Palantir's 30% Decline: Investment Strategy Considerations

Table of Contents

Understanding Palantir's Recent Performance

Analyzing the 30% Decline

Palantir's 30% stock price decline wasn't a sudden crash but rather a gradual decrease over [Insert timeframe, e.g., the last quarter]. This decline significantly impacted investor sentiment, leading to increased uncertainty surrounding the future of PLTR stock. Comparing this performance to the broader tech sector reveals [Insert comparison data, e.g., whether it underperformed or outperformed the Nasdaq].

- Specific dates of decline: [Insert key dates and percentage drops for each date]

- Percentage changes: [Insert precise percentage changes during the decline period]

- Comparison to tech sector performance: [Insert data comparing PLTR's performance to relevant tech indices]

- Volume traded during the decline: [Insert data on trading volume during the decline, indicating potential selling pressure]

Key Financial Indicators

Analyzing Palantir's financial health is crucial for assessing the validity of the recent decline. While Palantir demonstrates strong revenue growth, profitability remains a key area of focus for investors.

- Revenue figures for recent quarters: [Insert revenue figures for the last few quarters, highlighting growth trends]

- Profit margins: [Insert profit margin data, showing trends and comparing to previous periods]

- Debt-to-equity ratio: [Insert the debt-to-equity ratio, indicating financial leverage]

- Cash flow: [Insert cash flow data, illustrating the company's financial liquidity]

Factors Contributing to Palantir's Stock Price Drop

Market Sentiment and Macroeconomic Factors

The recent decline in Palantir stock isn't solely attributable to company-specific issues. Broader macroeconomic factors and prevailing market sentiment have played a significant role.

- Impact of inflation: Rising inflation and the Federal Reserve's response have created uncertainty in the market, impacting investor risk appetite, particularly for growth stocks like Palantir.

- Federal Reserve policy: Interest rate hikes aimed at curbing inflation have increased borrowing costs, negatively affecting the valuation of many technology companies.

- General investor sentiment towards tech stocks: A general shift in investor sentiment towards tech stocks, driven by concerns about growth and valuation, has contributed to the sell-off.

Company-Specific Challenges

While macroeconomic factors played a role, some company-specific challenges might have exacerbated the stock price decline.

- Competitive landscape analysis: Increased competition in the data analytics market requires Palantir to continuously innovate and adapt to maintain its market share.

- Specific market segment struggles: Challenges in penetrating specific market segments or experiencing slower-than-expected growth in certain areas could be contributing factors.

- Challenges with government contracts: Any delays or setbacks in securing or fulfilling government contracts could negatively impact revenue and investor confidence.

- R&D spending: High R&D spending, while essential for innovation, can impact short-term profitability and influence investor sentiment.

- Execution risks: Challenges in executing its growth strategy, scaling operations, or integrating acquisitions could also contribute to the stock price drop.

Investment Strategy Considerations Following the Decline

Risk Assessment and Due Diligence

Before making any investment decisions regarding Palantir stock, thorough due diligence is paramount.

- Reviewing Palantir's financial statements: Carefully analyze Palantir's financial reports to gain a comprehensive understanding of its financial health and performance.

- Assessing long-term growth potential: Consider Palantir's long-term growth prospects in the rapidly evolving data analytics market.

- Understanding the company's competitive advantages and disadvantages: Identify Palantir's strengths and weaknesses compared to its competitors.

Diversification and Portfolio Management

Effective portfolio management necessitates diversification to mitigate risk.

- Allocating assets across different sectors and asset classes: Diversifying your investments reduces the impact of any single stock's underperformance.

- Adjusting investment strategies based on risk tolerance: Your investment strategy should reflect your individual risk tolerance and financial goals.

Buy the Dip or Sell? A Balanced Perspective

The decision of whether to buy the dip or sell Palantir stock depends on your individual risk tolerance, investment horizon, and assessment of the company's long-term prospects.

- Arguments for buying the dip: The decline might present an opportunity to acquire undervalued shares, especially if you believe in Palantir's long-term growth potential.

- Arguments for selling: The decline could indicate further downward pressure, and selling might be prudent if you're concerned about the company's future performance or your risk tolerance is low.

- Considerations of individual investor goals and risk tolerance: Your investment decisions should align with your personal financial goals and risk profile.

Conclusion

Palantir's 30% stock price decline is a complex situation influenced by both macroeconomic factors and company-specific challenges. Investors need to carefully weigh the potential risks and rewards before making any decisions concerning their Palantir stock holdings (or potential new investments in PLTR stock). Thorough due diligence, risk assessment, and a well-diversified portfolio are crucial. Before making any decisions, consider consulting a financial advisor to ensure your investment strategy aligns with your personal financial goals and risk tolerance. Understanding the intricacies of Palantir stock and the broader market is key to making informed investment decisions.

Featured Posts

-

Nyt Spelling Bee April 1 2025 Finding The Pangram And All Words

May 10, 2025

Nyt Spelling Bee April 1 2025 Finding The Pangram And All Words

May 10, 2025 -

Weston Cage Cope Ongoing Legal Battle With Father Nicolas Cage

May 10, 2025

Weston Cage Cope Ongoing Legal Battle With Father Nicolas Cage

May 10, 2025 -

150 Million Settlement For Credit Suisse Whistleblowers

May 10, 2025

150 Million Settlement For Credit Suisse Whistleblowers

May 10, 2025 -

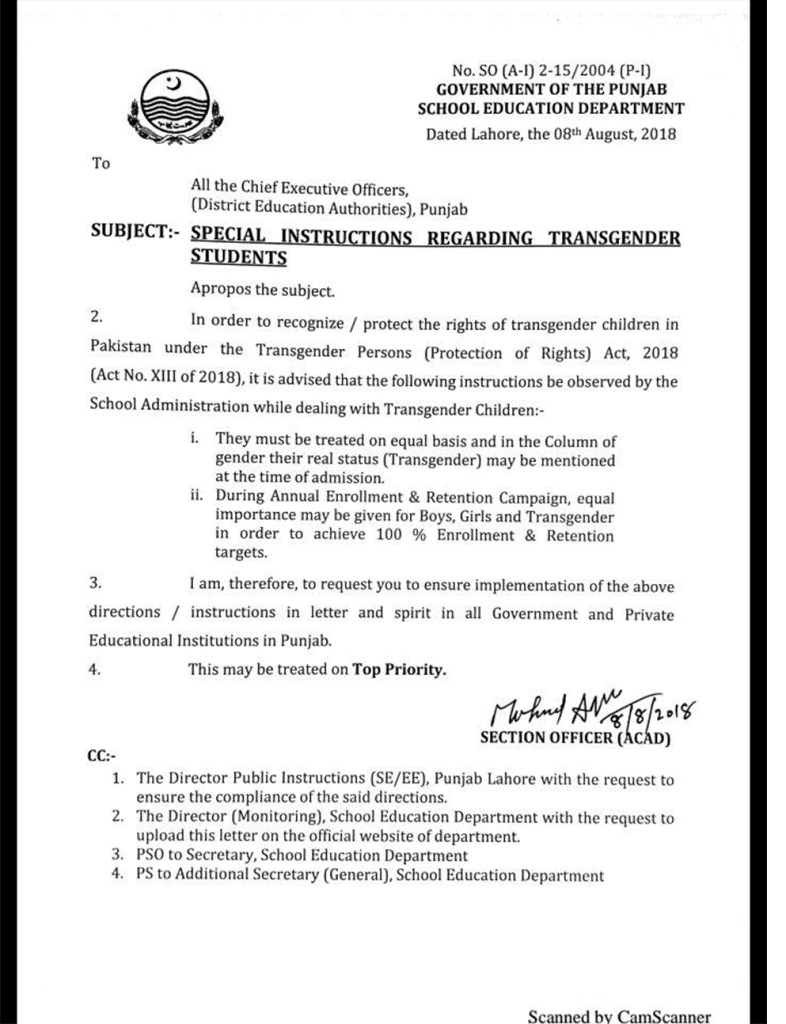

Empowering Transgenders In Punjab Through Technical Training

May 10, 2025

Empowering Transgenders In Punjab Through Technical Training

May 10, 2025 -

Pam Bondis Statement On The Epstein Case Files

May 10, 2025

Pam Bondis Statement On The Epstein Case Files

May 10, 2025