Amundi MSCI All Country World UCITS ETF USD Acc: NAV Analysis And Performance

Table of Contents

Analyzing the NAV of Amundi MSCI All Country World UCITS ETF USD Acc

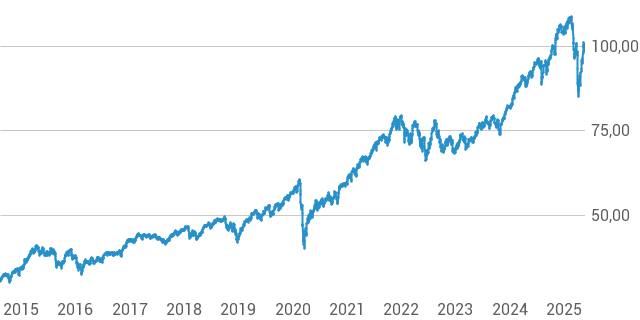

Net Asset Value (NAV) is the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For ETF investors, understanding the NAV is crucial as it represents the underlying value of each share. The Amundi MSCI All Country World UCITS ETF USD Acc's NAV is calculated daily by Amundi, reflecting the closing prices of the underlying securities in the MSCI All Country World Index.

Several factors influence the daily fluctuations in the ETF's NAV:

- Global Stock Market Performance: The primary driver of NAV changes is the performance of the underlying global equities within the MSCI All Country World Index. Positive market movements generally lead to NAV appreciation, while negative movements result in depreciation.

- Currency Fluctuations: As the ETF is denominated in USD, fluctuations in exchange rates against other currencies can impact the NAV, particularly for holdings in non-USD denominated markets.

- Dividend Distributions and Reinvestments: Dividend payments from the underlying companies are typically reinvested, impacting the NAV. This reinvestment increases the number of underlying assets and generally leads to a slight increase in NAV.

[Insert a chart here showing NAV changes over short, medium, and long-term periods. Clearly label the axes and include a legend comparing NAV to the MSCI All Country World Index benchmark.]

By comparing the NAV performance to the benchmark MSCI All Country World Index, investors can assess how effectively the ETF tracks its underlying index. A close tracking indicates efficient management and portfolio construction.

Performance Evaluation: Amundi MSCI All Country World UCITS ETF USD Acc Returns

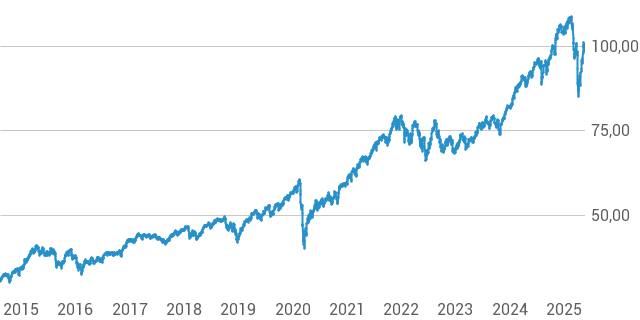

Assessing the Amundi MSCI All Country World UCITS ETF USD Acc's performance requires examining historical returns and risk-adjusted metrics.

[Insert charts and graphs here illustrating total return, capital appreciation, and dividend yields over different time periods. Clearly label all axes and include a legend comparing performance to the MSCI ACWI benchmark.]

Analyzing total return, which includes both capital appreciation and dividend yields, provides a holistic view of the ETF's performance. Comparison to the MSCI ACWI (MSCI All Country World Investable Market Index) benchmark is critical to evaluate its tracking ability.

Key performance metrics like the Sharpe Ratio and Sortino Ratio provide insights into risk-adjusted returns. The Sharpe Ratio measures excess return per unit of total risk, while the Sortino Ratio focuses on downside risk. Higher values generally indicate better risk-adjusted performance.

[Include a brief discussion of periods of strong and weak performance, highlighting contributing macroeconomic factors like global economic growth, geopolitical events, or sector-specific trends.]

Expense Ratio and Fees: Cost of Investing in the Amundi MSCI All Country World UCITS ETF USD Acc

The expense ratio of the Amundi MSCI All Country World UCITS ETF USD Acc is a crucial factor to consider. [State the expense ratio clearly]. This should be compared to the expense ratios of similar globally diversified ETFs to assess its competitiveness.

- Impact on Long-Term Returns: Even seemingly small expense ratios can significantly impact long-term returns due to the compounding effect. It's essential to understand how these fees erode your investment growth over time.

- Other Fees: Remember to account for brokerage fees charged by your broker when buying or selling the ETF.

Risk Assessment: Understanding the Volatility of Amundi MSCI All Country World UCITS ETF USD Acc

Investing in global equities inherently carries risk. Analyzing the ETF's historical volatility and beta helps assess this risk. Beta measures the ETF's price sensitivity relative to the overall market. A beta of 1 indicates similar volatility to the market, while a beta greater than 1 suggests higher volatility.

- Diversification Benefits: While global equity investments carry risk, the Amundi MSCI All Country World UCITS ETF USD Acc's broad diversification across numerous countries and sectors helps mitigate this risk by reducing the impact of any single market downturn.

- Individual Risk Tolerance: It is crucial to consider your own risk tolerance before investing in this or any ETF.

Conclusion: Making Informed Investment Decisions with the Amundi MSCI All Country World UCITS ETF USD Acc

This analysis of the Amundi MSCI All Country World UCITS ETF USD Acc's NAV and performance highlights its potential as a vehicle for global diversification. While offering broad market exposure and generally strong long-term returns, remember to factor in the expense ratio and inherent risks associated with global equity investments. Thorough due diligence, including considering your personal risk tolerance and investment goals, is essential before making any investment decisions. Regular monitoring of the ETF's NAV is crucial for informed investment choices. Further research into the Amundi MSCI All Country World UCITS ETF USD Acc, including reviewing its prospectus and consulting with a financial advisor, is strongly recommended. [Include links to relevant resources here, such as Amundi's website and reputable financial data providers]. Make informed choices and consider the Amundi MSCI All Country World UCITS ETF USD Acc for your global diversification strategy.

Featured Posts

-

Steady Dax Opening Frankfurt Stock Market Update

May 25, 2025

Steady Dax Opening Frankfurt Stock Market Update

May 25, 2025 -

Traffic Alert M62 Westbound Closed For Resurfacing Manchester To Warrington

May 25, 2025

Traffic Alert M62 Westbound Closed For Resurfacing Manchester To Warrington

May 25, 2025 -

Avrupa Borsalarinda Karisik Seyir Yatirimcilar Icin Oenemli Noktalar

May 25, 2025

Avrupa Borsalarinda Karisik Seyir Yatirimcilar Icin Oenemli Noktalar

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 25, 2025 -

Change At The Top Guccis Supply Chain Leadership Transition

May 25, 2025

Change At The Top Guccis Supply Chain Leadership Transition

May 25, 2025

Latest Posts

-

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Investment

May 25, 2025

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Investment

May 25, 2025 -

Berkshire Hathaways Future Analyzing The Apple Stock Holding Post Buffett

May 25, 2025

Berkshire Hathaways Future Analyzing The Apple Stock Holding Post Buffett

May 25, 2025 -

Buffetts Departure Whats Next For Berkshire Hathaways Apple Investment

May 25, 2025

Buffetts Departure Whats Next For Berkshire Hathaways Apple Investment

May 25, 2025 -

Ces Unveiled Europe Un Evenement Technologique Majeur A Amsterdam

May 25, 2025

Ces Unveiled Europe Un Evenement Technologique Majeur A Amsterdam

May 25, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations Technologiques A Decouvrir

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Les Innovations Technologiques A Decouvrir

May 25, 2025