Interpreting The Net Asset Value (NAV) For The Amundi DJIA UCITS ETF

Table of Contents

What is the NAV of the Amundi DJIA UCITS ETF and How is it Calculated?

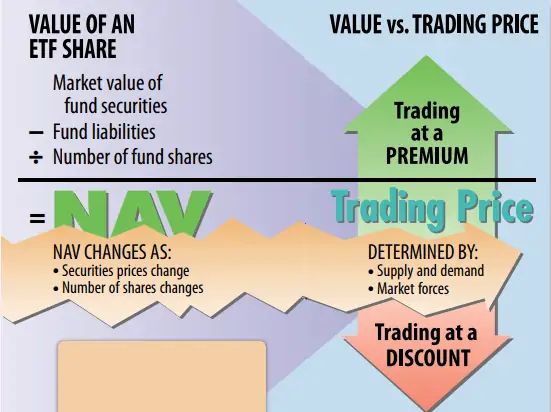

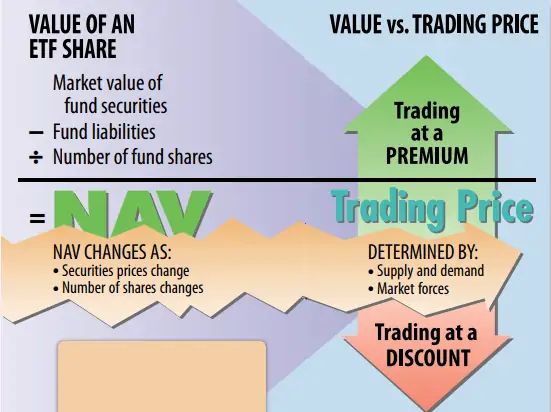

The Net Asset Value (NAV) of the Amundi DJIA UCITS ETF represents the net value of the ETF's assets minus its liabilities, per share. Think of it as the underlying worth of your investment. This ETF tracks the DJIA, so its NAV is directly influenced by the performance of the 30 constituent companies of this prominent index.

The NAV is calculated daily, typically at the close of the market. The calculation involves several key steps:

- Determining the total market value of assets: This includes the value of all the stocks held within the ETF, mirroring the composition of the DJIA.

- Accounting for liabilities: These include management fees, administrative expenses, and any other outstanding obligations.

- Calculating the net asset value: This is simply the total market value of assets minus the total liabilities.

- Dividing by the number of outstanding shares: This gives the NAV per share, the value you see reported.

It's important to distinguish between the NAV and the market price of the ETF. While they should ideally be very close, they can sometimes differ slightly due to supply and demand fluctuations throughout the trading day. Several factors influence the daily NAV calculation:

- Underlying asset performance (DJIA components): Positive performance of the DJIA companies increases the NAV; negative performance decreases it.

- Currency fluctuations (if applicable): If the ETF holds assets in multiple currencies, exchange rate movements can impact the NAV.

- Management fees and expenses: These fees reduce the overall net asset value.

- Dividend distributions: When the underlying companies pay dividends, the NAV will adjust accordingly after the distribution.

Interpreting NAV Changes in the Amundi DJIA UCITS ETF

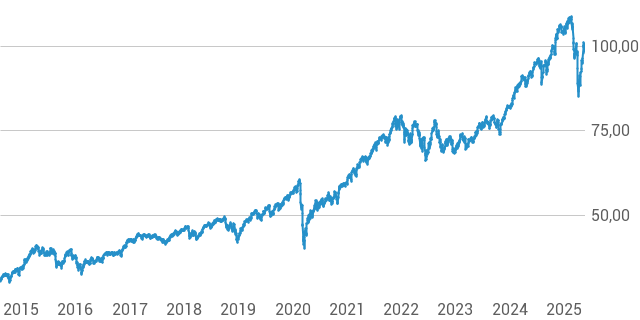

Understanding NAV changes is key to tracking your investment's performance. A rising NAV generally indicates positive performance, while a falling NAV suggests negative performance. The relationship between DJIA movements and NAV changes is generally very strong, as the ETF aims to closely track the index.

However, it's crucial to consider the time horizon when analyzing NAV fluctuations:

- Significant NAV increase: This could be due to strong positive performance across the DJIA components, potentially indicating a bullish market trend. This could signal an opportunity to potentially consider taking profits or holding for further growth.

- Significant NAV decrease: This may result from negative market sentiment, poor performance of major DJIA components, or broader economic factors. It’s important to analyze the underlying causes before making any hasty decisions. This might indicate a time for careful consideration, potentially requiring adjustments to your investment strategy.

- Slight NAV fluctuations: Small daily fluctuations are normal and typically reflect the natural ebb and flow of the market. Don't overreact to minor changes; focus on the long-term trend.

Using NAV to Make Informed Investment Decisions for the Amundi DJIA UCITS ETF

The Amundi DJIA UCITS ETF NAV is a powerful tool for making informed investment choices. By tracking the NAV over time, you can assess the long-term performance of your investment and compare it against the DJIA's performance. This allows you to evaluate the effectiveness of your investment strategy.

- Comparing NAV to the market price: Identifying discrepancies between the NAV and market price can reveal potential arbitrage opportunities for sophisticated investors.

- Tracking NAV over time: This provides a clear picture of the ETF's performance and helps inform long-term investment strategies.

- Using NAV data in conjunction with other performance indicators: Consider factors like the expense ratio and trading volume alongside the NAV for a comprehensive assessment.

Conclusion: Mastering the Amundi DJIA UCITS ETF NAV for Successful Investing

Understanding and interpreting the Amundi DJIA UCITS ETF's NAV is crucial for successful investing. By regularly monitoring the NAV and considering its relationship to the DJIA and other market indicators, you can make more informed decisions about your investment strategy. Remember to consider the NAV in conjunction with other relevant factors, such as expense ratios and trading volume, for a holistic view of your investment's performance.

Stay informed about the Amundi DJIA UCITS ETF's NAV to optimize your investment strategy. Learn more about NAV and ETF investing today! [Link to relevant resources]

Featured Posts

-

Amundi Msci All Country World Ucits Etf Usd Acc Nav Analysis And Performance

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Nav Analysis And Performance

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Significance

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Significance

May 25, 2025 -

Evrovidenie 2025 Chetyre Potentsialnykh Pobeditelya Po Versii Konchity Vurst

May 25, 2025

Evrovidenie 2025 Chetyre Potentsialnykh Pobeditelya Po Versii Konchity Vurst

May 25, 2025 -

Escape To The Country Analyzing Nicki Chapmans Successful Property Investment

May 25, 2025

Escape To The Country Analyzing Nicki Chapmans Successful Property Investment

May 25, 2025 -

Joy Crookes Releases New Song I Know You D Kill Details And Listening Options

May 25, 2025

Joy Crookes Releases New Song I Know You D Kill Details And Listening Options

May 25, 2025

Latest Posts

-

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025

2024 Philips Annual General Meeting Financial Results And Future Plans

May 25, 2025 -

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025

Report Philips Holds Annual General Meeting For Shareholders

May 25, 2025 -

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025 -

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025

Royal Philips Details On The 2025 Shareholders Annual General Meeting

May 25, 2025 -

Annual General Meeting 2025 Philips Announces Agenda Updates

May 25, 2025

Annual General Meeting 2025 Philips Announces Agenda Updates

May 25, 2025