Analysis Of ING Group's 2024 Annual Report (Form 20-F)

Table of Contents

Financial Highlights: Key Performance Indicators (KPIs) from ING's 2024 20-F

ING's 2024 20-F filing provides a wealth of data on its financial performance. Analyzing key performance indicators (KPIs) allows us to assess its profitability and efficiency.

Revenue and Net Income: ING's revenue and net income figures are critical indicators of its overall financial health. (Note: Replace the bracketed information below with actual data from the 2024 20-F filing once available).

- Revenue: [Insert Revenue Figure] – representing a [percentage change]% change compared to 2023. This revenue growth can be attributed to [mention specific factors from the 20-F, e.g., strong performance in a specific segment, successful new product launches].

- Net Income: [Insert Net Income Figure] – showing a [percentage change]% change from the previous year. This reflects a [positive/negative] trend in profitability, potentially influenced by [mention contributing factors from the 20-F, e.g., changes in interest rates, cost-cutting measures].

Return on Equity (ROE) and Return on Assets (ROA): These profitability ratios offer insights into how effectively ING utilizes shareholder equity and assets to generate profits.

- ROE: [Insert ROE Figure] – indicating [positive/negative] changes compared to the previous year and industry benchmarks. A higher ROE suggests better management of shareholder investments.

- ROA: [Insert ROA Figure] – showing [positive/negative] trends, reflecting the efficiency of asset utilization in generating profits. This is a key measure of the bank's overall financial efficiency.

Key Business Segments Performance: ING operates across various segments, each contributing differently to its overall performance.

- Retail Banking: [Describe the performance of the retail banking segment, including key metrics like customer growth, loan volume, and profitability. Cite relevant sections of the 20-F].

- Wholesale Banking: [Analyze the performance of the wholesale banking segment, focusing on areas like trading revenue, corporate lending, and market share. Cite relevant sections of the 20-F].

- Investment Management: [Discuss the performance of the investment management segment, highlighting assets under management, investment returns, and market positioning. Cite relevant sections of the 20-F].

Risk Factors and Challenges Identified in ING's 2024 20-F

ING's 20-F filing transparently outlines several risks that could impact its financial performance. Understanding these is crucial for a holistic assessment.

Regulatory and Compliance Risks: The financial industry is heavily regulated, and changes in regulations can significantly impact banks' operations and profitability.

- [List specific regulatory risks mentioned in the 20-F, e.g., changes in capital requirements, new anti-money laundering regulations, etc., and their potential impact on ING’s operations].

Economic and Geopolitical Risks: Global economic conditions and geopolitical events can create uncertainty and pose significant challenges to financial institutions.

- [Highlight macroeconomic factors like inflation, recessionary pressures, or geopolitical instability discussed in the 20-F and their potential consequences for ING]. Mention any risk mitigation strategies outlined in the report.

Credit Risk and Loan Portfolio Quality: The quality of ING's loan portfolio is crucial for its financial stability. Non-performing loans (NPLs) can severely impact profitability.

- [Analyze data on loan quality from the 20-F, including the percentage of NPLs and any trends indicating potential deterioration in asset quality. Discuss the implications of these figures].

Opportunities and Growth Prospects for ING in 2024 and Beyond

Despite the challenges, ING also identifies several opportunities for growth and expansion.

Digital Transformation and Innovation: ING is investing heavily in digital technologies to enhance customer experience and improve operational efficiency.

- [Discuss specific examples of ING's digital initiatives mentioned in the 20-F, such as investments in fintech, mobile banking advancements, or digital transformation projects].

Sustainable Finance and ESG Initiatives: The growing focus on environmental, social, and governance (ESG) factors presents significant opportunities for ING.

- [Highlight ING's ESG initiatives from the 20-F, including their commitment to sustainable finance, investments in renewable energy projects, or social responsibility programs].

Expansion into New Markets and Products: Expansion into new geographic markets or diversification into new products can drive growth.

- [Mention any expansion plans or new product launches mentioned in the 20-F, including details on target markets or product categories].

Conclusion: Key Takeaways from the ING Group's 2024 20-F Analysis and Call to Action

This analysis of ING Group's 2024 Annual Report (Form 20-F) reveals a mixed picture. While ING demonstrates [mention key positive aspects, e.g., strong revenue growth in certain segments], it also faces challenges related to [mention key risks, e.g., regulatory changes, geopolitical uncertainty]. The bank's commitment to digital transformation, sustainable finance, and expansion into new markets presents significant opportunities for future growth. However, careful management of credit risk and adaptation to evolving economic conditions will be crucial for continued success. To gain a more comprehensive understanding of ING's financial performance and strategic direction, we strongly encourage you to download and review the full ING Group's 2024 Annual Report (Form 20-F). Further analysis and discussion of this important ING 20-F filing are welcomed.

Featured Posts

-

Understanding The Love Monster Phenomenon

May 22, 2025

Understanding The Love Monster Phenomenon

May 22, 2025 -

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Yeni Teknik Direktoer Arayisi

May 22, 2025

Ancelotti Nin Ayriliginin Ardindan Real Madrid In Yeni Teknik Direktoer Arayisi

May 22, 2025 -

Abn Amro Storingen Bij Opslag En Online Betalingsmogelijkheden

May 22, 2025

Abn Amro Storingen Bij Opslag En Online Betalingsmogelijkheden

May 22, 2025 -

Clisson Un College Face A La Question Des Signes Religieux

May 22, 2025

Clisson Un College Face A La Question Des Signes Religieux

May 22, 2025 -

Proekt Remontu Pivdennogo Mostu Pidryadniki Termini Ta Koshtoris

May 22, 2025

Proekt Remontu Pivdennogo Mostu Pidryadniki Termini Ta Koshtoris

May 22, 2025

Latest Posts

-

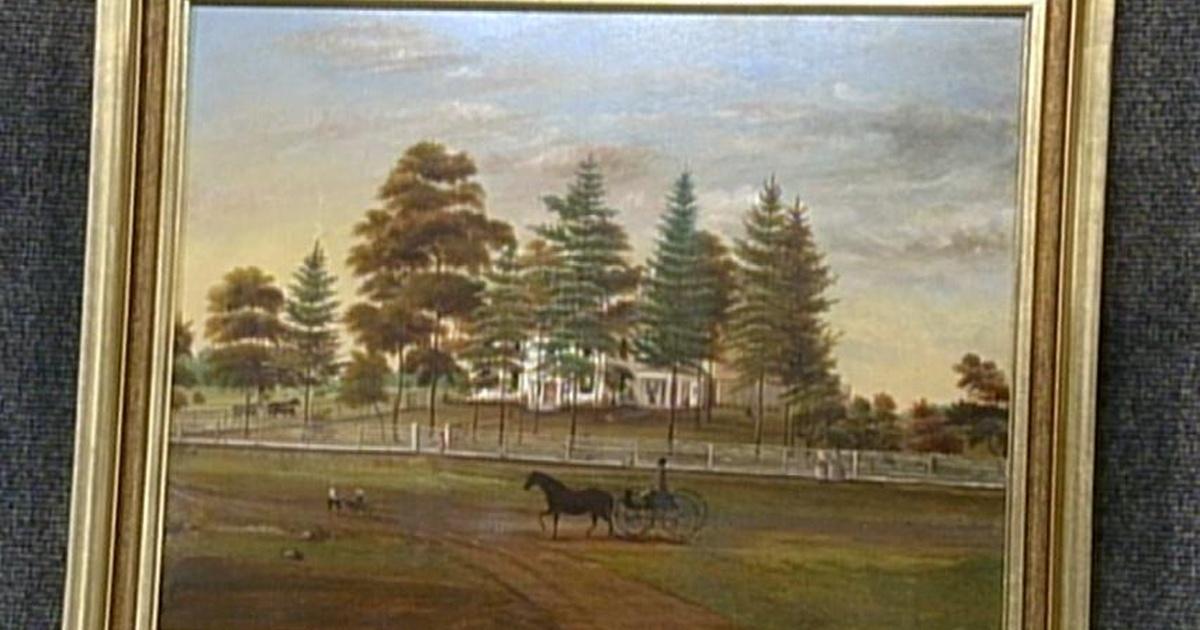

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025

Antiques Roadshow Couples Appraisal Results In Serious Charges

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Ends In Arrest

May 22, 2025 -

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025

Antiques Roadshow Stolen Goods Discovery Leads To Arrests

May 22, 2025 -

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025

Antiques Roadshow Couple Arrested After National Treasure Appraisal

May 22, 2025 -

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025

Appraisal On Antiques Roadshow Results In Jail Sentences

May 22, 2025