Amundi MSCI World II UCITS ETF Dist: Daily NAV And Its Significance

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. It's calculated by subtracting the ETF's liabilities from the total market value of its assets. For the Amundi MSCI World II UCITS ETF Dist, this means calculating the value of its holdings in global equities, less any expenses. Daily NAV fluctuations directly reflect the performance of the underlying assets, providing a crucial indicator of investment growth or loss. Understanding NAV is essential for tracking your investment's progress and making informed decisions.

- Definition of NAV: The net value of an ETF's assets minus its liabilities.

- How NAV is calculated for ETFs: The market value of all holdings is summed, expenses and liabilities are deducted, and the result is divided by the number of outstanding shares.

- The relationship between NAV and ETF share price: While ideally closely aligned, the ETF share price can deviate slightly from the NAV due to market supply and demand.

- NAV's role in assessing investment performance: NAV provides a clear picture of the actual value of your investment, unaffected by short-term market fluctuations in the ETF's share price.

Understanding the Daily NAV of Amundi MSCI World II UCITS ETF Dist

Finding the daily NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward. You can typically access this information through several reliable sources:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial News Sources: Major financial news websites and platforms usually provide real-time or end-of-day NAV data for popular ETFs like the Amundi MSCI World II UCITS ETF Dist.

- Brokerage Platforms: If you hold the ETF through a brokerage account, your platform will likely display the current NAV.

Several factors influence the daily NAV changes:

- Global Market Trends: The performance of the global equity markets, the ETF's primary investment focus, significantly impacts its NAV.

- Currency Fluctuations: As the Amundi MSCI World II UCITS ETF Dist holds assets globally, currency exchange rate changes can affect the NAV.

- Dividend Distributions: When the underlying companies in the ETF pay dividends, this can cause a slight decrease in the NAV, as the dividends are distributed to shareholders. This is a normal occurrence for the "Dist" version of the fund which pays out dividends.

Using Daily NAV for Informed Investment Decisions

Daily NAV data is a powerful tool for informed investment decisions, but it's essential to use it wisely.

- Monitoring investment performance using daily NAV: By tracking the daily NAV, you can easily monitor the growth (or decline) of your investment in the Amundi MSCI World II UCITS ETF Dist.

- Utilizing NAV for buy/sell decisions (with cautionary notes): While tempting, using daily NAV fluctuations as the sole basis for buy/sell decisions is risky. Focus on long-term trends rather than short-term volatility.

- Long-term vs. short-term NAV analysis: Short-term fluctuations are often noise; concentrate on long-term trends to assess the underlying performance of the Amundi MSCI World II UCITS ETF Dist.

- NAV in risk management for ETF investments: Monitoring the NAV helps you assess your investment's risk exposure and adjust your portfolio accordingly.

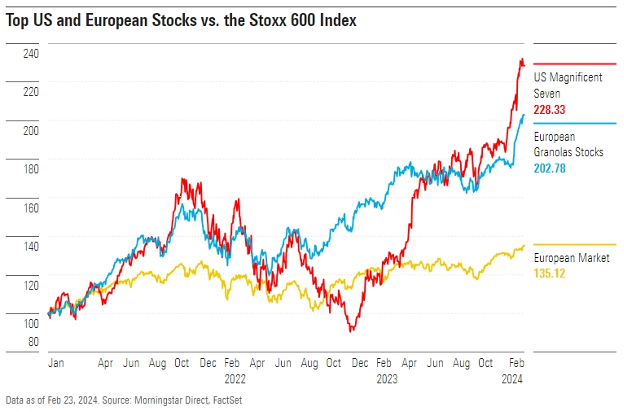

Comparing Amundi MSCI World II UCITS ETF Dist NAV to Benchmark Indices

Comparing the Amundi MSCI World II UCITS ETF Dist's NAV to its benchmark index, the MSCI World Index, is crucial for evaluating its tracking performance. The difference between the ETF's performance and the benchmark index's performance is called the tracking error. A low tracking error indicates that the ETF effectively mirrors the performance of its benchmark. Regularly assessing the tracking error against the benchmark helps to determine if the fund is effectively managing its investment strategy.

Conclusion

Understanding and regularly monitoring the daily NAV of the Amundi MSCI World II UCITS ETF Dist is essential for effective portfolio management. By utilizing this crucial information, you can make informed investment decisions, assess risk, and track your investment's performance against its benchmark. Remember to consider both short-term fluctuations and long-term trends to make well-informed decisions. Stay informed about your investment performance by regularly tracking the daily NAV of the Amundi MSCI World II UCITS ETF Dist. Learn more about optimizing your investment strategy using NAV data today!

Featured Posts

-

Leeds Eye Southamptons Kyle Walker Peters Transfer News

May 25, 2025

Leeds Eye Southamptons Kyle Walker Peters Transfer News

May 25, 2025 -

Dazi Trump Analisi Dell Effetto Negativo Sul Mercato Della Moda Europea

May 25, 2025

Dazi Trump Analisi Dell Effetto Negativo Sul Mercato Della Moda Europea

May 25, 2025 -

Smart Memorial Day 2025 Travel When To Fly And When To Avoid

May 25, 2025

Smart Memorial Day 2025 Travel When To Fly And When To Avoid

May 25, 2025 -

Teenager Arrested After Darwin Shop Owners Fatal Stabbing In Nightcliff

May 25, 2025

Teenager Arrested After Darwin Shop Owners Fatal Stabbing In Nightcliff

May 25, 2025 -

The M62 Relief Road Burys Unrealized Infrastructure Project

May 25, 2025

The M62 Relief Road Burys Unrealized Infrastructure Project

May 25, 2025

Latest Posts

-

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 25, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Au Dela De L Ecole

May 25, 2025 -

Focusing On Collaboration And Growth The 2nd Edition Of Best Of Bangladesh In Europe

May 25, 2025

Focusing On Collaboration And Growth The 2nd Edition Of Best Of Bangladesh In Europe

May 25, 2025 -

Best Of Bangladesh In Europe 2nd Edition Driving Collaboration And Economic Growth

May 25, 2025

Best Of Bangladesh In Europe 2nd Edition Driving Collaboration And Economic Growth

May 25, 2025 -

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 25, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 25, 2025 -

Analyse Snelle Marktdraai Europese Aandelen Implicaties Voor Beleggers

May 25, 2025

Analyse Snelle Marktdraai Europese Aandelen Implicaties Voor Beleggers

May 25, 2025