Amsterdam Stock Market Plunge: 7% Drop Amidst Trade War Fears

Table of Contents

The 7% Plunge: A Detailed Analysis of the AEX Index Drop

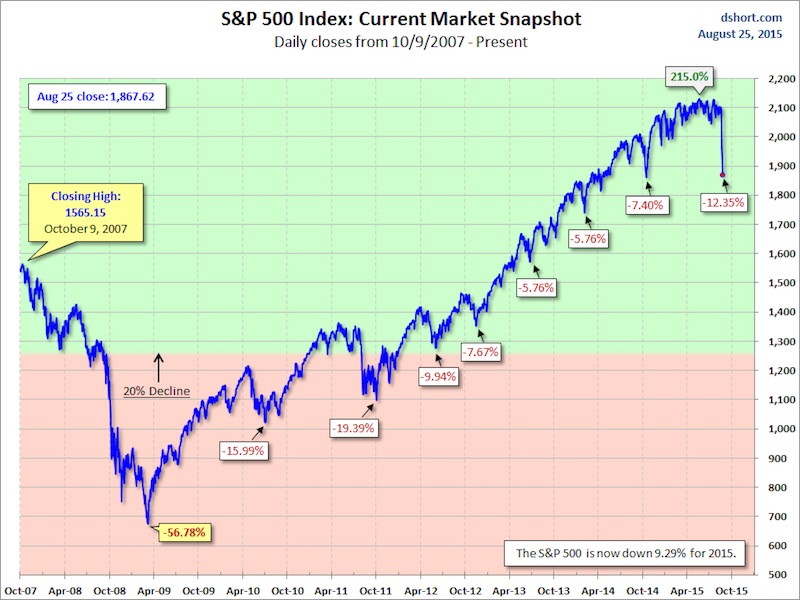

The AEX index, the benchmark index of the Amsterdam Stock Exchange, suffered a severe blow, plummeting 7% in a single trading session. This represents a substantial loss for investors and signifies a significant shift in market sentiment. The closing value of the AEX reached [Insert actual closing value here], a stark contrast to the previous day's closing. This Amsterdam stock market crash wasn't uniform across all sectors.

- Technology stocks: Experienced the sharpest decline, falling by [Insert percentage here] due to increased uncertainty in global trade.

- Financial sector: Saw a notable decrease of [Insert percentage here], reflecting anxieties about potential economic slowdown.

- Energy companies: Were also impacted, with a drop of approximately [Insert percentage here], likely tied to global energy market instability.

This widespread decline paints a picture of a market deeply affected by current global economic pressures.

Trade War Fears: The Primary Catalyst for the Market Decline

The primary catalyst for this Amsterdam stock market plunge is undoubtedly the escalating global trade war. Uncertainty surrounding trade policies and increased tariffs significantly impact investor confidence. The fear of reduced exports and disrupted supply chains is driving investors to seek safer havens, contributing to the sell-off.

- Increased tariffs on [Specific goods, e.g., semiconductors]: Directly affected Dutch exporters, leading to decreased profitability and share value reductions.

- Uncertainty surrounding future trade agreements: This ambiguity creates a volatile environment that discourages investment and promotes divestment.

- Retaliatory measures: The possibility of further retaliatory tariffs from trading partners further compounds the negative impact on Dutch businesses and the Amsterdam stock market.

Global Market Reactions: Ripple Effects of the Amsterdam Plunge

The Amsterdam stock market plunge didn't exist in isolation. Its impact rippled across European and global markets, triggering a wave of investor anxiety. The interconnected nature of global finance means that a significant drop in one major market invariably influences others.

- FTSE 100 (London): Experienced a [Insert percentage here]% drop, reflecting the contagion effect.

- DAX (Frankfurt): Saw a decrease of [Insert percentage here]%, indicating widespread concern.

- Investor flight to safety: Investors sought refuge in safer assets like gold and government bonds, further contributing to the downturn in riskier equities.

Expert Opinions and Predictions: Assessing the Future of the Amsterdam Stock Market

Financial analysts offer a range of perspectives on the future of the Amsterdam stock market following this significant drop. While some forecast a gradual recovery, others express concerns about lingering volatility.

- [Analyst's Name]: Predicts a gradual recovery in the coming weeks, contingent on de-escalation of trade tensions.

- [Economic expert's name]: Warns of further volatility if trade tensions escalate or if new negative economic indicators emerge.

- Market sentiment: Currently remains cautious, with many investors adopting a "wait-and-see" approach.

Protecting Your Investments: Strategies for Navigating Market Volatility

The Amsterdam stock market plunge highlights the importance of robust investment strategies that account for market volatility. Protecting your investments requires careful planning and proactive risk management.

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk.

- Risk management: Implement stop-loss orders to limit potential losses if the market continues to decline.

- Long-term perspective: Remember that market fluctuations are normal. Maintain a long-term investment horizon and avoid panic selling.

Conclusion

The Amsterdam stock market plunge, a significant 7% drop, underscores the considerable impact of escalating trade war fears on global markets. The AEX index decline highlights the interconnectedness of global finance and the importance of preparedness. Expert opinions vary, yet the need for carefully constructed investment strategies that account for volatility remains paramount. Stay updated on the latest developments in the Amsterdam Stock Market and protect your investments by following sound financial advice. Understanding the factors influencing the Amsterdam stock market, including global trade dynamics, is crucial for navigating market uncertainty and making informed investment decisions.

Featured Posts

-

Aubrey Wursts Stellar Performance Powers Maryland Softball Past Delaware

May 25, 2025

Aubrey Wursts Stellar Performance Powers Maryland Softball Past Delaware

May 25, 2025 -

News Corp Undervalued And Underappreciated Examining The Investment Case

May 25, 2025

News Corp Undervalued And Underappreciated Examining The Investment Case

May 25, 2025 -

Dazi Trump Sul 20 Impatto Sul Settore Moda

May 25, 2025

Dazi Trump Sul 20 Impatto Sul Settore Moda

May 25, 2025 -

Shes Still Waiting By The Phone A Relatable Story

May 25, 2025

Shes Still Waiting By The Phone A Relatable Story

May 25, 2025 -

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 25, 2025

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 25, 2025

Latest Posts

-

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025 -

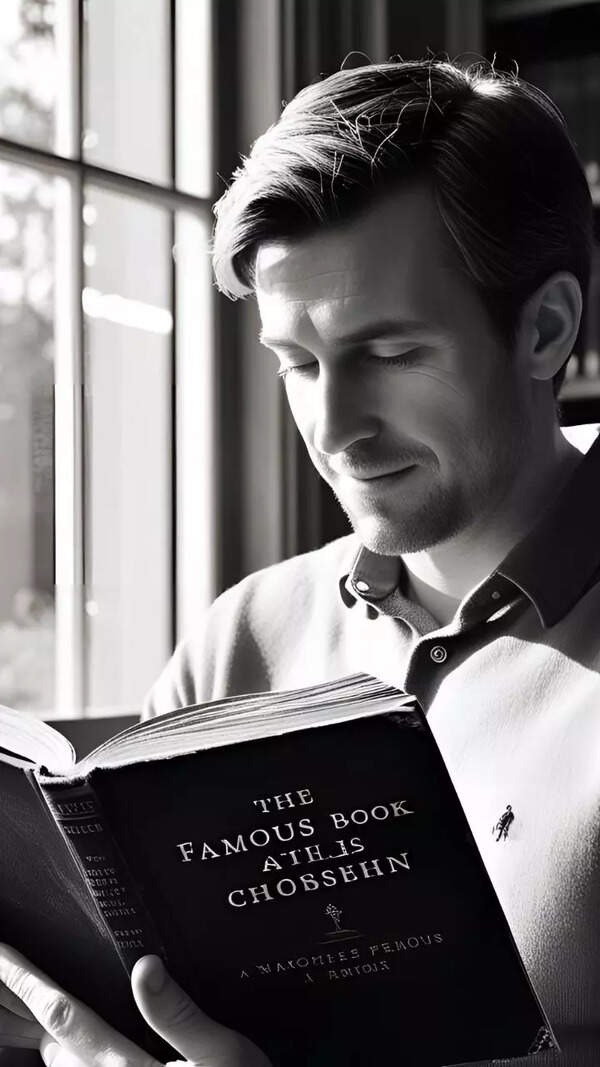

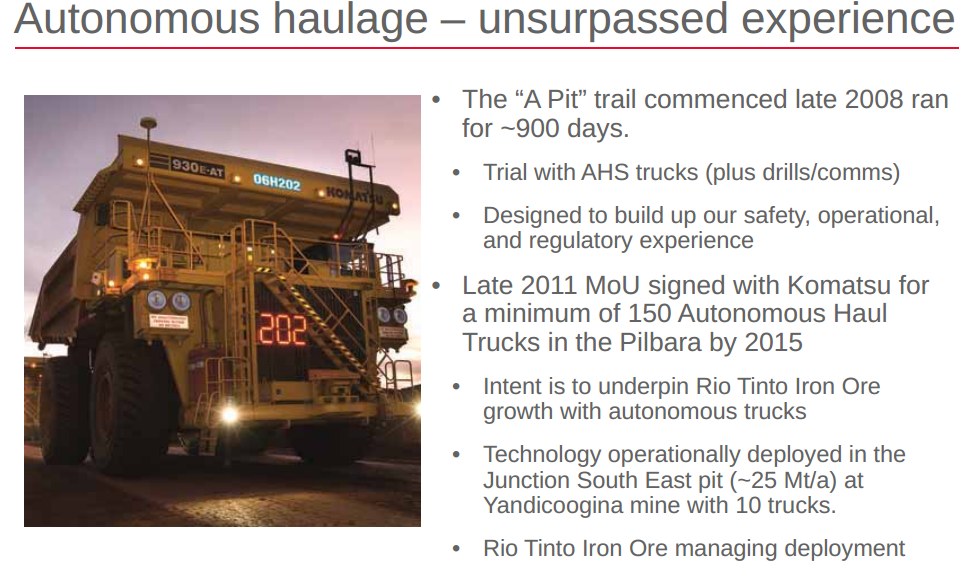

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025 -

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025 -

Rio Tintos Pilbara Operations A Response To Environmental Criticism

May 25, 2025

Rio Tintos Pilbara Operations A Response To Environmental Criticism

May 25, 2025 -

Sse Announces Significant Spending Cuts Amidst Economic Slowdown

May 25, 2025

Sse Announces Significant Spending Cuts Amidst Economic Slowdown

May 25, 2025