Rising Sea Levels, Falling Credit Scores: The Link Between Climate And Homeownership

Table of Contents

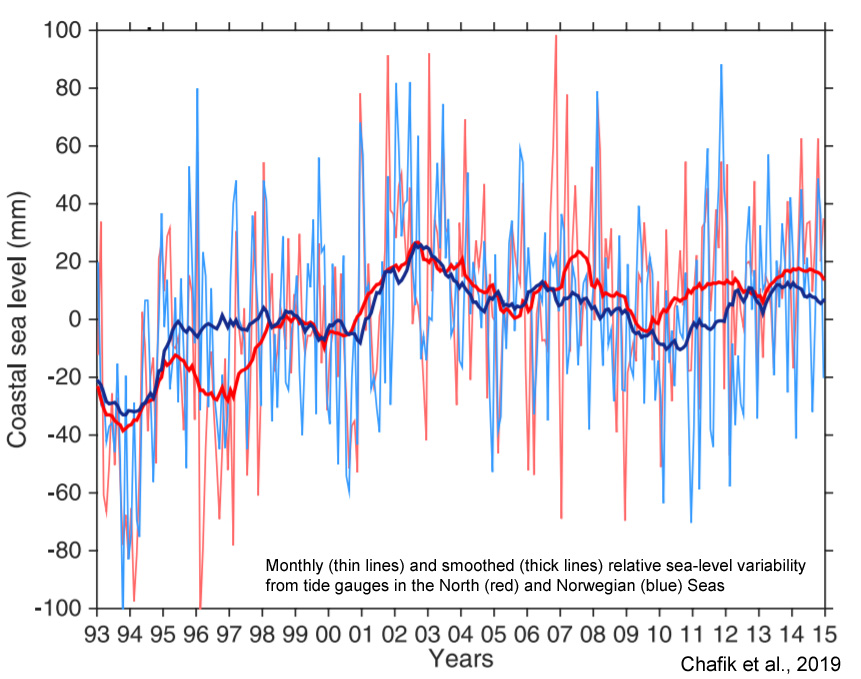

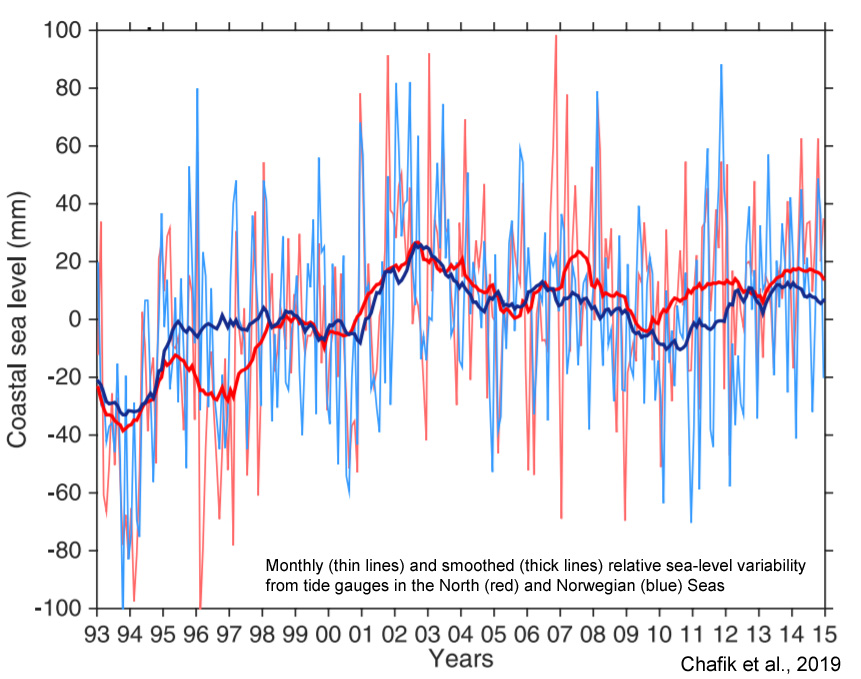

Sea levels are rising at an alarming rate, with some coastal areas experiencing increases of several inches per decade. This isn't just an environmental concern; it's a significant financial threat to homeowners. This article explores the critical link between "Rising Sea Levels, Falling Credit Scores," demonstrating how climate change impacts homeownership and creditworthiness. We'll examine the direct and indirect effects of rising sea levels on property values and credit scores, discuss the role of climate change disclosure, and offer mitigation strategies for homeowners.

H2: The Direct Impact of Rising Sea Levels on Property Values

Rising sea levels directly threaten coastal properties through increased flood risk, erosion, and storm damage. These threats dramatically decrease property values, impacting homeowners' financial security.

- Increased Insurance Premiums and Difficulty Obtaining Insurance: As flood risk increases, insurance companies raise premiums, making homeownership more expensive. In some high-risk areas, insurance becomes virtually unobtainable, leaving homeowners vulnerable.

- Decreased Demand for Properties in High-Risk Zones: Buyers are increasingly wary of purchasing properties in areas prone to flooding or erosion. This reduced demand directly lowers property values, creating a downward spiral for existing homeowners.

- Government Buyouts and Relocation Programs: In areas facing severe and persistent flooding, governments may initiate buy-out programs, forcing homeowners to sell their properties often at significantly reduced prices. This can negatively impact credit scores if homeowners are forced into foreclosure.

- Examples: Florida coastal properties, particularly in Miami real estate, are already experiencing these effects. Similar trends are observed in other vulnerable coastal areas such as New Orleans, Louisiana and coastal regions of North Carolina. Search terms like "Norfolk Virginia sea level rise" and "coastal property insurance crisis" illustrate the growing concern.

H2: Indirect Impacts on Credit Scores

The devaluation of properties due to rising sea levels has significant indirect impacts on homeowners' credit scores. The connection between climate change and creditworthiness is becoming increasingly clear.

- Reduced Equity in Homes Leading to Lower Credit Scores: As property values decline, homeowners see their equity decrease. This reduced equity can impact their creditworthiness, making it harder to secure loans or lines of credit.

- Difficulty Securing Refinancing or Home Equity Loans: Lenders are less likely to approve refinancing or home equity loans for properties in high-risk areas due to the increased perceived risk.

- Potential Foreclosure Due to Inability to Maintain Mortgage Payments: Facing increased insurance premiums, repairs, or even forced relocation, homeowners may struggle to maintain their mortgage payments, leading to foreclosure and severely damaged credit.

- Impact of Government Assistance Programs on Credit Reports: While government assistance programs can help homeowners in distress, participation in such programs may sometimes have an impact on credit reports, though this can vary depending on the specific program.

H2: The Role of Climate Change Disclosure and its Impact on Homeowners

Mandatory climate-related financial disclosures are becoming increasingly important. Transparency regarding climate risks will significantly influence home buying decisions and valuations.

- Impact of Transparent Disclosure of Flood Risk on Property Prices: Open and honest disclosure of flood risk will inevitably lead to lower prices for properties in high-risk areas, reflecting the true market value.

- How Investors and Lenders Are Incorporating Climate Risk into Their Decision-Making: Investors and lenders are increasingly incorporating climate risk assessments into their investment and lending decisions. This means stricter lending criteria and potentially higher interest rates for properties in vulnerable zones.

- The Role of Climate Risk Assessments in Determining Mortgage Eligibility: Mortgage lenders are starting to use climate risk assessments to determine mortgage eligibility, making it harder to secure financing for properties in high-risk areas. Keywords like "climate risk mortgage" are gaining relevance in this context.

- Related Legislation and Regulations Impacting Homeowners: Several states and municipalities are already implementing legislation and regulations requiring climate risk disclosures, impacting homeowners' rights and responsibilities. Searching for "climate change and real estate legislation" will reveal relevant updates.

H2: Mitigation Strategies and Financial Planning for Homeowners

Homeowners can take proactive steps to protect their investments and credit scores from the effects of rising sea levels. Proactive financial planning is crucial.

- Investing in Flood Mitigation Measures: Investing in flood mitigation measures, such as elevating homes or installing flood barriers, can reduce risk and protect property value.

- Exploring Insurance Options and Understanding Flood Insurance Policies: Understanding flood insurance policies and exploring various options is crucial to minimize financial losses from flooding.

- Diversifying Investments to Reduce Reliance on Home Equity: Diversifying investments reduces reliance on home equity as a primary source of wealth, safeguarding against potential losses.

- Building Emergency Funds to Handle Unexpected Costs Related to Climate Change Impacts: Building an emergency fund can help manage unexpected costs associated with climate change impacts.

- Seeking Financial Advice Tailored to Climate Risk: Seeking financial advice tailored to climate risk is crucial for developing a robust financial plan that considers these challenges.

Conclusion:

The connection between rising sea levels, falling property values, and declining credit scores is undeniable. Understanding and addressing these climate-related financial risks is crucial for homeowners. The impact of climate change on homeownership is a serious financial concern that necessitates proactive planning and responsible investment decisions. To learn more about protecting your homeownership from the effects of rising sea levels and understanding the relationship between rising sea levels and credit scores, explore resources available at [link to relevant website/tool]. Protecting your financial future requires understanding and acting on the implications of rising sea levels.

Featured Posts

-

Ings 2024 Annual Report Key Highlights From Form 20 F Filing

May 21, 2025

Ings 2024 Annual Report Key Highlights From Form 20 F Filing

May 21, 2025 -

Wildfire Betting A Reflection Of Our Times In Los Angeles

May 21, 2025

Wildfire Betting A Reflection Of Our Times In Los Angeles

May 21, 2025 -

The Wayne Gretzky Loyalty Debate Examining Trumps Impact On Canadian Sentiment

May 21, 2025

The Wayne Gretzky Loyalty Debate Examining Trumps Impact On Canadian Sentiment

May 21, 2025 -

Femicide In Latin America The Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025

Femicide In Latin America The Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025 -

Un Siecle De Diversification A Moncoutant Sur Sevre Et Clisson

May 21, 2025

Un Siecle De Diversification A Moncoutant Sur Sevre Et Clisson

May 21, 2025

Latest Posts

-

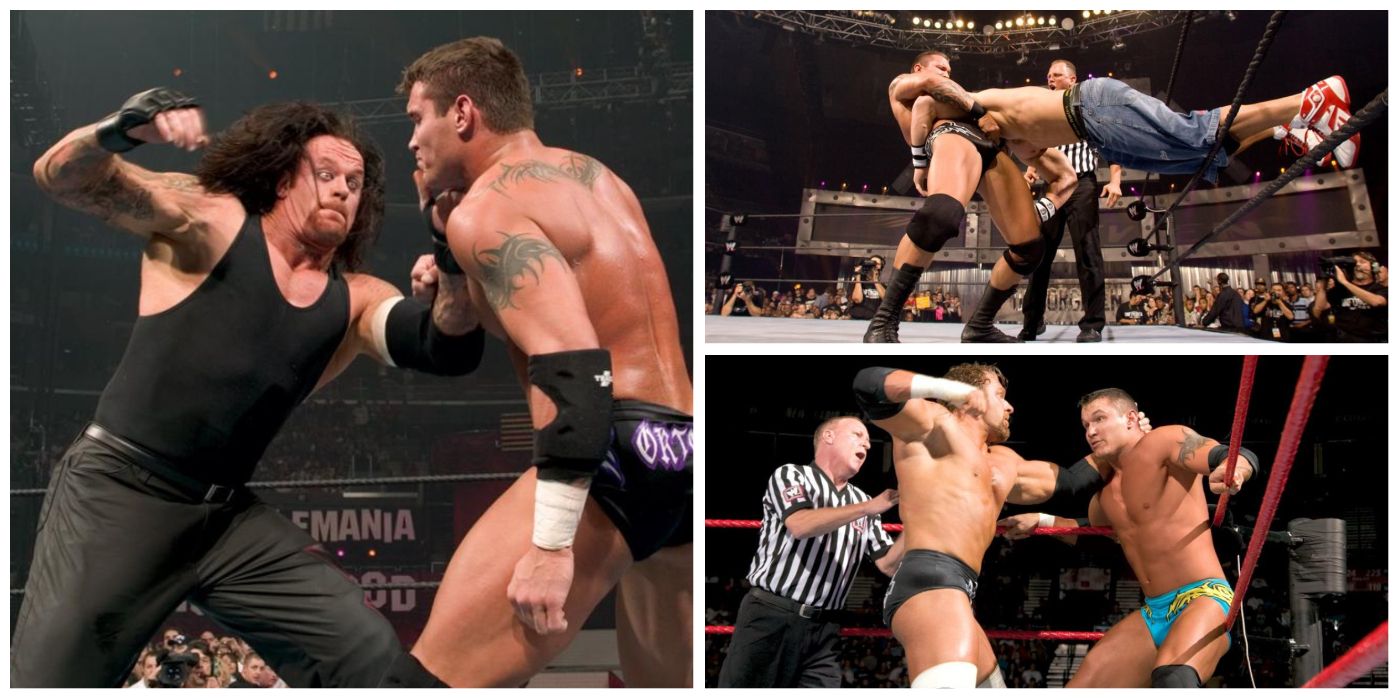

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 21, 2025

John Cena Vs Randy Orton Feud Brewing Plus Bayleys Injury Update

May 21, 2025 -

Former Aew Star Rey Fenix Smack Down Debut And Wwe Ring Name Unveiled

May 21, 2025

Former Aew Star Rey Fenix Smack Down Debut And Wwe Ring Name Unveiled

May 21, 2025 -

Aew Star Rey Fenix Debuts On Wwe Smack Down His New Ring Name

May 21, 2025

Aew Star Rey Fenix Debuts On Wwe Smack Down His New Ring Name

May 21, 2025 -

Wwe Speculation Ronda Rouseys Future Logan Pauls Next Move Jey Usos Status And Big Es Engagement

May 21, 2025

Wwe Speculation Ronda Rouseys Future Logan Pauls Next Move Jey Usos Status And Big Es Engagement

May 21, 2025 -

Breaking Wwe News Updates On Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 21, 2025

Breaking Wwe News Updates On Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 21, 2025