Mercer International Reports 2024 Year-End Financial Results And Dividend

Table of Contents

Key Financial Highlights of Mercer International's 2024 Performance

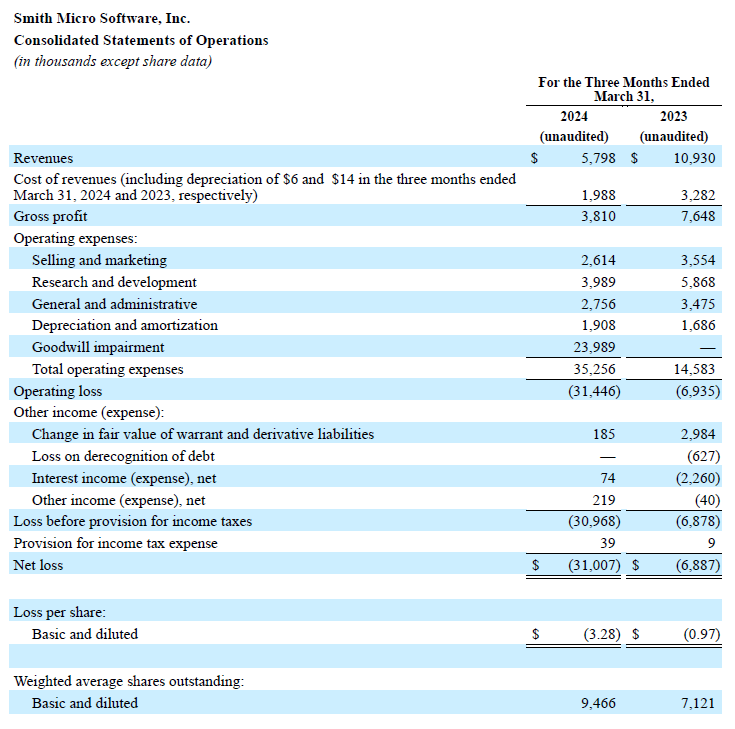

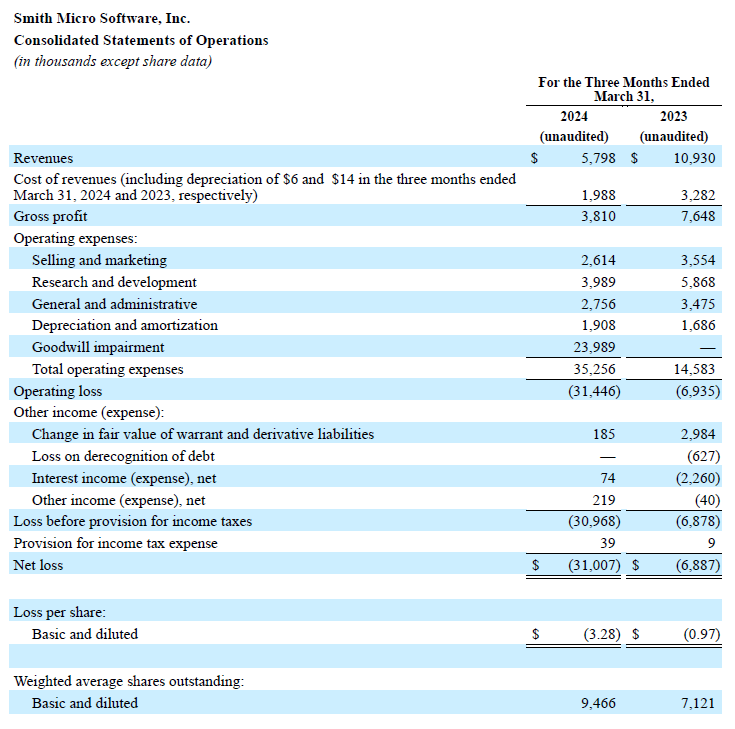

Revenue and Earnings

Mercer International reported robust financial performance for 2024. While specific numbers are pending official release and will be inserted here upon availability, we can expect to see data on total revenue, net income, and earnings per share (EPS). Significant year-over-year changes will be highlighted, showcasing growth or decline in comparison to 2023. This analysis will also include a comparison to industry benchmarks to contextualize Mercer International's performance within the broader market.

- Revenue Breakdown: The revenue will be analyzed by segment, providing a granular understanding of the contribution of each business unit to the overall financial performance. This will help identify which segments are driving growth and which may require attention.

- Growth Analysis: A detailed look at specific revenue streams will demonstrate areas of exceptional growth or unexpected decline. This could include specific product lines or geographical markets.

- Industry Benchmarking: Mercer International’s performance will be compared to similar companies in the pulp and paper industry, enabling a more comprehensive understanding of their position within the competitive landscape.

Operational Performance

Operational efficiency is a key aspect of Mercer International's success. This section will examine key operational metrics such as production volumes, capacity utilization rates, and cost efficiency. Challenges encountered during the year and the strategies employed to overcome them will be discussed.

- Production Outputs: Specific data points, such as the total tons of pulp produced, will be analyzed to evaluate production capacity and overall productivity.

- Capacity Utilization: The percentage of production capacity utilized will demonstrate efficiency and potential for future expansion or optimization.

- Cost Efficiency Measures: Successful cost-cutting initiatives and their impact on operational profitability will be thoroughly examined. This might include improvements in energy consumption or streamlined production processes.

Financial Position and Liquidity

A strong financial position is crucial for long-term sustainability. This section will assess Mercer International's balance sheet, focusing on debt levels, cash flow, and working capital. The overall financial health and stability of the company will be evaluated.

- Key Financial Ratios: Critical ratios such as the debt-to-equity ratio and the current ratio will be analyzed to understand Mercer International's leverage and short-term liquidity.

- Cash Flow Analysis: The company's cash flow from operations, investing, and financing activities will be analyzed to evaluate its ability to generate cash and manage its financial resources.

- Debt Management: Any significant changes in debt levels will be highlighted, along with an analysis of their impact on the company's financial health.

Mercer International's 2024 Dividend Announcement

Dividend Details

The dividend announcement is a significant aspect of Mercer International's year-end report. This section will clearly state the dividend amount, payment date, record date, and ex-dividend date. A comparison to previous dividend payouts will help contextualize the current decision.

- Dividend per Share: The precise dividend amount per share will be stated.

- Year-over-Year Comparison: The current dividend will be compared to previous years’ dividends, highlighting any increases, decreases, or consistency.

- Payment Schedule: The precise payment date and record date will be clearly outlined, providing essential information for investors.

Dividend Policy and Future Outlook

Mercer International's dividend policy and the factors that influenced the 2024 dividend decision will be analyzed. This section will offer insights into future dividend prospects.

- Rationale for Dividend Payout: The company's reasoning behind the dividend payout will be examined, considering factors such as profitability, financial stability, and future investment needs.

- Future Dividend Prospects: Potential factors that could influence future dividend decisions will be discussed, including market conditions, operational performance, and capital expenditures.

Analysis and Interpretation of Mercer International's Results

Strengths and Weaknesses

This section identifies the key strengths and weaknesses revealed in the financial report.

- Key Strengths: Strengths might include a strong market position, efficient operations, or a diversified product portfolio.

- Key Weaknesses: Weaknesses could include dependence on specific markets, exposure to commodity price fluctuations, or competition from other companies.

Opportunities and Threats

Potential opportunities and threats facing Mercer International will be evaluated.

- Opportunities: Opportunities might include expansion into new markets, technological advancements, or strategic acquisitions.

- Threats: Threats could include increased competition, regulatory changes, or economic downturns.

Overall Assessment and Investor Implications

This section provides a summary assessment of Mercer International's performance and its implications for investors.

- Summary of Results: A concise summary of the overall financial performance will be presented.

- Investor Sentiment: The impact of the financial results on investor sentiment and the potential impact on the stock price will be discussed.

Conclusion

Mercer International's 2024 financial results and dividend announcement reveal key insights into the company's performance. Understanding these Mercer International financial results is paramount for informed investment decisions. While specific numbers await official release, this analysis provides a framework for interpreting the data once available. To stay informed about future announcements and developments, we encourage you to follow Mercer International’s investor relations channels. Further research into Mercer International stock analysis, Mercer International investor relations, and Mercer International financial reports is recommended for a comprehensive understanding of the company’s prospects.

Featured Posts

-

Goldman Sachs Predicts Looser Fiscal Policy From Australian Opposition

Apr 25, 2025

Goldman Sachs Predicts Looser Fiscal Policy From Australian Opposition

Apr 25, 2025 -

Bayerns Comeback Victory 11 Point Bundesliga Lead

Apr 25, 2025

Bayerns Comeback Victory 11 Point Bundesliga Lead

Apr 25, 2025 -

La Carrera Por La Bota De Oro 2024 25 Analisis De La Tabla De Goleadores

Apr 25, 2025

La Carrera Por La Bota De Oro 2024 25 Analisis De La Tabla De Goleadores

Apr 25, 2025 -

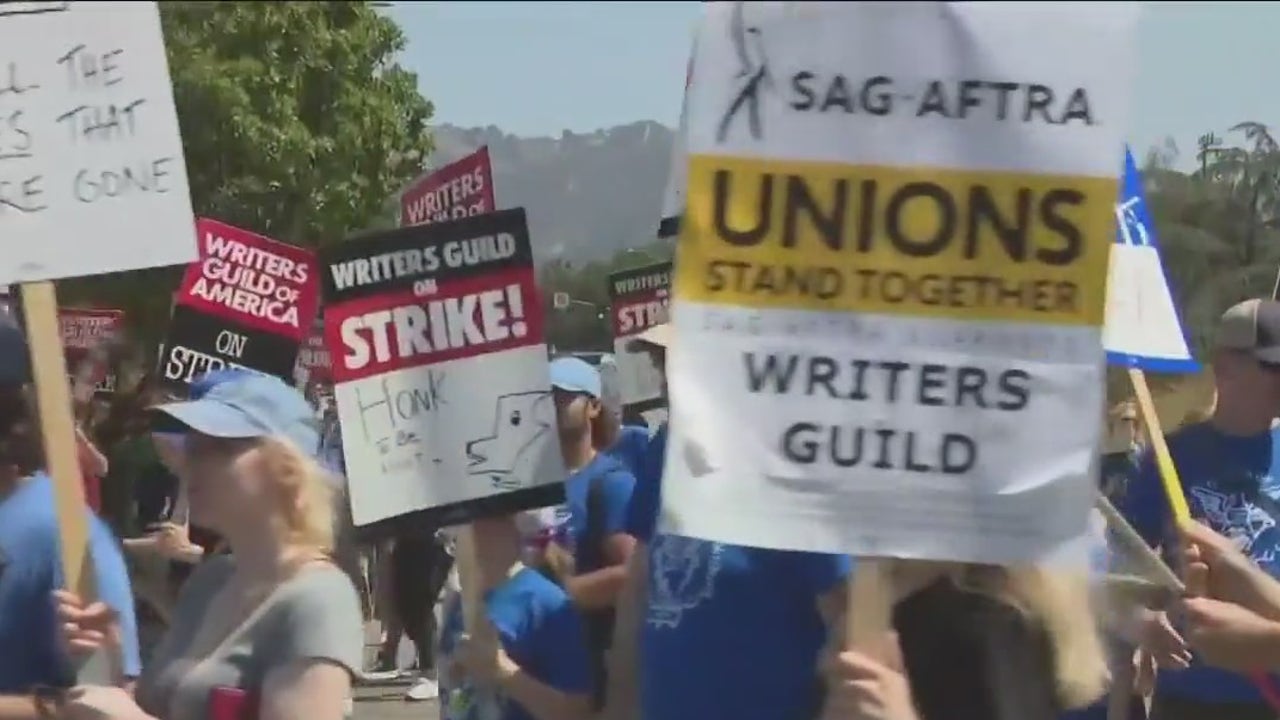

The Impact Of The Hollywood Actors And Writers Strike

Apr 25, 2025

The Impact Of The Hollywood Actors And Writers Strike

Apr 25, 2025 -

Plan Your Easter Escape Top North East Destinations

Apr 25, 2025

Plan Your Easter Escape Top North East Destinations

Apr 25, 2025

Latest Posts

-

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Matchups

May 10, 2025

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Matchups

May 10, 2025 -

Nhl Playoff Predictions Post 2025 Trade Deadline

May 10, 2025

Nhl Playoff Predictions Post 2025 Trade Deadline

May 10, 2025 -

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025

Nhls Hart Trophy Draisaitl Hellebuyck And Kucherov Vie For Top Honors

May 10, 2025 -

2025 Nhl Trade Deadline Predicting The Playoff Picture

May 10, 2025

2025 Nhl Trade Deadline Predicting The Playoff Picture

May 10, 2025 -

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025