Goldman Sachs: Comparing Labor And Opposition Fiscal Plans In Australia

Table of Contents

Goldman Sachs' Assessment of the Labor Party's Fiscal Plan

Goldman Sachs' analysis of the Australian Labor Party's fiscal plan reveals a focus on increased government spending across several key areas.

Key Promises and Spending Priorities

Labor's key policy proposals, as highlighted by Goldman Sachs, include significant investments in:

- Infrastructure: Major investments in roads, railways, and public transport, aiming to boost economic activity and create jobs. Goldman Sachs estimates this could add X percentage points to GDP growth over the next Y years.

- Healthcare: Increased funding for public hospitals and Medicare, potentially easing pressure on the system and improving healthcare outcomes. The report suggests this could lead to Z increase in healthcare employment.

- Education: Expanded funding for schools and universities, with a focus on improving educational outcomes and workforce skills. Goldman Sachs projects a potential positive impact on long-term productivity.

- Social Welfare: Increased spending on social security and welfare programs to support vulnerable Australians. The report notes potential impacts on income inequality.

Keywords: Labor Fiscal Policy, Labor Budget, Labor Spending, Labor Economic Plan.

Goldman Sachs' Analysis of Labor's Revenue Projections

Goldman Sachs' assessment of Labor's revenue projections centers on their proposed tax policies. These include:

- Increased corporate tax: A potential increase in the corporate tax rate to fund increased spending. Goldman Sachs analyzes the potential impact on business investment and competitiveness.

- Changes to capital gains tax: Potential adjustments to capital gains tax rates, affecting investment decisions. The report assesses the potential revenue generated and its impact on the broader economy.

The report highlights the challenge of balancing increased spending with the realism of achieving these revenue projections, emphasizing the importance of economic growth to support the fiscal plan's ambitions.

Keywords: Labor Tax Policy, Labor Revenue Projections, Tax Revenue, Tax Reform.

Goldman Sachs' Overall Evaluation of Labor's Plan

Goldman Sachs' overall evaluation of Labor's plan acknowledges its ambition but raises concerns regarding the potential impact on national debt and the feasibility of achieving projected revenue targets. While the increased spending aims to stimulate economic growth and address social needs, the report emphasizes the need for careful fiscal management to mitigate potential risks. The report states (insert direct quote from the Goldman Sachs report, if available).

Keywords: Goldman Sachs Labor Analysis, Labor Economic Outlook.

Goldman Sachs' Assessment of the Opposition's Fiscal Plan

Goldman Sachs' analysis of the Opposition's fiscal plan reveals a contrasting approach, prioritizing tax cuts and deregulation.

Key Promises and Spending Priorities

The Opposition's key proposals, according to Goldman Sachs, include:

- Tax cuts: Significant personal and/or corporate tax cuts designed to stimulate economic activity through increased consumer and business spending. Goldman Sachs models the potential impact on consumption and investment.

- Deregulation: Easing regulations in specific sectors to encourage investment and job creation. The report assesses the potential benefits and risks associated with deregulation.

- Targeted infrastructure spending: Focus on infrastructure projects deemed to deliver the highest economic returns. Goldman Sachs evaluates the efficiency and potential impact on GDP growth.

Keywords: Opposition Fiscal Policy, Opposition Budget, Opposition Spending, Opposition Economic Plan.

Goldman Sachs' Analysis of the Opposition's Revenue Projections

Goldman Sachs assesses the Opposition's revenue projections based on their proposed tax cuts. The report analyzes whether the projected revenue growth is sufficient to cover the reduced tax revenue and potential impact on government services. It also assesses the potential for unintended consequences, such as increased income inequality.

Keywords: Opposition Tax Policy, Opposition Revenue Projections.

Goldman Sachs' Overall Evaluation of the Opposition's Plan

Goldman Sachs' overall evaluation of the Opposition's plan highlights the potential for short-term economic benefits through increased consumer spending and investment. However, the report also emphasizes the long-term risks, such as potential increases in income inequality and the sustainability of fiscal policy in the long run. The report concludes with (insert direct quote from the Goldman Sachs report, if available).

Keywords: Goldman Sachs Opposition Analysis, Opposition Economic Outlook.

Direct Comparison: Labor vs. Opposition Fiscal Plans (Goldman Sachs Perspective)

| Feature | Labor Party | Opposition | Goldman Sachs Assessment |

|---|---|---|---|

| Spending | High, focused on social programs & infrastructure | Lower, focused on targeted infrastructure | Labor's plan poses higher debt risk. Opposition's relies on strong economic growth assumptions. |

| Tax Policy | Increased taxes in some areas | Significant tax cuts | Labor's higher revenue projections, but uncertainty around revenue targets. Opposition's lower revenue uncertain due to tax cuts. |

| Projected Debt | Higher | Lower (potentially) | Debt sustainability a key concern in both plans. |

| GDP Growth | Projected moderate growth | Projected potentially higher growth, but dependent on economic assumptions. | Growth projections are subject to economic conditions and policy effectiveness. |

| Employment | Positive impact expected | Positive impact expected, but potentially uneven distribution. | Both plans have potential for job creation, however detailed analysis is necessary. |

Keywords: Labor vs Opposition, Fiscal Policy Comparison, Economic Comparison, Budget Comparison.

Conclusion: Understanding the Implications of Australian Fiscal Policy Choices (Goldman Sachs Insights)

Goldman Sachs' analysis reveals distinct approaches to fiscal policy between the Australian Labor Party and the Opposition. Labor's plan prioritizes increased spending on social programs and infrastructure, potentially boosting economic growth but also increasing national debt. The Opposition’s plan emphasizes tax cuts and targeted spending, aiming to stimulate the economy through private sector investment. However, this approach carries its own risks, depending heavily on economic growth assumptions.

Understanding these differing perspectives is critical for Australian voters and investors. The Goldman Sachs report offers valuable insights into the potential economic consequences of each party's fiscal plan. We strongly encourage you to review the complete Goldman Sachs report for a comprehensive understanding of the Goldman Sachs analysis of Australian Labor and Opposition fiscal plans and conduct further independent research to form your own informed opinion.

Featured Posts

-

Mercer International Reports 2024 Year End Financial Results And Dividend

Apr 25, 2025

Mercer International Reports 2024 Year End Financial Results And Dividend

Apr 25, 2025 -

Understanding Cool Sculpting Complications Lessons From Linda Evangelistas Experience

Apr 25, 2025

Understanding Cool Sculpting Complications Lessons From Linda Evangelistas Experience

Apr 25, 2025 -

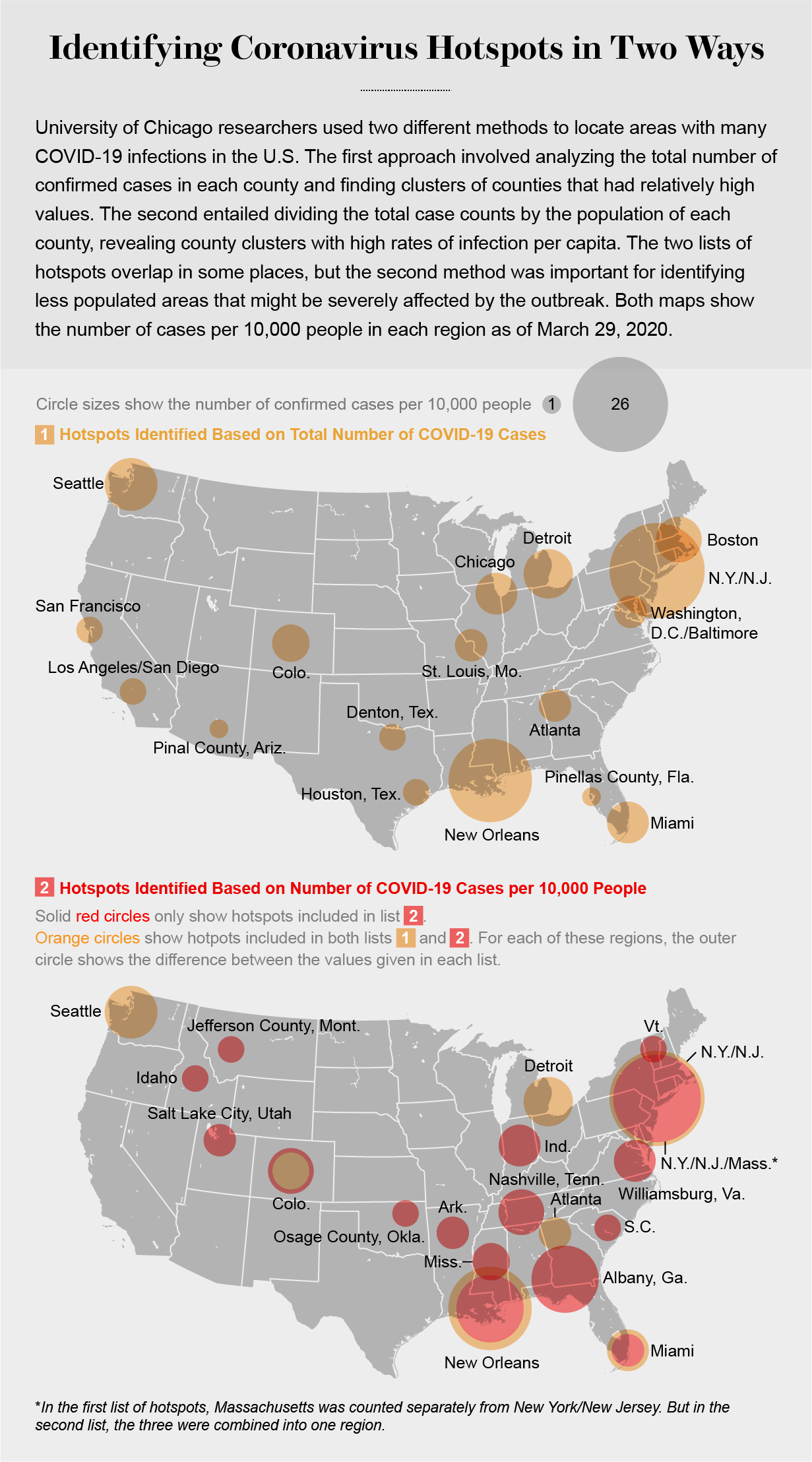

Analyzing The Growth Of New Business Hot Spots Across The Country

Apr 25, 2025

Analyzing The Growth Of New Business Hot Spots Across The Country

Apr 25, 2025 -

Stock Market Uncertainty Strategies For Long Term Investment Success

Apr 25, 2025

Stock Market Uncertainty Strategies For Long Term Investment Success

Apr 25, 2025 -

Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 25, 2025

Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 25, 2025

Latest Posts

-

Golden Knights Blank Blue Jackets 4 0 Hills Stellar Performance

May 10, 2025

Golden Knights Blank Blue Jackets 4 0 Hills Stellar Performance

May 10, 2025 -

Game 4 Recap Barbashevs Overtime Goal Secures Vegas Golden Knights Victory Against Minnesota Wild

May 10, 2025

Game 4 Recap Barbashevs Overtime Goal Secures Vegas Golden Knights Victory Against Minnesota Wild

May 10, 2025 -

Vegas Golden Knights Even Series Against Minnesota Wild With Barbashevs Overtime Winner

May 10, 2025

Vegas Golden Knights Even Series Against Minnesota Wild With Barbashevs Overtime Winner

May 10, 2025 -

Ivan Barbashevs Ot Goal Powers Vegas Golden Knights To Game 4 Victory Over Minnesota Wild

May 10, 2025

Ivan Barbashevs Ot Goal Powers Vegas Golden Knights To Game 4 Victory Over Minnesota Wild

May 10, 2025 -

Las Vegas Golden Knights Update Hertls Absence A Possibility Following Injury

May 10, 2025

Las Vegas Golden Knights Update Hertls Absence A Possibility Following Injury

May 10, 2025