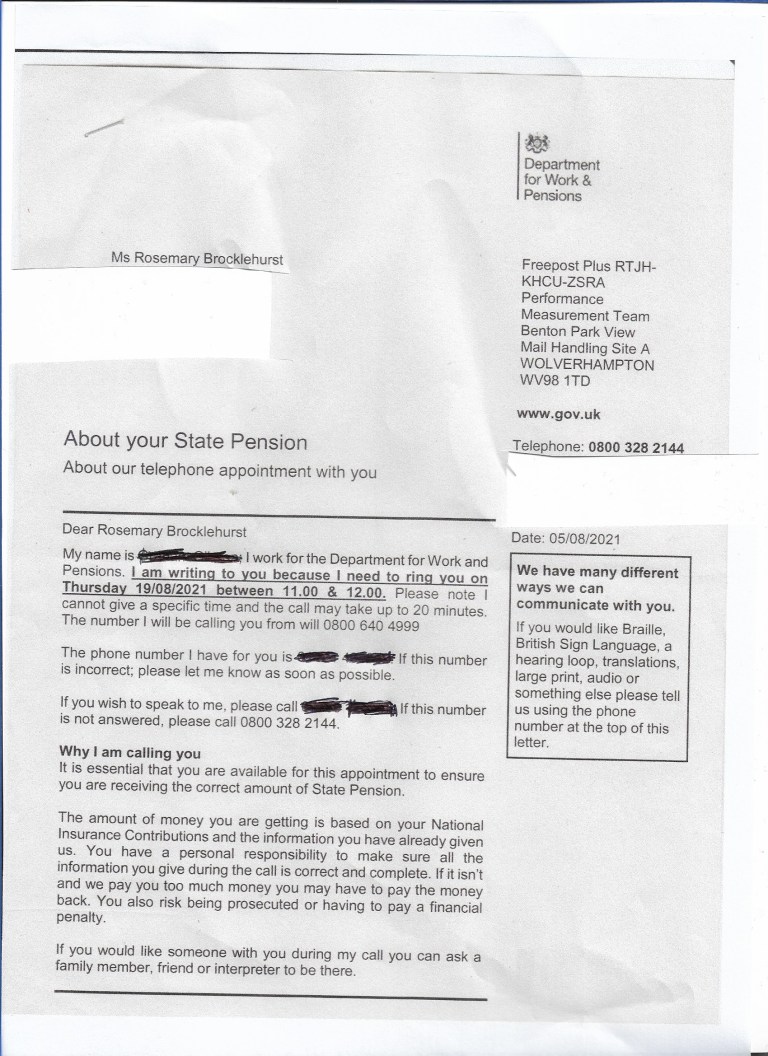

Dont Lose Out What To Do If Your Dwp Letters Missing

May 08, 2025

Dont Lose Out What To Do If Your Dwp Letters Missing

May 08, 2025 -

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025

Dwp Letter Not On Doormat Potential 6 828 Loss Explained

May 08, 2025 -

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025

Market Update Why Scholar Rock Stock Experienced A Setback On Monday

May 08, 2025 -

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025

Scholar Rock Stock Factors Contributing To Mondays Price Decrease

May 08, 2025 -

Understanding The Dwps New Universal Credit Verification System

May 08, 2025

Understanding The Dwps New Universal Credit Verification System

May 08, 2025