Gold Price Surge Follows Trump's Softer Tone: Market Analysis

Table of Contents

Trump's Softer Tone and its Impact on Geopolitical Uncertainty

Trump's recent adoption of a less aggressive tone regarding international relations has had a palpable impact on global markets. This shift in rhetoric has led to a perceived reduction in geopolitical risks, influencing investor sentiment considerably. A more conciliatory approach towards trade partners and a less bellicose stance on foreign policy have calmed some of the market anxieties that have fueled gold prices in the past.

- Reduced trade war tensions: The easing of trade disputes, particularly with China, has lessened fears of escalating economic conflict. This positive development contributes to a decrease in uncertainty.

- Decreased likelihood of immediate military conflicts: A more diplomatic approach to international conflicts reduces the perceived probability of immediate military intervention, thus decreasing the need for safe-haven assets.

- Impact on global economic stability: Reduced geopolitical tensions generally contribute to greater global economic stability, making riskier assets more attractive and potentially diminishing the demand for gold.

- Shift in investor confidence and risk appetite: Investors, sensing a decrease in immediate threats, may shift their portfolios away from safer assets like gold toward higher-yielding investments.

Historical data demonstrates a clear correlation between Trump's past pronouncements and market reactions. For example, [Insert data/chart showing market reaction to a specific past statement - e.g., a specific tweet or press conference]. This visual representation underscores the significant influence of political rhetoric on investor behavior and the gold price.

Safe-Haven Demand and the Gold Price Surge

Gold is widely recognized as a safe-haven asset, meaning its value tends to increase during times of economic or political uncertainty. The recent gold price surge, while partially attributed to Trump's softer tone, highlights the complex interplay of investor behavior. The initial reaction to a less aggressive political climate might be a reduction in safe-haven demand for gold. However, this nuanced relationship is influenced by several other factors.

- Increased demand for gold as a hedge against geopolitical and economic instability: While reduced immediate risks exist, lingering uncertainties about long-term global stability could still drive demand for gold as a hedge against unforeseen events.

- How investor behavior contributes to price increases: Even a slight increase in perceived risk can trigger a wave of buying, pushing up the gold price. The gold market is particularly susceptible to shifts in investor sentiment.

- Correlation between reduced geopolitical risk and gold price movement: While often negatively correlated in the short term (less risk, less gold demand), the relationship is not always straightforward and depends on the overall market context.

- Mention other factors contributing to the demand (e.g., inflation concerns): Inflationary pressures can independently boost gold demand, as it’s seen as a hedge against inflation's erosion of purchasing power.

Analyzing Other Contributing Factors to the Gold Price Surge

While Trump's statements played a role, it's crucial to acknowledge other factors that contribute to the recent gold price surge. A holistic understanding requires considering a multitude of economic and market forces.

- Weakening US dollar: A weaker US dollar typically makes gold, priced in dollars, more attractive to international buyers, thereby increasing demand.

- Central bank policies: Monetary policies adopted by central banks around the world, including interest rate adjustments, can influence gold prices. For example, quantitative easing can increase inflation and indirectly boost gold demand.

- Inflationary pressures: Rising inflation erodes the purchasing power of fiat currencies, making gold, a tangible asset, a more appealing investment.

- Supply and demand dynamics in the gold market: The overall supply and demand dynamics in the gold market inherently impact price fluctuations. Increased mining production, for instance, could exert downward pressure.

- Impact of major gold mining companies' production: Changes in production output by leading gold mining companies also influence the overall supply and impact pricing.

Predicting Future Gold Price Trends Based on Current Market Dynamics

Predicting future gold prices with certainty is impossible, but by analyzing current market dynamics, we can outline potential scenarios. The interplay of geopolitical factors, macroeconomic indicators, and investor sentiment will be crucial in determining future price movements.

- Potential scenarios for future price movement: A continuation of Trump's softer tone could lead to sustained lower gold prices. Conversely, unexpected geopolitical events could trigger renewed demand.

- Factors that could lead to further price increases or decreases: Changes in US monetary policy, global economic growth rates, and shifting investor risk appetite will significantly influence future gold prices.

- Importance of ongoing market monitoring: Continuous monitoring of news and market data is essential for navigating the complexities of the gold market.

- Recommendations for investors (e.g., diversification): Investors should consider diversifying their portfolios to mitigate risks and capitalize on different market trends.

Conclusion:

The recent gold price surge is a complex phenomenon driven by a confluence of factors. While Trump's less aggressive rhetoric played a role by initially reducing perceived geopolitical risks, other market forces, including inflation concerns, a weakening dollar, and supply/demand dynamics, also contributed significantly. Understanding the intricate relationship between geopolitical events and gold market behavior is crucial for informed investment decisions. To stay ahead of the curve in this dynamic market, consistently monitoring gold prices, following financial news, and conducting thorough market analysis are essential. Subscribe to our newsletter for updates and insights on the ever-evolving gold price and related market trends.

Featured Posts

-

Inspirasi Meja Rias Sederhana And Elegan Untuk Rumah Anda 2025

Apr 25, 2025

Inspirasi Meja Rias Sederhana And Elegan Untuk Rumah Anda 2025

Apr 25, 2025 -

Sadie Sinks Age Implications For Mcu Casting And Spider Man 4

Apr 25, 2025

Sadie Sinks Age Implications For Mcu Casting And Spider Man 4

Apr 25, 2025 -

5 Positive Review Trends For Ridley Scotts Apple Tv Show

Apr 25, 2025

5 Positive Review Trends For Ridley Scotts Apple Tv Show

Apr 25, 2025 -

April 1945 A Month Of Pivotal World Events

Apr 25, 2025

April 1945 A Month Of Pivotal World Events

Apr 25, 2025 -

Trump Hosts Elite Group Of Meme Coin Investors For Private Dinner

Apr 25, 2025

Trump Hosts Elite Group Of Meme Coin Investors For Private Dinner

Apr 25, 2025

Latest Posts

-

R5 1078

May 10, 2025

R5 1078

May 10, 2025 -

Stock Market Today Sensex Nifty Close Higher Ultra Tech Cement Dips

May 10, 2025

Stock Market Today Sensex Nifty Close Higher Ultra Tech Cement Dips

May 10, 2025 -

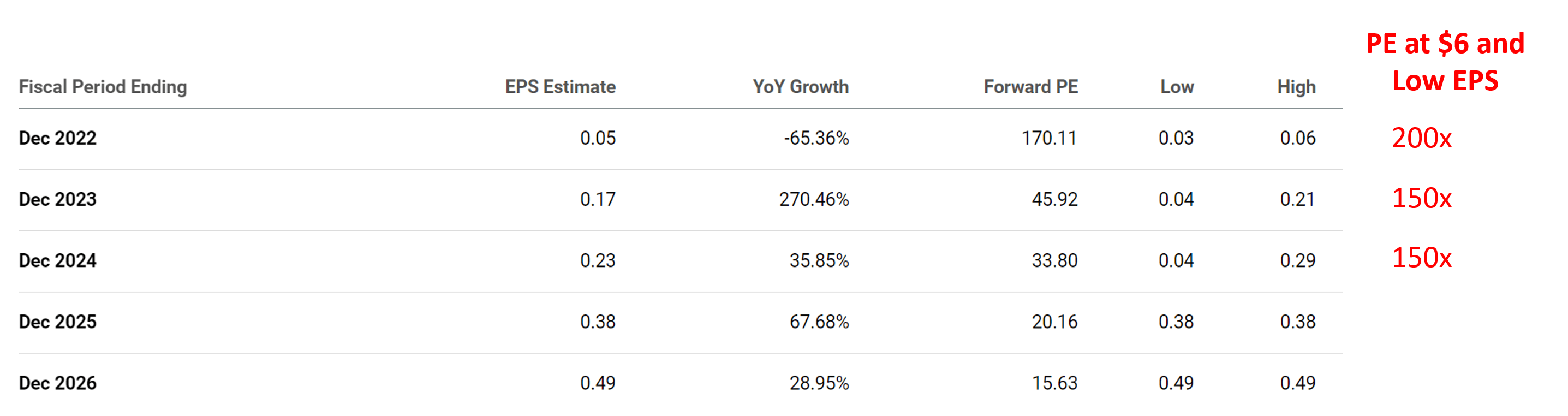

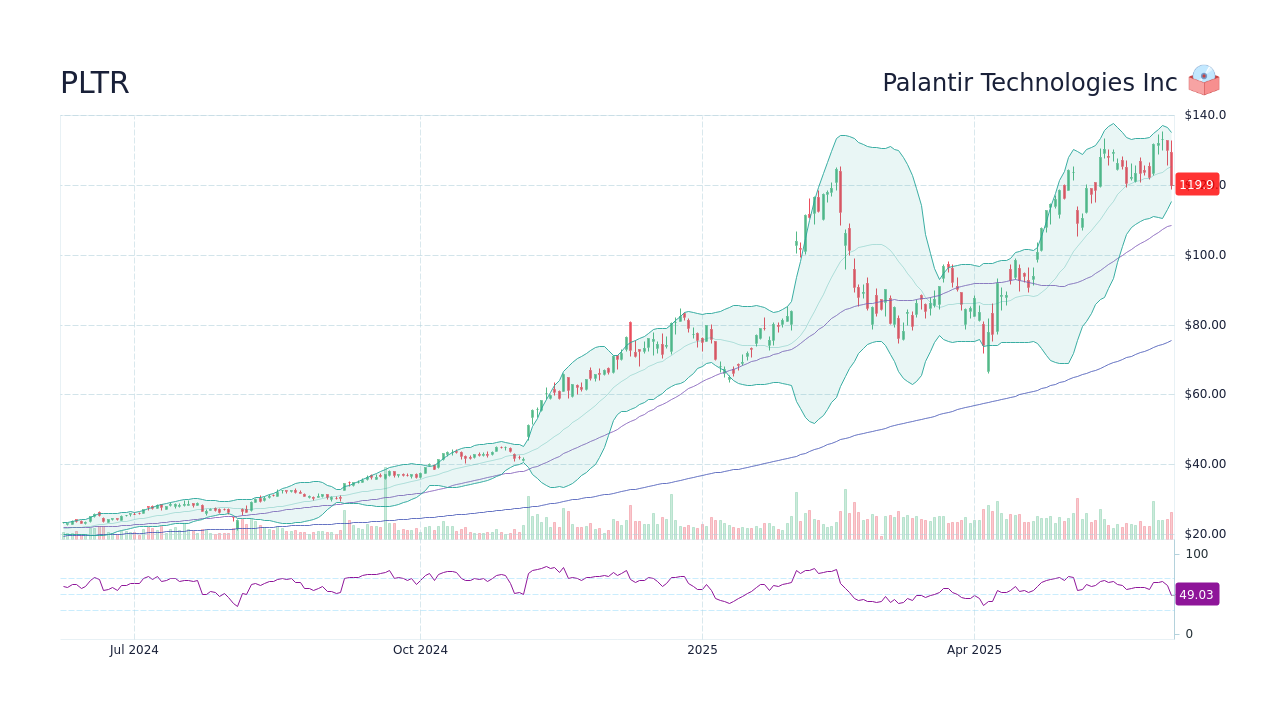

Evaluating Palantir Following A 30 Market Correction

May 10, 2025

Evaluating Palantir Following A 30 Market Correction

May 10, 2025 -

Palantirs 30 Decline Investment Strategy Considerations

May 10, 2025

Palantirs 30 Decline Investment Strategy Considerations

May 10, 2025 -

Palantir Stock Price Drop A Detailed Analysis And Investment Recommendation

May 10, 2025

Palantir Stock Price Drop A Detailed Analysis And Investment Recommendation

May 10, 2025