Euronext Amsterdam Stocks Surge 8% After Trump Tariff Pause

Table of Contents

The Trump Tariff Pause and its Impact

The recent pause in the implementation of specific Trump-era tariffs targeting European Union businesses had a profound and immediate effect on the Euronext Amsterdam market. These tariffs, primarily focused on [insert specific examples of tariffs paused, e.g., steel and aluminum imports], had created significant uncertainty and hampered economic growth for numerous companies listed on the Amsterdam Stock Exchange.

-

Specific Tariffs Paused: The specific tariffs paused included [list specific tariff codes or product categories affected, linking to official sources if possible]. These tariffs directly impacted [mention specific sectors and companies affected, e.g., the Dutch steel manufacturing industry, impacting companies like [company name]].

-

Immediate Market Reaction: The announcement of the tariff pause was met with an almost immediate surge in stock prices across the Euronext Amsterdam exchange. Within hours, the index showed an 8% increase, demonstrating the significant market sensitivity to trade policy uncertainty.

-

Long-Term Economic Effects: The long-term effects of this tariff pause remain to be seen. However, analysts predict a positive impact on European businesses, particularly those heavily reliant on trade with the United States. Increased investor confidence could lead to higher investments and economic growth within the EU, positively impacting the Amsterdam Stock Exchange.

-

Sectoral Impact: The impact varied across different sectors. Technology companies listed on Euronext Amsterdam, which were indirectly affected by the trade war, saw considerable gains. The manufacturing sector, directly impacted by the steel and aluminum tariffs, experienced the most significant recovery.

Analysis of Euronext Amsterdam Stock Performance

The 8% surge in Euronext Amsterdam stocks wasn't uniform. While the overall index saw a significant increase, specific stocks outperformed others.

-

Stocks Most Affected: [Mention specific companies that experienced the largest gains, providing percentage increases where possible. Examples: "Company X saw a 12% increase, while Company Y gained 9%"]. This disparity reflects the varied exposure of different companies to the previously imposed tariffs.

-

Trading Volume: The trading volume on Euronext Amsterdam during the surge was unusually high, indicating a considerable influx of buying activity driven by investor optimism. This suggests a strong belief in the positive implications of the tariff pause.

-

Comparison to Other Exchanges: Compared to other major European stock exchanges, such as the London Stock Exchange or the Frankfurt Stock Exchange, Euronext Amsterdam exhibited a more pronounced positive reaction. This highlights the specific impact of the tariff pause on Dutch businesses listed on the exchange.

-

Future Growth Potential: While the immediate future looks positive, analysts caution against over-optimism. The potential for market correction remains, depending on various factors, including the duration of the tariff pause and overall global economic conditions.

Investor Sentiment and Future Outlook

The tariff pause dramatically shifted investor sentiment towards a more optimistic outlook.

-

Changed Investor Confidence: The uncertainty surrounding the Trump-era tariffs had significantly dampened investor confidence. The pause alleviated these concerns, leading to increased investment activity on the Amsterdam Stock Exchange.

-

Risks and Opportunities: While the current situation presents opportunities for investors, it's crucial to acknowledge potential risks. A reversal of the tariff pause or unexpected global economic downturn could negatively impact stock prices.

-

Future Trends: Experts predict continued growth in specific sectors, like technology and renewable energy, which are less affected by trade disputes. However, the long-term impact will depend on broader geopolitical factors and global economic stability.

-

Investment Strategies: Investors considering the Amsterdam Stock Exchange should adopt a diversified approach, focusing on long-term investment strategies rather than short-term speculation. Thorough due diligence and risk assessment are crucial before making any investment decisions.

Conclusion

The unexpected 8% surge in Euronext Amsterdam stocks following the pause in Trump-era tariffs represents a significant market event. This analysis highlights the impact of trade policy on investor sentiment and stock performance, revealing both the immediate and potential long-term consequences. While the outlook appears positive, maintaining a cautious and diversified investment strategy is crucial.

Call to Action: Stay informed on the evolving situation at Euronext Amsterdam. Follow our blog for further updates and in-depth analysis on Euronext Amsterdam stocks and the impact of global trade policies. Learn more about investment opportunities on the Amsterdam Stock Exchange. Remember to consult a financial advisor before making any investment decisions related to Euronext Amsterdam stocks.

Featured Posts

-

M56 Car Crash Leaves One Injured Motorway Closed

May 24, 2025

M56 Car Crash Leaves One Injured Motorway Closed

May 24, 2025 -

Mamma Mia A Closer Look At The New Ferrari Hot Wheels

May 24, 2025

Mamma Mia A Closer Look At The New Ferrari Hot Wheels

May 24, 2025 -

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Odotettavissa

May 24, 2025

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Odotettavissa

May 24, 2025 -

Orchestration At Camunda Con 2025 Amsterdam Boosting Roi On Ai And Automation

May 24, 2025

Orchestration At Camunda Con 2025 Amsterdam Boosting Roi On Ai And Automation

May 24, 2025 -

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 24, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 24, 2025

Latest Posts

-

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025

Public Figure Questions The Accusations Sean Penn And The Dylan Farrow Case

May 24, 2025 -

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025

Mia Farrow On Trumps Venezuelan Deportation Lock Him Up

May 24, 2025 -

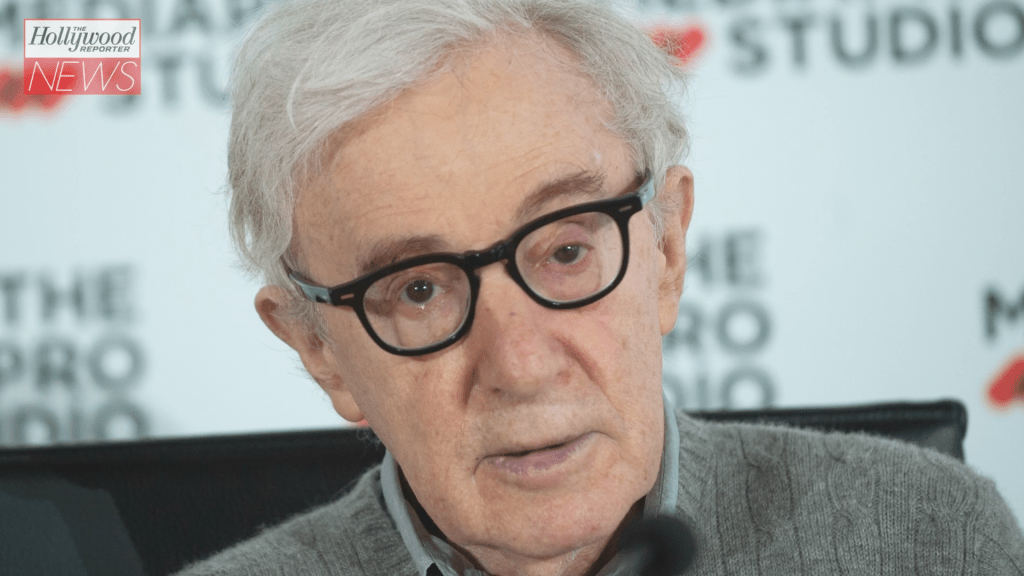

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025

Woody Allen And Dylan Farrow Sean Penns Perspective On The Allegations

May 24, 2025 -

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Actress Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Sexual Assault Case

May 24, 2025