Philips AGM 2024: Review Of Financial Performance And Future Outlook

Table of Contents

Financial Performance Review of Philips AGM 2024

Revenue and Profitability

Analyzing year-over-year revenue growth and profitability margins is crucial to understanding Philips' financial health. The Philips AGM 2024 likely presented data illustrating revenue figures and profit margins for the preceding fiscal year. Key factors influencing these metrics include:

- Market Demand: The overall demand for healthcare technology and consumer electronics significantly impacts Philips' revenue. Strong market demand in specific segments, such as diagnostic imaging or personal care, would translate into higher revenue streams.

- Product Launches: Successful launches of new and innovative products can drive substantial revenue growth. The AGM would have likely highlighted the performance of recently introduced products.

- Pricing Strategies: Philips' pricing strategies, including adjustments for market competition and cost fluctuations, directly influence profitability margins.

Analyzing revenue streams across different product segments is essential. We can expect data breakdowns for:

- Healthcare: This segment likely accounts for a significant portion of Philips' revenue, with performance influenced by hospital investment, government healthcare spending, and technological advancements in medical imaging and patient monitoring.

- Consumer: This segment, encompassing personal care and home appliances, might reveal different trends, influenced by consumer spending patterns and competition in the broader consumer electronics market.

(Note: Specific data and charts from the actual Philips AGM 2024 presentation would be inserted here for a complete analysis.) This data would support the analysis of Philips financial results, revenue growth, profitability margins, and market share.

Key Financial Metrics Analysis

The Philips AGM 2024 undoubtedly reviewed essential financial ratios and metrics to provide a holistic picture of the company's financial health. Key metrics to consider include:

- Debt-to-Equity Ratio: This indicates Philips' financial leverage and risk profile. A higher ratio suggests higher reliance on debt financing.

- Return on Equity (ROE): This metric measures the profitability of Philips' investments relative to shareholder equity. A higher ROE indicates better efficiency in using shareholder funds.

- Cash Flow: This reflects the actual cash generated by Philips' operations, crucial for investment, debt repayment, and overall financial stability. Strong operational cash flow is a positive indicator.

Analyzing the trends in these financial ratios, debt-to-equity, return on equity, and cash flow analysis over time, and comparing them to industry benchmarks, provides crucial insights into Philips' financial performance compared to its competitors. Any significant deviations from expectations would need further explanation during the AGM.

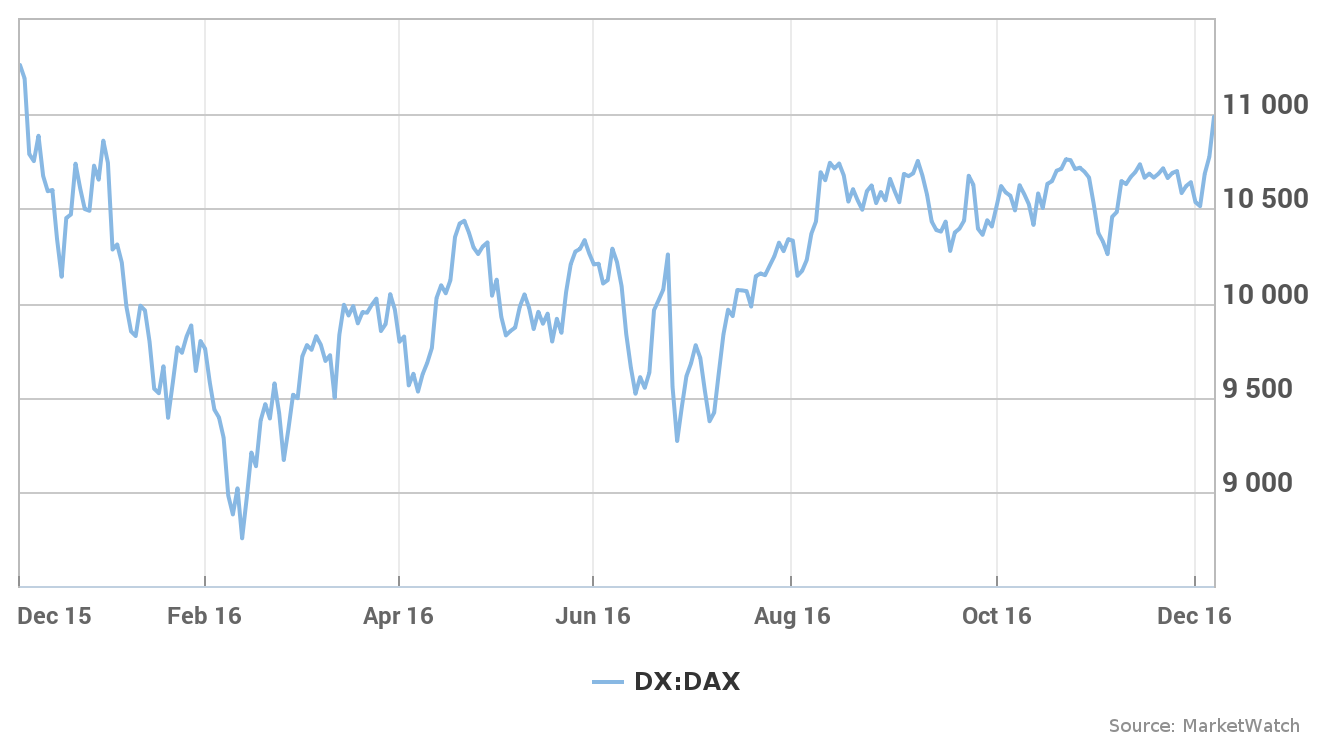

Impact of Global Economic Conditions

Global macroeconomic factors significantly affect Philips' financial performance. The AGM 2024 likely addressed:

- Inflation: Rising inflation increases production costs and can affect consumer spending, impacting both revenue and profitability.

- Supply Chain Disruptions: Global supply chain challenges can lead to production delays, increased costs, and potential shortages, affecting Philips' ability to meet market demand.

- Geopolitical Instability: Geopolitical events can create uncertainty in the global markets and impact Philips' operations in different regions.

Analyzing how Philips adapted to these challenges—such as through diversification of supply chains, price adjustments, or operational efficiencies—is crucial for understanding the resilience of the company. This demonstrates Philips' ability to navigate macroeconomic factors, inflation, supply chain disruptions, and geopolitical risk, ultimately affecting Philips performance.

Strategic Outlook and Future Plans from Philips AGM 2024

Product Innovation and Development

The Philips AGM 2024 likely highlighted the company's commitment to product innovation and R&D investment. Key areas to analyze include:

- New Product Launches: Details on new product launches in healthcare, consumer electronics, and other areas would have been presented. These launches demonstrate Philips’ commitment to innovation and technological advancement.

- R&D Focus Areas: The AGM would have revealed the key technological areas where Philips is investing, indicating future growth opportunities and competitive advantages.

- Impact on Revenue Growth: Analyzing the potential impact of new products on future revenue growth is critical for understanding the company's long-term strategic direction. This demonstrates Philips' dedication to Philips technology and its role in driving future revenue growth.

Market Expansion and Acquisitions

Expansion strategies were likely a major discussion point at the Philips AGM 2024. This involves:

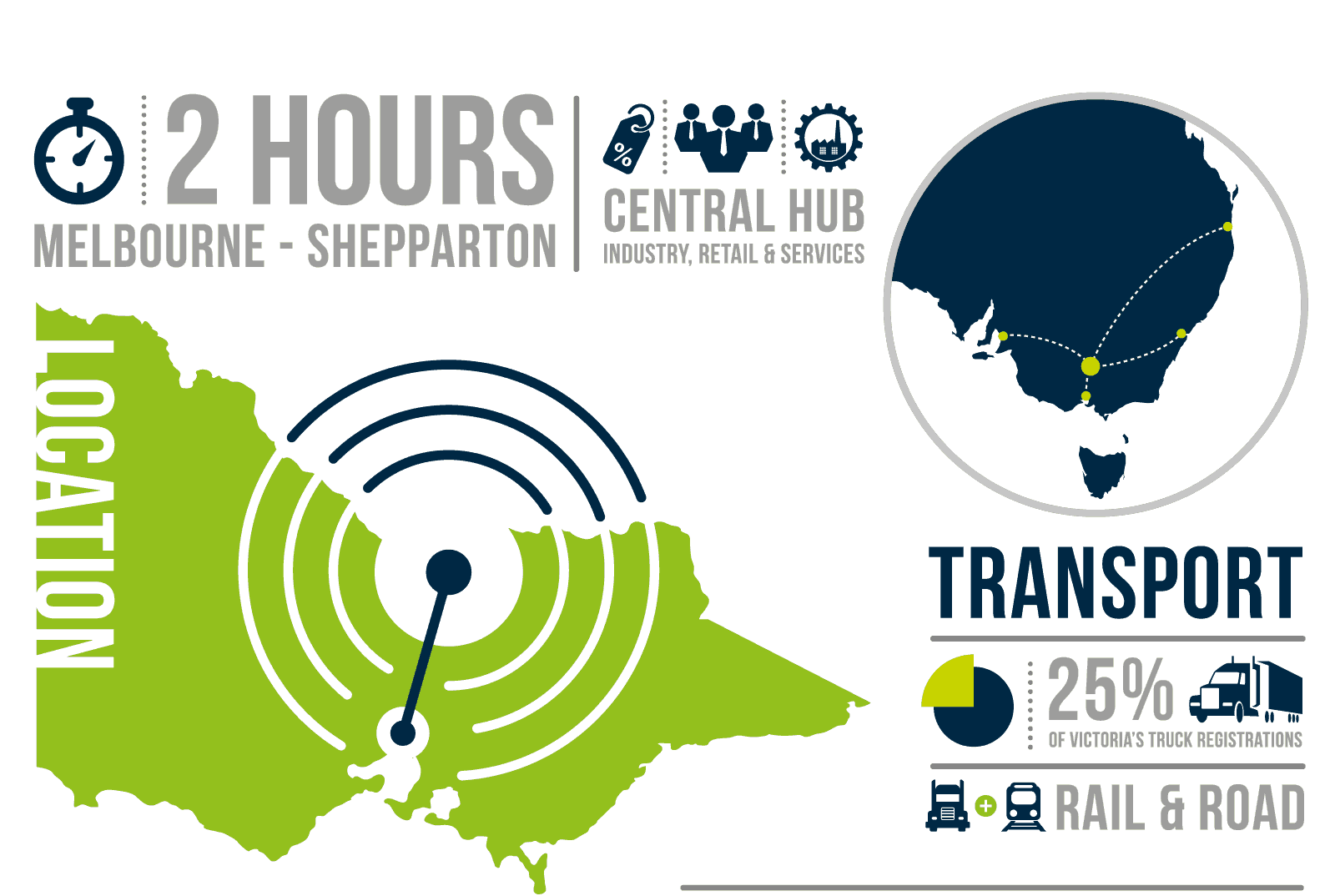

- Geographic Diversification: Expanding into new geographical markets can mitigate risks and access new customer bases.

- New Product Categories: Entering new product categories can diversify Philips' revenue streams and reduce reliance on specific markets.

- Acquisitions and Partnerships: Strategic acquisitions or partnerships allow Philips to gain access to new technologies, markets, or expertise. Details on any potential acquisitions or partnerships announced would reveal the company’s direction. This illustrates Philips strategy for market expansion and geographic diversification.

Sustainability Initiatives

The Philips AGM 2024 likely detailed the company's commitment to sustainability and ESG (Environmental, Social, and Governance) factors. This may include:

- Environmental Responsibility: Philips' commitment to reducing its environmental footprint, through initiatives like carbon reduction and waste management, would be highlighted.

- Social Responsibility: Philips’ social responsibility initiatives, such as ethical sourcing and community engagement, would be discussed.

- Sustainability Targets: The AGM might have announced new targets for environmental and social performance, reflecting the company's ongoing commitment to sustainability. This aspect illustrates the company's commitment to environmental responsibility, social responsibility, and highlights Philips sustainability initiatives.

Conclusion

The Philips AGM 2024 offered a comprehensive overview of the company's financial performance and strategic outlook. While strong revenue growth in certain healthcare sectors was likely reported, challenges remain in areas such as supply chain management and navigating global economic uncertainties. The company's focus on innovation, market expansion, and sustainability suggests a positive trajectory for the future. To stay updated on Philips' performance and future plans, regularly check for official company releases and further analysis regarding the Philips AGM 2024. Stay informed on future developments related to the Philips AGM and its implications for the company’s long-term success.

Featured Posts

-

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025

Sean Penn And Woody Allen Examining A Continued Me Too Blind Spot

May 24, 2025 -

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025

Apple Stock Performance Exceeding Q2 Expectations

May 24, 2025 -

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 24, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Borsalari Duesueste 16 Nisan 2025

May 24, 2025 -

Porsche Dan Seni Rupa Indonesia Classic Art Week 2025

May 24, 2025

Porsche Dan Seni Rupa Indonesia Classic Art Week 2025

May 24, 2025 -

Jymypaukku Saako Tuukka Taponen F1 Paikan Jo Taenae Vuonna

May 24, 2025

Jymypaukku Saako Tuukka Taponen F1 Paikan Jo Taenae Vuonna

May 24, 2025

Latest Posts

-

Mapping The Countrys Newest Business Hotspots

May 24, 2025

Mapping The Countrys Newest Business Hotspots

May 24, 2025 -

Global Deforestation Surges Wildfires Drive Unprecedented Losses

May 24, 2025

Global Deforestation Surges Wildfires Drive Unprecedented Losses

May 24, 2025 -

The Countrys Top Emerging Business Hubs A Geographic Analysis

May 24, 2025

The Countrys Top Emerging Business Hubs A Geographic Analysis

May 24, 2025 -

Navigating The China Market Case Studies Of Bmw Porsche And Others

May 24, 2025

Navigating The China Market Case Studies Of Bmw Porsche And Others

May 24, 2025 -

The China Market Hurdle Bmw Porsche And The Future Of Auto Sales

May 24, 2025

The China Market Hurdle Bmw Porsche And The Future Of Auto Sales

May 24, 2025