Nippon-U.S. Steel Deal Moves Forward After Trump's Approval

Key Details of the Nippon-U.S. Steel Merger

The merger agreement between Nippon Steel and U.S. Steel outlines a complex transaction, likely structured as an acquisition where Nippon Steel acquires a controlling interest in U.S. Steel. The exact financial details, including the final valuation and investment amounts, remain partially undisclosed, but reports suggest a significant investment from Nippon Steel to acquire a majority stake. Expected returns for both companies are projected to be substantial, driven by increased efficiency, market share expansion, and economies of scale.

- Percentage of Ownership: While precise figures are yet to be publicly released, it’s anticipated that Nippon Steel will hold a controlling stake, exceeding 50% ownership of the combined entity.

- Key Executives: Senior executives from both Nippon Steel and U.S. Steel have played vital roles in the negotiations, with specific details on leadership roles within the merged company still being finalized.

- Timeline for Completion: The merger is expected to close within a specific timeframe (mention specific timeframe if available from reliable sources), subject to the fulfillment of customary closing conditions.

Trump Administration's Role in Approving the Deal

The merger faced considerable regulatory hurdles, primarily concerns about antitrust implications and potential impacts on national security within the U.S. steel industry. The Trump administration's stance played a crucial role in navigating these challenges and ultimately securing approval. The administration's focus on bolstering American industry likely influenced its decision, weighing the potential benefits of a strengthened U.S. steel sector against potential competitive concerns.

- Specific Actions: The Trump administration may have engaged in direct discussions with both companies, potentially requesting concessions to address antitrust concerns or guarantees regarding job security and domestic production. (Mention specifics if available from reliable sources).

- Concessions: Nippon Steel and U.S. Steel might have offered concessions, such as commitments to maintain certain levels of U.S. production or investments in U.S. facilities.

- Comparison with Previous Mergers: This merger can be compared to previous mergers in the steel industry that faced similar regulatory scrutiny, highlighting the unique aspects of this deal and the influence of the Trump administration's policies.

Impact on the Global Steel Market

The Nippon-U.S. Steel merger is poised to significantly impact the global steel market. The combined entity will command a considerably larger market share, potentially leading to changes in global steel prices and influencing competition among other steel producers.

- Changes in Production Capacity: The merger will likely result in optimized production capacity through the consolidation of facilities and streamlining of operations, potentially leading to increased overall production.

- Effects on Steel Prices: The increased market share of the combined entity could lead to fluctuations in steel prices, although the net effect is complex and depends on various factors, including global demand and supply dynamics.

- Impact on Employment: While some job losses may occur due to operational streamlining, the merger might also create new opportunities through investments in research, development, and expansion of operations.

Potential Challenges and Future Outlook for the Combined Entity

Despite the significant potential, the merged company faces considerable challenges in the years ahead. Integrating two distinct corporate cultures, harmonizing production processes and technologies, and navigating global economic fluctuations will require careful planning and execution.

- Integration Challenges: Integrating the IT systems, production methods, and workforce of two large companies from different countries will demand substantial investment and time.

- Global Economic Risks: Fluctuations in global demand, raw material prices, and trade policies pose significant risks to the merged company's profitability and stability.

- Long-Term Growth Strategies: Success will depend on the development and implementation of a robust long-term growth strategy, considering technological innovation, diversification of product offerings, and expansion into new markets.

Conclusion

The approval of the Nippon-U.S. Steel merger marks a pivotal moment for the global steel industry. While the deal offers substantial potential benefits—including increased efficiency, expanded market share, and technological advancements—it also presents significant challenges. The Trump administration's active involvement highlights the importance of government oversight in major industrial partnerships.

Call to Action: Stay informed on the unfolding developments of this significant Nippon-U.S. Steel merger. Follow our updates to remain informed about the global steel market and the implications of this groundbreaking deal. Continue to follow our coverage of this important Nippon-U.S. Steel merger for the latest updates and analysis.

Michael Schumacher And His Rivals A Complex Dynamic

Michael Schumacher And His Rivals A Complex Dynamic

Is A Us Band Playing Glastonbury Fans Speculate After Online Clues

Is A Us Band Playing Glastonbury Fans Speculate After Online Clues

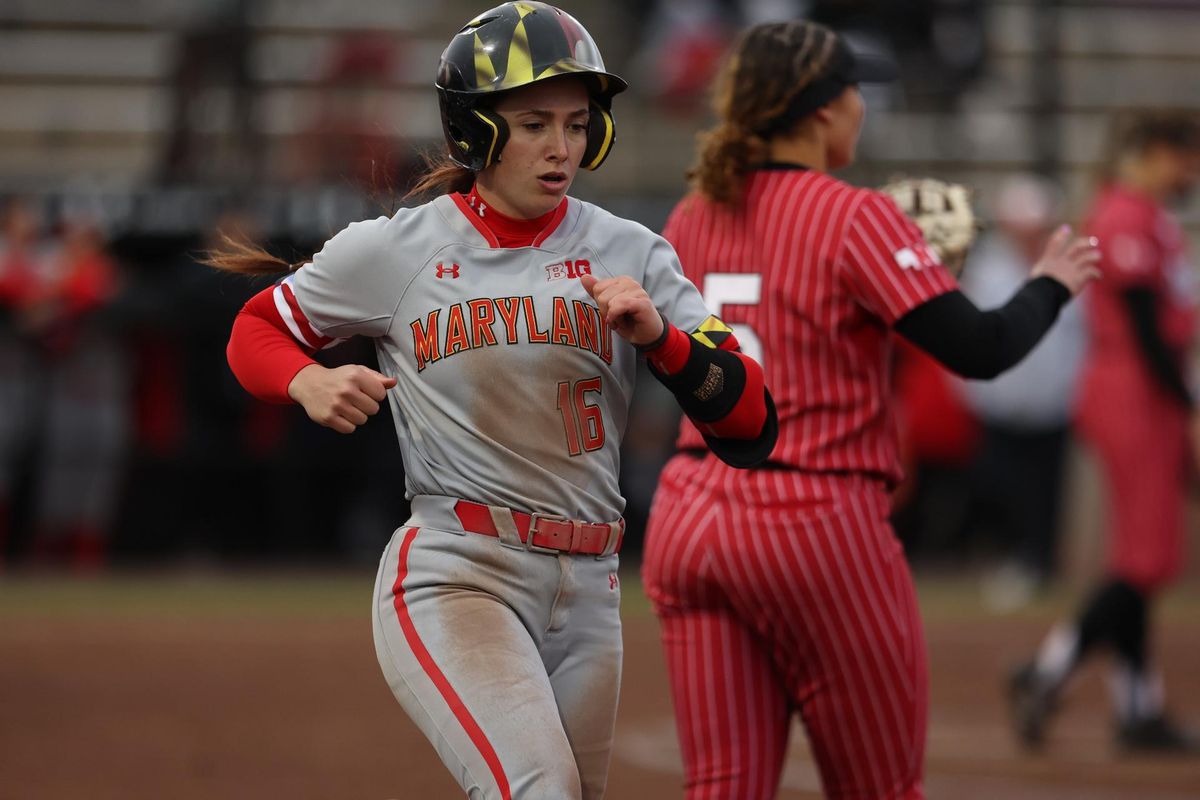

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

Thames Waters Executive Pay Scrutiny And Public Outrage

Thames Waters Executive Pay Scrutiny And Public Outrage

Rome Open Zheng Scores Upset Victory Over Sabalenka Faces Gauff

Rome Open Zheng Scores Upset Victory Over Sabalenka Faces Gauff