Is Apple Stock Headed To $254? Analyst Prediction And Investment Advice

Table of Contents

Analyst Predictions and Their Rationale

The prediction of Apple stock reaching $254 is not a unanimous sentiment. Analyst opinions diverge significantly, creating a fascinating case study in market forecasting.

Bullish Predictions Supporting $254

Several prominent analysts forecast Apple reaching $254, basing their predictions on several key factors:

- New Product Launches: The anticipation surrounding new iPhone releases, innovative MacBooks, and advancements in wearables consistently fuels positive sentiment and drives stock prices higher. Successful product launches translate directly into increased revenue and market share.

- Strong iPhone Sales: The iPhone remains the cornerstone of Apple's revenue generation. Continued strong sales, even in a potentially slowing smartphone market, are vital for sustaining upward momentum in the Apple stock price.

- Expanding Services Revenue: Apple's services segment (including Apple Music, iCloud, and App Store) shows consistent growth, providing a crucial and increasingly important revenue stream that mitigates reliance solely on hardware sales. This diversification strengthens Apple's financial resilience.

- Market Share Growth: Continued growth in market share, particularly in emerging markets, signals increasing consumer preference for Apple products and strengthens its long-term growth prospects.

Key Factors Driving Bullish Predictions:

- Positive economic forecasts suggesting continued consumer spending.

- Growing global demand for Apple's premium products.

- Continuous technological innovation and integration within Apple's ecosystem.

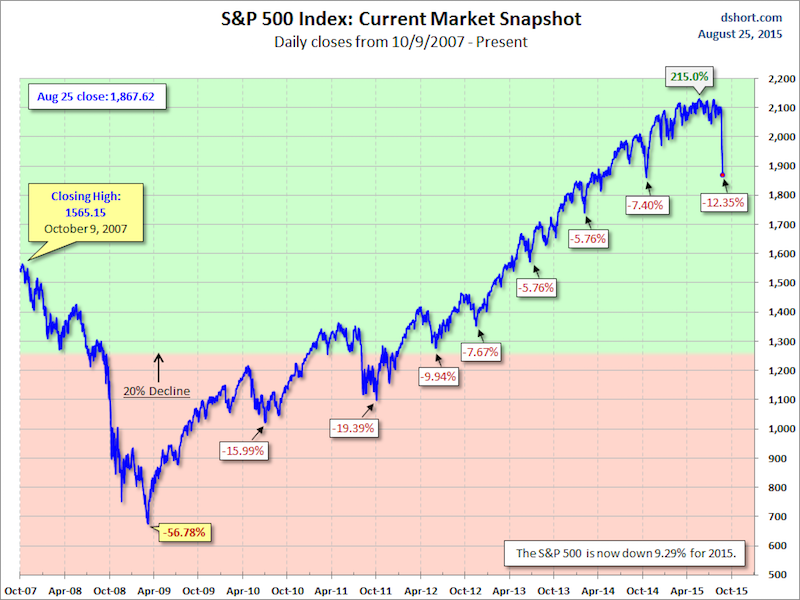

[Insert chart showing predicted growth based on bullish analyst forecasts]

Bearish Predictions and Potential Risks

However, a counter-narrative exists. Some analysts predict a lower price or stagnation, citing potential headwinds:

- Increased Competition: Intense competition from other tech giants in smartphones, wearables, and other technology sectors presents a significant risk to Apple's market share and profitability.

- Supply Chain Issues: Geopolitical instability and global supply chain disruptions can impact production and delivery of Apple products, leading to revenue shortfalls.

- Economic Downturn: A global economic downturn could significantly reduce consumer spending on discretionary items like Apple products, impacting sales and stock performance.

- Regulatory Hurdles: Increasing regulatory scrutiny and potential antitrust actions could pose challenges for Apple's operations and growth.

Factors That Could Hinder Apple's Growth:

- Slowing growth in the global smartphone market.

- Rising production costs and component shortages.

- Significant currency fluctuations affecting international sales.

[Insert chart showing potential downside scenarios based on bearish analyst forecasts]

Analyzing the Consensus

While the $254 Apple stock price target represents a significant upside, it's not a universally accepted prediction. The consensus among analysts displays a range of price targets, reflecting the inherent uncertainty in market forecasting. A balanced perspective is crucial; the potential for substantial gains coexists with the risk of setbacks. Considering the range of predictions provides a more realistic view of the potential outcomes.

Factors Influencing Apple Stock Price

Numerous factors interplay to shape Apple's stock price trajectory.

Product Innovation and Market Demand

Apple's consistent ability to innovate and introduce groundbreaking products significantly influences its stock price. New iPhones, Macs, wearables, and services continually capture market attention and drive demand, directly affecting revenue and investor confidence. Analyzing market trends and consumer preferences is crucial in predicting future stock performance.

Competition and Market Share

Apple operates in a highly competitive landscape. Its ability to maintain and grow its market share against formidable competitors determines its long-term success. Analyzing market share trends, competitive advantages, and innovative strategies is essential for evaluating Apple's future prospects.

Global Economic Conditions

Macroeconomic factors, such as interest rates, inflation, and recessionary fears, significantly impact investor sentiment and stock valuations. Understanding the global economic outlook is crucial for assessing the risks and opportunities associated with investing in Apple stock.

Apple's Financial Performance

Analyzing Apple's financial reports – including revenue, earnings, and cash flow – is essential for evaluating its financial health and future growth prospects. Strong financial performance typically translates into increased investor confidence and higher stock prices.

Investment Strategies and Advice

Investing in Apple stock, like any investment, involves risk.

Risk Assessment and Diversification

Before investing in Apple stock (or any stock), it's crucial to assess your personal risk tolerance. Diversifying your investment portfolio across different asset classes is a crucial risk-mitigation strategy.

Long-Term vs. Short-Term Investing

Apple stock presents opportunities for both long-term and short-term investors. Long-term investors benefit from the potential for significant growth over time, while short-term investors focus on capitalizing on short-term price fluctuations. Each approach has its own risks and rewards.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a valuable strategy for mitigating risk, particularly in volatile markets. By investing a fixed amount at regular intervals, investors avoid the risk of investing a large sum at a market peak.

Seeking Professional Financial Advice

Before making any investment decisions, it's highly recommended to seek advice from a qualified financial advisor. A professional can help you assess your risk tolerance, create a personalized investment strategy, and make informed decisions aligned with your financial goals.

Conclusion

The question of whether Apple stock will reach $254 is complex, with varying analyst predictions reflecting differing perspectives on its future growth trajectory. Key factors influencing the stock price include product innovation, competition, macroeconomic conditions, and Apple's financial performance. While the potential for substantial gains exists, investors must carefully consider potential risks. A balanced investment strategy that includes diversification, risk assessment, and perhaps dollar-cost averaging is crucial. Remember to conduct thorough research and, most importantly, consider consulting a qualified financial advisor before investing in Apple stock or making any other significant investment decisions. Further research using keywords like "Apple stock analysis," "Apple stock forecast 2024," or "Apple investment strategies" can provide additional insights to inform your decision-making process.

Featured Posts

-

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025

The Mia Farrow Trump Dispute A Focus On Venezuelan Gang Member Deportations

May 25, 2025 -

Amsterdam Stock Market Plunge 7 Drop Amidst Trade War Fears

May 25, 2025

Amsterdam Stock Market Plunge 7 Drop Amidst Trade War Fears

May 25, 2025 -

Guccis New Era Kering Reports Sales Decrease Demnas Designs Incoming

May 25, 2025

Guccis New Era Kering Reports Sales Decrease Demnas Designs Incoming

May 25, 2025 -

Best New R And B Songs This Week Leon Thomas And Flo Top The Charts

May 25, 2025

Best New R And B Songs This Week Leon Thomas And Flo Top The Charts

May 25, 2025 -

Consequences Of Change Why Speaking Up Can Be Risky

May 25, 2025

Consequences Of Change Why Speaking Up Can Be Risky

May 25, 2025

Latest Posts

-

Climate Change And The Rise Of Deadly Fungi A Growing Concern

May 25, 2025

Climate Change And The Rise Of Deadly Fungi A Growing Concern

May 25, 2025 -

Nippon U S Steel Deal Moves Forward After Trumps Approval

May 25, 2025

Nippon U S Steel Deal Moves Forward After Trumps Approval

May 25, 2025 -

Apple Ceo Tim Cooks Tumultuous Year A Series Of Setbacks

May 25, 2025

Apple Ceo Tim Cooks Tumultuous Year A Series Of Setbacks

May 25, 2025 -

Container Ship Grounding Cnn Coverage Of Front Lawn Incident

May 25, 2025

Container Ship Grounding Cnn Coverage Of Front Lawn Incident

May 25, 2025 -

The History And Demise Of Black Lives Matter Plaza In Washington D C

May 25, 2025

The History And Demise Of Black Lives Matter Plaza In Washington D C

May 25, 2025