Cryptocurrency's Resilience Amidst Global Trade Tensions

Table of Contents

1. Decentralization: Crypto's Shield Against Geopolitical Risks

Cryptocurrencies operate on decentralized networks, unlike traditional fiat currencies controlled by central banks or governments. This fundamental decentralization offers significant protection against geopolitical risks and the impact of global trade wars.

- Reduced vulnerability to sanctions: Cryptocurrency transactions are not subject to the same level of regulatory control as traditional banking systems. This makes them significantly less susceptible to sanctions and trade restrictions imposed during international disputes, offering a bypass for financial restrictions.

- Bypass of traditional financial systems: Cryptocurrency transactions can bypass traditional banking channels, which can be disrupted or manipulated during periods of political instability or escalating trade tensions. This allows for faster and more reliable cross-border payments, even during trade wars or periods of economic sanctions.

- Global accessibility: Cryptocurrencies are accessible from anywhere with an internet connection, making them a truly global asset unaffected by national borders or trade barriers. This borderless nature is a key factor in their resilience against global trade conflicts.

Examples of Decentralized Cryptocurrencies:

- Bitcoin (BTC): The original and most well-known cryptocurrency, Bitcoin is a prime example of decentralization and its resistance to geopolitical events.

- Ethereum (ETH): Ethereum's decentralized network supports a vast ecosystem of decentralized applications (dApps) further highlighting the resilience of decentralized finance (DeFi).

- Litecoin (LTC): Litecoin, a peer-to-peer cryptocurrency, offers faster transaction speeds than Bitcoin, providing another example of the advantages of decentralization in the face of global trade uncertainty.

2. Volatility as a Double-Edged Sword

While often cited as a drawback, the volatility of cryptocurrencies can paradoxically make them a hedge against traditional market fluctuations, especially during periods of heightened global trade tensions.

- Diversification benefits: Including cryptocurrencies in a diversified investment portfolio can reduce overall portfolio risk during periods of global trade uncertainty. The lack of correlation between crypto prices and traditional asset classes can prove significantly beneficial.

- Safe haven potential: During times of economic and geopolitical turmoil, investors may seek alternative assets perceived as safer stores of value. Cryptocurrencies are gaining traction as a potential safe haven, especially for investors concerned about traditional asset devaluation caused by global trade disputes.

- Understanding volatility: It's crucial to understand that cryptocurrency markets are inherently volatile. While offering potential benefits as a hedge against global trade uncertainty, investors must be prepared for significant price swings and employ appropriate risk management strategies.

Strategies for Managing Crypto Volatility:

- Dollar-cost averaging (DCA): Regularly investing smaller amounts over time reduces the impact of price fluctuations.

- Long-term investment approach: Holding cryptocurrencies for the long term can mitigate the effects of short-term volatility.

- Diversification across multiple cryptocurrencies: Spreading investments across various crypto assets reduces risk associated with the volatility of any single cryptocurrency.

3. The Growing Adoption of Crypto for Cross-Border Payments

Global trade tensions often lead to increased barriers to international payments. Cryptocurrencies are emerging as a solution, offering a faster, cheaper, and more transparent alternative to traditional cross-border payment systems, especially when global trade is disrupted.

- Reduced transaction costs: Cryptocurrency transfers typically involve lower fees compared to traditional banking systems, particularly for international transactions, making them a cost-effective solution amid rising trade tensions.

- Increased speed and efficiency: Crypto transactions are often processed much faster than traditional wire transfers, reducing delays and improving efficiency, crucial when dealing with international trade challenges.

- Enhanced transparency: Blockchain technology provides a transparent record of all transactions, increasing accountability and reducing the risk of fraud, adding another layer of security during uncertain times in global trade.

4. Regulatory Uncertainty and its Impact

While crypto's resilience is promising, the regulatory landscape remains a major factor affecting the space and its ability to act as a hedge against global trade tensions.

- Varying regulations across jurisdictions: The lack of a global regulatory framework creates challenges for cross-border crypto transactions and investment.

- Ongoing regulatory developments: Governments worldwide are constantly developing regulations concerning cryptocurrencies, creating both opportunities and uncertainties for the market. Keeping abreast of these developments is crucial.

- Navigating regulatory compliance: Investors and businesses need to be aware of the regulatory environment in their respective jurisdictions when dealing with cryptocurrencies to mitigate risk.

Conclusion:

Cryptocurrencies are exhibiting surprising resilience in the face of escalating global trade tensions. Their decentralized nature, potential as a safe haven asset, and increasing use for cross-border payments are driving their growth despite regulatory and market challenges. While volatility and regulatory uncertainty remain significant factors, the long-term potential of cryptocurrencies as a hedge against geopolitical risks and a facilitator of global trade is undeniable. Understanding the nuances of the cryptocurrency market and staying informed about regulatory developments is crucial for those seeking to leverage its resilience. Learn more about how to incorporate cryptocurrencies into your investment strategy and benefit from their growing resilience amidst global trade tensions. Start exploring the world of cryptocurrencies today and discover how they can offer a resilient investment option during periods of global trade uncertainty.

Featured Posts

-

Barbashevs Overtime Goal Propels Vegas Golden Knights To Victory Over Minnesota Wild In Game 4

May 09, 2025

Barbashevs Overtime Goal Propels Vegas Golden Knights To Victory Over Minnesota Wild In Game 4

May 09, 2025 -

Dakota Johnson Ma Dvojnicku Na Slovensku Neuveritelna Podobnost

May 09, 2025

Dakota Johnson Ma Dvojnicku Na Slovensku Neuveritelna Podobnost

May 09, 2025 -

Trumps Billionaire Network Assessing Financial Losses After Liberation Day Tariffs

May 09, 2025

Trumps Billionaire Network Assessing Financial Losses After Liberation Day Tariffs

May 09, 2025 -

Hoe Brekelmans India Zo Nauw Mogelijk Betrekt

May 09, 2025

Hoe Brekelmans India Zo Nauw Mogelijk Betrekt

May 09, 2025 -

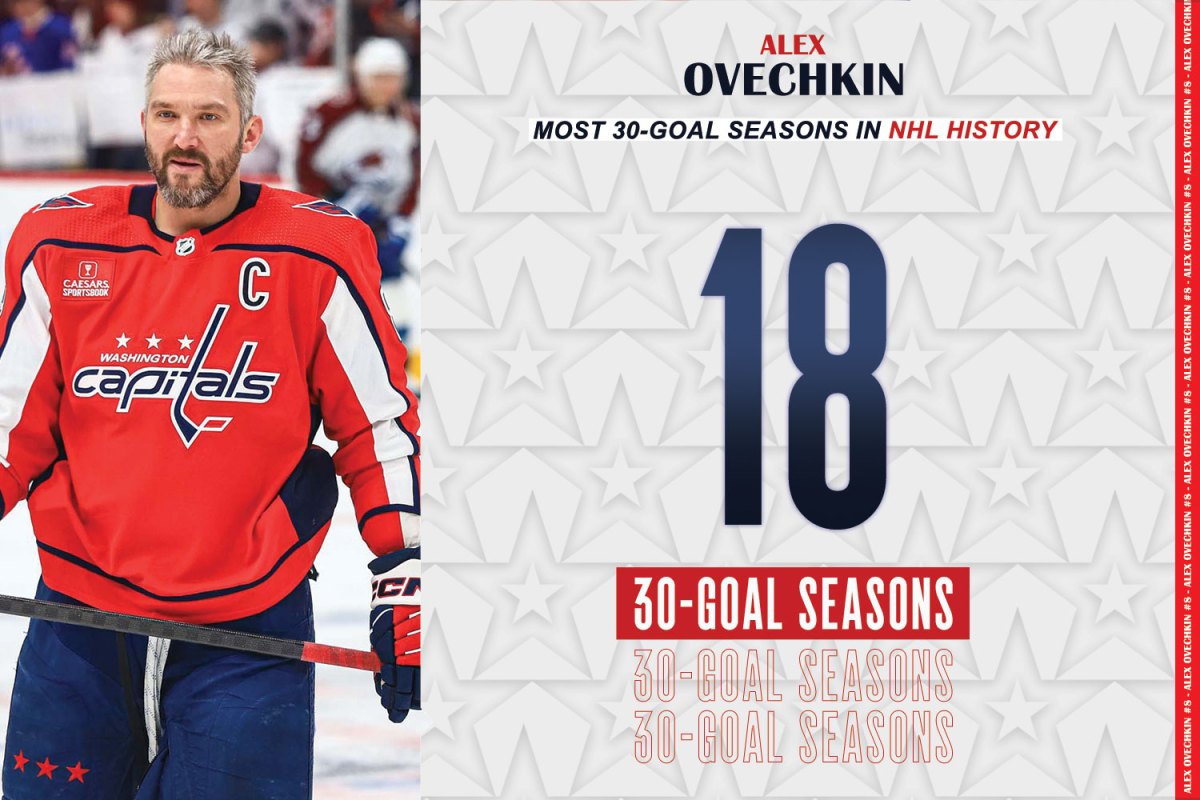

9 Nhl Players Poised To Break Ovechkins Goal Record

May 09, 2025

9 Nhl Players Poised To Break Ovechkins Goal Record

May 09, 2025