Holzmann (ECB) On The Disinflationary Effects Of Trump Tariffs

Holzmann's Key Arguments on Trump Tariff Impacts

Holzmann's analysis of the Trump tariffs' impact on inflation presented a nuanced perspective, deviating from the immediate expectation of inflationary pressure. He argued that while tariffs initially might increase prices of specific imported goods, their broader impact could be disinflationary. This counterintuitive effect, according to Holzmann, stemmed from several key mechanisms.

-

Reduced Consumer Spending: Increased prices on tariffed goods led to decreased consumer spending power. This reduced demand, in turn, dampened overall inflationary pressures across the economy. Holzmann likely considered the impact on consumer price indices (CPI) and other relevant economic indicators to support this argument.

-

Suppressed Import Prices: While tariffs directly increased the price of some imports, the overall effect on import prices could be complex. The decreased demand resulting from tariffs could, in some cases, exert downward pressure on the prices of imported goods, counteracting the direct effect of tariffs themselves.

-

Specific Sectoral Impacts: Holzmann likely focused on specific sectors heavily impacted by the tariffs, such as manufacturing and possibly energy. Analyzing the price changes within these sectors provides a more granular understanding of the disinflationary effects. He may have cited specific data on price changes within these sectors to support his argument.

-

Initial Inflation vs. Long-Term Disinflation: Holzmann's analysis likely distinguished between the short-term inflationary pressures immediately following the tariff imposition and the longer-term disinflationary impact due to reduced demand and suppressed import prices in certain sectors. The initial price increases were likely seen as temporary compared to the sustained dampening of inflation.

Analyzing the Disinflationary Impact: Beyond the Headlines

While Holzmann's analysis provides valuable insights, the disinflationary impact of Trump's tariffs is far more complex than headlines might suggest. Several other factors need consideration:

-

Counterarguments and Alternative Viewpoints: Some economists argued that the tariffs' inflationary effects were masked by other global economic factors or that the long-term effects on inflation remain unclear, potentially even leading to future inflationary spikes.

-

Supply Chain Disruptions: The tariffs significantly disrupted global supply chains, leading to shortages and higher costs in some sectors. These disruptions could exacerbate inflationary pressures, counteracting any disinflationary effects from reduced consumer demand.

-

Varying Impacts Across Economies: The impact of the tariffs varied considerably across different economies. The US, as the initiator of the tariffs, experienced a different impact than the EU or other trading partners subjected to retaliatory tariffs.

-

Short-Term vs. Long-Term Effects: The short-term effects of tariffs on prices might differ substantially from the long-term consequences. Analyzing both is crucial for a complete understanding of the economic implications.

The Broader Context: Trade Wars and Global Economic Stability

Holzmann's analysis is inextricably linked to the larger debate surrounding trade wars and their impact on global economic stability. The Trump administration's protectionist policies sparked a wave of retaliatory tariffs, creating uncertainty and disrupting established trade relationships.

-

Impact of Protectionist Trade Policies: Protectionist policies, by their very nature, distort market mechanisms and reduce overall economic efficiency. This can have significant negative consequences on global growth and stability.

-

Tariffs, Inflation, and Economic Growth: The relationship between tariffs, inflation, and economic growth is complex and non-linear. While tariffs can influence inflation in multiple ways, their overall effect on economic growth is generally considered negative.

-

Role of International Organizations: The WTO (World Trade Organization) plays a crucial role in managing trade disputes and promoting a rules-based trading system. The actions of the Trump administration, however, challenged the authority and effectiveness of the WTO.

-

Future Scenarios: The ongoing trade tensions and protectionist tendencies highlight the need for a more nuanced approach to trade policy. The future stability of the global economy heavily depends on how international cooperation and multilateral institutions address these challenges.

Conclusion

Holzmann's analysis of the disinflationary effects of Trump's tariffs offers a valuable, albeit complex, perspective on the consequences of protectionist trade policies. His arguments highlight the non-linear relationship between tariffs and inflation, demonstrating how reduced consumer spending and suppressed import prices in specific sectors can counter the initial inflationary pressures. However, the complete picture necessitates considering counterarguments, supply chain disruptions, varying economic impacts, and the broader context of global trade wars. For a comprehensive understanding of the complexities surrounding Holzmann's analysis of the disinflationary effects of Trump tariffs, explore further research on this critical topic. This includes examining ECB publications, Holzmann's own work, and independent studies analyzing the impact of Trump's tariffs and the ongoing challenges to global trade stability.

Benson Boone Photos 2025 I Heart Radio Music Awards Sheer Lace Top

Benson Boone Photos 2025 I Heart Radio Music Awards Sheer Lace Top

Krogkommissionen Recenserar Aer Stockholm Stadshotell Vaert Besoeket

Krogkommissionen Recenserar Aer Stockholm Stadshotell Vaert Besoeket

Ai Transforms Repetitive Scatological Documents Into Engaging Podcasts

Ai Transforms Repetitive Scatological Documents Into Engaging Podcasts

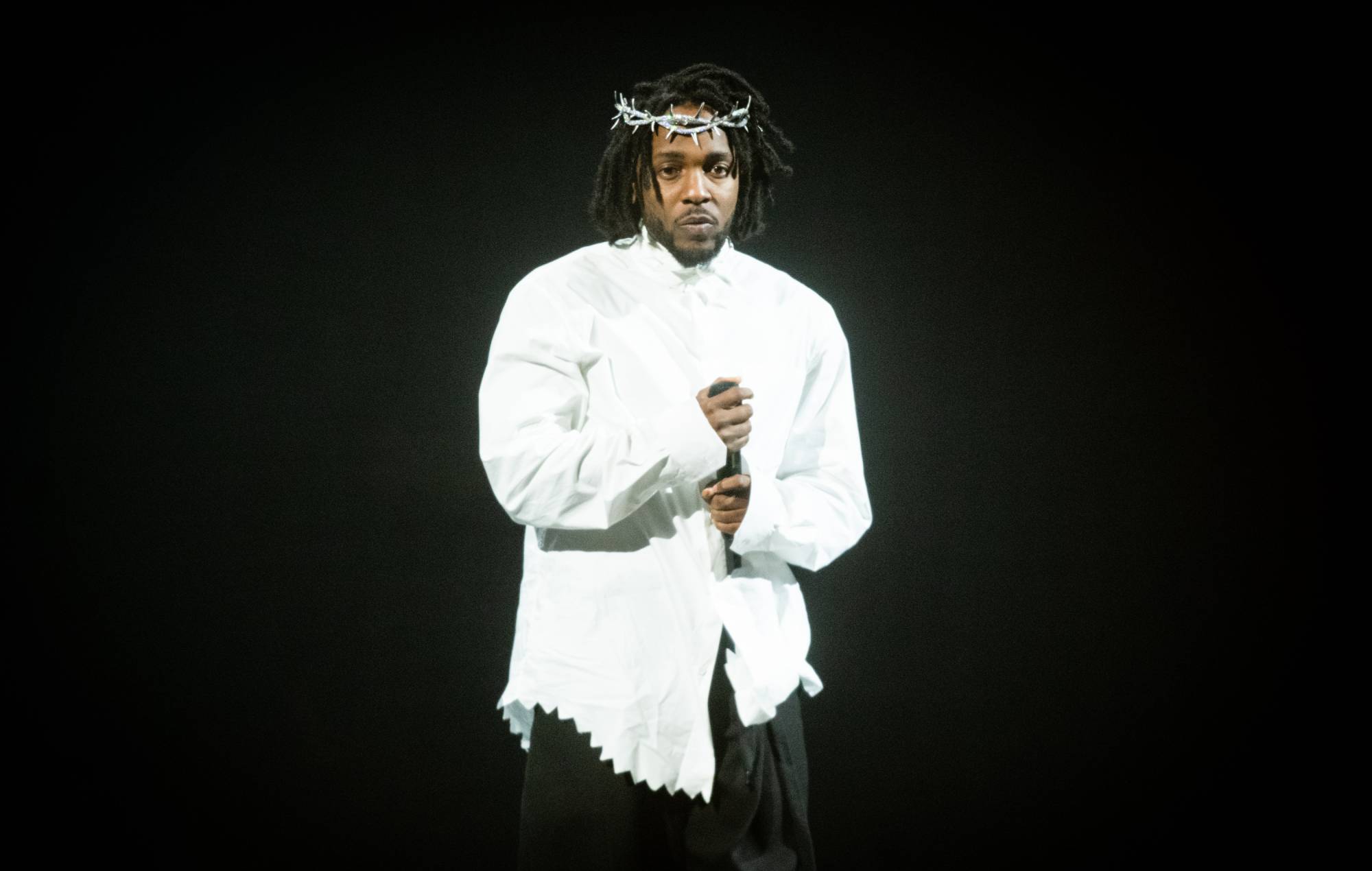

Kendrick Lamars Hampden Gig Fans React To Expensive Tickets

Kendrick Lamars Hampden Gig Fans React To Expensive Tickets

The Military Base At The Heart Of Us China Rivalry

The Military Base At The Heart Of Us China Rivalry

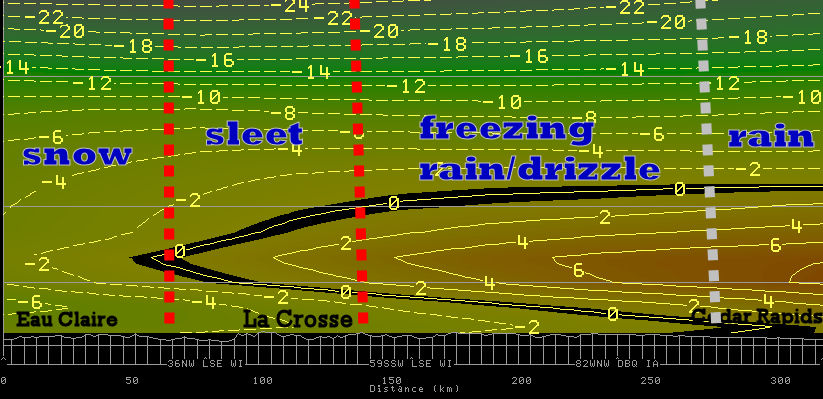

Driving In A Wintry Mix Rain And Snow Safety Tips

Driving In A Wintry Mix Rain And Snow Safety Tips

Investing In Big Bear Ai A Practical Guide For Investors

Investing In Big Bear Ai A Practical Guide For Investors

Big Bear Ai Stock Current Market Conditions And Investment Implications

Big Bear Ai Stock Current Market Conditions And Investment Implications

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

Preparing For A Wintry Mix Rain And Snow Preparedness Guide

Wintry Mix Of Rain And Snow What To Expect

Wintry Mix Of Rain And Snow What To Expect