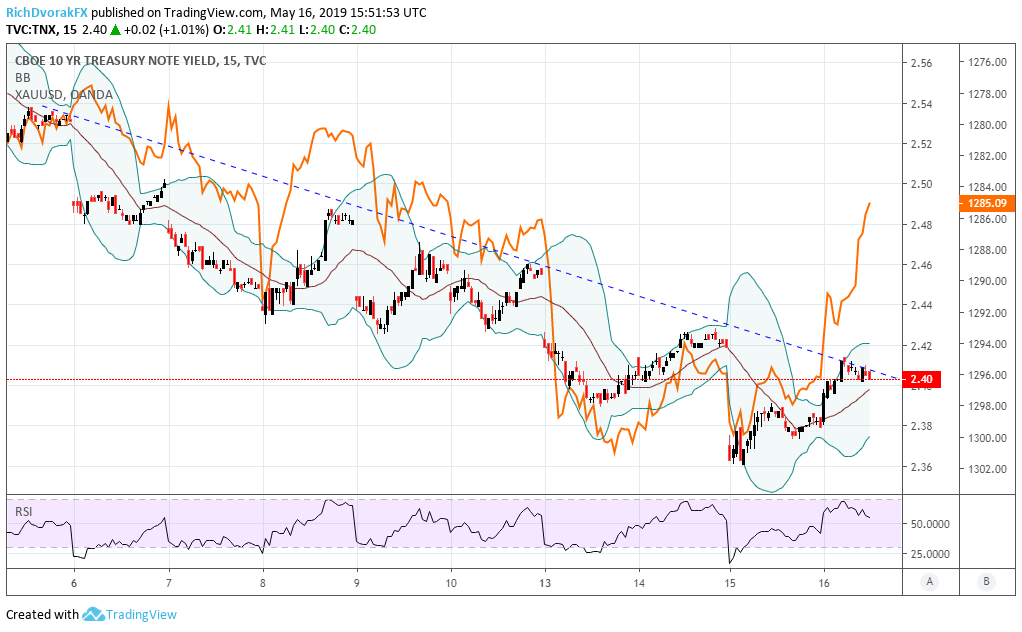

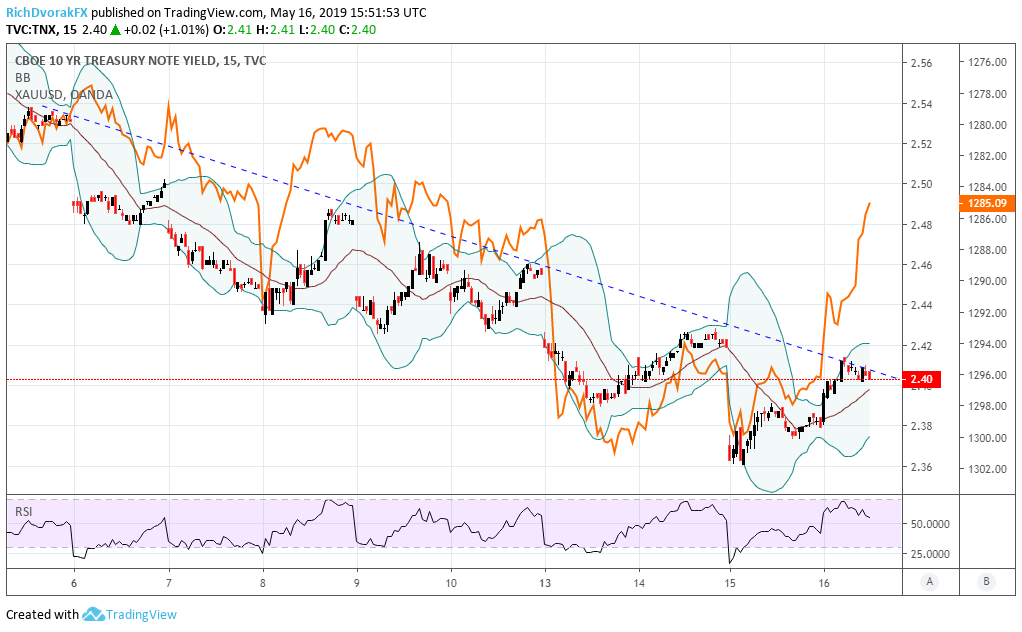

Gold Price Drops: Two Consecutive Weekly Losses In 2025

Table of Contents

Factors Contributing to the Gold Price Drops

Several interconnected factors contributed to the recent gold price drops. Understanding these elements is crucial for investors seeking to make informed decisions.

Strengthening US Dollar

The US dollar's recent surge in value is a primary driver of the gold price drops. Gold is priced in US dollars, so a stronger dollar makes gold more expensive for those holding other currencies. This naturally reduces demand, leading to a price decrease.

- Increased interest rates in the US boosting the dollar: The Federal Reserve's monetary policy, including raising interest rates, has made the dollar a more attractive investment, increasing its value.

- Global economic uncertainty driving safe-haven flows into the dollar: During times of global uncertainty, investors often flock to the perceived safety of the US dollar, further strengthening it.

- Impact on international gold investors: A stronger dollar makes gold purchases more expensive for international investors, thus decreasing global demand and contributing to gold price drops.

Increased Interest Rates

Higher interest rates make holding non-interest-bearing assets like gold less appealing. Investors can earn returns on interest-bearing accounts and bonds, making these alternatives more attractive than gold, which doesn't offer interest.

- Impact of Federal Reserve policy on gold prices: The Federal Reserve's decisions regarding interest rates directly influence investor behavior and consequently, gold prices.

- Comparison of gold returns vs. bond yields: When bond yields rise, the opportunity cost of holding gold increases, as the potential returns from bonds become more attractive.

- The effect of rising interest rates on investor sentiment: Rising interest rates can shift investor sentiment away from precious metals and towards fixed-income investments.

Profit-Taking by Investors

After a period of sustained gold price increases, some investors may have decided to secure their profits by selling their gold holdings. This selling pressure contributed to the downward trend in gold prices.

- Analysis of trading volume and investor behavior: Increased trading volume during the price drops suggests significant selling activity by investors.

- Short-term vs. long-term investment strategies: Short-term investors are more likely to react to price fluctuations and engage in profit-taking, while long-term investors typically hold onto their gold investments regardless of short-term volatility.

- The role of speculative trading in price volatility: Speculative trading can amplify price swings, both upwards and downwards, exacerbating the impact of other factors on gold prices.

Impact on the Gold Market and Investors

The recent gold price drops have significant implications for both the market and investors, both in the short and long term.

Short-Term Implications

The two consecutive weeks of losses signal a potential shift in market sentiment, potentially leading to further short-term price corrections. This volatility presents both risks and opportunities.

- Volatility in the gold futures market: Futures contracts experienced increased volatility, reflecting the uncertainty surrounding gold's future price direction.

- Impact on gold mining companies' stock prices: Gold mining companies' stock prices often correlate with gold prices, meaning they were also impacted by the recent drop.

- Advice for short-term gold traders: Short-term traders should exercise caution and consider hedging strategies to mitigate potential losses during this period of increased volatility.

Long-Term Outlook for Gold

Despite the recent dip, many analysts maintain a positive long-term outlook for gold. Its role as a hedge against inflation and economic uncertainty remains a key factor supporting its long-term value.

- Analysis of historical gold price trends: Historical data shows gold's ability to retain value over the long term, often appreciating during times of economic instability.

- Geopolitical factors influencing long-term gold demand: Geopolitical risks and uncertainty often drive increased demand for gold as a safe haven asset.

- The role of gold in diversification strategies: Gold continues to play a vital role in diversified investment portfolios, providing a hedge against other asset classes.

Strategies for Investors During Gold Price Drops

Periods of gold price drops can present both challenges and opportunities for investors. Here are some strategies to consider.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount at regular intervals, regardless of price fluctuations. This strategy helps mitigate the risk of buying at a market peak.

- Mitigates the risk of investing a lump sum at a market peak: Dollar-cost averaging spreads out the risk of investing a large amount at an inopportune time.

- Helps average out the purchase price over time: By buying regularly, investors benefit from averaging their purchase price over both high and low periods.

- Ideal for long-term gold investors: This strategy is particularly suitable for long-term investors who are less concerned about short-term price fluctuations.

Holding or Buying More Gold

For long-term investors, a price drop can be seen as an opportunity to acquire more gold at a lower cost, increasing their holdings.

- Assessing personal risk tolerance and investment goals: Investors should carefully evaluate their personal financial situation and investment goals before making any significant changes to their gold holdings.

- Understanding the benefits of long-term gold ownership: Gold's inherent value and its role as a hedge against inflation make it a desirable asset for long-term investors.

- Comparing physical gold vs. gold ETFs: Investors can choose between physically holding gold or investing in gold exchange-traded funds (ETFs), each with its own advantages and disadvantages.

Conclusion

The recent gold price drops, representing two consecutive weeks of losses in 2025, are likely due to a combination of factors: a stronger US dollar, higher interest rates, and profit-taking. While this may lead to short-term volatility, many believe the long-term outlook for gold remains positive. Investors should carefully consider their risk tolerance and investment timeline when making decisions about their gold holdings. Understanding these factors and employing strategies like dollar-cost averaging can help you navigate the fluctuations of the gold market and potentially capitalize on opportunities presented by periods of gold price drops. Stay informed about gold price drops and market trends to make sound investment decisions.

Featured Posts

-

Sheins Stalled London Ipo Us Tariffs Take Their Toll

May 05, 2025

Sheins Stalled London Ipo Us Tariffs Take Their Toll

May 05, 2025 -

Andrew Cuomos Undisclosed Nuclear Startup Stock Options A 3 Million Question

May 05, 2025

Andrew Cuomos Undisclosed Nuclear Startup Stock Options A 3 Million Question

May 05, 2025 -

How Norways Top Investor Nicolai Tangen Navigated Trumps Tariffs

May 05, 2025

How Norways Top Investor Nicolai Tangen Navigated Trumps Tariffs

May 05, 2025 -

Unlocking The Tampa Bay Derby 2025 Odds Field Preview And Kentucky Derby Predictions

May 05, 2025

Unlocking The Tampa Bay Derby 2025 Odds Field Preview And Kentucky Derby Predictions

May 05, 2025 -

Cult Group Members Jailed For Childs Disturbing Death

May 05, 2025

Cult Group Members Jailed For Childs Disturbing Death

May 05, 2025

Latest Posts

-

Exploring Fleetwood Macs Vast And Successful Music Catalog

May 05, 2025

Exploring Fleetwood Macs Vast And Successful Music Catalog

May 05, 2025 -

The Buckingham Fleetwood Reunion Hope For A Fleetwood Mac Revival

May 05, 2025

The Buckingham Fleetwood Reunion Hope For A Fleetwood Mac Revival

May 05, 2025 -

Lindsey Buckingham And Mick Fleetwood Reunite After Years Apart

May 05, 2025

Lindsey Buckingham And Mick Fleetwood Reunite After Years Apart

May 05, 2025 -

Fleetwood Macs Future Lindsey Buckingham And Mick Fleetwoods Reunion

May 05, 2025

Fleetwood Macs Future Lindsey Buckingham And Mick Fleetwoods Reunion

May 05, 2025 -

Novi Koncert Gibonnija Pula Ceka Glazbenu Poslasticu

May 05, 2025

Novi Koncert Gibonnija Pula Ceka Glazbenu Poslasticu

May 05, 2025