Evaluating Palantir Following A 30% Market Correction

Table of Contents

Understanding the 30% Market Correction

Factors Contributing to the Decline

Several factors contributed to Palantir's recent 30% market correction. Understanding these is crucial for any Palantir stock evaluation. These include:

- Broader Market Sell-Off: The recent downturn wasn't isolated to Palantir; broader market volatility impacted many tech stocks, particularly those with high growth expectations and less established profitability. This overall market sentiment negatively affected Palantir's stock price.

- Analyst Downgrades: Several financial analysts lowered their price targets for PLTR, citing concerns about slowing revenue growth and increasing competition within the data analytics market. These downgrades fueled further selling pressure.

- Concerns About Specific Contracts: While Palantir continues to secure significant government contracts, concerns regarding the renewal of certain key contracts and the timing of future awards have contributed to investor uncertainty and impacted Palantir stock price.

- Increased Interest Rates: The rising interest rate environment has impacted the valuation of high-growth technology companies like Palantir, making alternative investments more attractive.

Analyzing Palantir's Financial Performance

Analyzing Palantir's financials is vital in any Palantir post-correction analysis. While revenue growth remains positive, several factors warrant attention:

- Revenue Growth: While Palantir has shown consistent revenue growth, the rate of growth has slowed in recent quarters, fueling concerns among some investors. This slowing growth needs to be considered against the backdrop of broader market conditions and the company's ongoing strategic initiatives.

- Profitability: Palantir is still working towards consistent profitability, and its path to profitability is a key factor to consider in a Palantir stock evaluation. Investors need to carefully analyze the company's operating expenses and margins to assess its long-term financial sustainability.

- Cash Flow: Examining Palantir's cash flow statement is essential. While the company has a substantial cash reserve, its ability to generate positive free cash flow consistently remains a key metric for evaluating long-term value. Consistent positive cash flow is crucial for sustainable growth and investment in future projects.

Evaluating Palantir's Long-Term Growth Potential

Despite the recent correction, Palantir's long-term growth potential remains a key factor in any comprehensive Palantir stock evaluation.

Government Contracts and Future Opportunities

Palantir’s significant presence in government contracts, particularly within national security and defense spending, provides a substantial revenue stream. However, dependence on this sector carries inherent risks. Future growth will rely on:

- Securing New Government Contracts: Palantir's ability to secure new contracts, both domestically and internationally, is crucial for its continued success. Analyzing government spending trends and Palantir's competitive position in bidding processes is vital.

- Expanding Existing Contracts: The extension and expansion of existing contracts with government agencies will be key to maintaining and growing this revenue stream.

Commercial Market Expansion

Palantir's commercial market expansion is a vital component of its long-term growth strategy. Its success hinges on:

- Attracting New Commercial Clients: Success in acquiring new clients in various sectors (finance, healthcare, etc.) will be crucial to diversifying its revenue streams and reducing reliance on government contracts. Analyzing the company's progress in this area is a critical part of any Palantir stock evaluation.

- Expanding Product Offerings: Continuous innovation and expansion of its product offerings to cater to the diverse needs of commercial clients will be essential. This includes adapting its AI solutions and data integration capabilities to meet the specific requirements of different industries.

Technological Innovation and Competitive Advantage

Palantir’s technological innovation is a significant factor in its competitive advantage within the data analytics and AI market.

- Artificial Intelligence (AI) advancements: Palantir is heavily investing in AI and machine learning capabilities, which are crucial for maintaining a competitive edge in the ever-evolving data analytics landscape.

- Data Integration Capabilities: The ability to integrate data from disparate sources remains a key differentiator. Palantir's strength in this area is a core aspect of its value proposition.

Assessing the Risk and Reward

Any Palantir stock evaluation must consider both the potential risks and rewards.

Potential Risks and Challenges

Investing in Palantir carries several inherent risks:

- Competition: The data analytics and AI market is intensely competitive, with established players and emerging startups vying for market share. Competition analysis is vital.

- Regulatory Hurdles: Navigating the complex regulatory landscape, particularly in the government sector, presents significant challenges. Regulatory risks need to be carefully considered in any investment strategy.

- Dependence on Key Contracts: As previously discussed, reliance on a few large government contracts creates significant financial risk.

Investment Opportunities and Potential Returns

Despite these risks, the potential returns from investing in Palantir at its current valuation could be substantial, particularly for long-term investors.

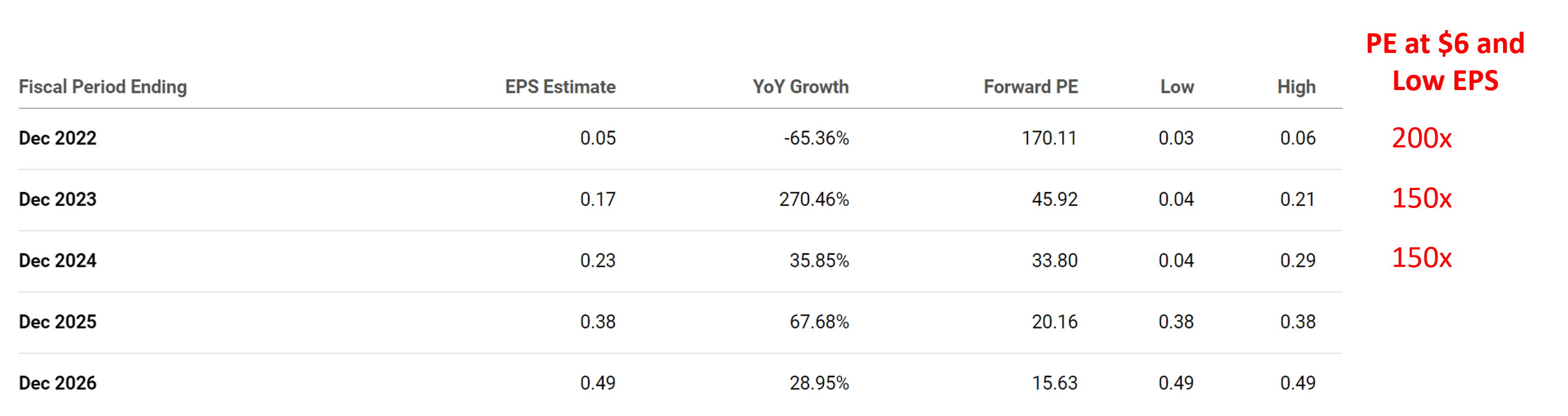

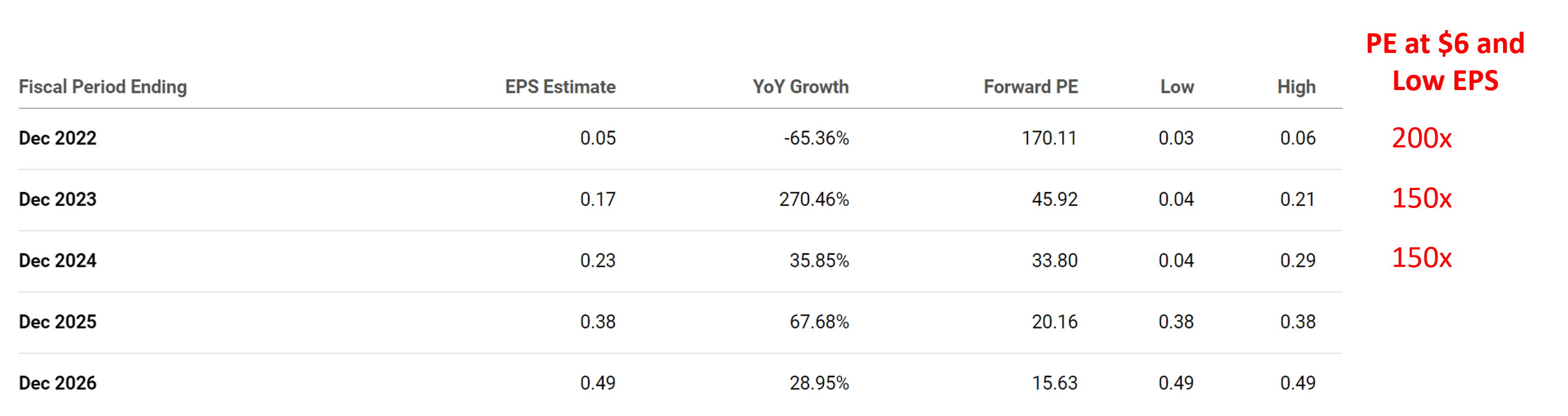

- Stock Valuation: A thorough stock valuation considering various financial models is critical to determining whether the current market price reflects the company's intrinsic value.

- Investment Strategy: Different investment strategies, such as dollar-cost averaging, might mitigate some of the risks associated with investing in a volatile stock like Palantir.

Conclusion: Should You Invest in Palantir After the Correction?

This analysis of evaluating Palantir following a 30% market correction highlights both significant risks and considerable growth potential. The recent downturn, influenced by broader market volatility, analyst downgrades, and concerns about contract renewals, presents a complex investment scenario. While Palantir's reliance on government contracts and its path to consistent profitability pose challenges, its innovative technology, expanding commercial market presence, and long-term growth prospects offer compelling opportunities. Ultimately, the decision of whether or not to invest in Palantir depends on your individual risk tolerance, investment horizon, and thorough due diligence. Remember to conduct your own in-depth research and consider consulting with a qualified financial advisor before making any investment decisions related to evaluating Palantir following a 30% market correction. Make informed choices regarding your Palantir investments.

Featured Posts

-

Impact Of Stricter Uk Visa Policies On Pakistani Students And Asylum Applications

May 10, 2025

Impact Of Stricter Uk Visa Policies On Pakistani Students And Asylum Applications

May 10, 2025 -

Jazz Cash And K Trade A New Era Of Accessible Stock Trading

May 10, 2025

Jazz Cash And K Trade A New Era Of Accessible Stock Trading

May 10, 2025 -

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Is Tikruju Ivyko

May 10, 2025

Dakota Johnson Kraujingos Plintos Nuotraukos Kas Is Tikruju Ivyko

May 10, 2025 -

New Uk Visa Regulations Nigeria And Pakistan Face Stricter Scrutiny

May 10, 2025

New Uk Visa Regulations Nigeria And Pakistan Face Stricter Scrutiny

May 10, 2025 -

La Fires Fuel Housing Crisis Landlord Price Gouging Claims Investigated

May 10, 2025

La Fires Fuel Housing Crisis Landlord Price Gouging Claims Investigated

May 10, 2025